This version of the form is not currently in use and is provided for reference only. Download this version of

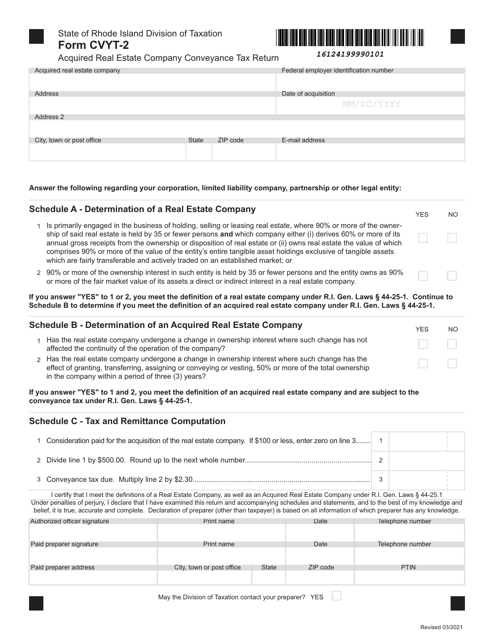

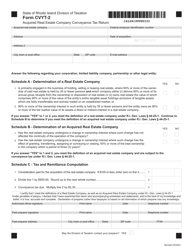

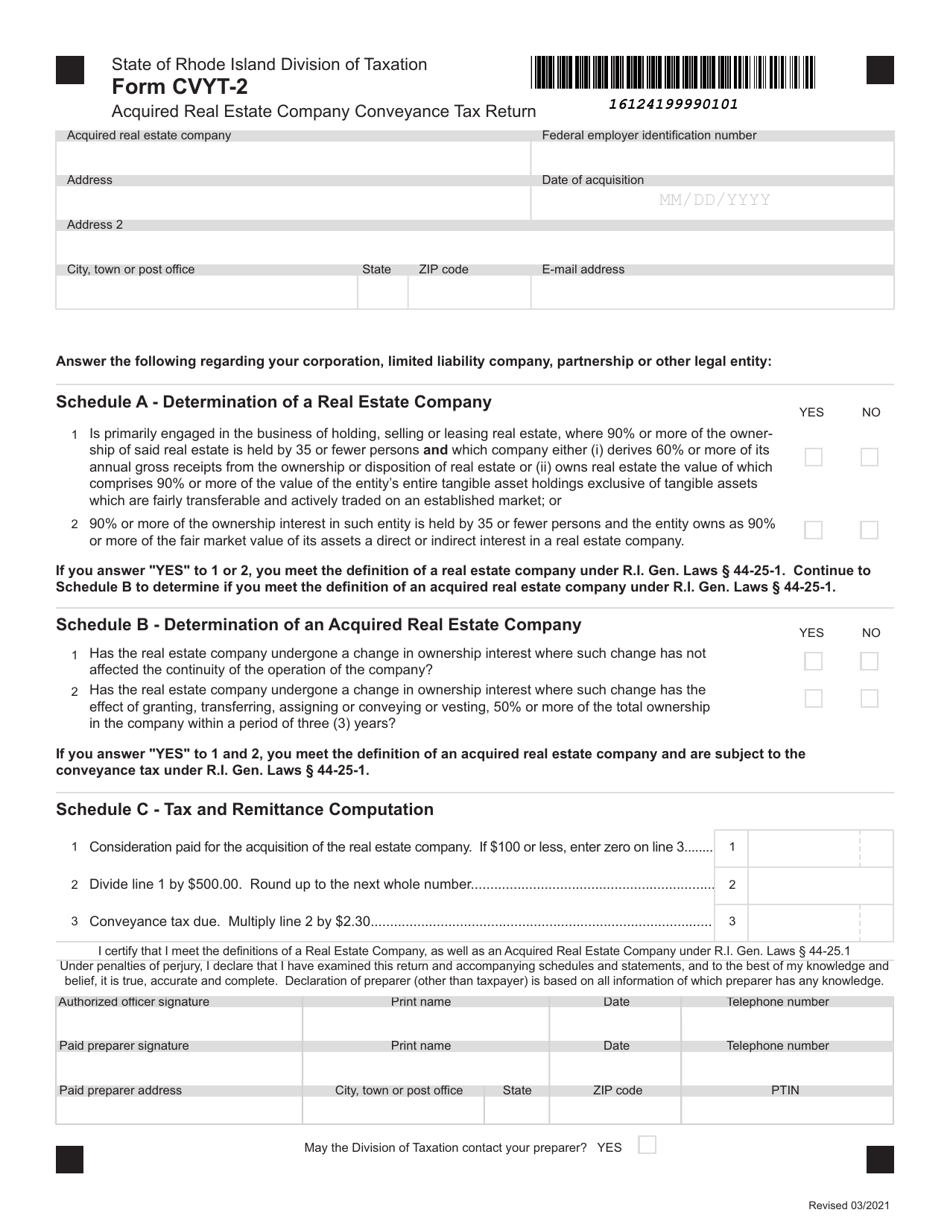

Form CVYT-2

for the current year.

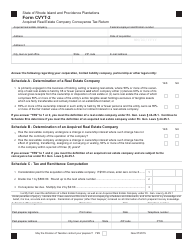

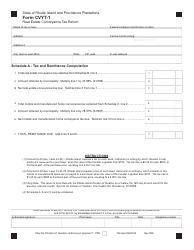

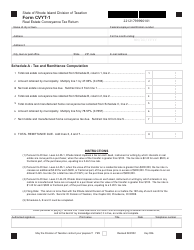

Form CVYT-2 Acquired Real Estate Company Conveyance Tax Return - Rhode Island

What Is Form CVYT-2?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form CVYT-2?

A: Form CVYT-2 is the Acquired Real Estate CompanyConveyance Tax Return for Rhode Island.

Q: What is the purpose of form CVYT-2?

A: The purpose of form CVYT-2 is to report and pay conveyance taxes on the transfer of real estate by an acquired real estate company in Rhode Island.

Q: Who needs to file form CVYT-2?

A: An acquired real estate company transferring real estate in Rhode Island is required to file form CVYT-2.

Q: What information is required on form CVYT-2?

A: Form CVYT-2 requires information about the acquired real estate company, the real estate being transferred, and the conveyance taxes owed.

Q: When is form CVYT-2 due?

A: Form CVYT-2 is due within 30 days of the transfer of real estate by the acquired real estate company.

Q: Are there any exemptions or deductions available for conveyance taxes?

A: Yes, there are certain exemptions and deductions available for conveyance taxes in Rhode Island. You should consult the instructions for form CVYT-2 for more information.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVYT-2 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.