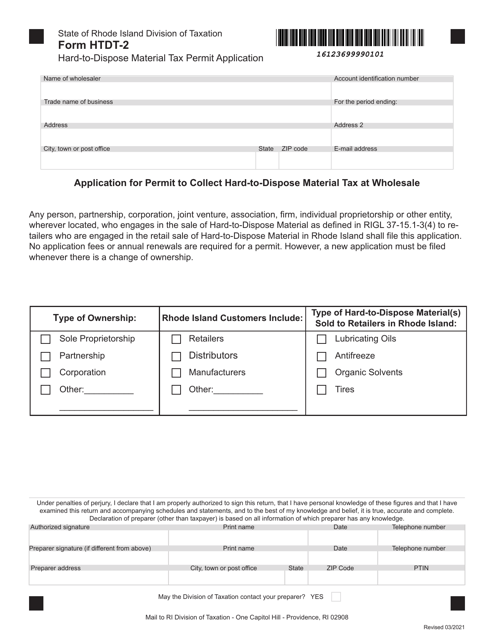

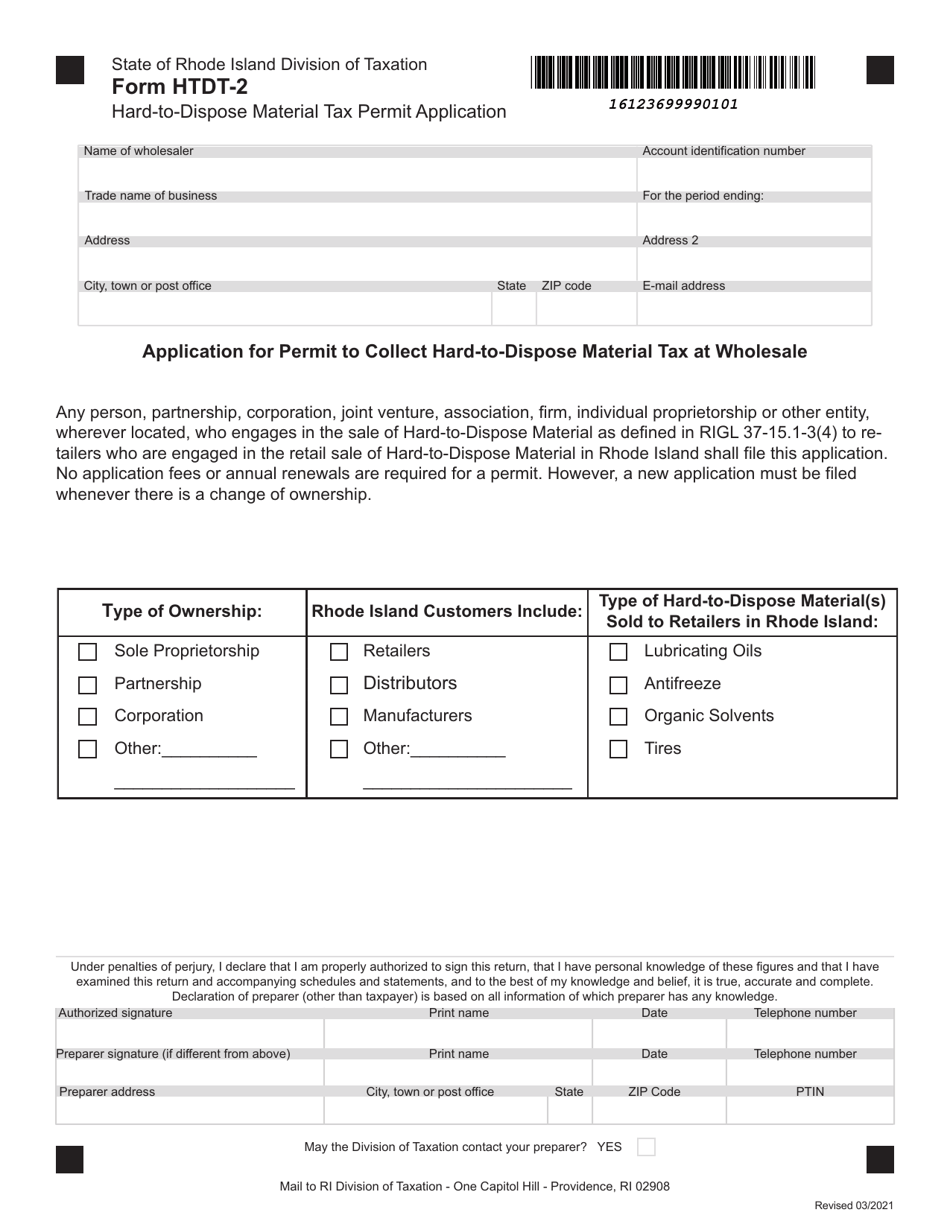

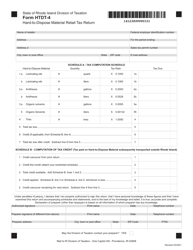

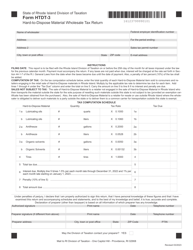

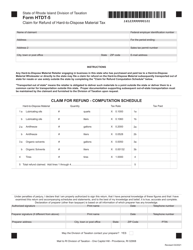

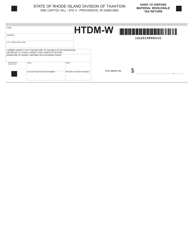

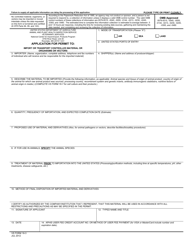

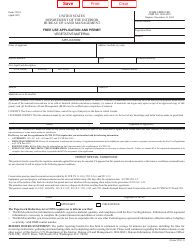

Form HTDT-2 Hard-To-Dispose Material Tax Permit Application - Rhode Island

What Is Form HTDT-2?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HTDT-2?

A: Form HTDT-2 is the Hard-To-Dispose Material Tax Permit Application.

Q: What is the purpose of Form HTDT-2?

A: The purpose of Form HTDT-2 is to apply for a Hard-To-Dispose Material Tax Permit in Rhode Island.

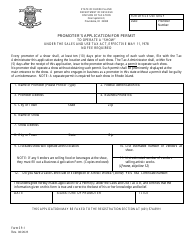

Q: What is a Hard-To-Dispose Material Tax Permit?

A: A Hard-To-Dispose Material Tax Permit is a permit required for businesses involved in the generation, storage, or disposal of hard-to-dispose materials in Rhode Island.

Q: Who needs to file Form HTDT-2?

A: Businesses involved in the generation, storage, or disposal of hard-to-dispose materials in Rhode Island need to file Form HTDT-2.

Q: Are there any fees associated with Form HTDT-2?

A: Yes, there are fees associated with the Hard-To-Dispose Material Tax Permit. The fees depend on the type and quantity of materials being handled.

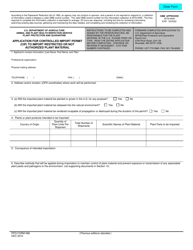

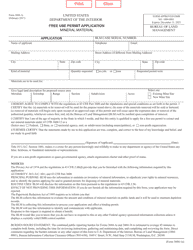

Q: What information is required on Form HTDT-2?

A: Form HTDT-2 requires information such as the business name, address, contact information, types of materials being handled, and estimated quantities.

Q: Are there any deadlines for filing Form HTDT-2?

A: Yes, Form HTDT-2 must be filed annually by January 31st for the upcoming tax year.

Q: Who can I contact for more information about Form HTDT-2?

A: You can contact the Rhode Island Department of Revenue for more information about Form HTDT-2 and the Hard-To-Dispose Material Tax Permit.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HTDT-2 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.