This version of the form is not currently in use and is provided for reference only. Download this version of

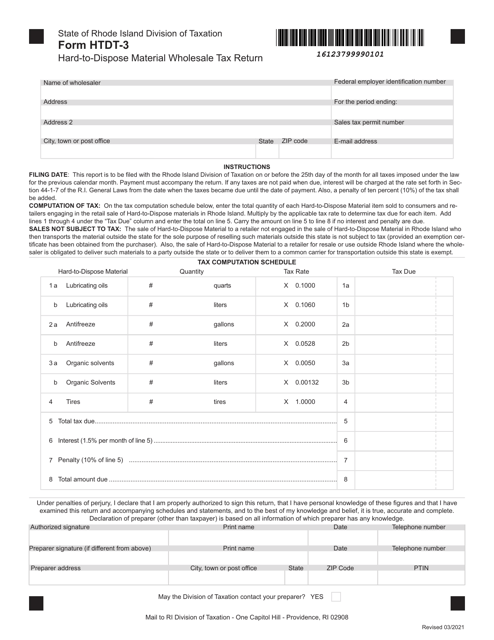

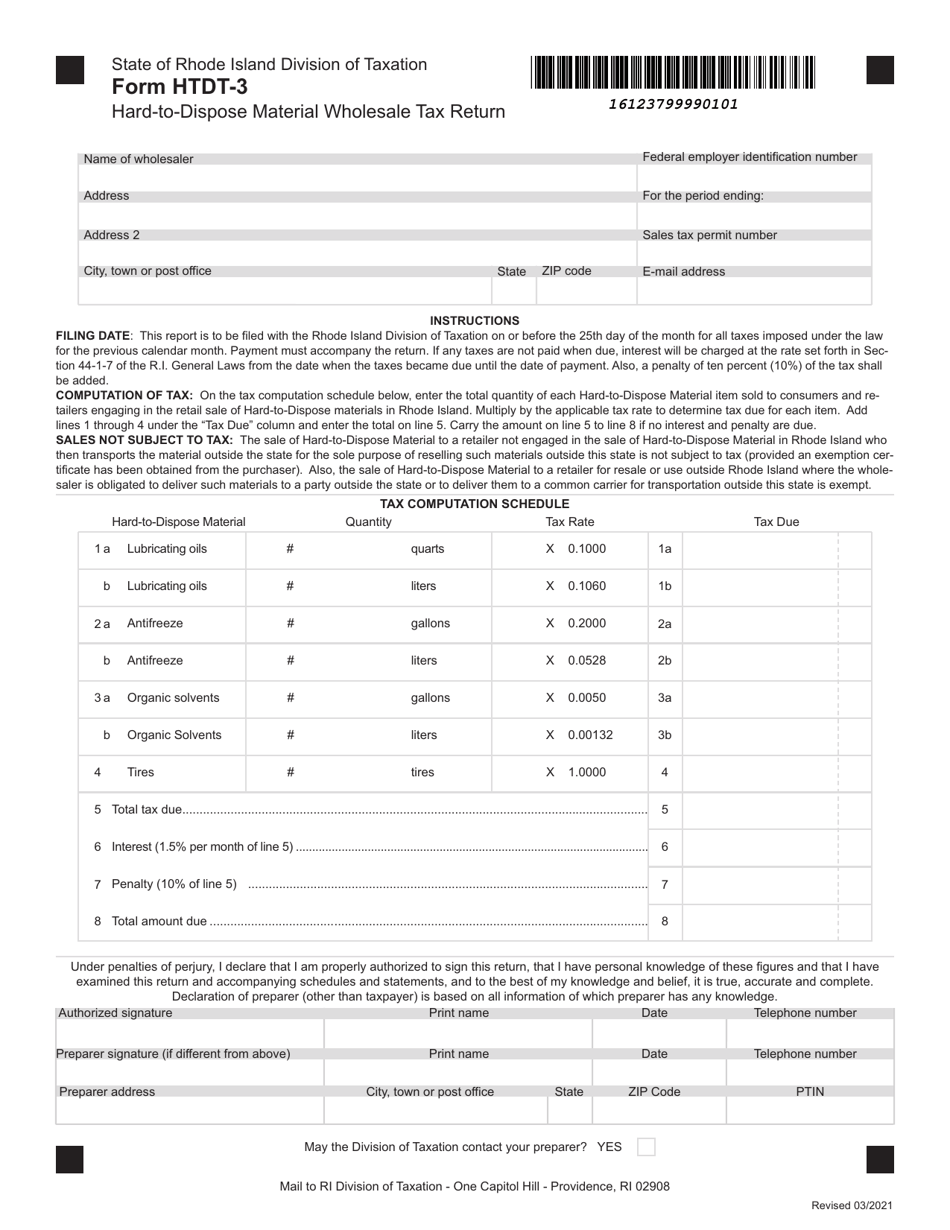

Form HTDT-3

for the current year.

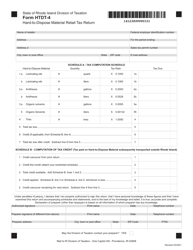

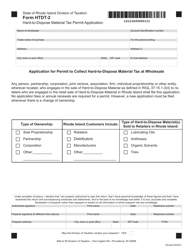

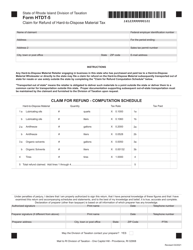

Form HTDT-3 Hard-To-Dispose Material Wholesale Tax Return - Rhode Island

What Is Form HTDT-3?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form HTDT-3?

A: Form HTDT-3 is the Hard-To-Dispose Material Wholesale Tax Return for Rhode Island.

Q: What is the purpose of Form HTDT-3?

A: The purpose of Form HTDT-3 is to report and pay taxes on the wholesale sale of hard-to-dispose materials in Rhode Island.

Q: Who needs to file Form HTDT-3?

A: Wholesale dealers of hard-to-dispose materials in Rhode Island are required to file Form HTDT-3.

Q: What are hard-to-dispose materials?

A: Hard-to-dispose materials include tires, lead-acid batteries, waste oil, and antifreeze.

Q: When is Form HTDT-3 due?

A: Form HTDT-3 is due on a quarterly basis, with the following deadlines: April 20th, July 20th, October 20th, and January 20th.

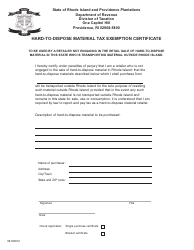

Q: Are there any exemptions for Form HTDT-3?

A: Yes, there are exemptions available for certain wholesale dealers. Please refer to the instructions of Form HTDT-3 for more information.

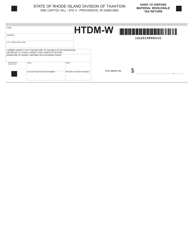

Q: How do I pay the taxes owed on Form HTDT-3?

A: Taxes owed on Form HTDT-3 can be paid electronically or by mailing a check or money order to the Rhode Island Division of Taxation.

Q: What happens if I don't file Form HTDT-3 or pay the taxes due?

A: Failure to file Form HTDT-3 or pay the taxes due may result in penalties and interest being assessed by the Rhode Island Division of Taxation.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form HTDT-3 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.