This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule M

for the current year.

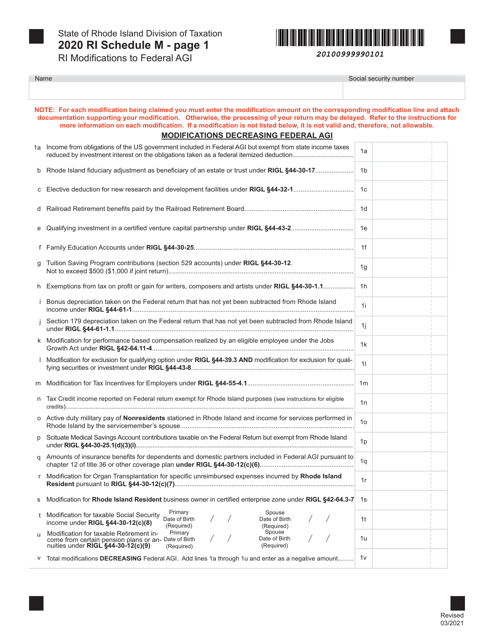

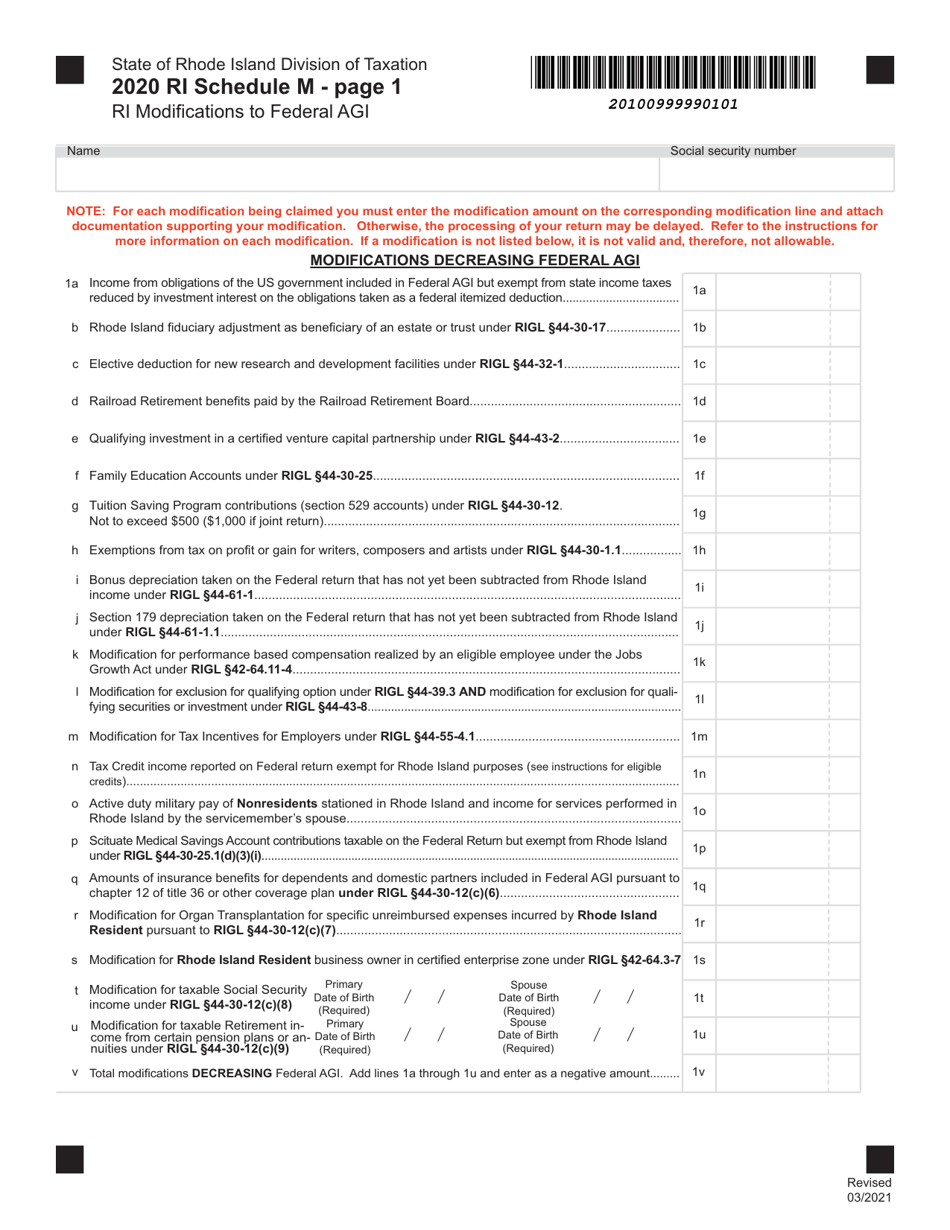

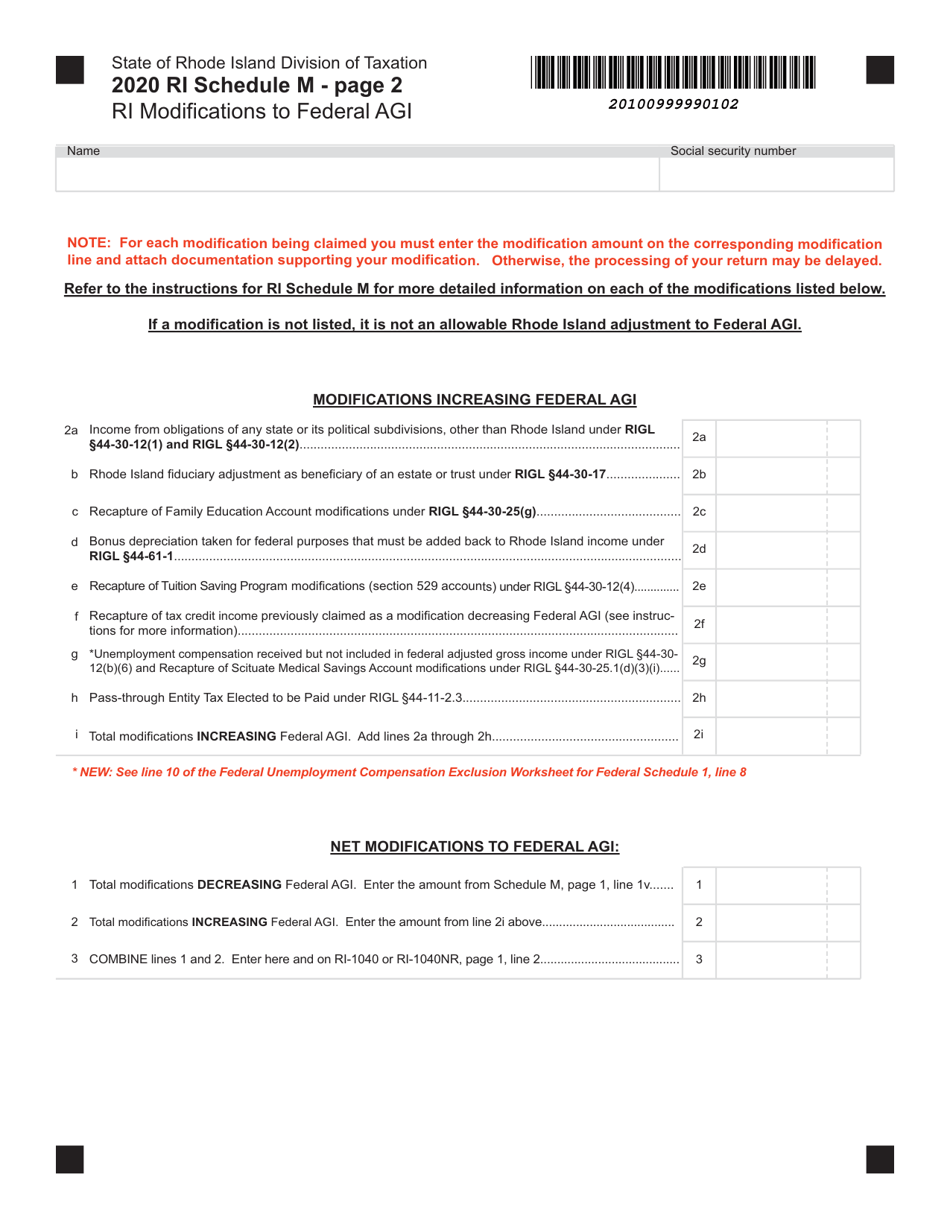

Schedule M Ri(modifications to Federal Agi - Rhode Island

What Is Schedule M?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M RI?

A: Schedule M RI is a form used in Rhode Island to report modifications to your Federal Adjusted Gross Income (AGI).

Q: Why would I need to complete Schedule M RI?

A: You would need to complete Schedule M RI if you have any modifications to your Federal AGI specifically for Rhode Island.

Q: What types of modifications does Schedule M RI cover?

A: Schedule M RI covers various types of modifications, such as additions or subtractions for Rhode Island-specific deductions, exemptions, or credits.

Q: Is Schedule M RI required for all Rhode Island taxpayers?

A: No, Schedule M RI is not required for all Rhode Island taxpayers. Only those who have specific modifications to their Federal AGI need to complete it.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.