This version of the form is not currently in use and is provided for reference only. Download this version of

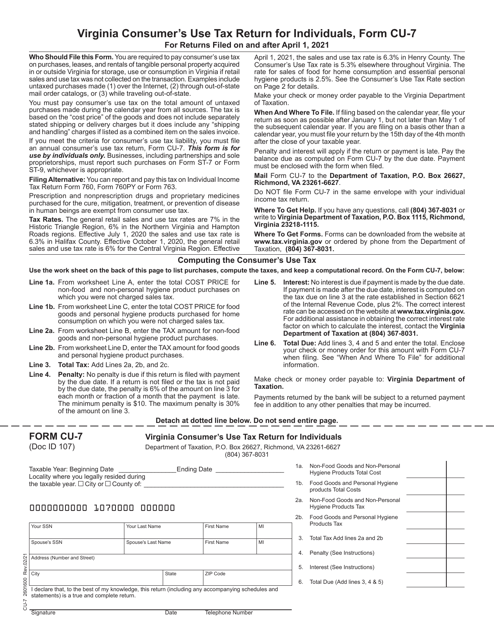

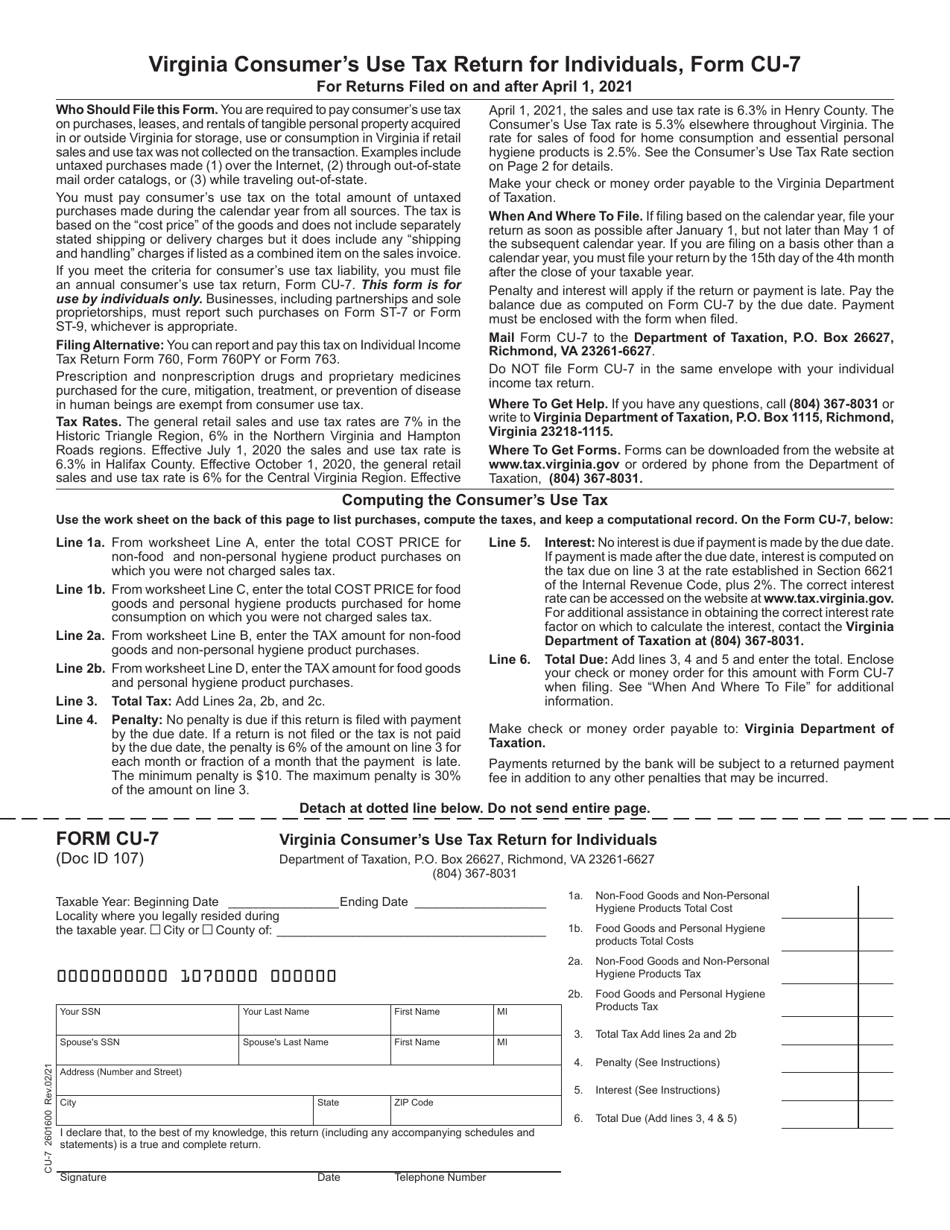

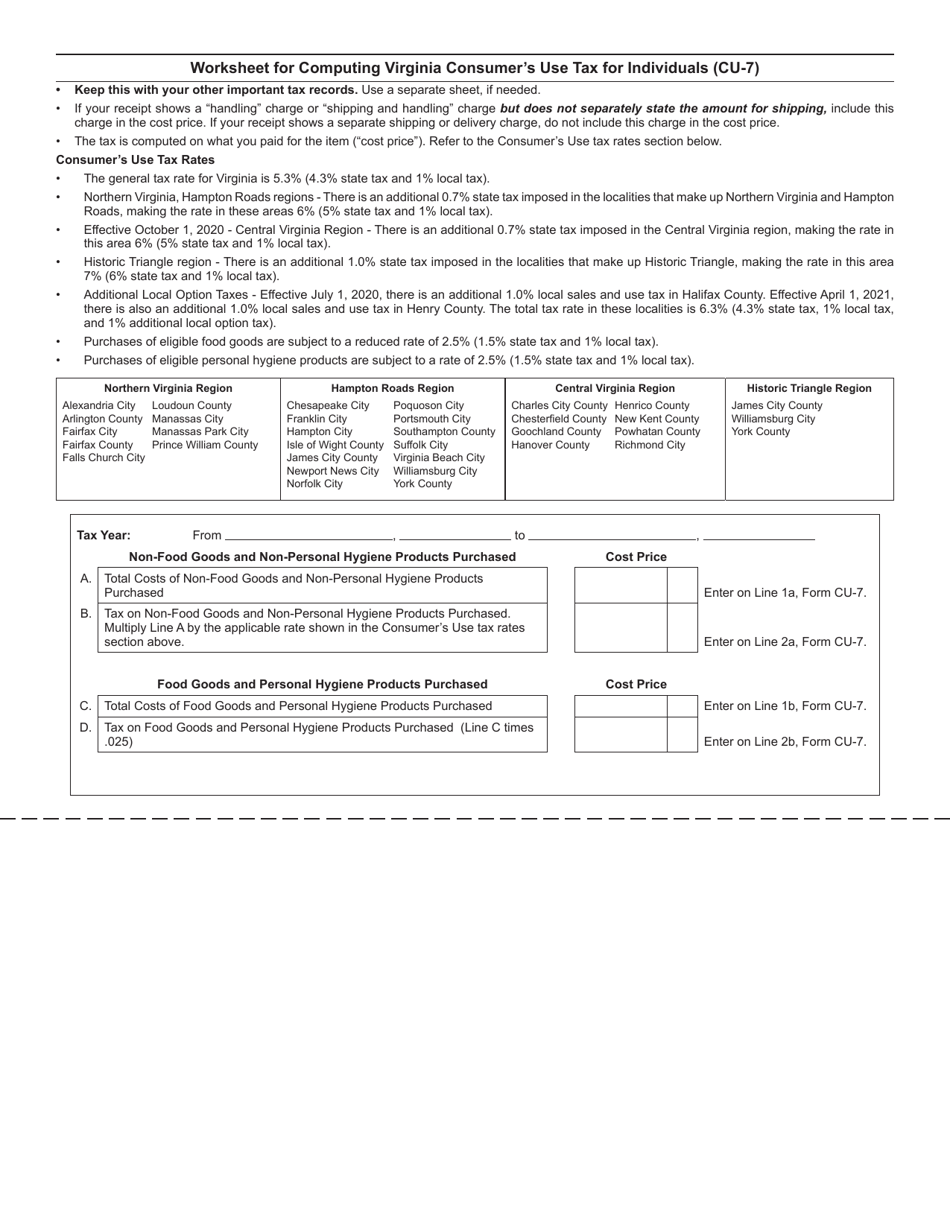

Form CU-7

for the current year.

Form CU-7 Virginia Consumer's Use Tax Return for Individuals - Virginia

What Is Form CU-7?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CU-7?

A: Form CU-7 is the Virginia Consumer's Use Tax Return for Individuals.

Q: What is the purpose of Form CU-7?

A: The purpose of Form CU-7 is to report and pay the consumer's use tax on taxable purchases.

Q: When is the deadline to file Form CU-7?

A: Form CU-7 is due on or before May 1st of each year.

Q: Do I need to include documentation with Form CU-7?

A: No, you do not need to include documentation with Form CU-7, but you should keep records of your taxable purchases.

Q: What is the penalty for not filing Form CU-7?

A: The penalty for not filing Form CU-7 can be up to 30% of the unpaid tax.

Q: Are there any exemptions to the consumer's use tax?

A: Yes, there are exemptions for certain items such as food, medicine, and vehicles.

Q: What should I do if I have questions about filing Form CU-7?

A: If you have questions about filing Form CU-7, you can contact the Virginia Department of Taxation for assistance.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CU-7 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.