This version of the form is not currently in use and is provided for reference only. Download this version of

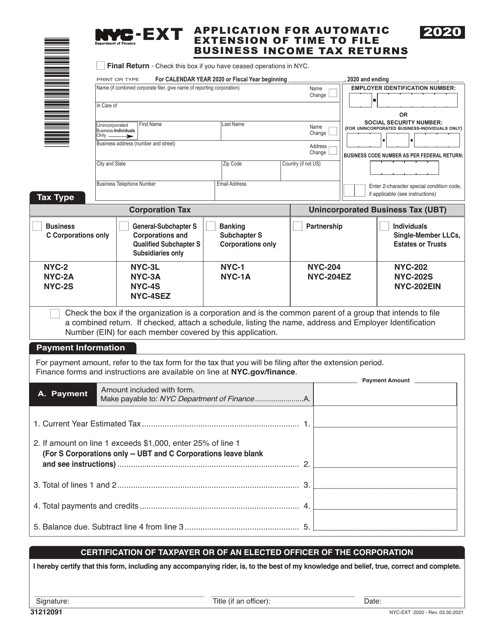

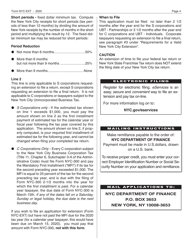

Form NYC-EXT

for the current year.

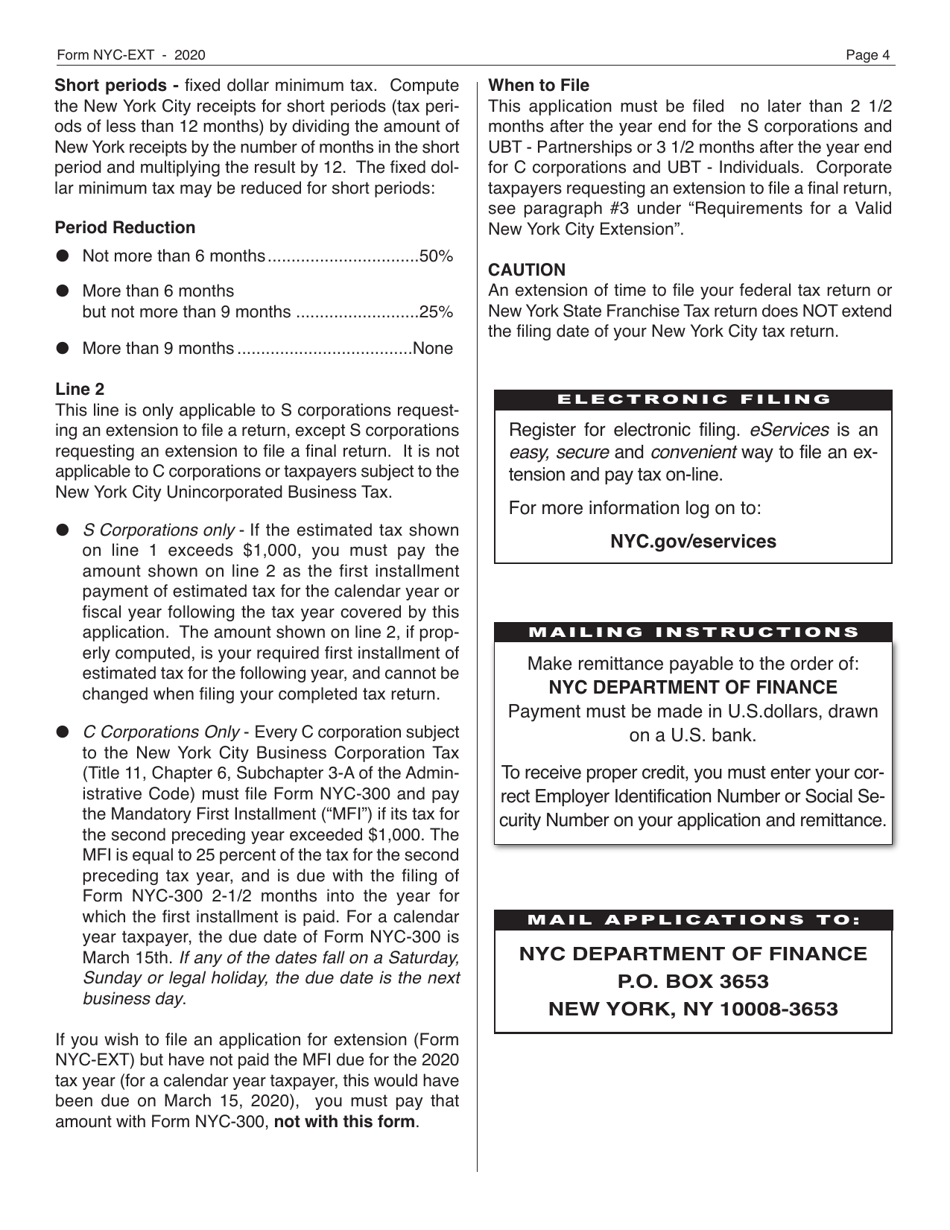

Form NYC-EXT Application for Automatic Extension of Time to File Business Income Tax Returns - New York City

What Is Form NYC-EXT?

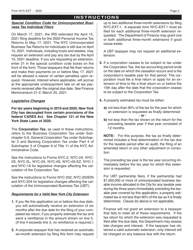

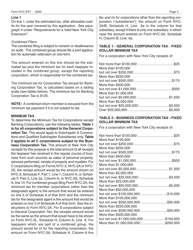

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NYC-EXT application?

A: The NYC-EXT application is a form used to request an automatic extension of time to filebusiness income tax returns in New York City.

Q: Who can use the NYC-EXT form?

A: Any business that needs additional time to file their income tax returns in New York City can use the NYC-EXT form.

Q: What is the deadline for filing the NYC-EXT application?

A: The NYC-EXT application must be filed by the original due date of your business income tax return in New York City.

Q: Does filing the NYC-EXT application extend the deadline for paying my taxes?

A: No, filing the NYC-EXT application only extends the deadline for filing your income tax return, not the deadline for paying any taxes owed.

Q: How long is the extension period granted by the NYC-EXT application?

A: The NYC-EXT application grants an automatic extension of six months for filing your business income tax return in New York City.

Q: Is there a penalty for filing the NYC-EXT application late?

A: Yes, there is a penalty for filing the NYC-EXT application late. The penalty is based on the amount of tax due and the length of the delay in filing the application.

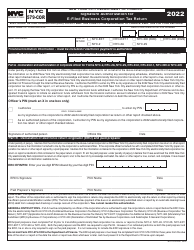

Form Details:

- Released on March 30, 2021;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NYC-EXT by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.