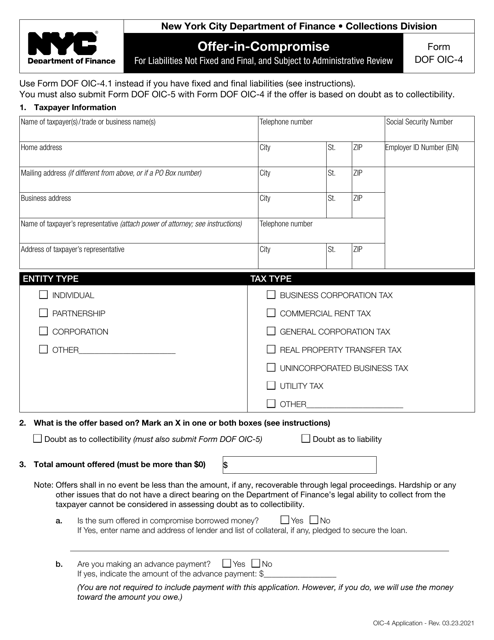

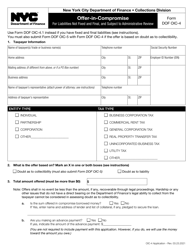

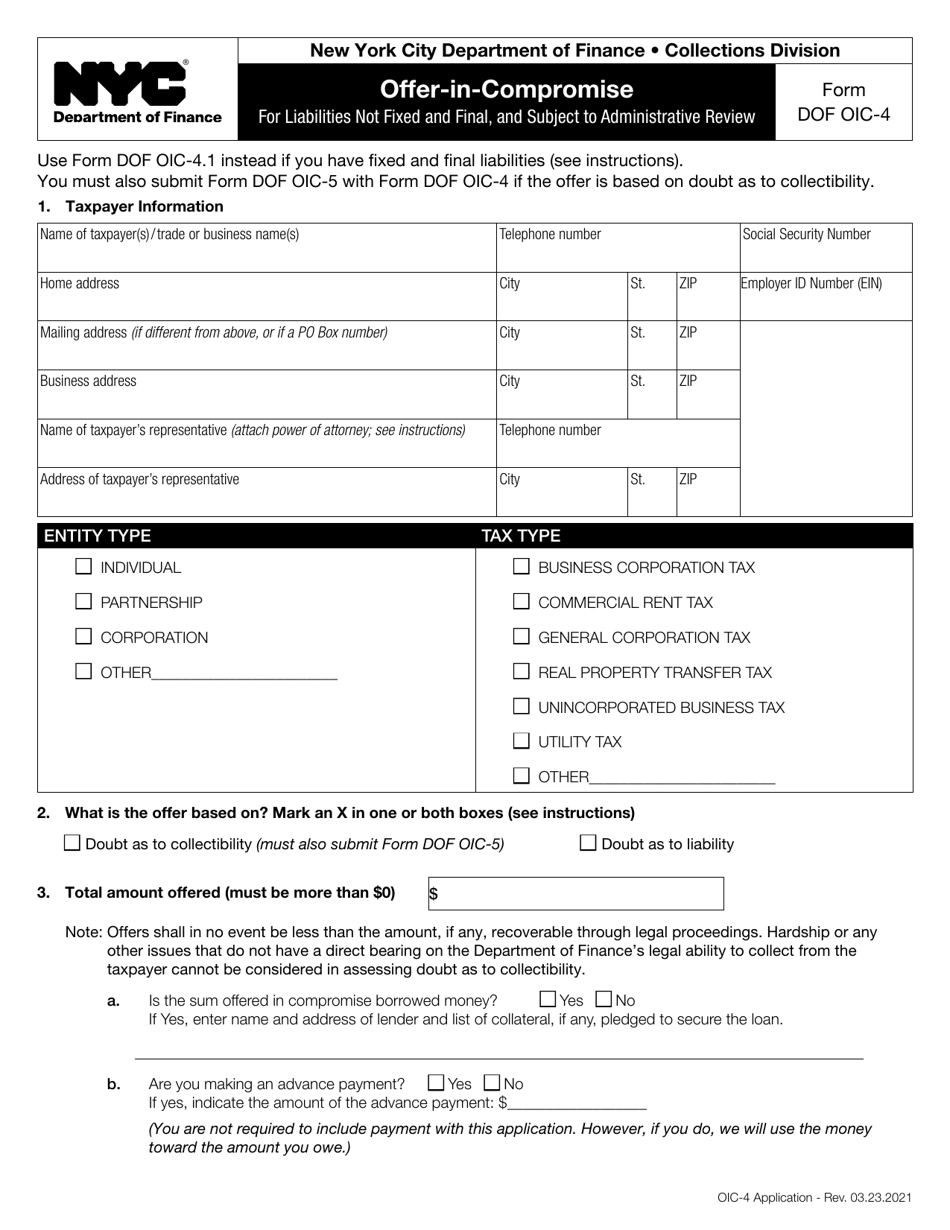

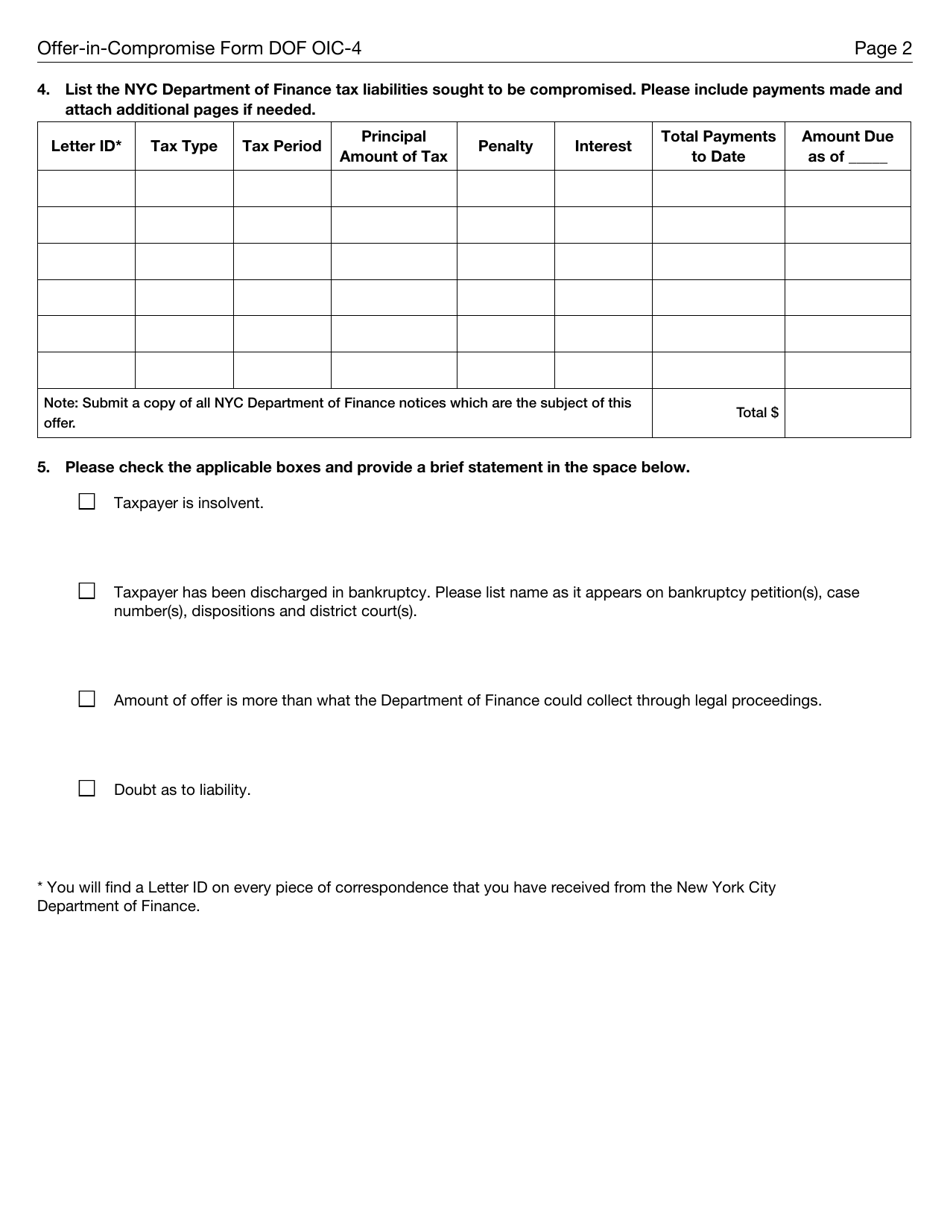

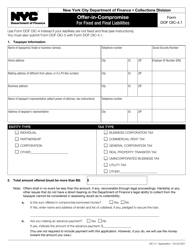

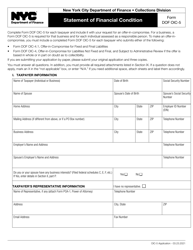

Form DOF OIC-4 Offer-In-compromise for Liabilities Not Fixed and Final, and Subject to Administrative Review - New York City

What Is Form DOF OIC-4?

This is a legal form that was released by the New York City Department of Finance - a government authority operating within New York City. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DOF OIC-4?

A: Form DOF OIC-4 is used for making an offer-in-compromise for liabilities that are not fixed and final, and subject to administrative review.

Q: What is an offer-in-compromise?

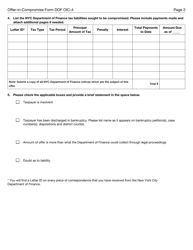

A: An offer-in-compromise is a settlement agreement offered by a taxpayer to the government to resolve a tax liability for less than the full amount owed.

Q: Who is eligible to submit Form DOF OIC-4?

A: Taxpayers whose liabilities are not fixed and final, and subject to administrative review in New York City are eligible to submit Form DOF OIC-4.

Q: What is the purpose of submitting Form DOF OIC-4?

A: The purpose of submitting Form DOF OIC-4 is to propose a settlement offer to resolve tax liabilities that are not fixed and final, and subject to administrative review.

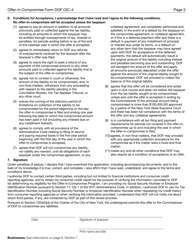

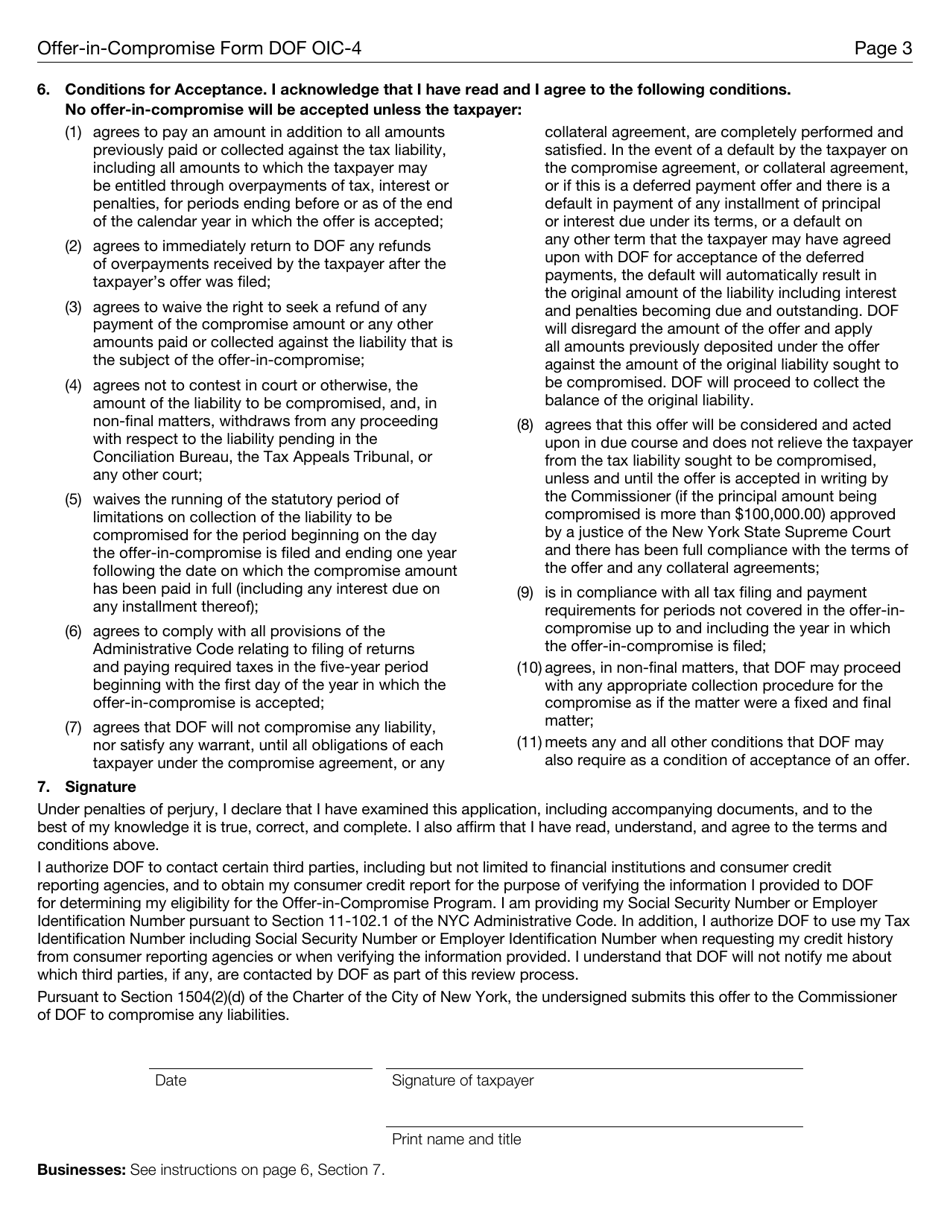

Q: What happens after submitting Form DOF OIC-4?

A: After submitting Form DOF OIC-4, the offer-in-compromise will go through an administrative review process to determine its acceptance or rejection.

Form Details:

- Released on March 23, 2021;

- The latest edition provided by the New York City Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DOF OIC-4 by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.