This version of the form is not currently in use and is provided for reference only. Download this version of

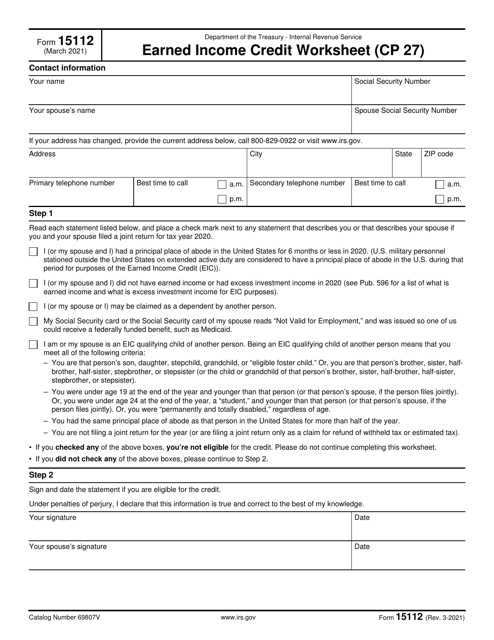

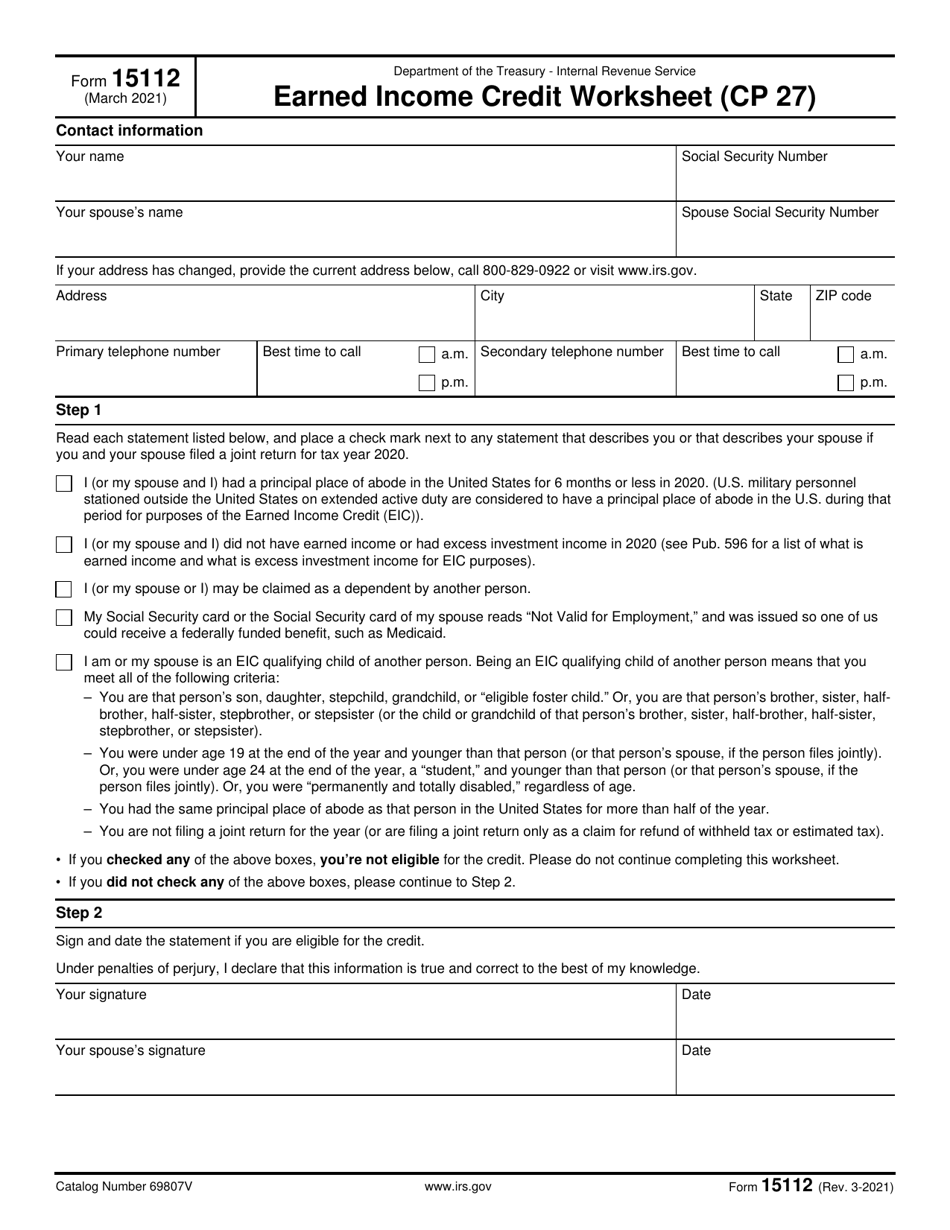

IRS Form 15112

for the current year.

IRS Form 15112 Earned Income Credit Worksheet (Cp 27)

What Is IRS Form 15112?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15112?

A: IRS Form 15112 is the Earned Income Credit Worksheet (Cp 27).

Q: What is the purpose of IRS Form 15112?

A: The purpose of IRS Form 15112 is to calculate the amount of earned income credit a taxpayer may be eligible for.

Q: Who needs to fill out IRS Form 15112?

A: Taxpayers who may be eligible for the earned income credit need to fill out IRS Form 15112.

Q: What information is required on IRS Form 15112?

A: IRS Form 15112 requires information about the taxpayer's income, filing status, and number of qualifying children.

Q: Is IRS Form 15112 required for everyone?

A: No, IRS Form 15112 is only required for taxpayers who may be eligible for the earned income credit.

Q: When is the deadline to submit IRS Form 15112?

A: The deadline to submit IRS Form 15112 is the same as the deadline for filing your federal income tax return.

Q: Can I file IRS Form 15112 electronically?

A: Yes, you can file IRS Form 15112 electronically if you are e-filing your tax return.

Q: What happens if I make a mistake on IRS Form 15112?

A: If you make a mistake on IRS Form 15112, you may need to file an amended tax return to correct it.

Q: Are there any other forms related to IRS Form 15112?

A: There may be other forms and schedules related to IRS Form 15112, depending on your individual tax situation.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 15112 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15112 through the link below or browse more documents in our library of IRS Forms.