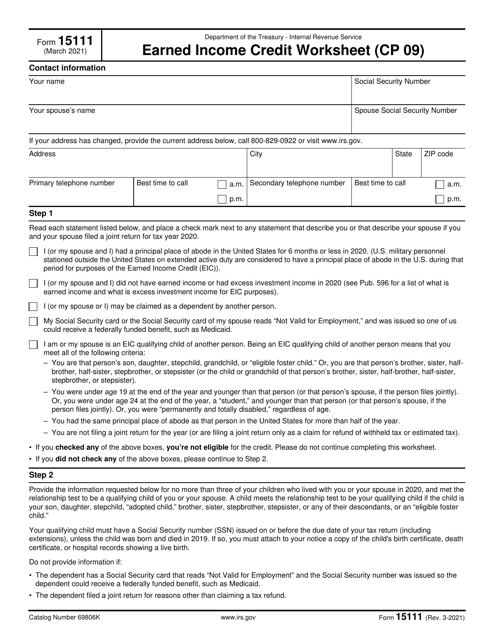

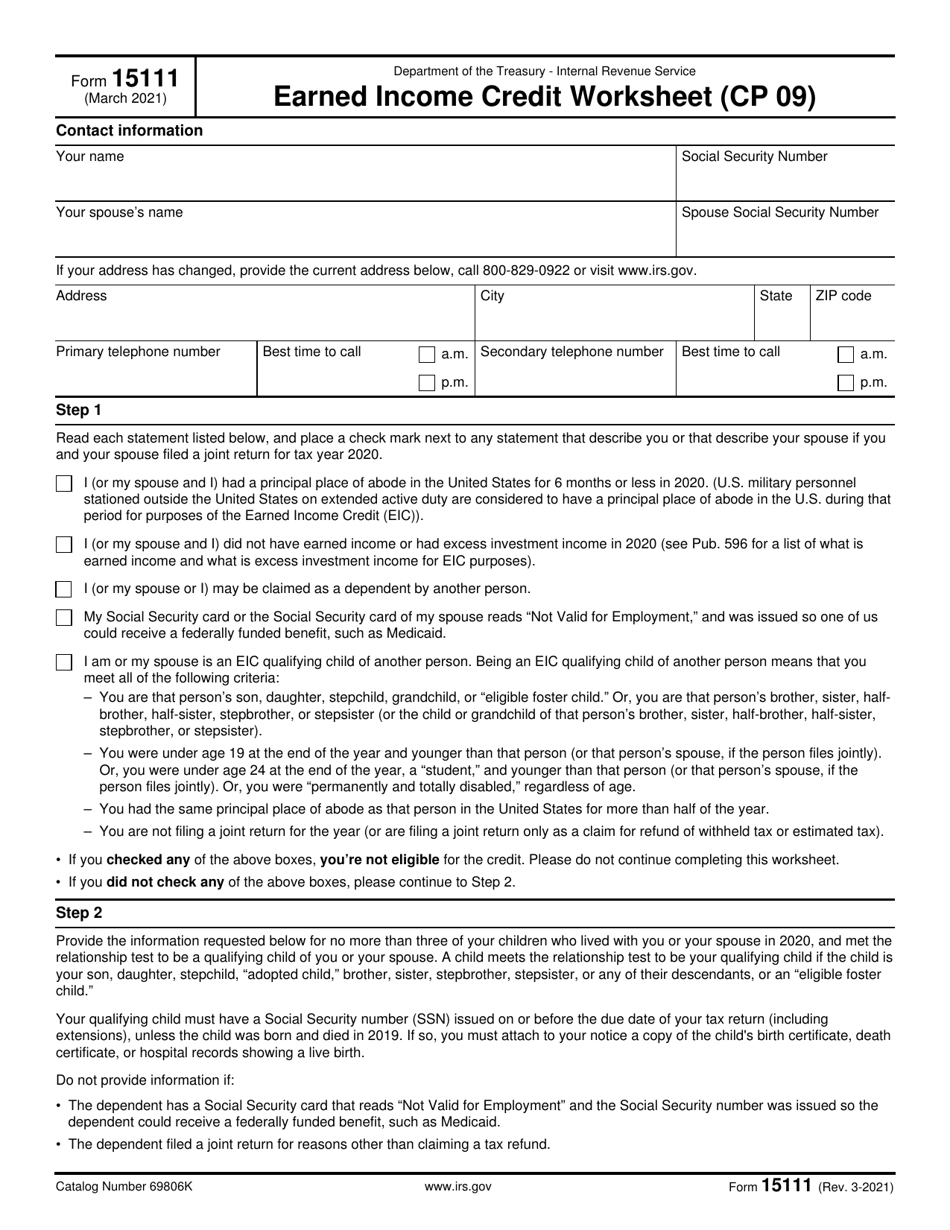

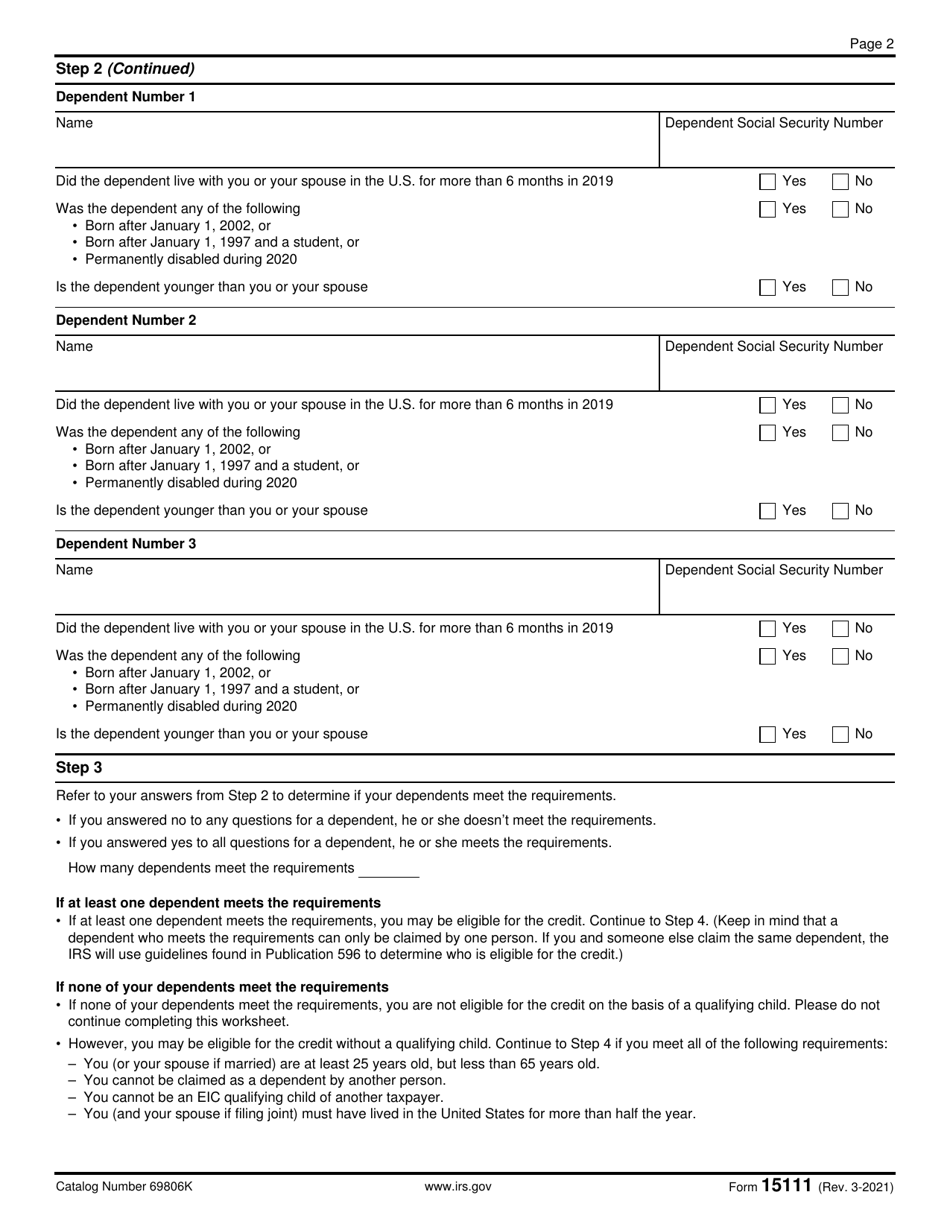

IRS Form 15111 Earned Income Credit Worksheet (Cp 09)

What Is IRS Form 15111?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15111?

A: IRS Form 15111 is the Earned Income Credit Worksheet (Cp 09).

Q: What is the Earned Income Credit?

A: The Earned Income Credit is a tax credit for low to moderate-income individuals and families.

Q: Who is eligible for the Earned Income Credit?

A: To be eligible for the Earned Income Credit, you must meet certain income and filing status requirements.

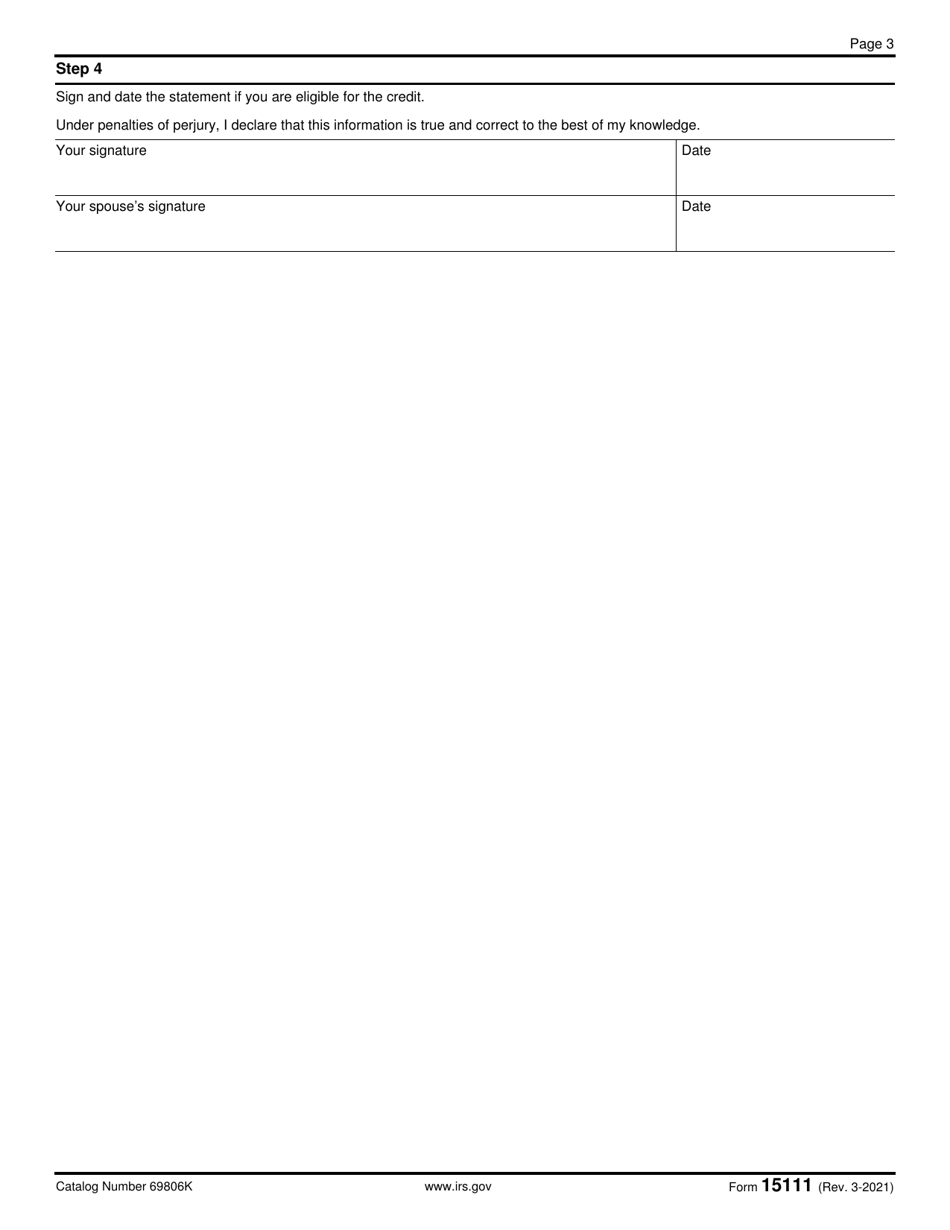

Q: How do I use IRS Form 15111?

A: IRS Form 15111 is used to calculate the amount of Earned Income Credit you may be eligible for.

Form Details:

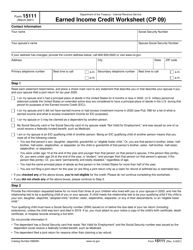

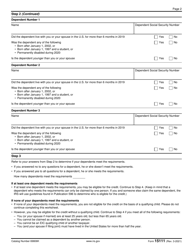

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- A Spanish version of IRS Form 15111 is available for spanish-speaking filers;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15111 through the link below or browse more documents in our library of IRS Forms.