This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 944-X

for the current year.

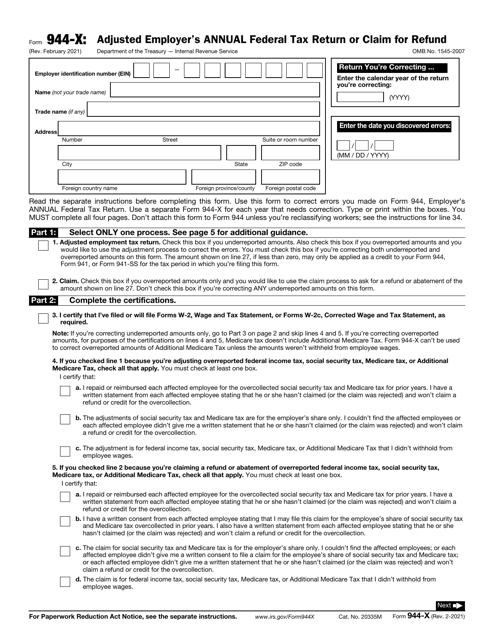

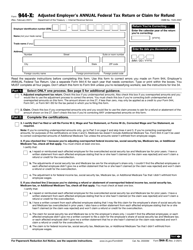

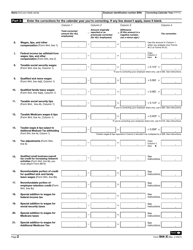

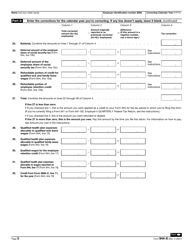

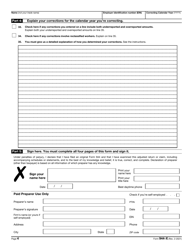

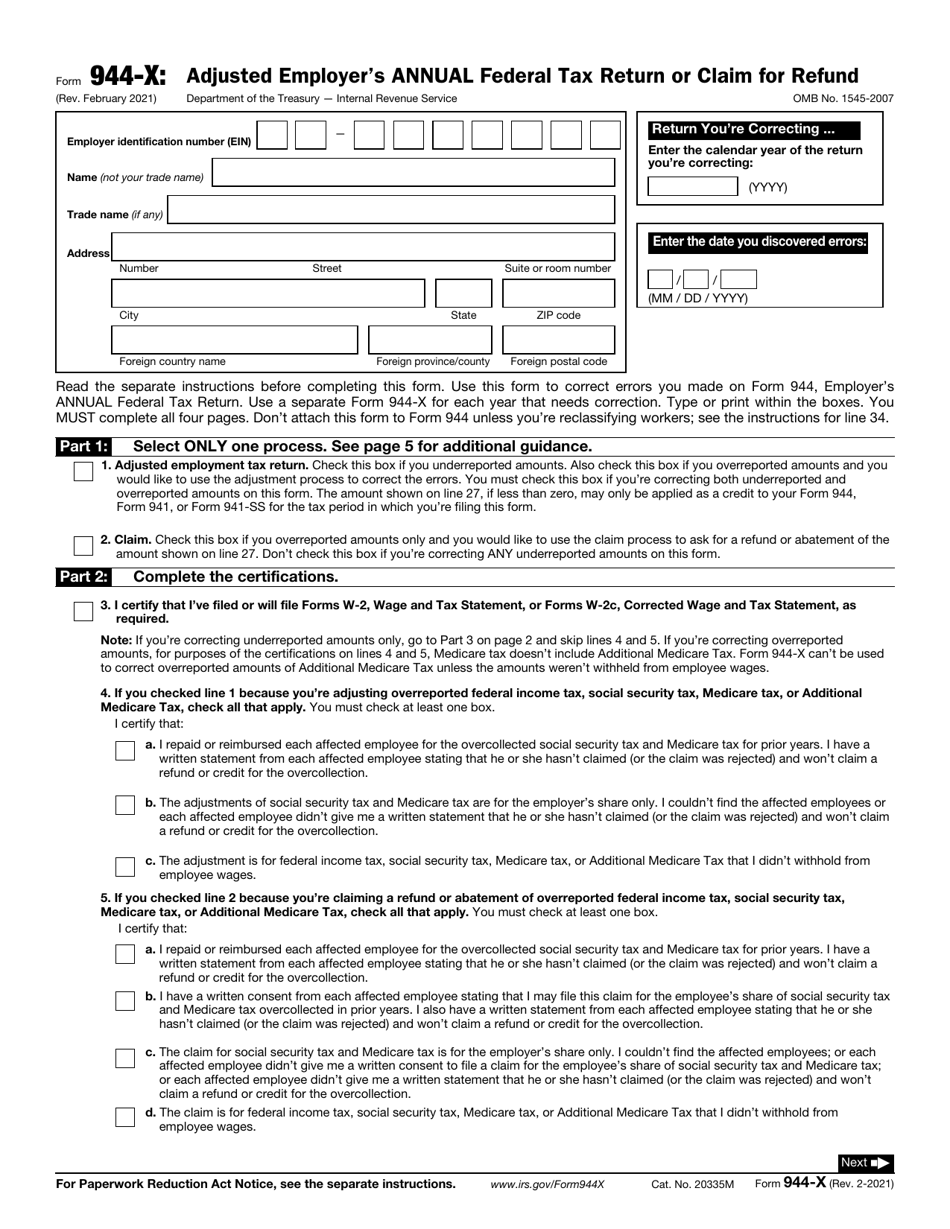

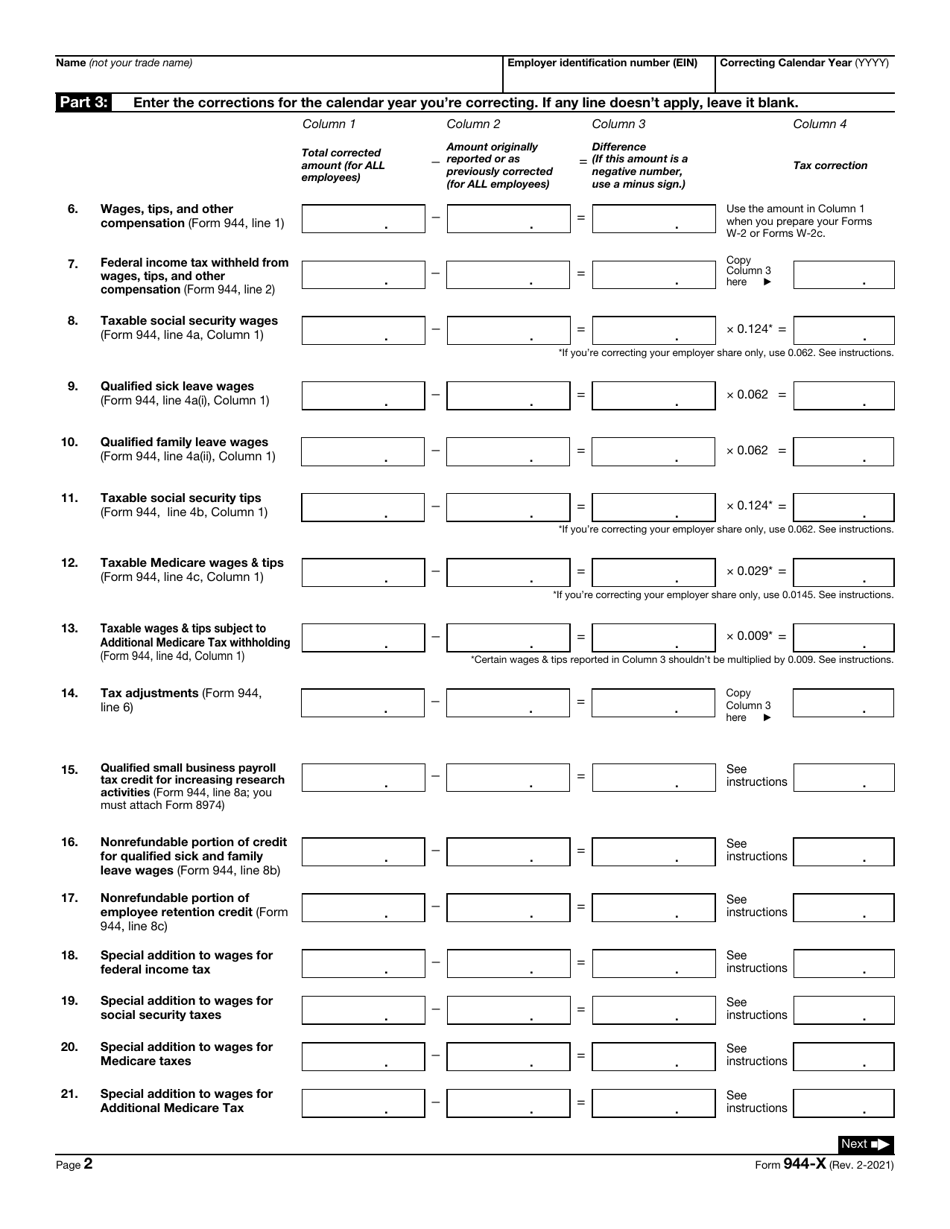

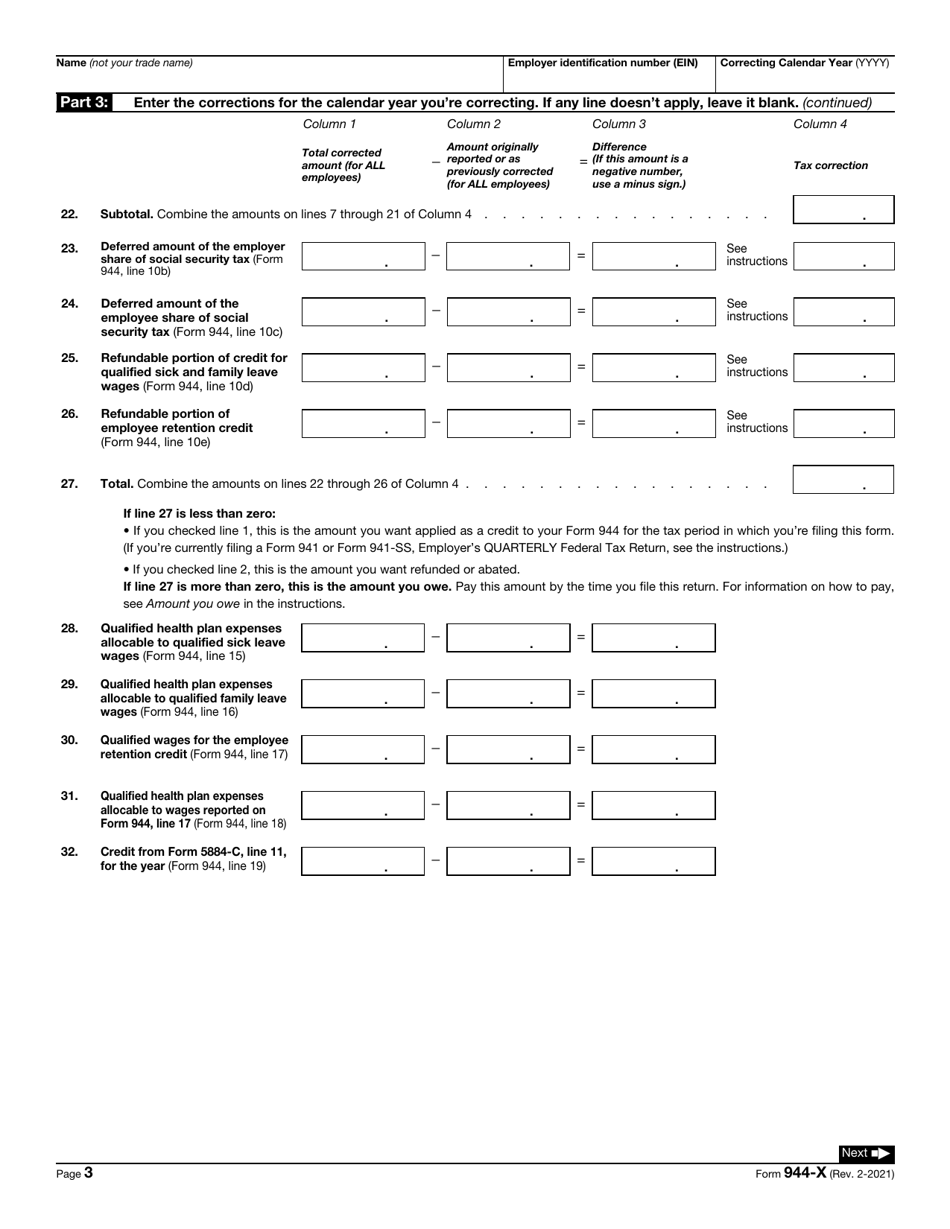

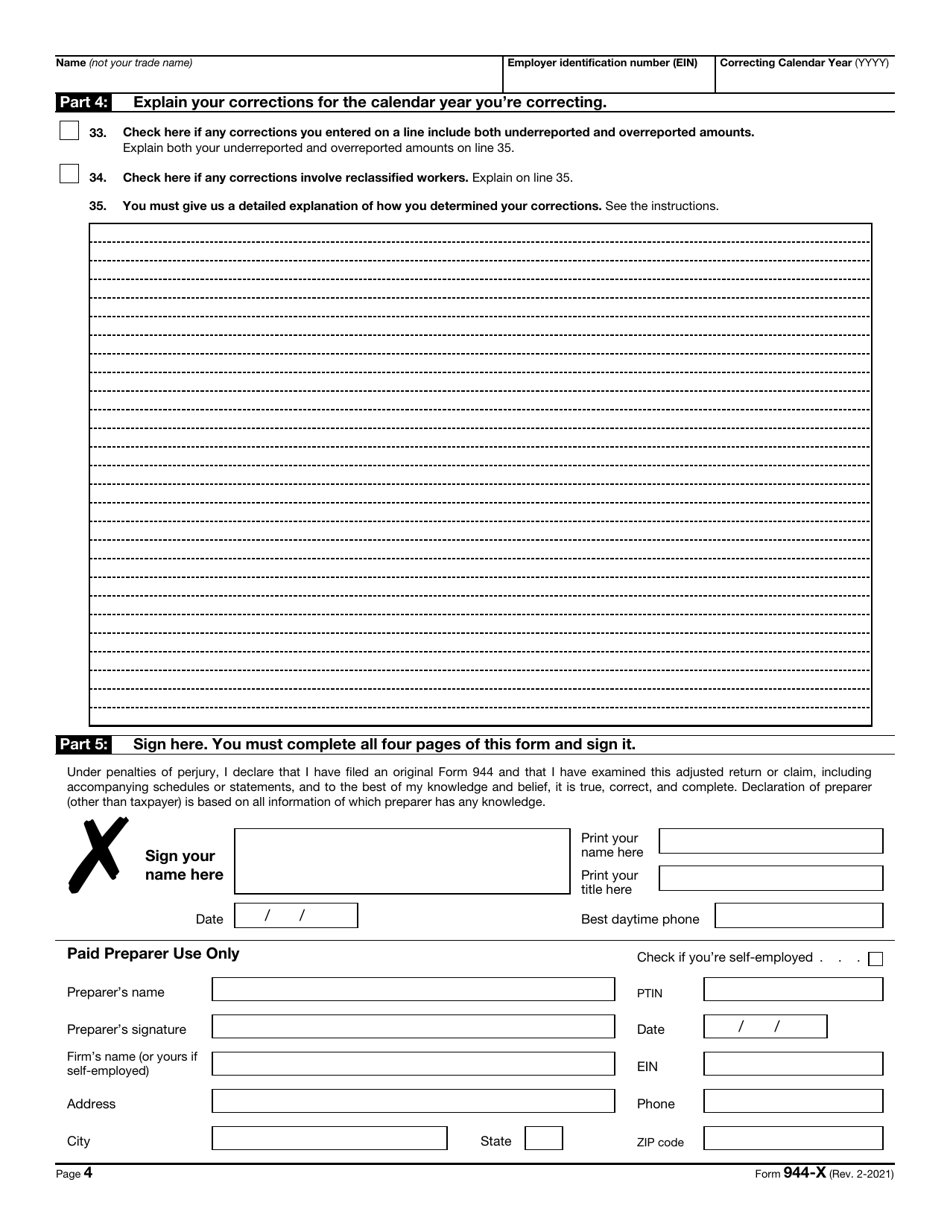

IRS Form 944-X Adjusted Employer's Annual Federal Tax Return or Claim for Refund

What Is IRS Form 944-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 944-X?

A: IRS Form 944-X is the Adjusted Employer's Annual Federal Tax Return or Claim for Refund.

Q: Who needs to file IRS Form 944-X?

A: Employers who need to make adjustments to their annual federal tax return or claim a refund should file Form 944-X.

Q: What is the purpose of filing IRS Form 944-X?

A: The purpose of filing Form 944-X is to correct errors or make adjustments to the employer's annual federal tax return.

Q: When should IRS Form 944-X be filed?

A: Form 944-X should be filed as soon as an error or adjustment needs to be made to the employer's annual federal tax return.

Q: Is there a deadline for filing IRS Form 944-X?

A: There is no specific deadline for filing Form 944-X, but it should be filed as soon as possible after the error or adjustment is discovered.

Q: Can I claim a refund using IRS Form 944-X?

A: Yes, employers can claim a refund for overpaid federal taxes using Form 944-X.

Q: Do I need to attach any documents with IRS Form 944-X?

A: Employers may need to attach supporting documents, such as amended employment tax returns, when filing Form 944-X.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 944-X through the link below or browse more documents in our library of IRS Forms.