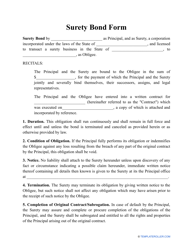

Performance Bond Form

What Is a Performance Bond?

A Performance Bond is a formal document that confirms the surety's obligation to make a payment towards the owner of a construction project in case the contractor hired to work on the project failed to comply with their responsibilities outlined in the construction contract. If the contractor is unable to finish the project or delays the schedule set in writing, the customer can launch a claim against them and demand compensation for money or time lost.

Alternate Name:

- Contract Bond.

Whether you work in a private or public sector, a document of this kind will protect your reputation, build a good working relationship with the customer who will choose you for other projects in the future, and confirm your trustworthiness to the financial institution if no claims are made on your bond. It helps the construction company to establish themselves as a respectable business and ensures the client can enter into any agreements with them without massive financial risks.

A Performance Bond template can be downloaded below. Note that if you represent a government entity or you offer your construction experience to public institutions, it is necessary to fill out an alternative form - GSA Standard Form 25, Performance Bond.

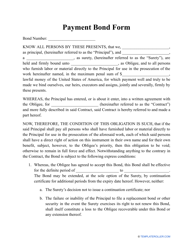

Bid Bond Vs. Performance Bond

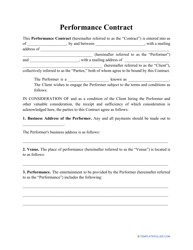

Both a Bid Bond and a Performance Bond are indispensable for construction projects - they safeguard the financial interests of the parties as part of risk management which is of particular importance if the contractor and the client do not know each other well. While the Bid Bond is needed to guarantee the contractor will perform the job in question, the Performance Bid is prepared by the winning bidder in addition to the main agreement between the contractor and the customer to make sure the latter knows the project will be finished on time and in accordance with all the expectations listed in writing. The moment of signing also varies: prepare the Bid Bond during the bidding process and sign the Performance Bond once the owner of the project chose you as the contractor.

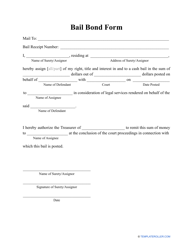

How to Get a Performance Bond?

Follow these steps to obtain a Performance Bond:

- Find the surety company that would be willing to vouch for your work on the construction project . Ideally, you can work with a financial institution that knows you for years as a client and will be prepared to offer you the most suitable rates. However, any bond surety or insurance provider would do as long as they confirm your business aims to perform the job correctly and on time judging by your professional experience and positive credit score.

- Discuss the terms and conditions of the Performance Bond . If the contractor breaches the agreement they signed with the client, the surety will have to act to deal with this issue - there are multiple options but often the surety would arrange for the completion of the project to satisfy the demands of the customer and later submit a claim to obtain compensation from the breaching party.

- Make sure the text of the Performance Bond form contains all necessary details : identification of the parties (the names and addresses should be enough), amount of money issued to cover the bond, list of the contractor's and surety's rights and obligations, duration of the bond and the time limit for any of the parties to submit a claim regarding the bond.

- Consider notarizing the document - bring it to the notary public and sign it. The Performance Bond insurance must bear the signatures of the contractor and the company that secures the bond.

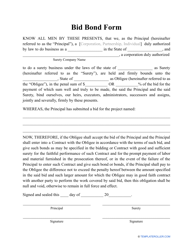

How Much Does a Performance Bond Cost?

The Performance Bond cost differs from project to project based on different factors: the skills and experience of the contractor, the conditions of the contract, and the duration of the planned project. Additionally, an insurance company or bank will be inclined to offer more favorable terms to their loyal customers or contractors with healthy balance sheets. In most cases, the cost of the Performance Bond does not exceed 1% of the contract price. If the construction business cannot confirm their strong financial performance or the estimated cost of the work is lower than $1 million, the parties may negotiate a different bond amount.

Haven't found what you were looking for? Take a look at the related templates below: