Bid Bond Form

What Is a Bid Bond?

A Bid Bond is a financial instrument that guarantees that a contractor selected for a specific job will fulfill their obligations listed in the text of the bid. Once a construction business is chosen to carry out a project, they have to certify their ability to perform the duties outlined in the bid - if they fail to do so, the owner of the project does not have to worry since they will be compensated by the third-party guarantor. It is recommended to find a financial institution such as a bank or insurance company that will support your bid making it more attractive to people who make the choice between different contractors - Bid Bond insurance will safeguard the interests of the customer and confirm the construction company has enough financial means to work on the project.

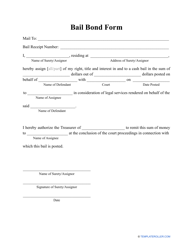

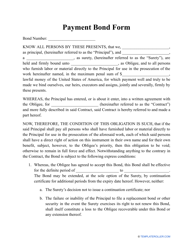

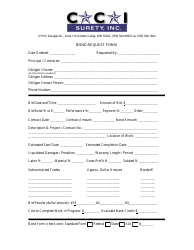

You can find a Bid Bond template via the link below. If you are going to sign a contract with a government entity to perform construction jobs, you will have to offer them a different kind of a Bid Bond guarantee: complete GSA Standard Form 24, Bid Bond. Just like a general Bid Bond, it will describe the bid, indicate the amount of the penal sum of the bond, and contain the signature of the insurance company representative that approved this financial guarantee.

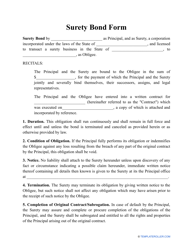

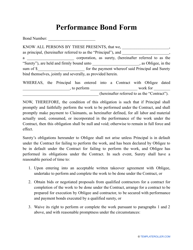

Bid Bond Vs. Performance Bond

Another common type of bond is a Performance Bond. Negotiated and signed once the project has been agreed upon and the parties have finalized their agreement, the Performance Bond certifies the principal's duty to complete the project described in writing and to meet all the expectations of the customer. The moment of the signing is not the only difference - a Bid Bond form is a necessity if you want to be chosen as a contractor while the existence of the Performance Bond will depend on the mutual wishes of the parties: if they believe a formal agreement is enough to cover the project, this bond will not be required. However, if you work with subcontractors, they would prefer you to have a Performance Bond in place since it decreases financial exposure for them.

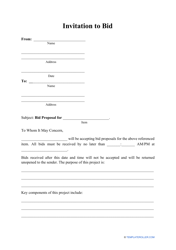

How to Get a Bid Bond?

To obtain a Bid Bond, the contractor must contact the potential guarantor - an insurance company they work with or a bond agency of their choice. Talk to your business partners and associates to find out the best possible guarantor in your area to be sure your interests are put first. Note that you should get a Bid Bond whether you plan to perform a public or a private job - both government resources and the funds of a private entity will require protection.

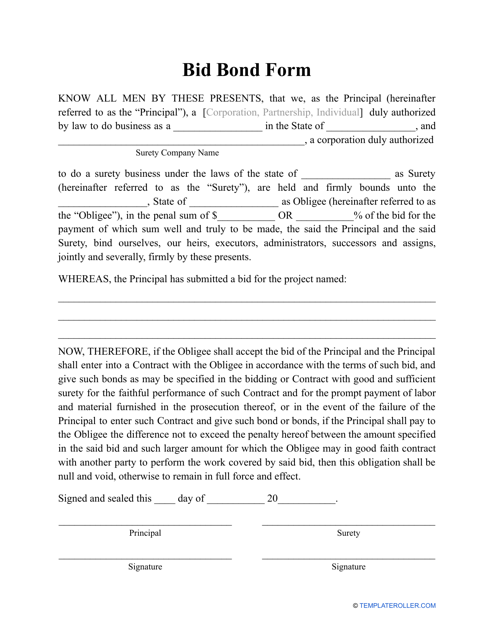

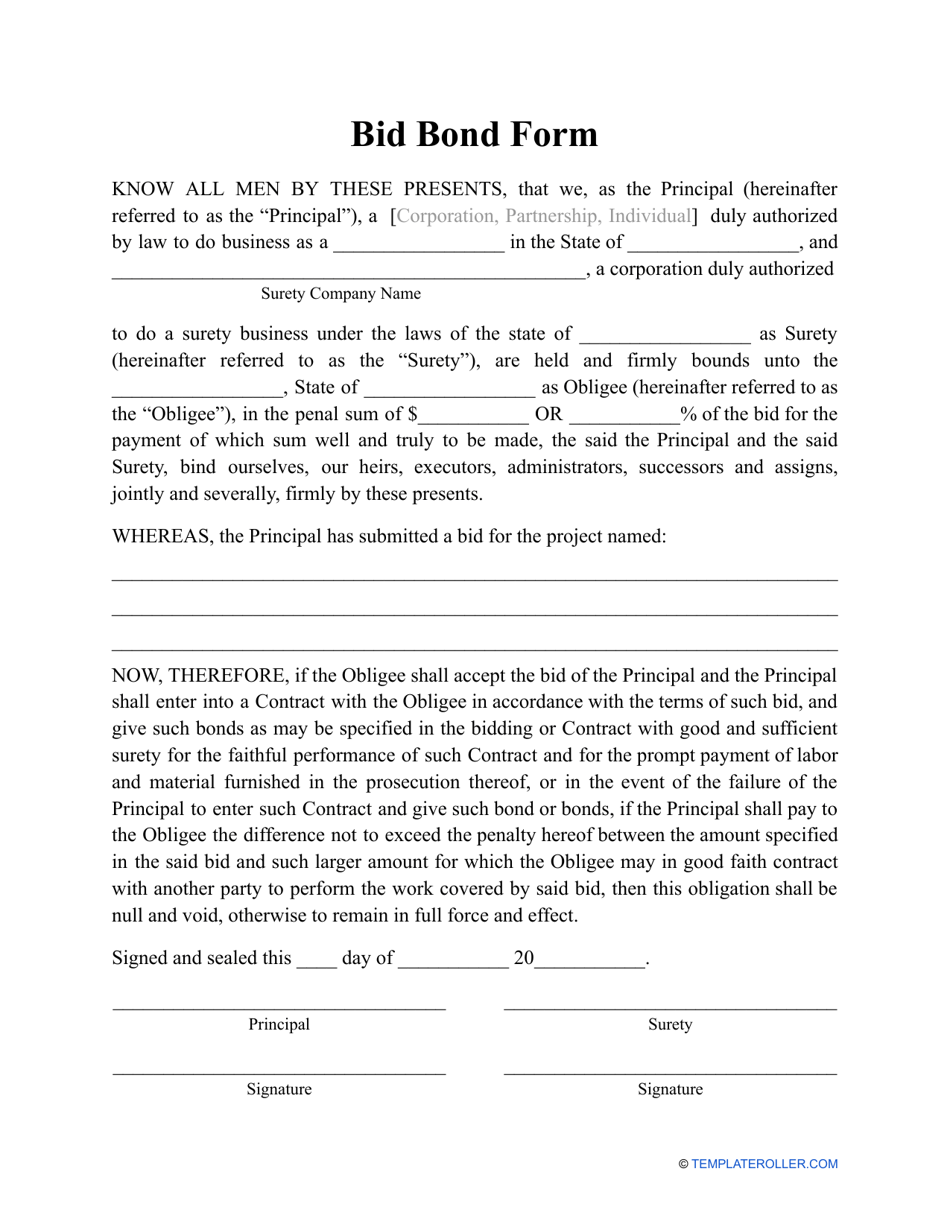

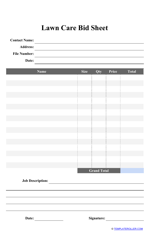

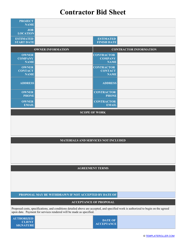

Bid Bond requirements will differ from job to job. At a minimum, it is necessary to include the following details in your document:

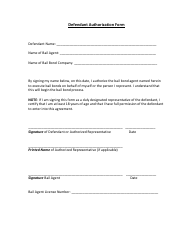

- Identification of the parties - the contractor and the surety company. You can state the legal names and addresses of the parties and confirm you are authorized to do business in your state or town.

- Declaration of the Bid Bond and its exact amount . If you do not know the numbers you will include in the final contract at the time of signing, you can indicate the percentage. The surety company must verify its willingness to provide a financial guarantee for the bid in question.

- Description of the project . Consider including several sentences that outline the basics of the job - the location, the approximate estimate, and the proposed work schedule.

- Date of the signing and signatures of the parties.

How Much Does a Bid Bond Cost?

The Bid Bond cost varies from contract to contract but a standard premium paid by the contractor to the guarantor is usually between $100 and $300. Alternatively, you may agree upon a different cost - for instance, 10% of the total contract price. The eventual amount of money you will have to pay will depend on several aspects such as the terms of the agreement you enter into with a customer, the location of the parties, the credit history of the principal as well as their former agreements with the guarantor, and the total amount of the bid.

Still looking for a particular template? Take a look at the related templates below: