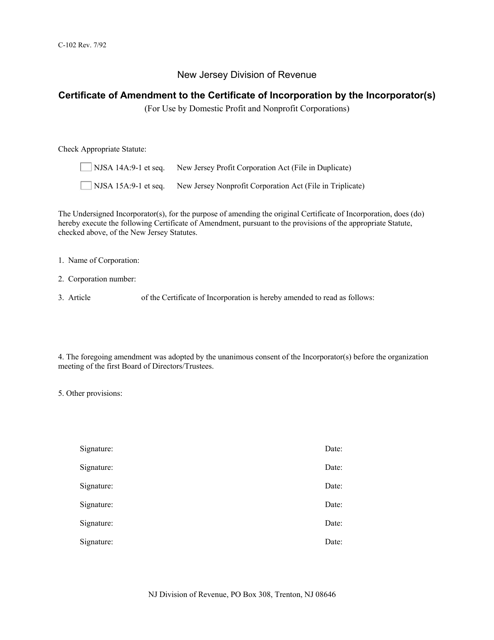

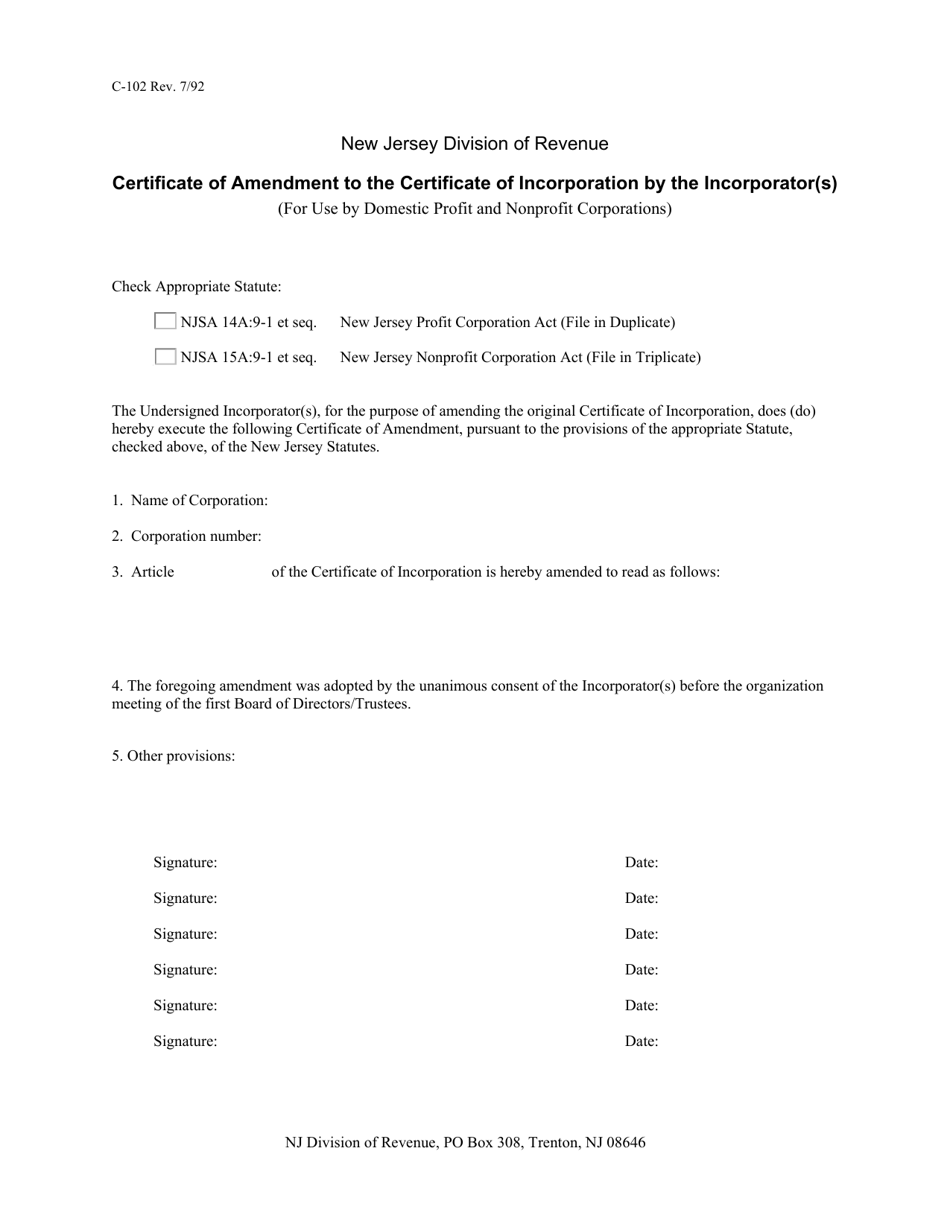

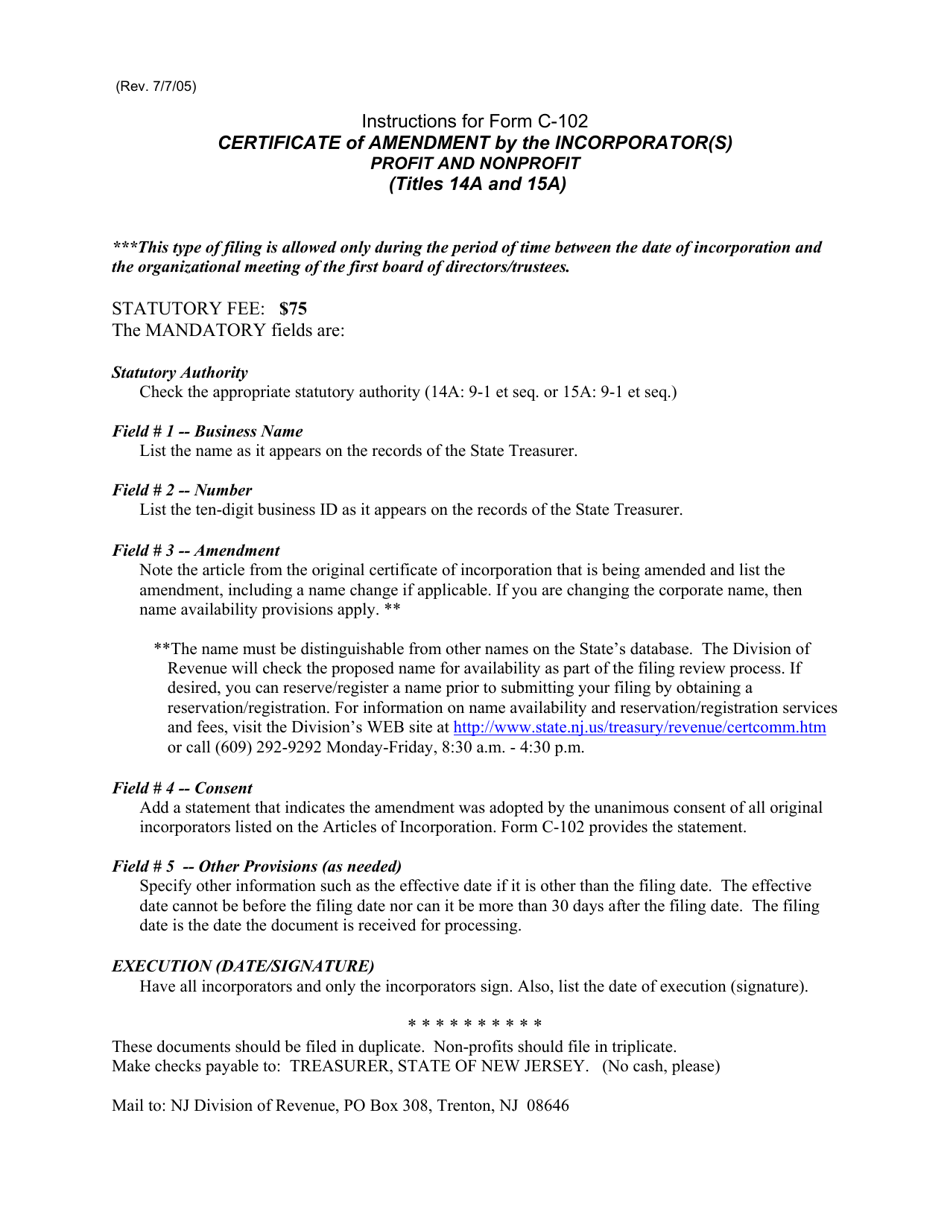

Form C-102 Certificate of Amendment to the Certificate of Incorporation by the Incorporator(S) (For Use by Domestic Profit and Nonprofit Corporations) - New Jersey

What Is Form C-102?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

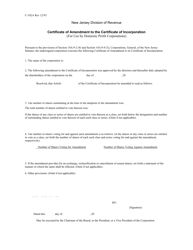

Q: What is Form C-102?

A: Form C-102 is a certificate of amendment to the certificate of incorporation by the incorporator(s) for domestic profit and nonprofit corporations in New Jersey.

Q: Who can use Form C-102?

A: Form C-102 can be used by domestic profit and nonprofit corporations in New Jersey.

Q: What is the purpose of Form C-102?

A: The purpose of Form C-102 is to make amendments to the certificate of incorporation of a corporation.

Q: Who is considered the incorporator(s)?

A: The incorporator(s) are the person or persons who founded the corporation.

Q: Is Form C-102 applicable for both profit and nonprofit corporations?

A: Yes, Form C-102 can be used by both profit and nonprofit corporations.

Q: What are the requirements for filing Form C-102?

A: The requirements for filing Form C-102 include providing the corporation's name, identifying information, the amendment being made, and paying the applicable fee.

Form Details:

- Released on July 1, 1992;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form C-102 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.