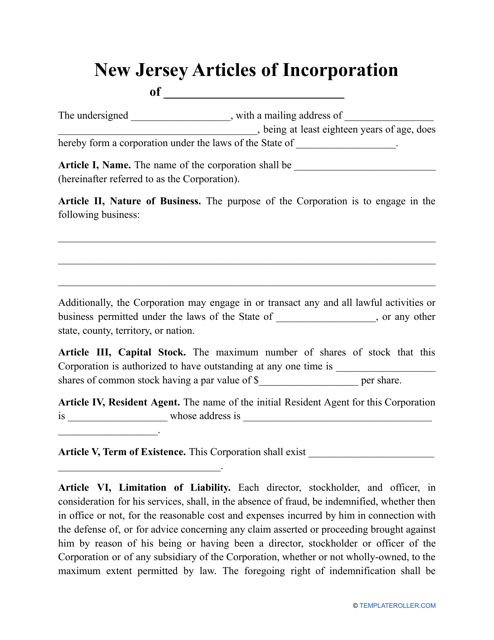

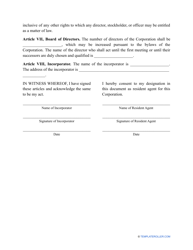

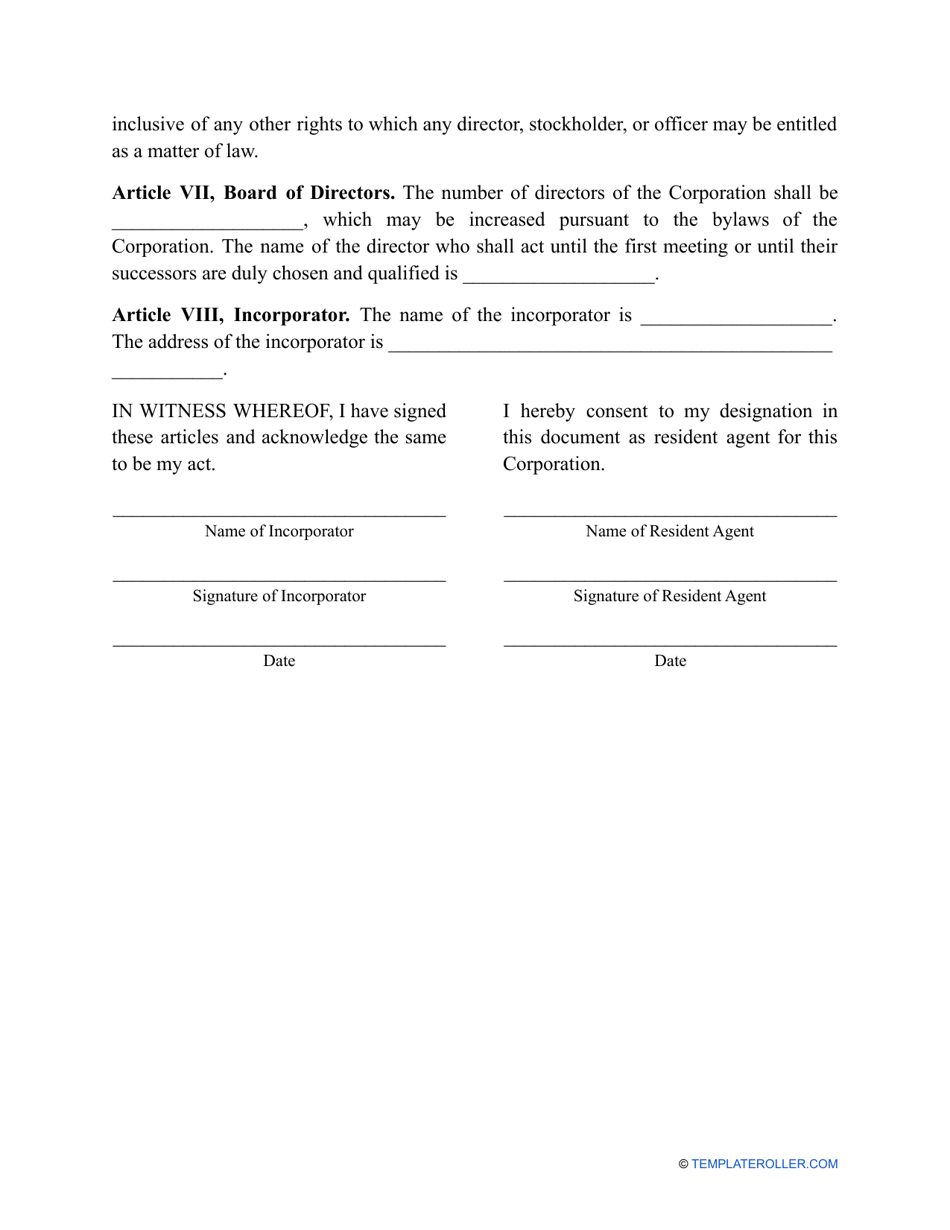

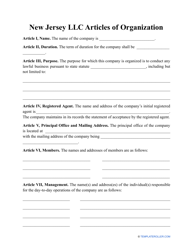

Articles of Incorporation Template - New Jersey

The Articles of Incorporation Template - New Jersey is a standard legal document that is used for forming a corporation in the state of New Jersey. It outlines the basic details of the corporation, such as its name, purpose, registered agent, and initial board of directors. It is filed with the New Jersey Secretary of State's office to establish the legal existence of the corporation.

The Articles of Incorporation template in New Jersey is typically filed by the individuals or entities that are incorporating a new business.

FAQ

Q: What is an Articles of Incorporation?

A: The Articles of Incorporation is a legal document that establishes the existence and purpose of a corporation.

Q: Why do I need an Articles of Incorporation?

A: You need an Articles of Incorporation to legally create a corporation and gain certain benefits, such as limited liability for shareholders.

Q: What information is typically included in an Articles of Incorporation?

A: Typically, it includes the corporation's name, purpose, registered agent, number of authorized shares, and the names and addresses of the initial directors.

Q: How do I file an Articles of Incorporation in New Jersey?

A: You can file it with the New Jersey Division of Revenue by submitting the completed form and paying the required fee.

Q: How much does it cost to file an Articles of Incorporation in New Jersey?

A: The filing fee is currently $125.

Q: Can I use a template for my Articles of Incorporation?

A: Yes, you can use a template as a starting point for drafting your Articles of Incorporation, but make sure to customize it to fit your specific needs.

Q: Can I change my Articles of Incorporation after filing?

A: Yes, you can amend the Articles of Incorporation by filing a Certificate of Amendment with the New Jersey Division of Revenue.

Q: Do I need a lawyer to file an Articles of Incorporation?

A: While it is not required, it is recommended to seek legal advice to ensure compliance with the relevant laws and regulations.

Q: How long does it take to get the Articles of Incorporation approved?

A: The processing time can vary, but it usually takes several weeks to receive approval.

Q: What are the benefits of incorporating a business?

A: Incorporating a business offers benefits such as limited liability protection, potential tax advantages, credibility with customers, and the ability to raise capital.