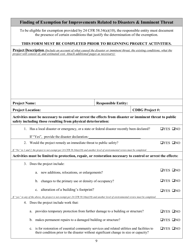

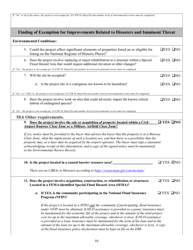

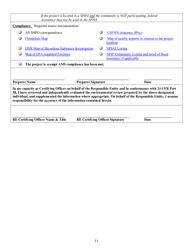

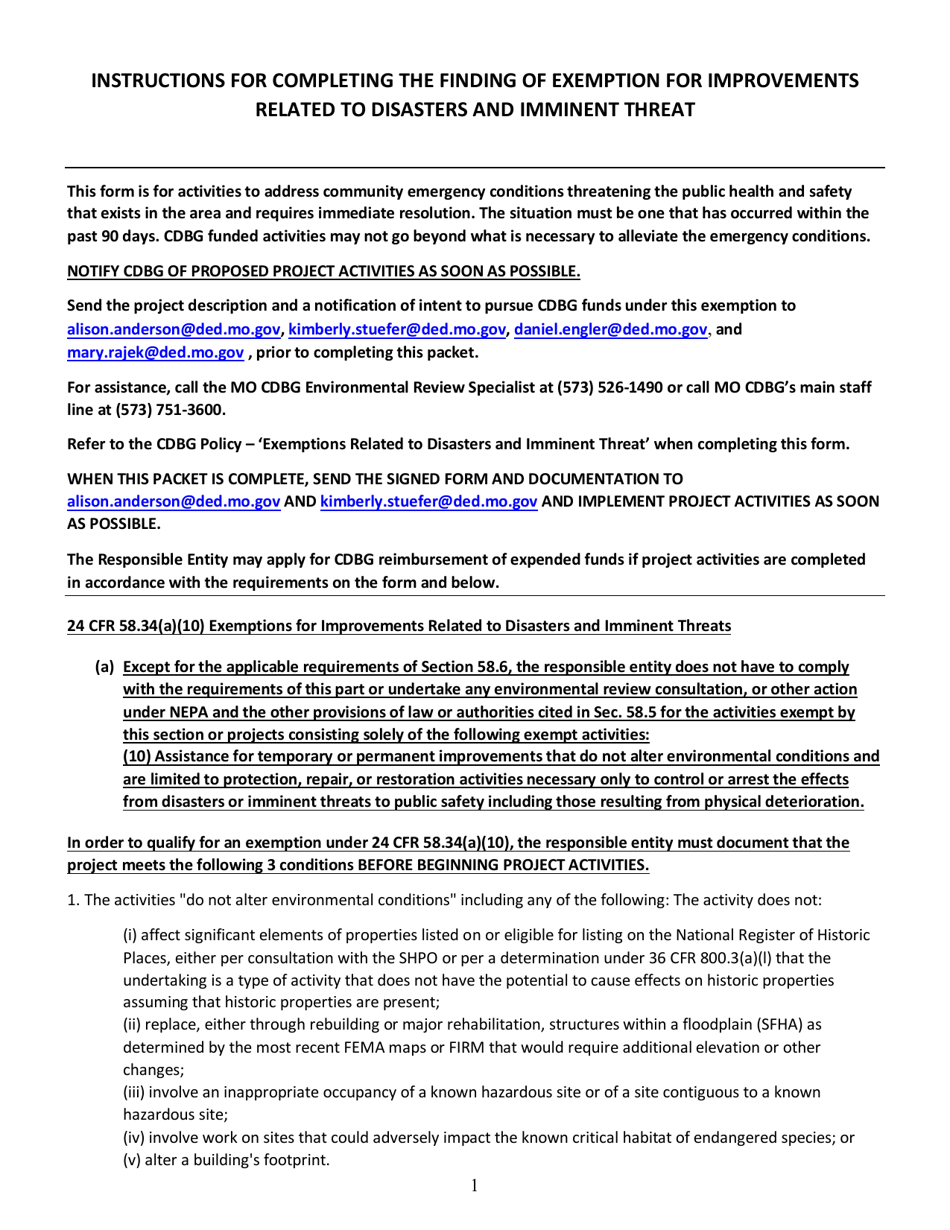

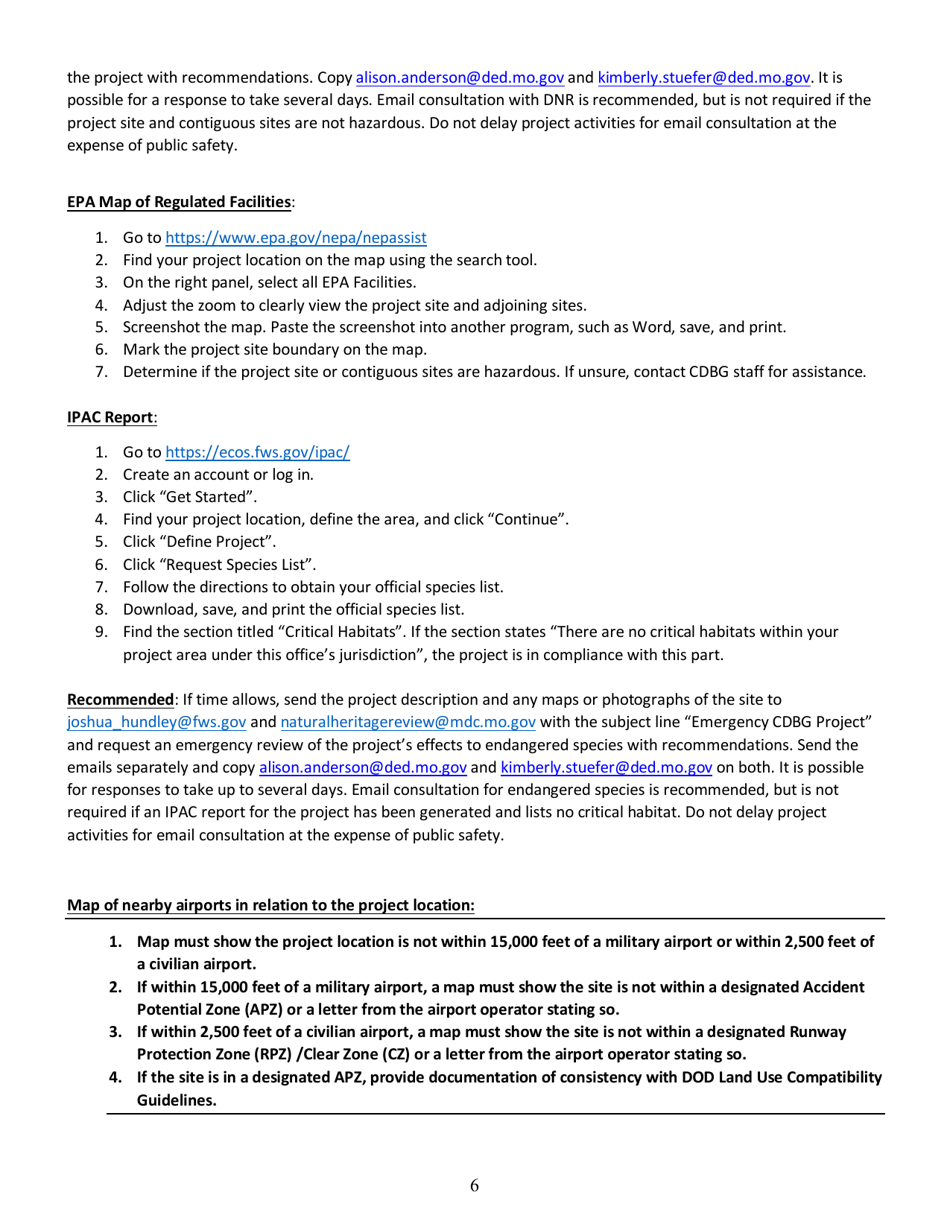

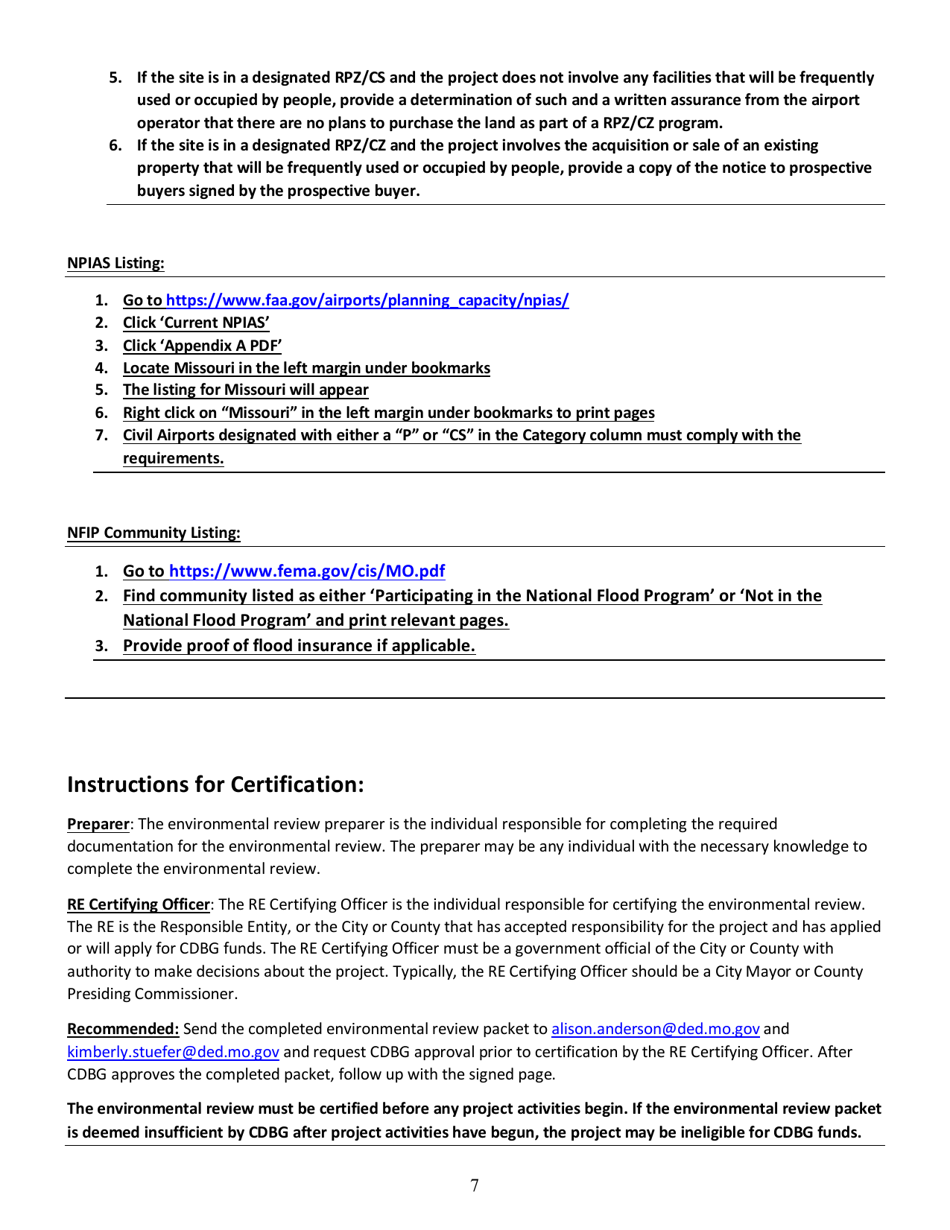

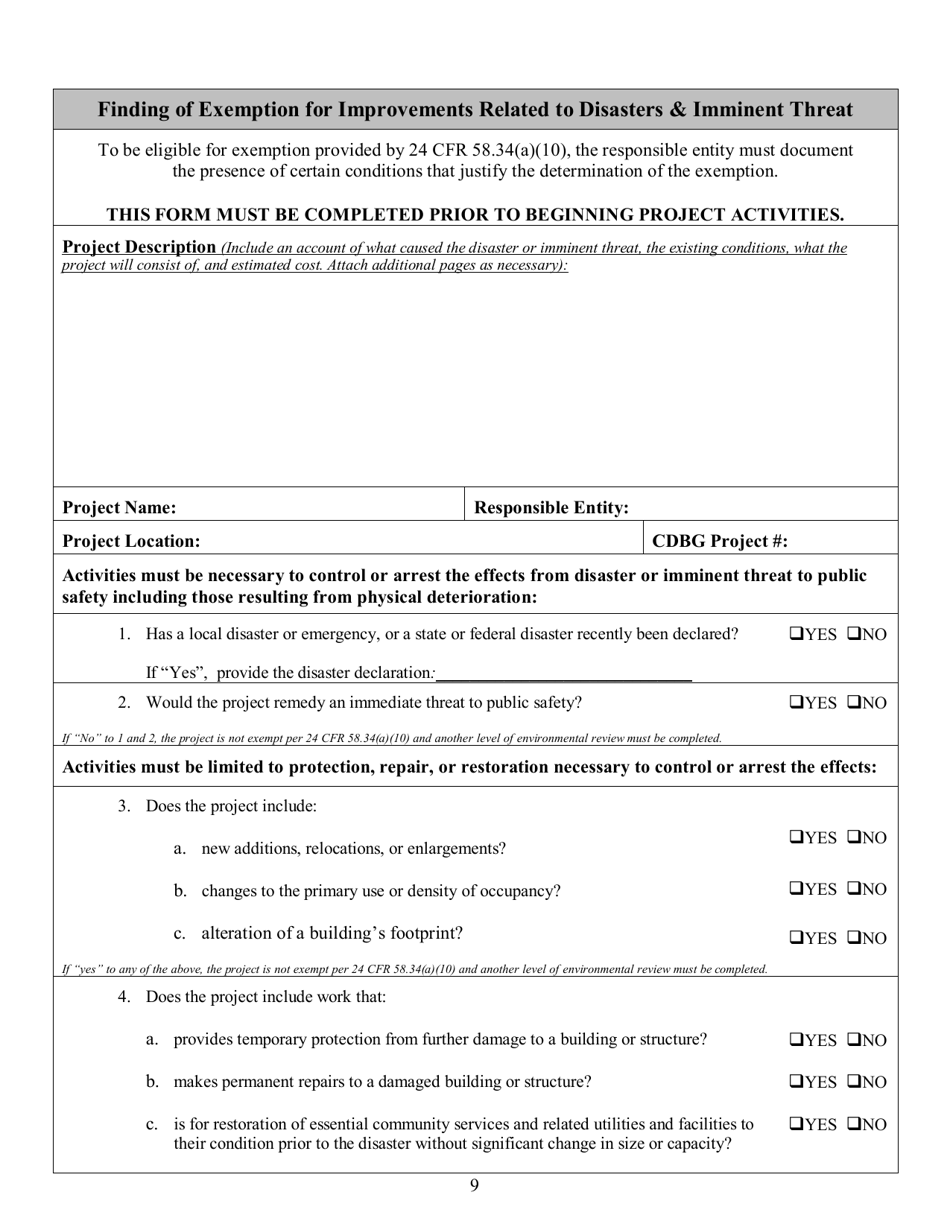

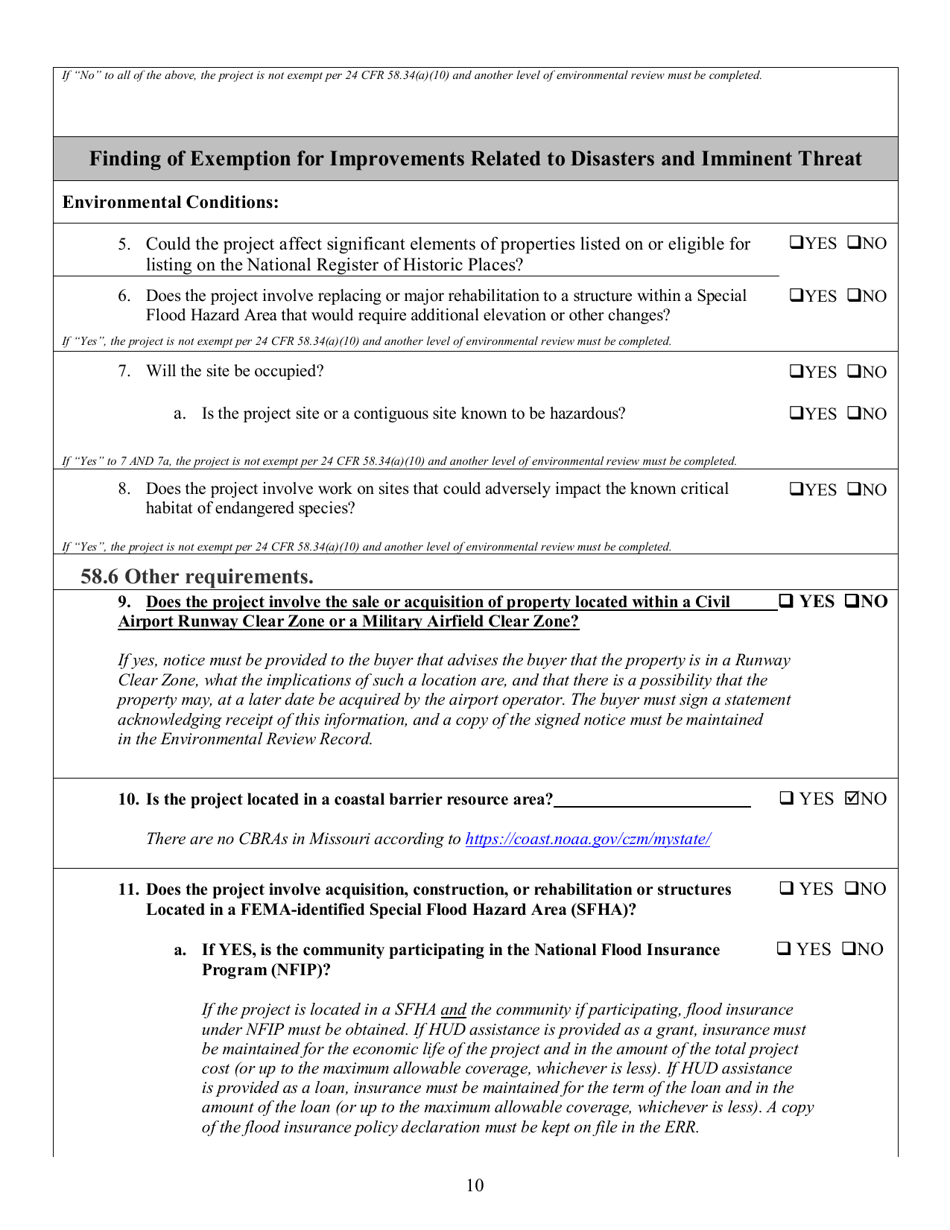

Finding of Exemption for Improvements Related to Disasters & Imminent Threat - Missouri

Finding of Exemption for Improvements Related to Disasters & Imminent Threat is a legal document that was released by the Missouri Department of Economic Development - a government authority operating within Missouri.

FAQ

Q: What is the finding of exemption for improvements related to disasters and imminent threat in Missouri?

A: The finding of exemption allows for certain improvements related to disasters and imminent threats to be exempt from property taxes in Missouri.

Q: What qualifies as improvements related to disasters and imminent threat?

A: Improvements such as repairs, reconstructions, or replacements necessary due to disasters or imminent threats, as determined by the state or local government, may qualify for exemption.

Q: How long does the exemption last?

A: The exemption can last for a period of up to 10 years, depending on the circumstances and the discretion of the county commission or other governing body.

Q: Who is eligible for this exemption?

A: Property owners who have made improvements related to disasters or imminent threats that have been approved and granted the exemption by the county commission or other governing body are eligible.

Q: What is the purpose of this exemption?

A: The purpose of this exemption is to provide relief to property owners who have been affected by disasters or imminent threats by reducing their property tax burden.

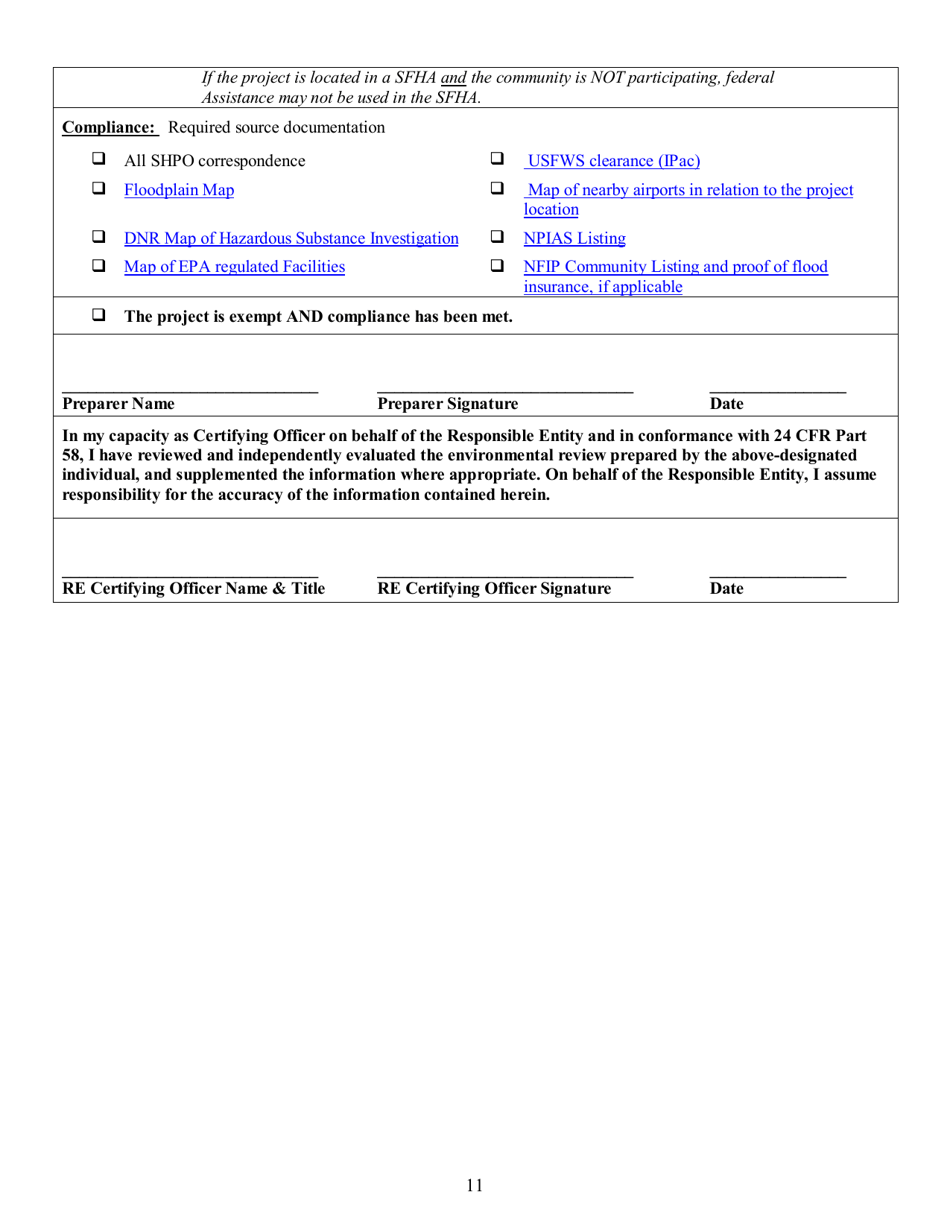

Form Details:

- The latest edition currently provided by the Missouri Department of Economic Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Missouri Department of Economic Development.