This version of the form is not currently in use and is provided for reference only. Download this version of

Form 1168A

for the current year.

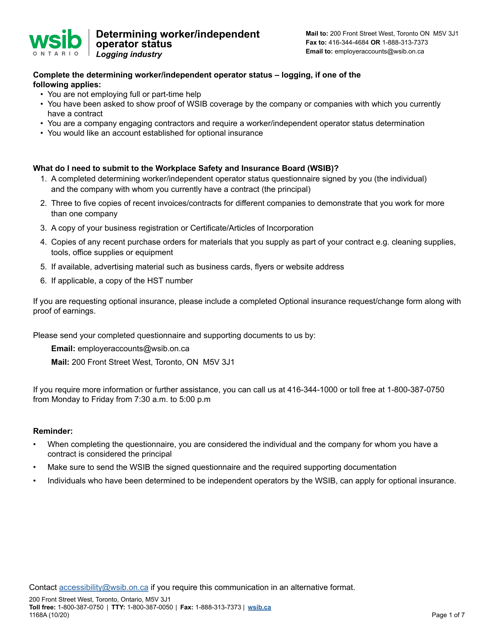

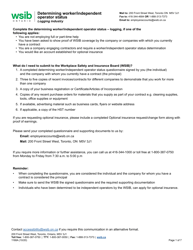

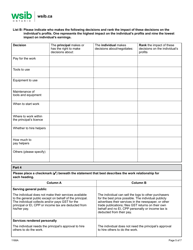

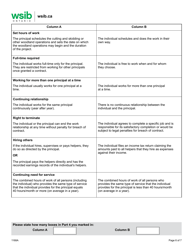

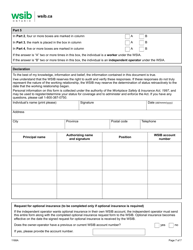

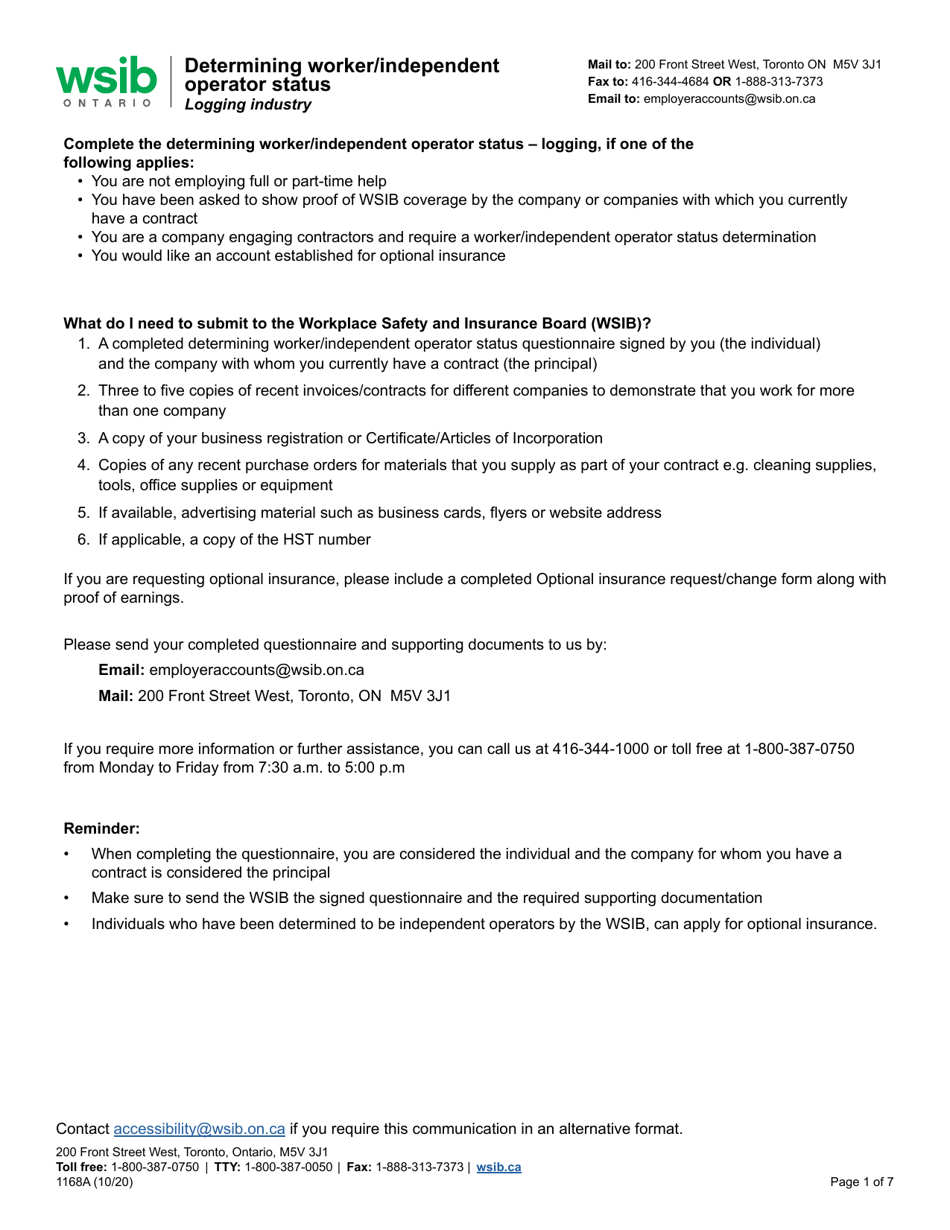

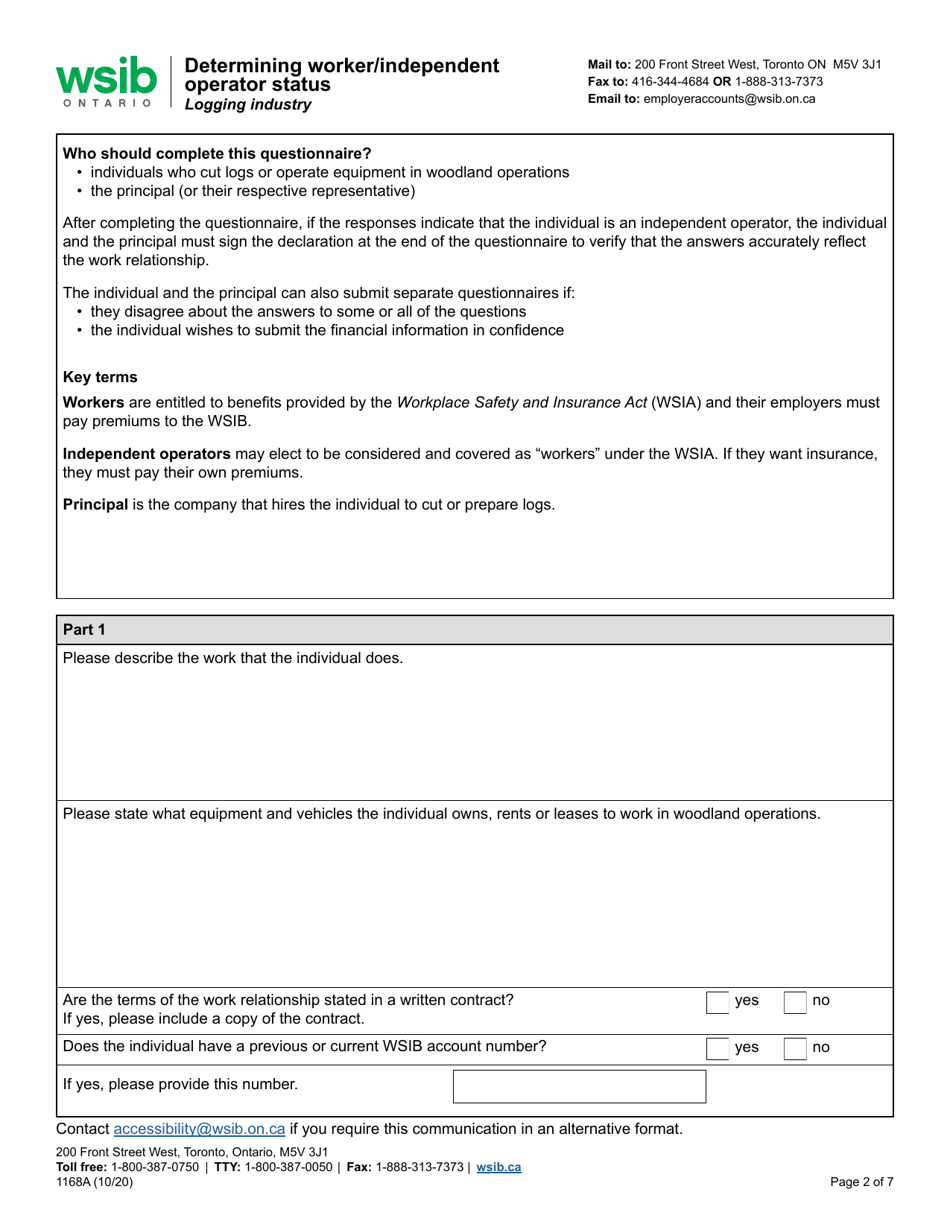

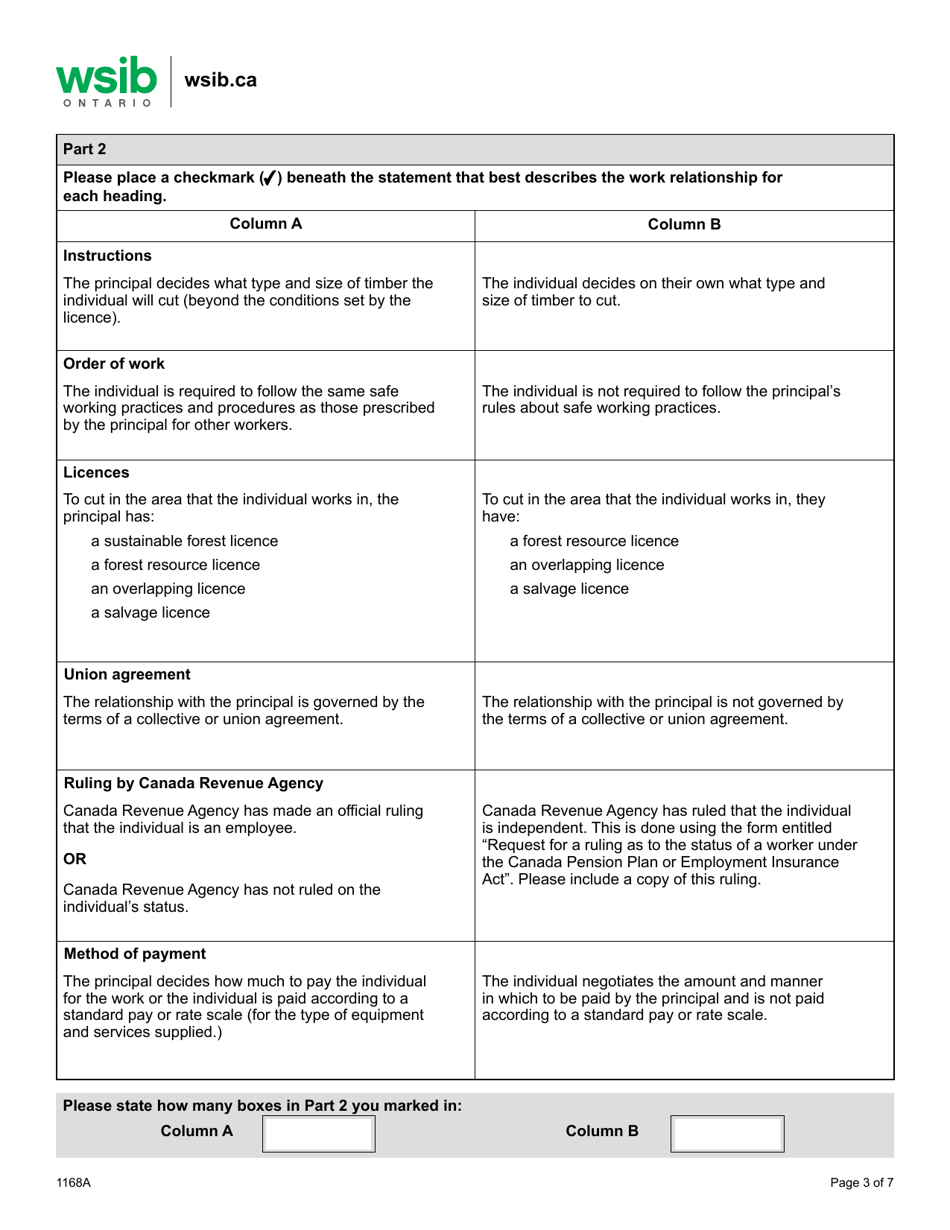

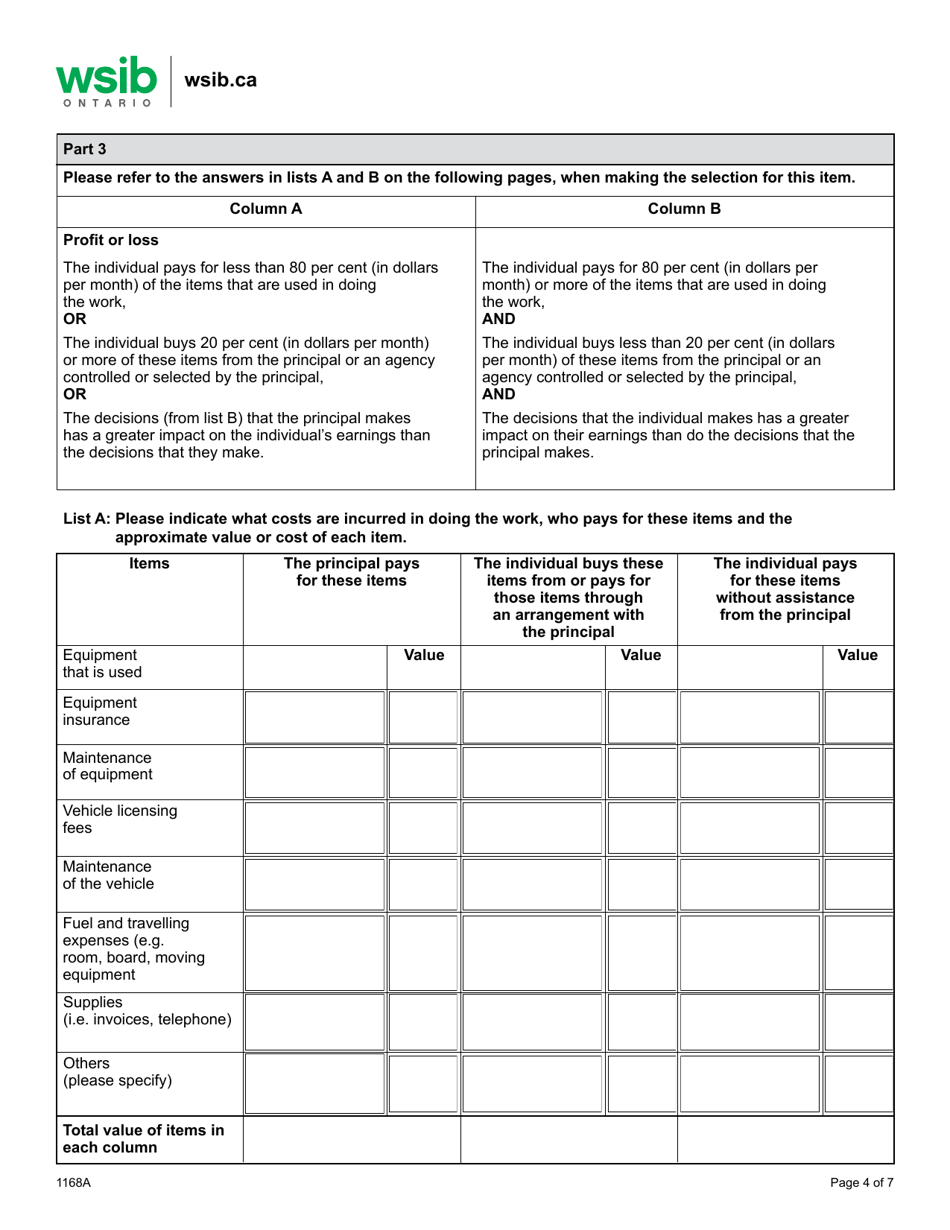

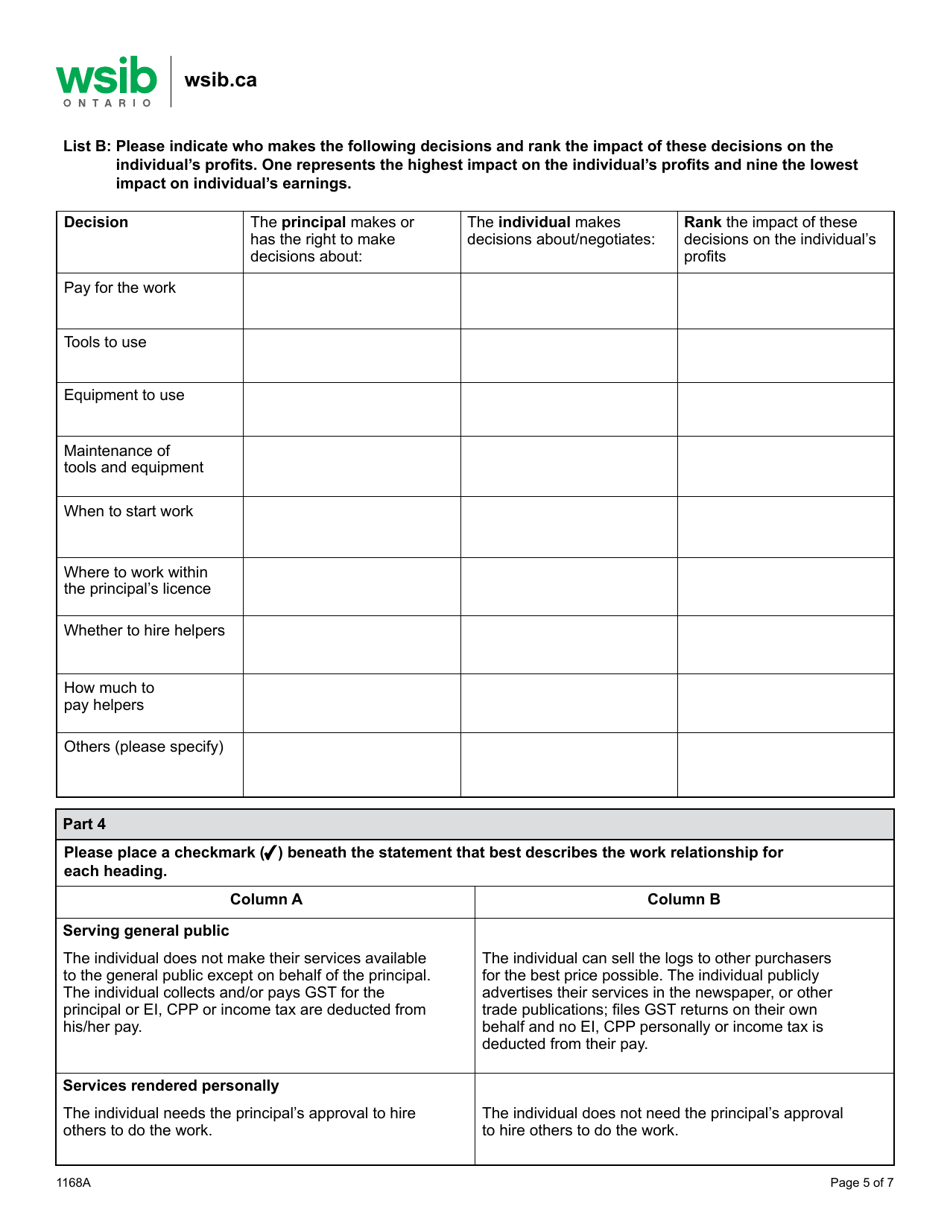

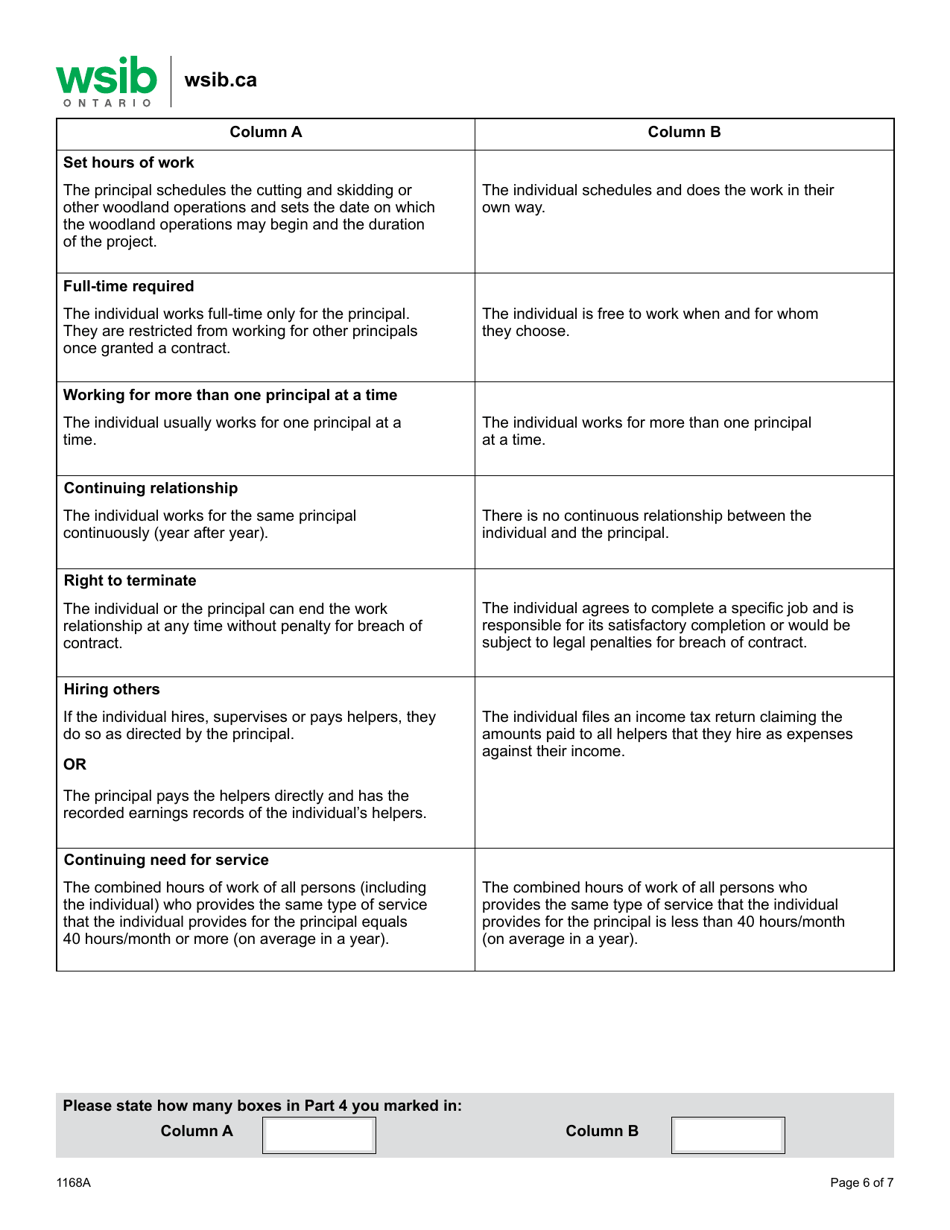

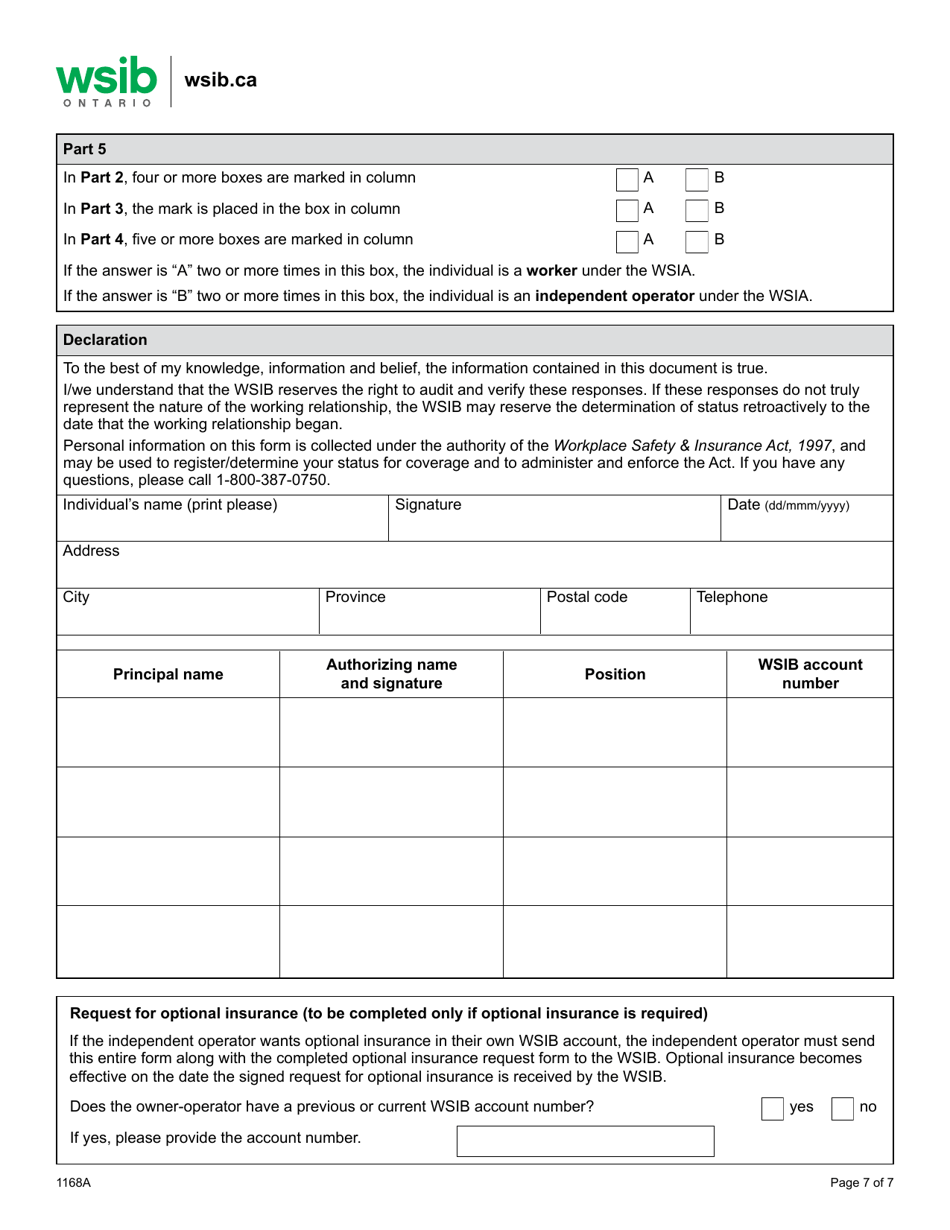

Form 1168A Determining Worker / Independent Operator Status Questionnaire - Logging Industry - Ontario, Canada

Form 1168A Determining Worker/Independent Operator Status Questionnaire - Logging Industry in Ontario, Canada is used to determine whether a worker in the logging industry should be classified as an employee or an independent operator. It helps assess the individual's employment status and their relationship with the company.

The Form 1168A Determining Worker/Independent Operator Status Questionnaire in the Logging Industry in Ontario, Canada is typically filed by the worker or independent operator themselves.

FAQ

Q: What is Form 1168A?

A: Form 1168A is a questionnaire used to determine worker/independent operator status in the logging industry in Ontario, Canada.

Q: Who uses Form 1168A?

A: Form 1168A is used by individuals and businesses in the logging industry in Ontario, Canada.

Q: What is the purpose of Form 1168A?

A: The purpose of Form 1168A is to determine whether a worker should be classified as an employee or an independent operator in the logging industry in Ontario, Canada.

Q: What is the logging industry?

A: The logging industry involves cutting, skidding, and transporting trees for timber.

Q: Why is it important to determine worker/independent operator status?

A: Determining worker/independent operator status is important for tax and employment purposes, as it affects how individuals are classified and the benefits they are entitled to.

Q: Are there any penalties for misclassifying workers?

A: Yes, there can be penalties for misclassifying workers, including fines and potential legal consequences.

Q: Who should I contact if I have questions about Form 1168A?

A: For questions about Form 1168A, you can contact the Ontario Ministry of Finance or seek professional advice from a tax or legal expert.