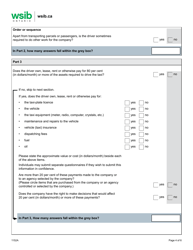

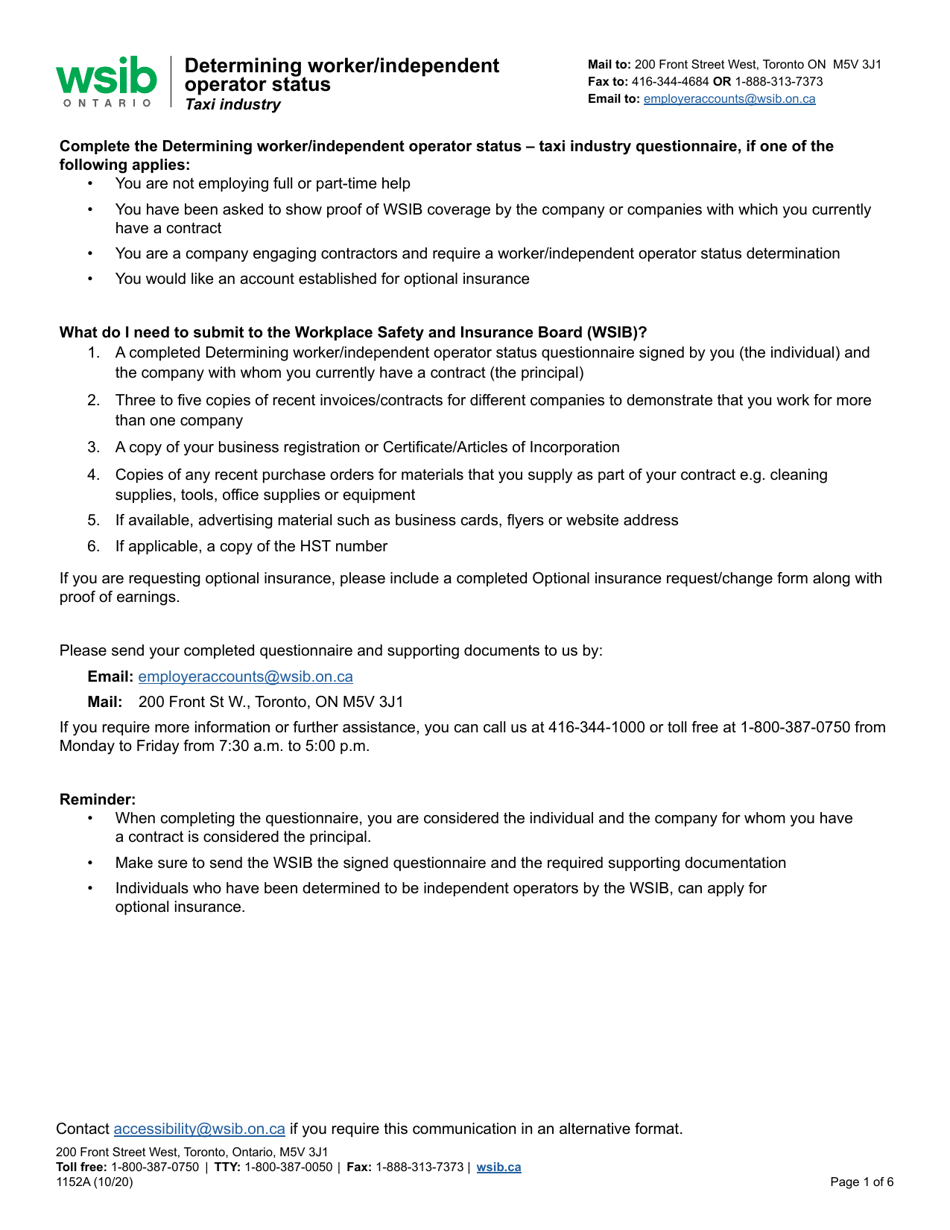

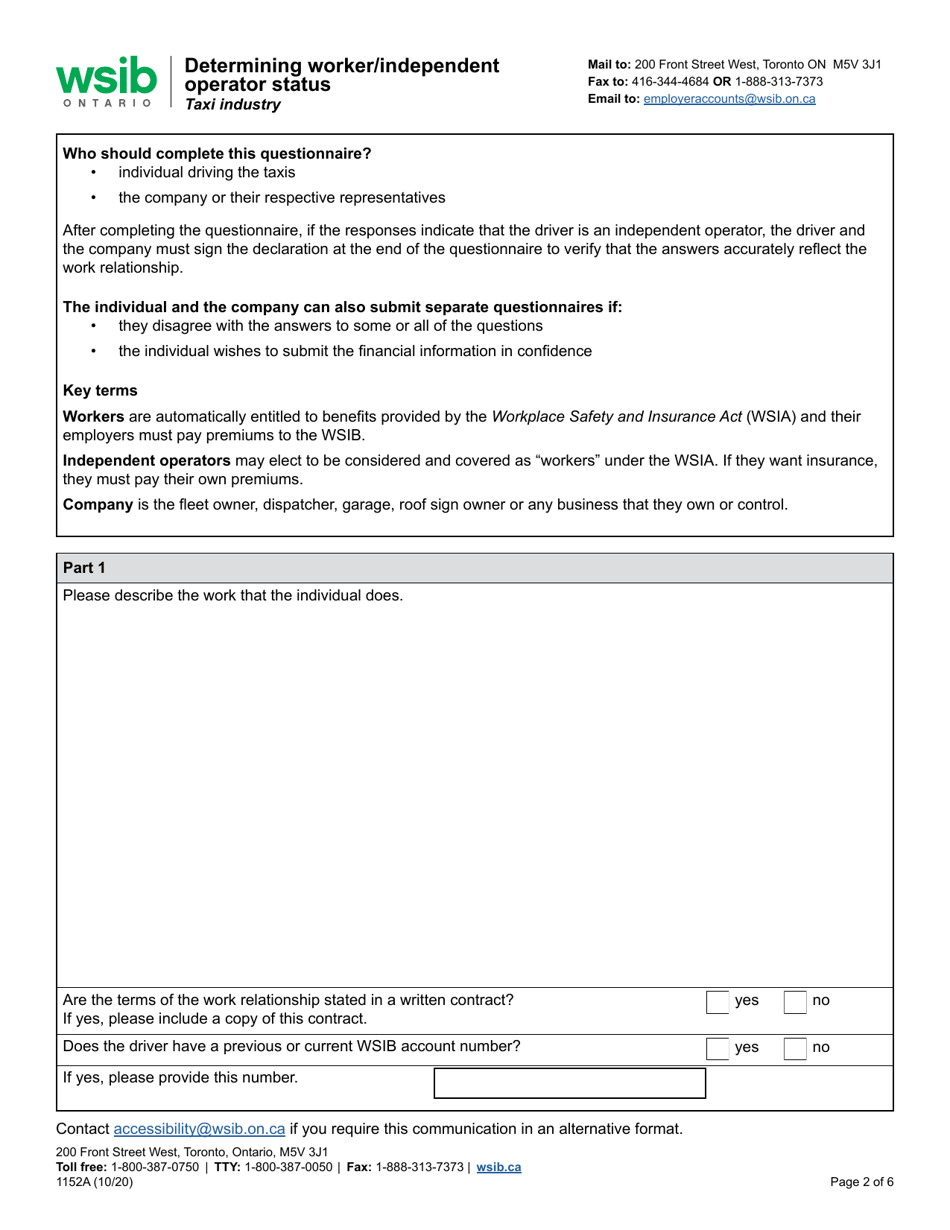

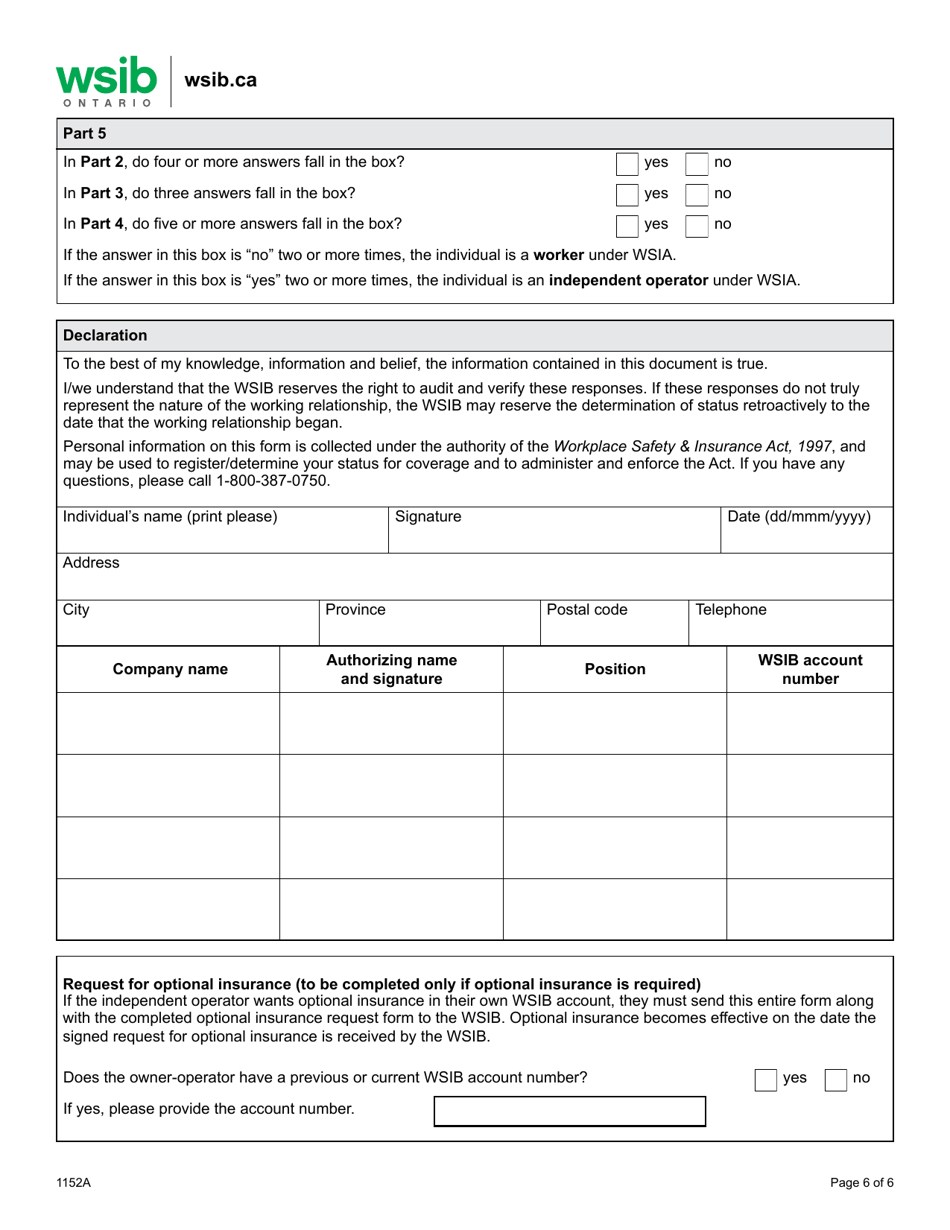

Form 1152A Determining Worker / Independent Operator Status - Taxi Industry - Ontario, Canada

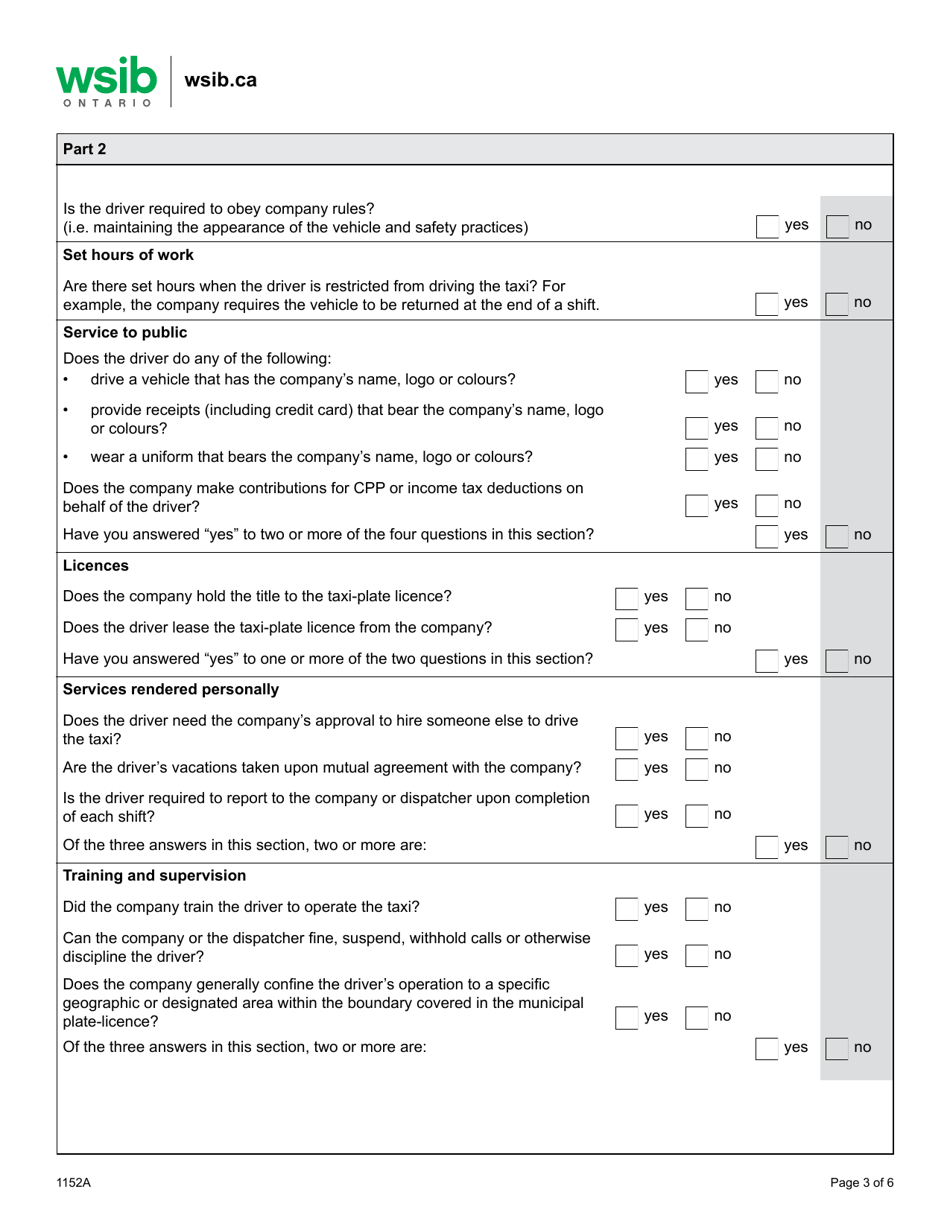

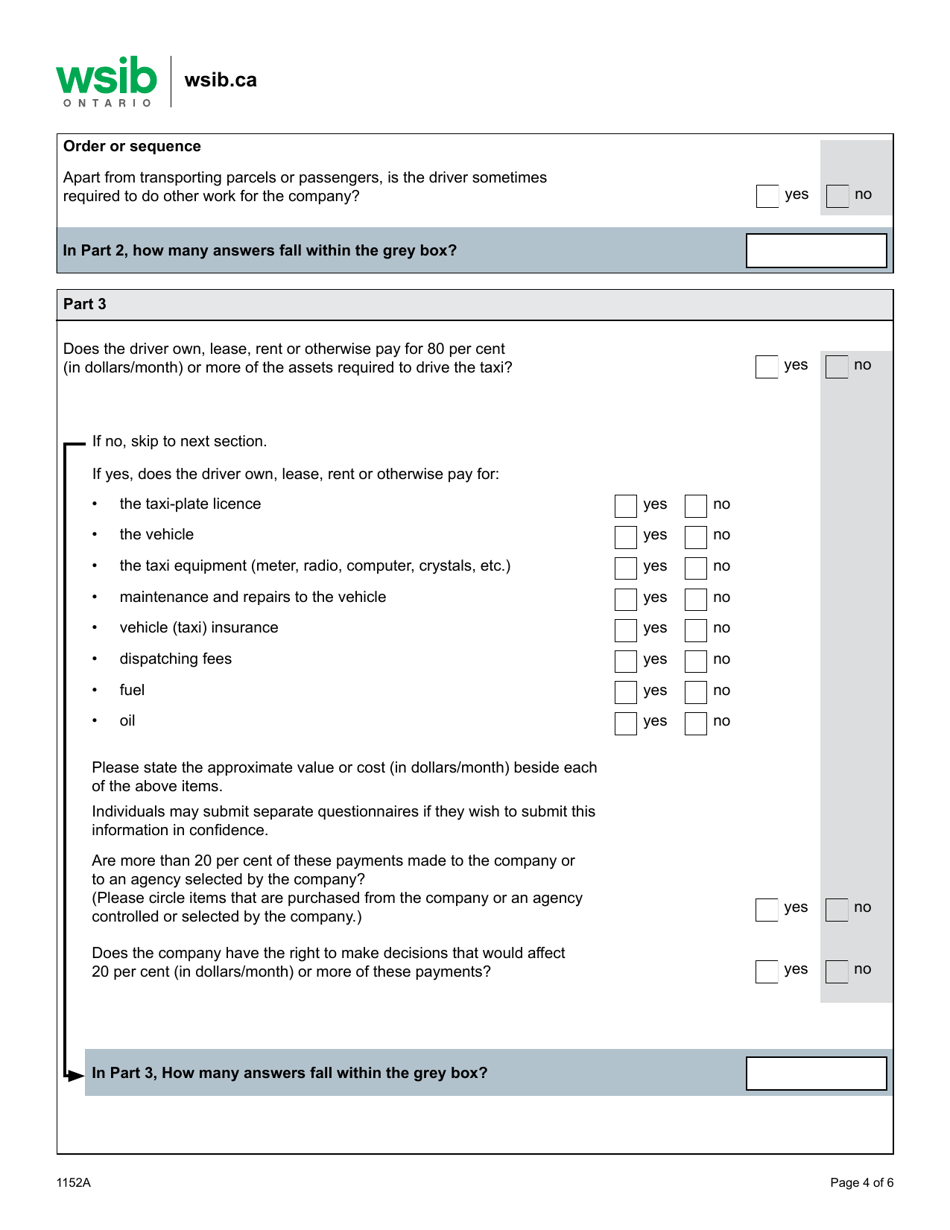

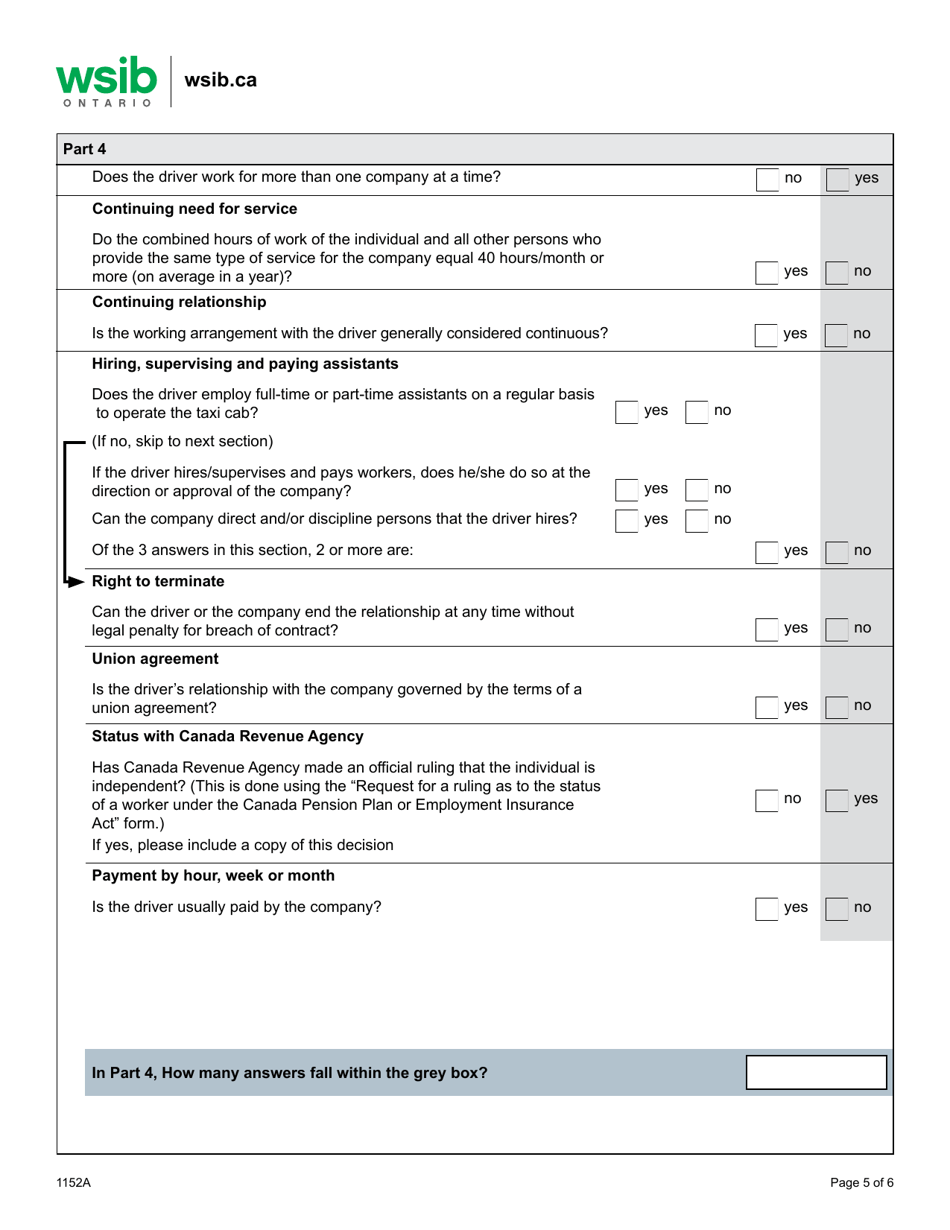

Form 1152A is used in Ontario, Canada to determine whether a person working in the taxi industry is classified as a worker or an independent operator for employment purposes. It helps determine the employment relationship between the individual and the taxi company.

The individual who wants to determine their worker/independent operator status in the taxi industry in Ontario, Canada would file the Form 1152A.

FAQ

Q: What is Form 1152A?

A: Form 1152A is a form used in Ontario, Canada to determine worker/independent operator status in the taxi industry.

Q: Who uses Form 1152A?

A: Form 1152A is used by individuals and businesses in the taxi industry in Ontario, Canada.

Q: What is the purpose of Form 1152A?

A: The purpose of Form 1152A is to determine whether a worker in the taxi industry is classified as an employee or an independent operator.

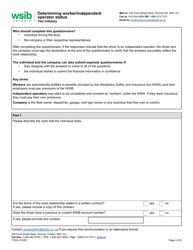

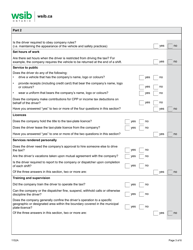

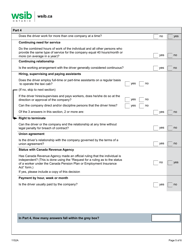

Q: What information is required on Form 1152A?

A: Form 1152A requires information about the nature of the relationship between the worker and the employer, as well as details about the worker's business.

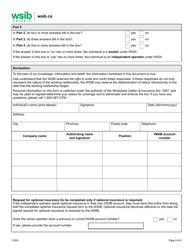

Q: What happens after submitting Form 1152A?

A: After submitting Form 1152A, the Ministry of Labour will review the information provided and make a determination on the worker's status.

Q: What are the potential outcomes of Form 1152A?

A: The potential outcomes of Form 1152A include being classified as an employee or an independent operator, which can have implications for taxation and employment rights.

Q: Are there any penalties for misclassifying workers in the taxi industry?

A: Yes, there can be penalties for misclassifying workers in the taxi industry, including fines and sanctions imposed by the Ministry of Labour.

Q: Is Form 1152A specific to the taxi industry in Ontario?

A: Yes, Form 1152A is specifically designed for the taxi industry in Ontario, Canada.