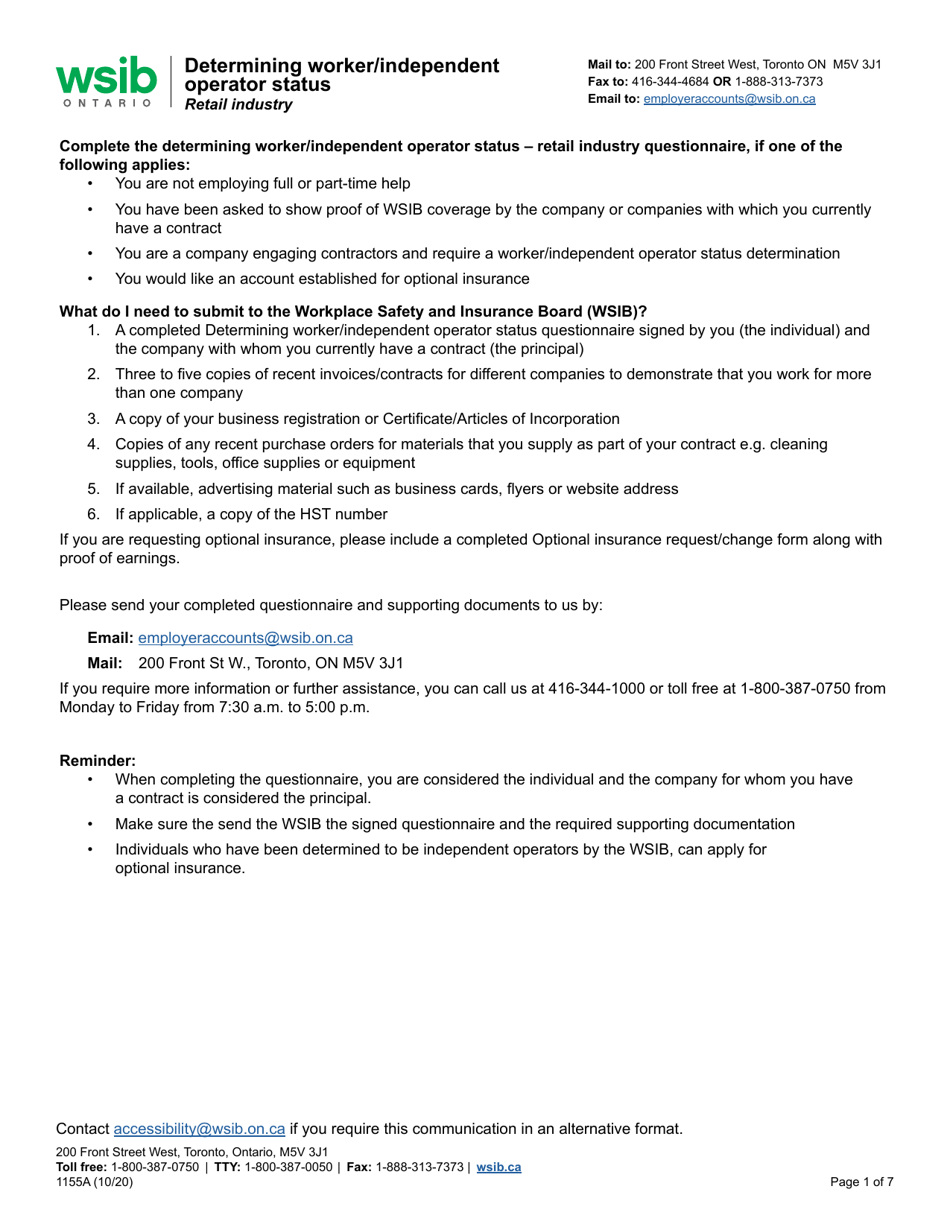

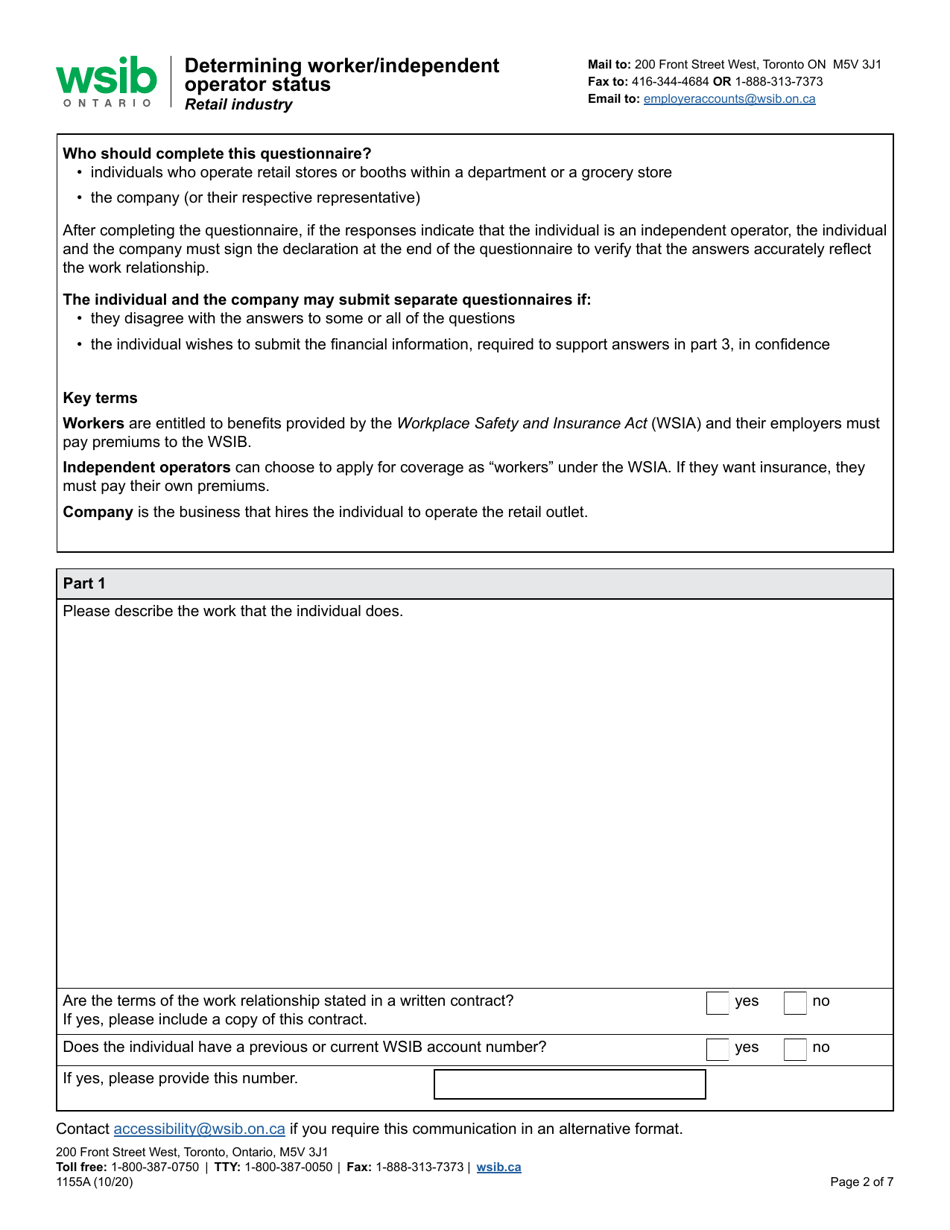

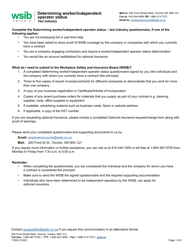

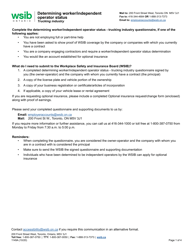

Form 1155A Determining Worker / Independent Operator Status - Retail Industry - Ontario, Canada

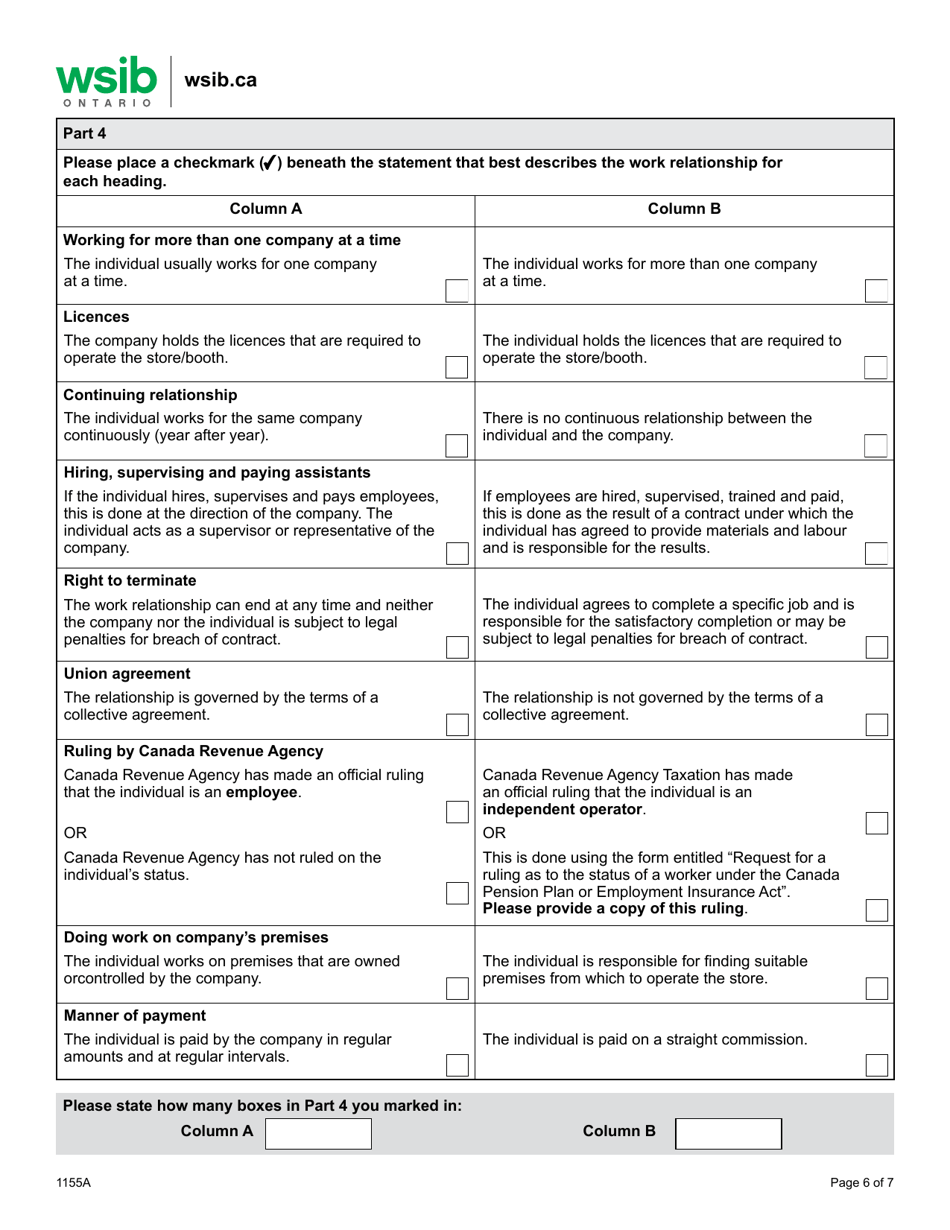

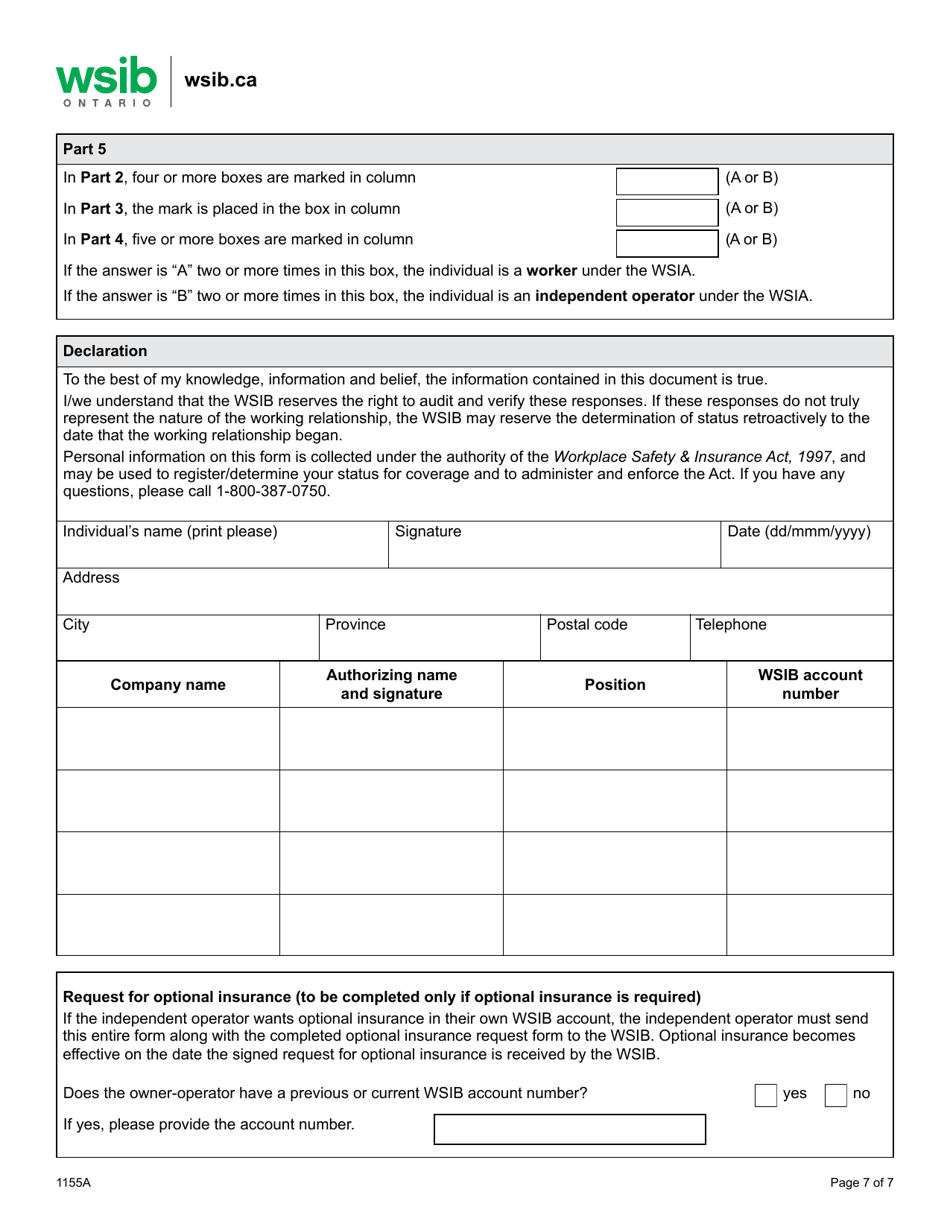

Form 1155A Determining Worker/Independent Operator Status - Retail Industry - Ontario, Canada is used to determine whether a worker should be classified as an independent operator or an employee in the retail industry in Ontario, Canada. It helps to assess the worker's status for employment and tax purposes.

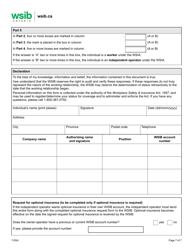

The employer or the worker would file the Form 1155A to determine worker/independent operator status in the retail industry in Ontario, Canada.

FAQ

Q: What is Form 1155A?

A: Form 1155A is a document used in Ontario, Canada to determine worker/independent operator status in the retail industry.

Q: Who uses Form 1155A?

A: Employers in the retail industry in Ontario, Canada use Form 1155A to determine if a worker should be classified as an independent operator or an employee.

Q: What does Form 1155A determine?

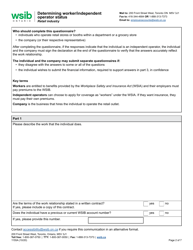

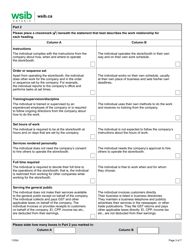

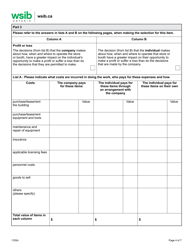

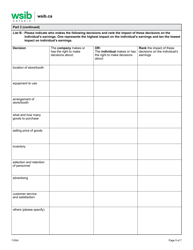

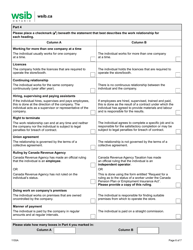

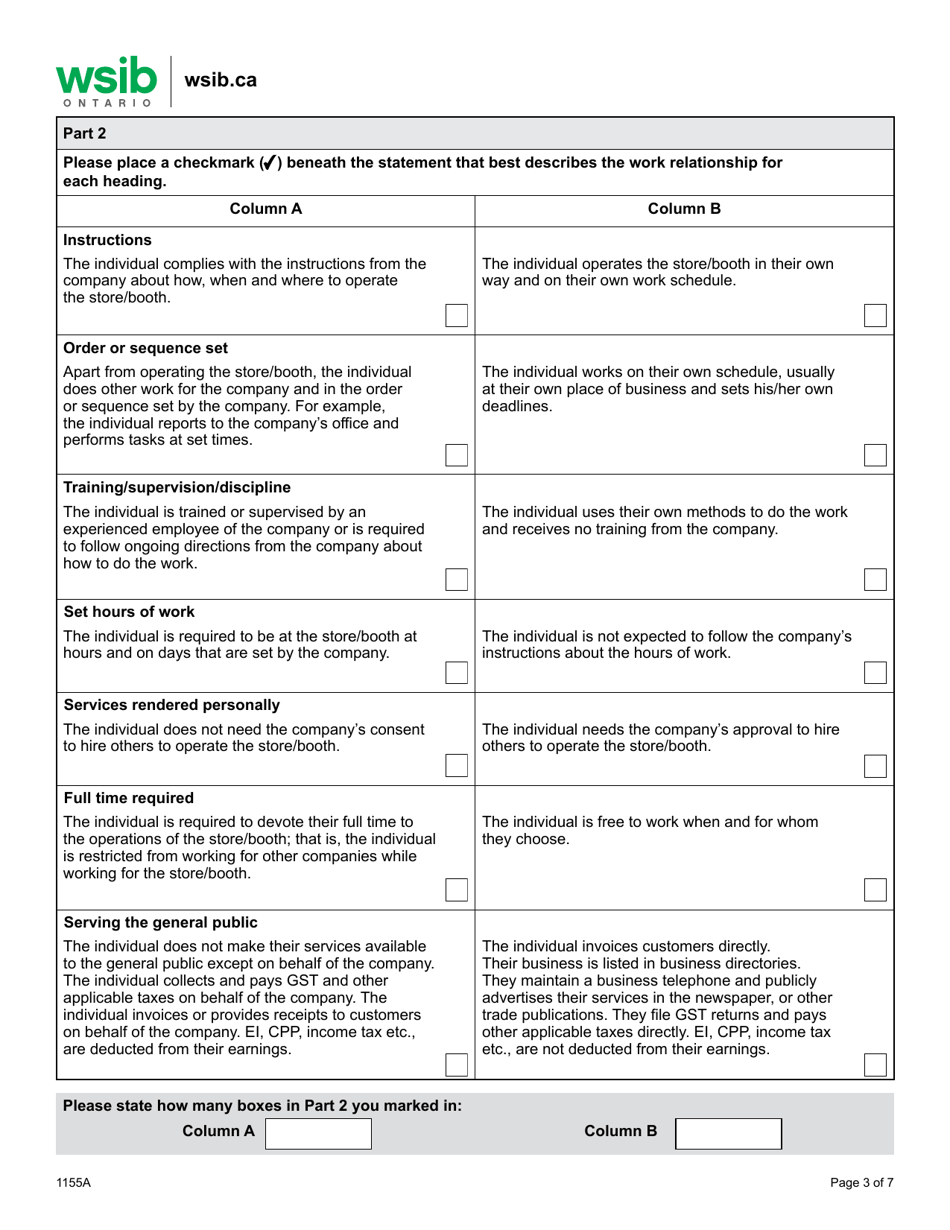

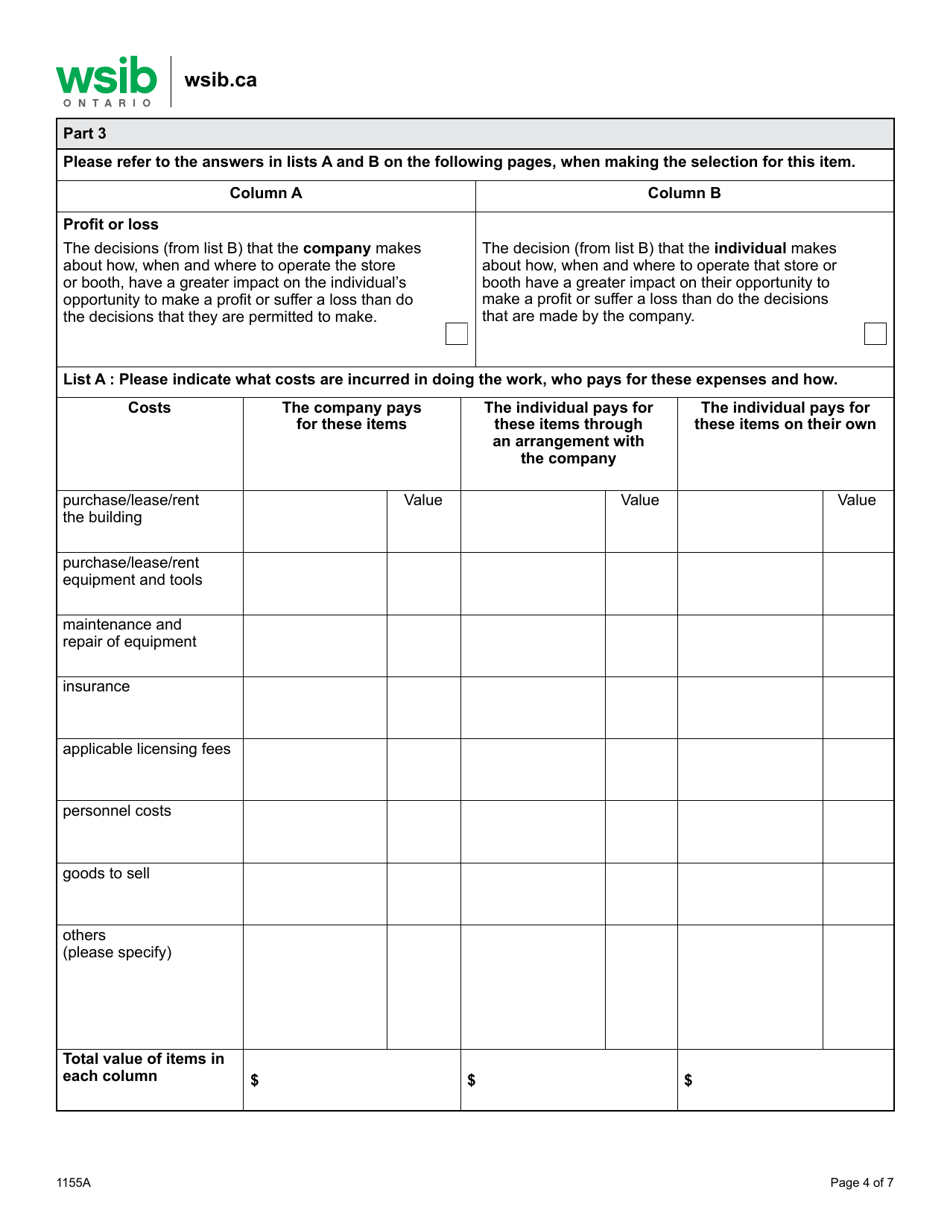

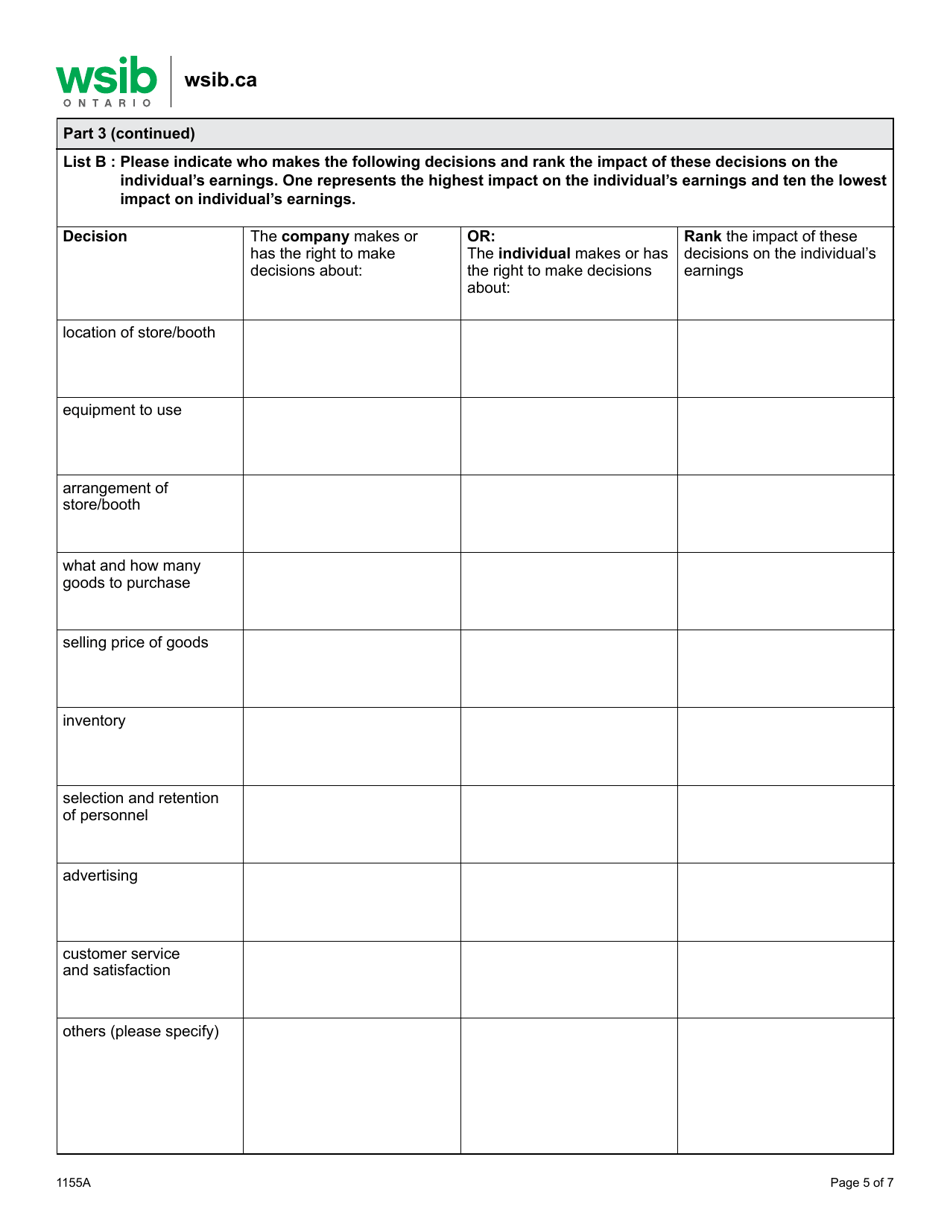

A: Form 1155A helps determine if a worker should be considered an independent operator or an employee based on certain factors like control, ownership, integration, and financial risk.

Q: Why is determining worker status important?

A: Determining worker status is important because it determines the rights and responsibilities of the worker and the employer, such as eligibility for benefits, tax obligations, and statutory protections.

Q: What is the role of the Retail Industry Advisory Group in relation to Form 1155A?

A: The Retail Industry Advisory Group provides guidance and assistance to the Ontario Ministry of Labour in developing and implementing Form 1155A and the related policies.