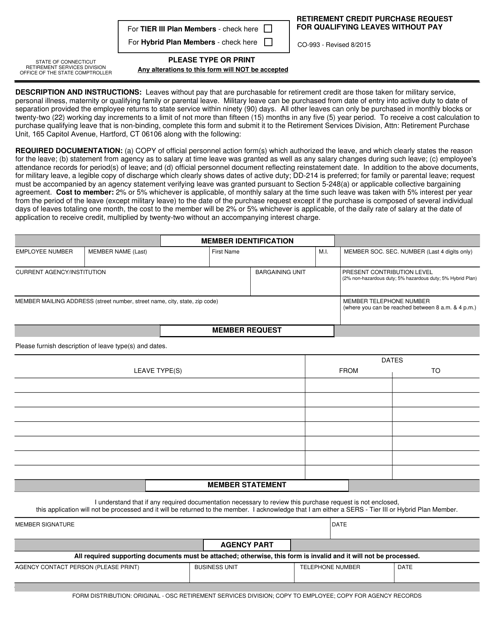

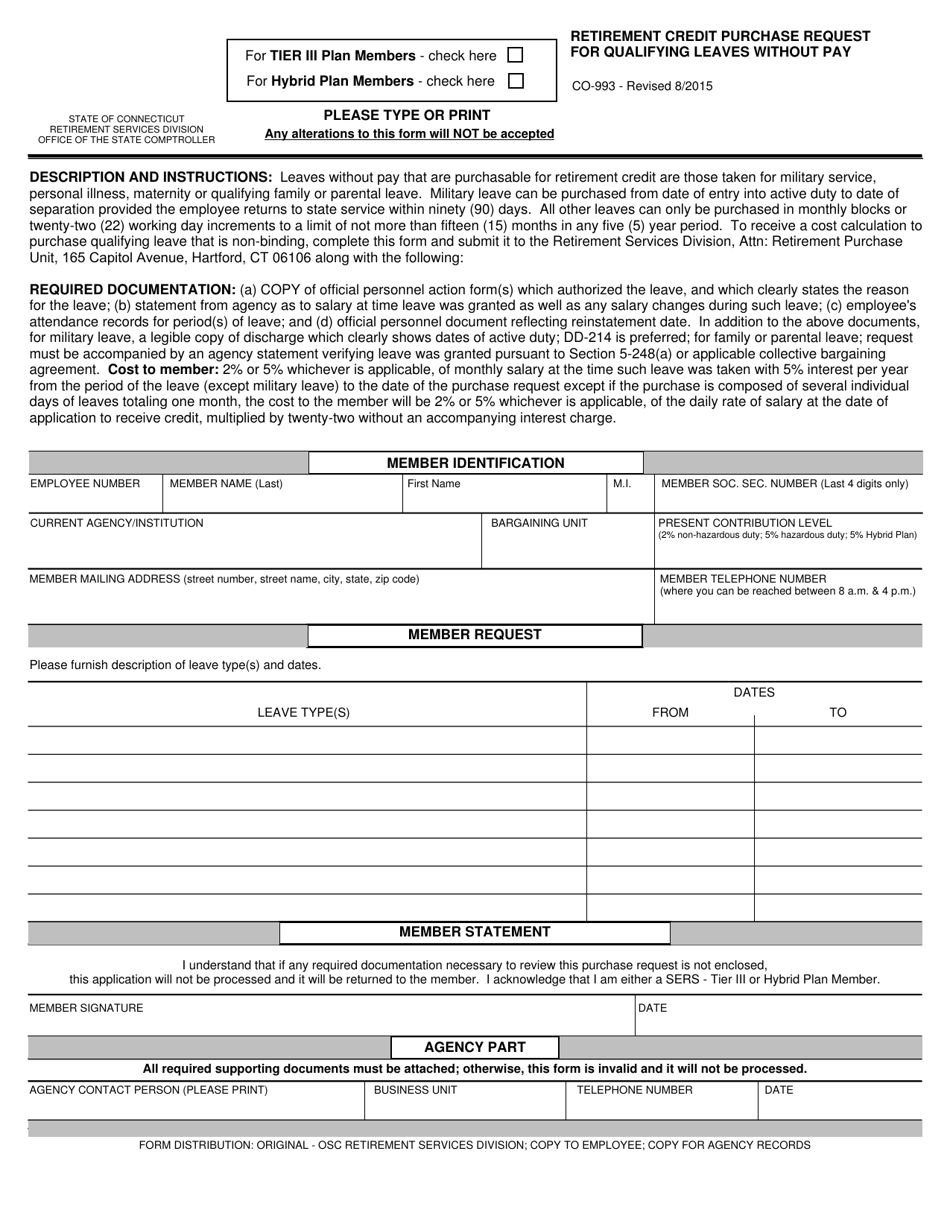

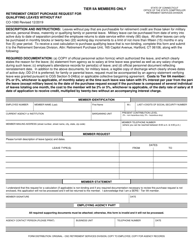

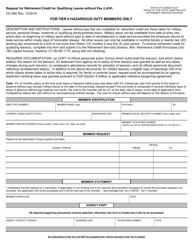

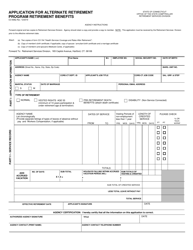

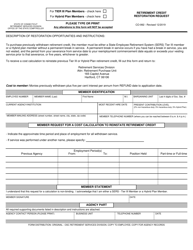

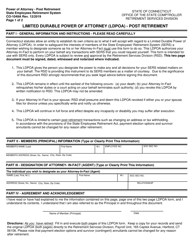

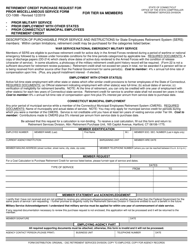

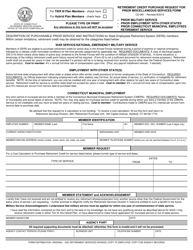

Form CO-993 Retirement Credit Purchase Request for Qualifying Leaves Without Pay - Connecticut

What Is Form CO-993?

This is a legal form that was released by the Connecticut Office of the State Comptroller - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

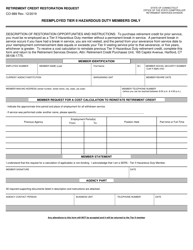

Q: What is the Form CO-993 Retirement Credit Purchase Request for Qualifying Leaves Without Pay?

A: The Form CO-993 is a request form used in Connecticut to purchase retirement credits for qualifying leaves without pay.

Q: What are qualifying leaves without pay?

A: Qualifying leaves without pay are periods of time when an employee does not receive a salary or wages but is still eligible to purchase retirement credits.

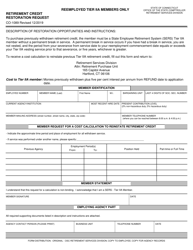

Q: How can I use the Form CO-993?

A: You can use the Form CO-993 to request the purchase of retirement credits for qualifying leaves without pay in Connecticut.

Q: Is the Form CO-993 specific to Connecticut?

A: Yes, the Form CO-993 is specific to Connecticut and is used in relation to the state's retirement system.

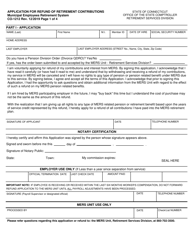

Q: Can anyone use the Form CO-993?

A: No, the Form CO-993 is intended for employees in Connecticut who wish to purchase retirement credits for qualifying leaves without pay.

Q: Are there any fees associated with using the Form CO-993?

A: There may be fees involved in the purchase of retirement credits using the Form CO-993. It is recommended to review the instructions provided with the form or contact your employer for more information.

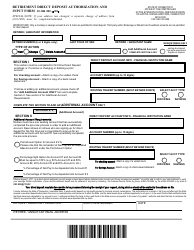

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the Connecticut Office of the State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-993 by clicking the link below or browse more documents and templates provided by the Connecticut Office of the State Comptroller.