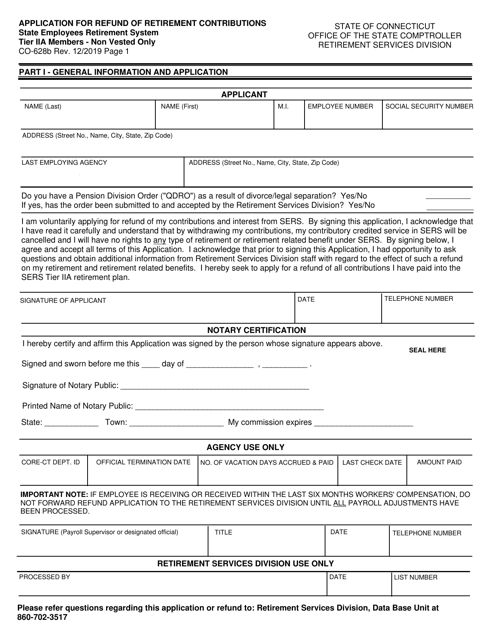

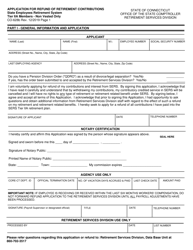

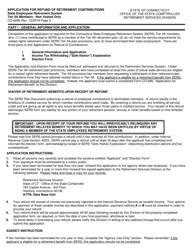

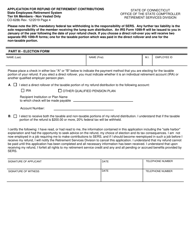

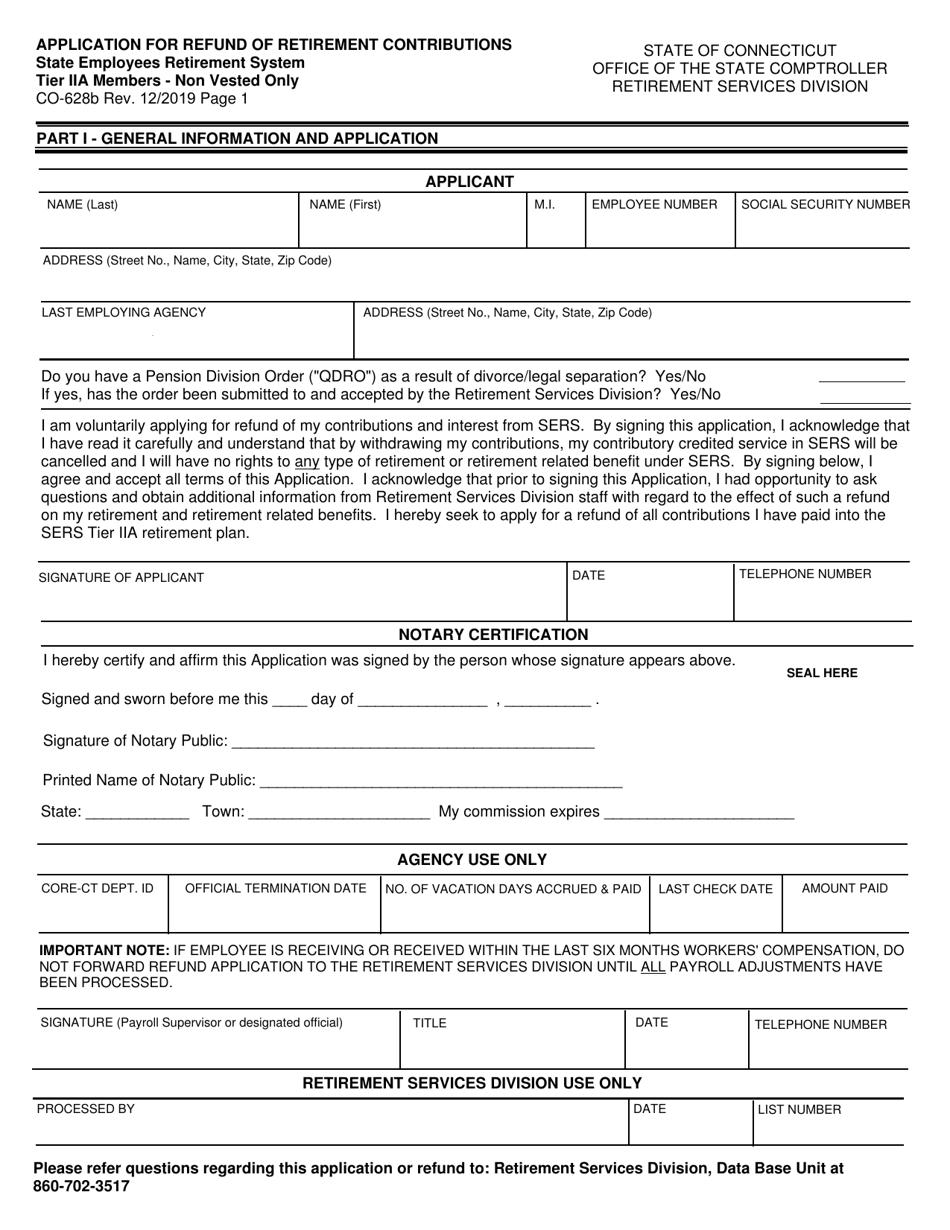

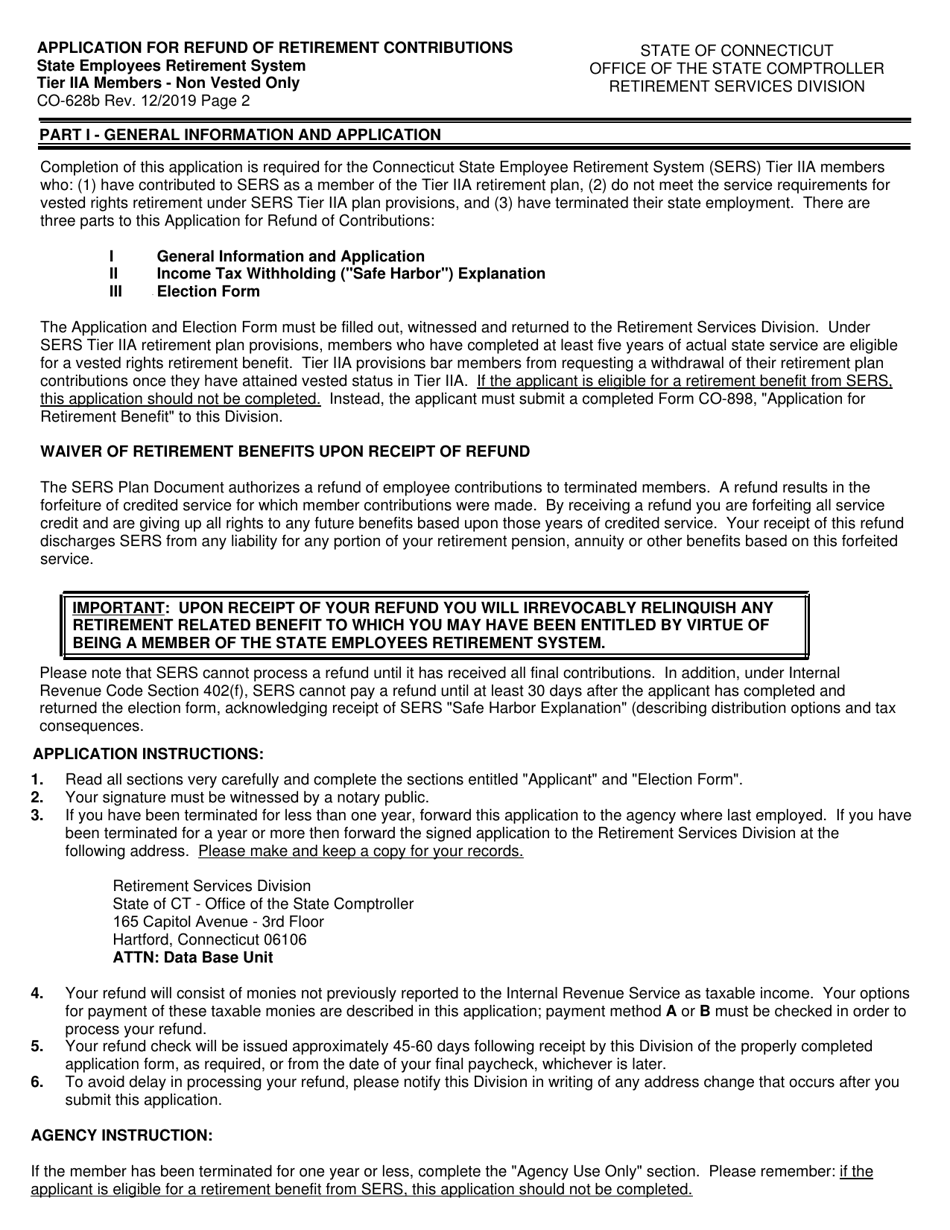

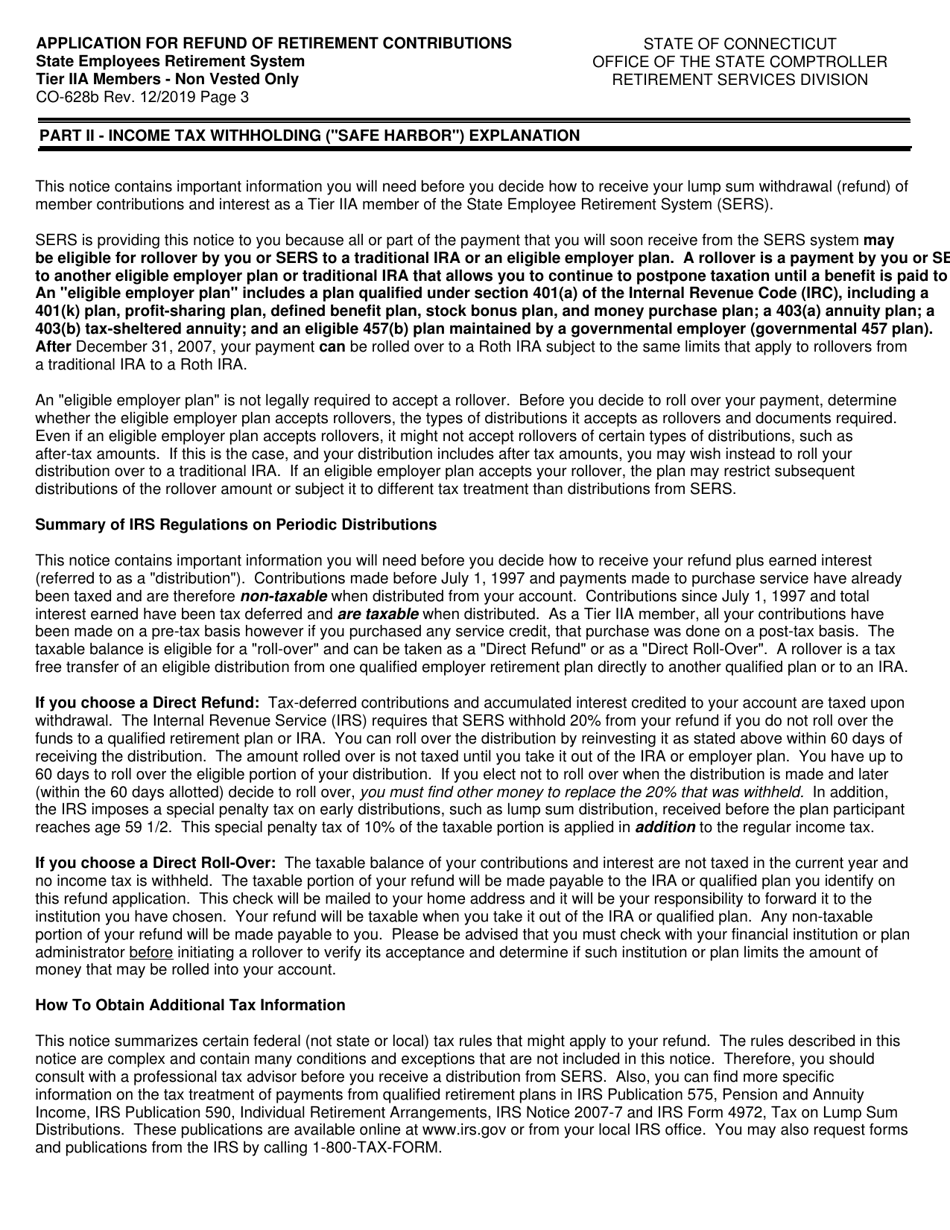

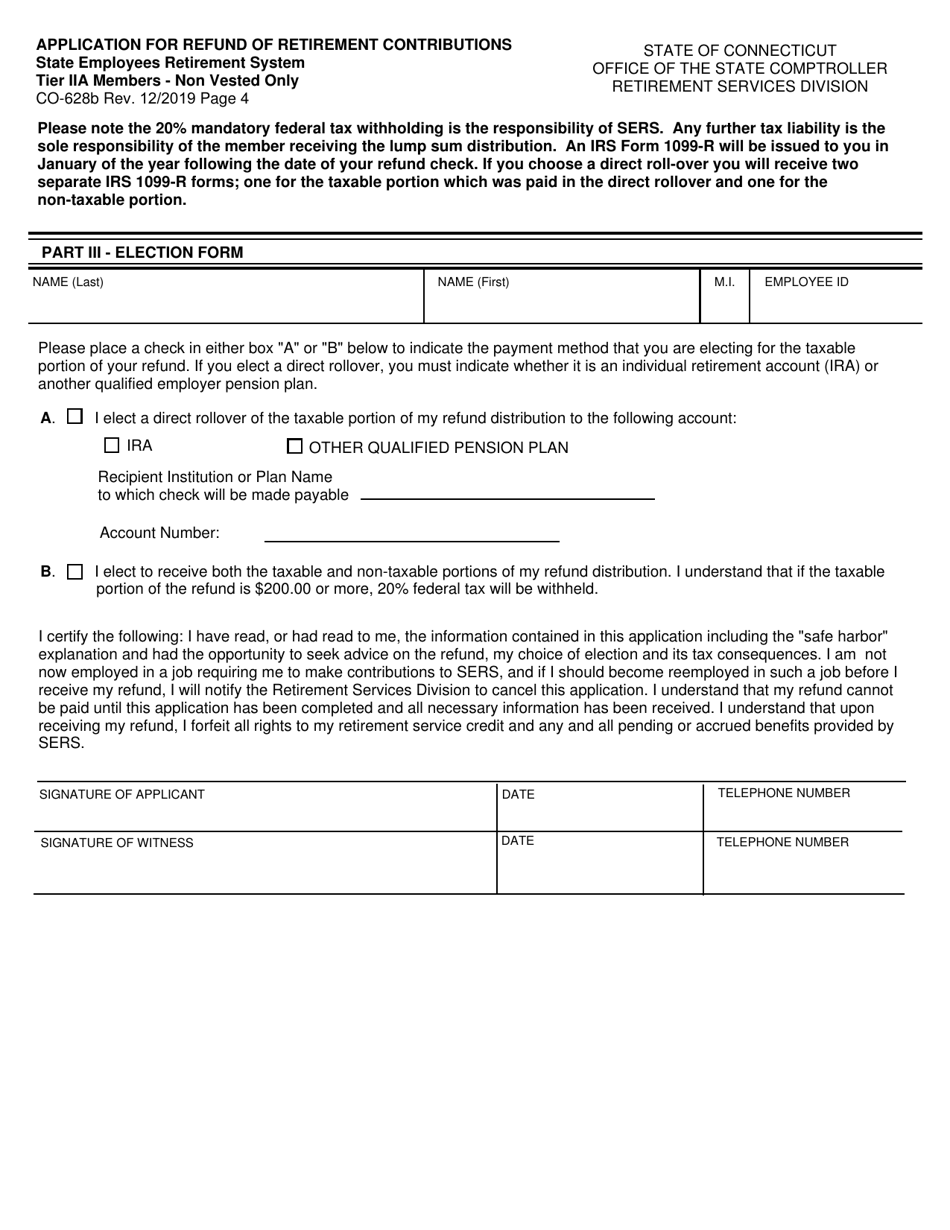

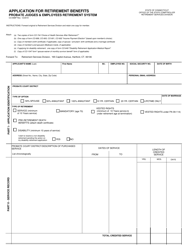

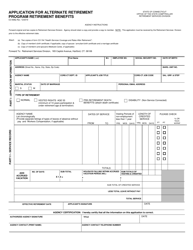

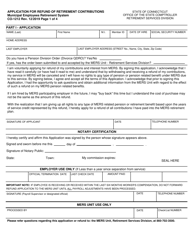

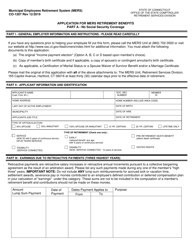

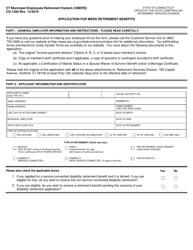

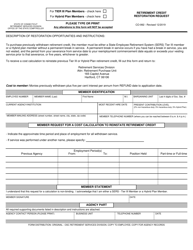

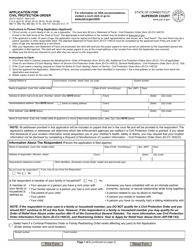

Form CO-628B Application for Refund of Retirement Contributions - Tier Iia Members - Non Vested Only - Connecticut

What Is Form CO-628B?

This is a legal form that was released by the Connecticut Office of the State Comptroller - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CO-628B?

A: Form CO-628B is the application for refund of retirement contributions for Tier IIA members in Connecticut.

Q: Who is eligible to use Form CO-628B?

A: Only non-vested Tier IIA members in Connecticut are eligible to use Form CO-628B.

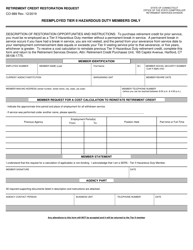

Q: What is a Tier IIA member?

A: A Tier IIA member is a participant in Connecticut's retirement system who falls under a specific set of eligibility criteria.

Q: What is the purpose of Form CO-628B?

A: The purpose of Form CO-628B is to apply for a refund of retirement contributions for non-vested Tier IIA members in Connecticut.

Q: Can I use Form CO-628B if I am a vested Tier IIA member?

A: No, Form CO-628B is only for non-vested Tier IIA members.

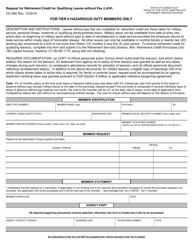

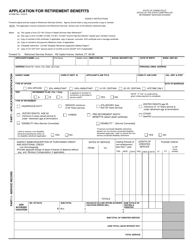

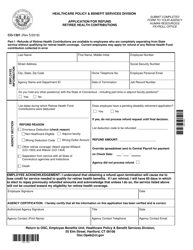

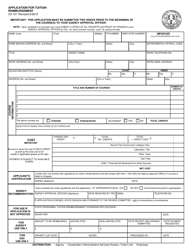

Q: What information is required on Form CO-628B?

A: Form CO-628B requires personal information, employment history, and other details related to your retirement contributions.

Q: What happens after I submit Form CO-628B?

A: Once Form CO-628B is submitted, the retirement system will process your application and issue a refund if you are eligible.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Connecticut Office of the State Comptroller;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CO-628B by clicking the link below or browse more documents and templates provided by the Connecticut Office of the State Comptroller.