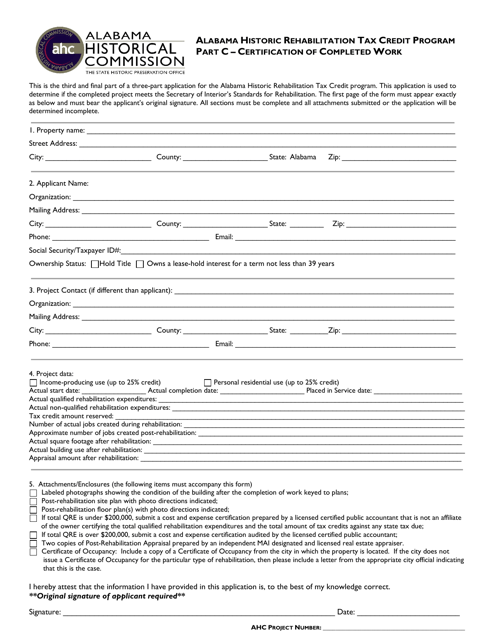

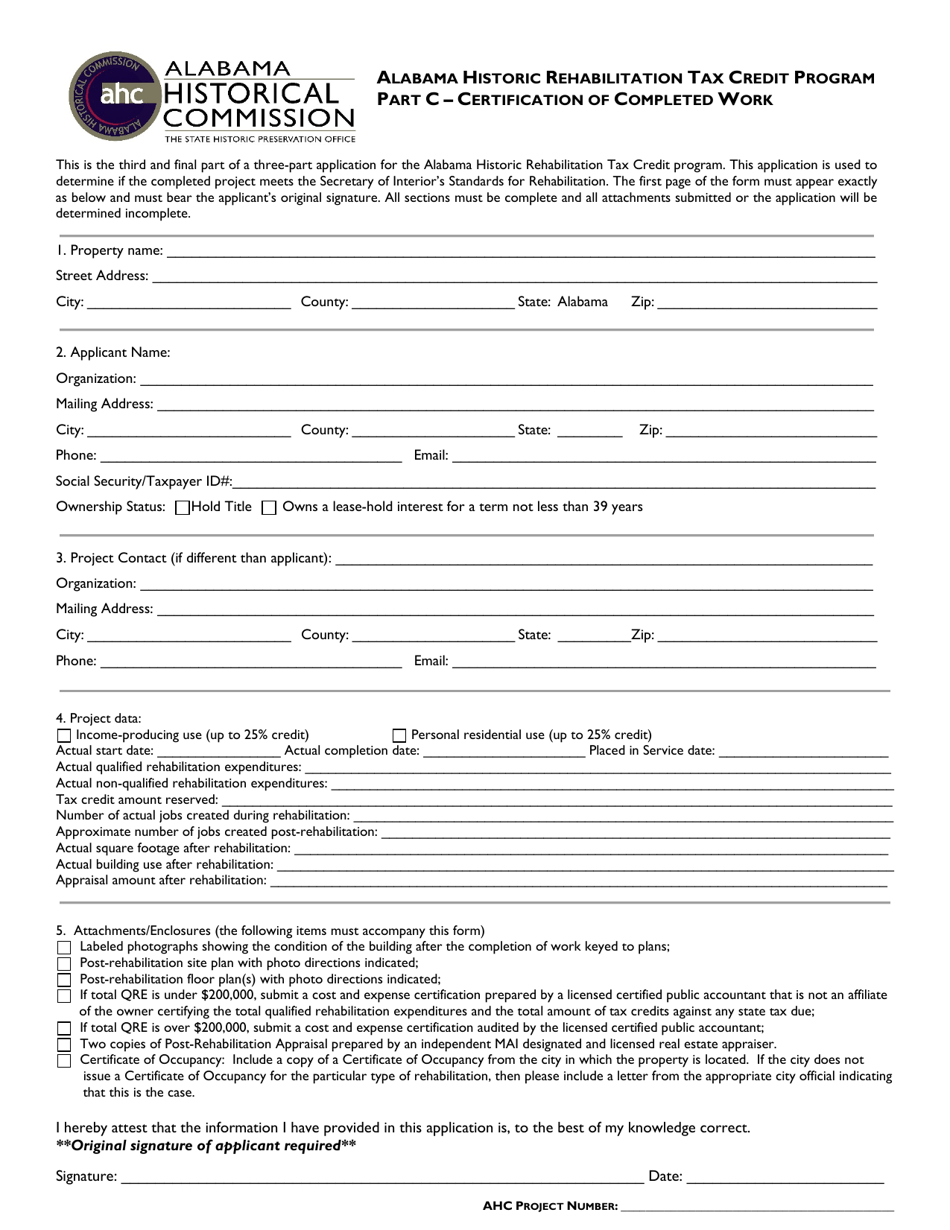

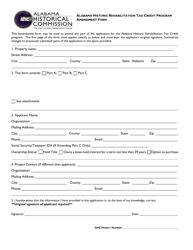

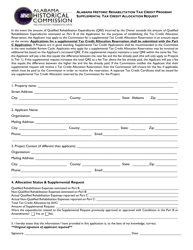

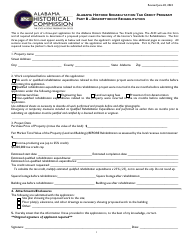

Part C Alabama Historic Rehabilitation Tax Credit Program Certification of Completed Work - Alabama

What Is Part C?

This is a legal form that was released by the Alabama Historical Commission - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Alabama Historic Rehabilitation Tax Credit Program?

A: The Alabama Historic RehabilitationTax Credit Program is a program that provides tax credits to property owners who rehabilitate and restore historic buildings in Alabama.

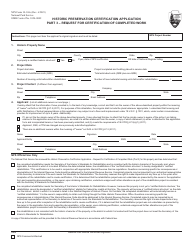

Q: What is the purpose of the Certification of Completed Work?

A: The Certification of Completed Work is a document that is required to be submitted by property owners who have completed the rehabilitation of a historic building in order to receive the tax credits.

Q: Who is eligible for the Alabama Historic Rehabilitation Tax Credit?

A: Property owners who rehabilitate and restore historic buildings in Alabama are eligible for the tax credit.

Q: How much tax credit can be received through the program?

A: The tax credit can be up to 25% of the qualifying expenses incurred during the rehabilitation of the historic building.

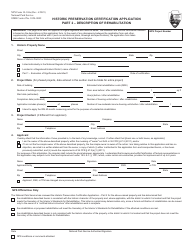

Q: What qualifies as a historic building?

A: A building is considered historic if it is listed on the National Register of Historic Places, or if it is located in a historic district that is listed on the National Register of Historic Places.

Q: What expenses qualify for the tax credit?

A: Qualifying expenses include costs related to the rehabilitation and restoration of the historic building, such as architectural and engineering fees, construction costs, and certain soft costs.

Q: How can property owners apply for the tax credit?

A: Property owners can apply for the tax credit by submitting an application to the Alabama Historical Commission, along with the required documentation and the Certification of Completed Work.

Form Details:

- The latest edition provided by the Alabama Historical Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Part C by clicking the link below or browse more documents and templates provided by the Alabama Historical Commission.