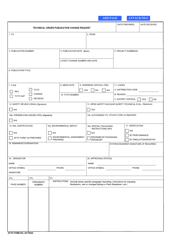

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

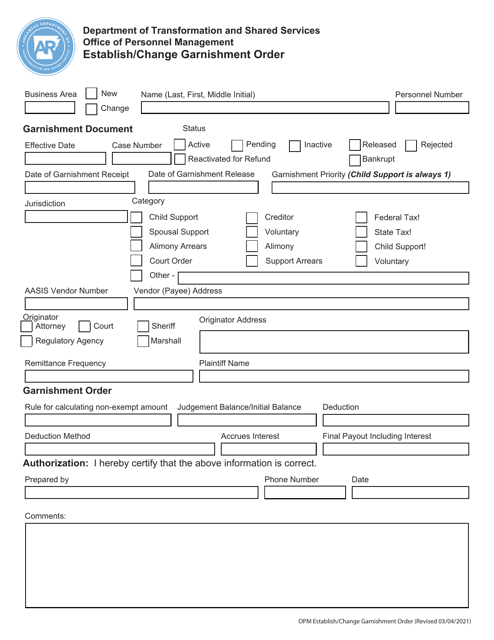

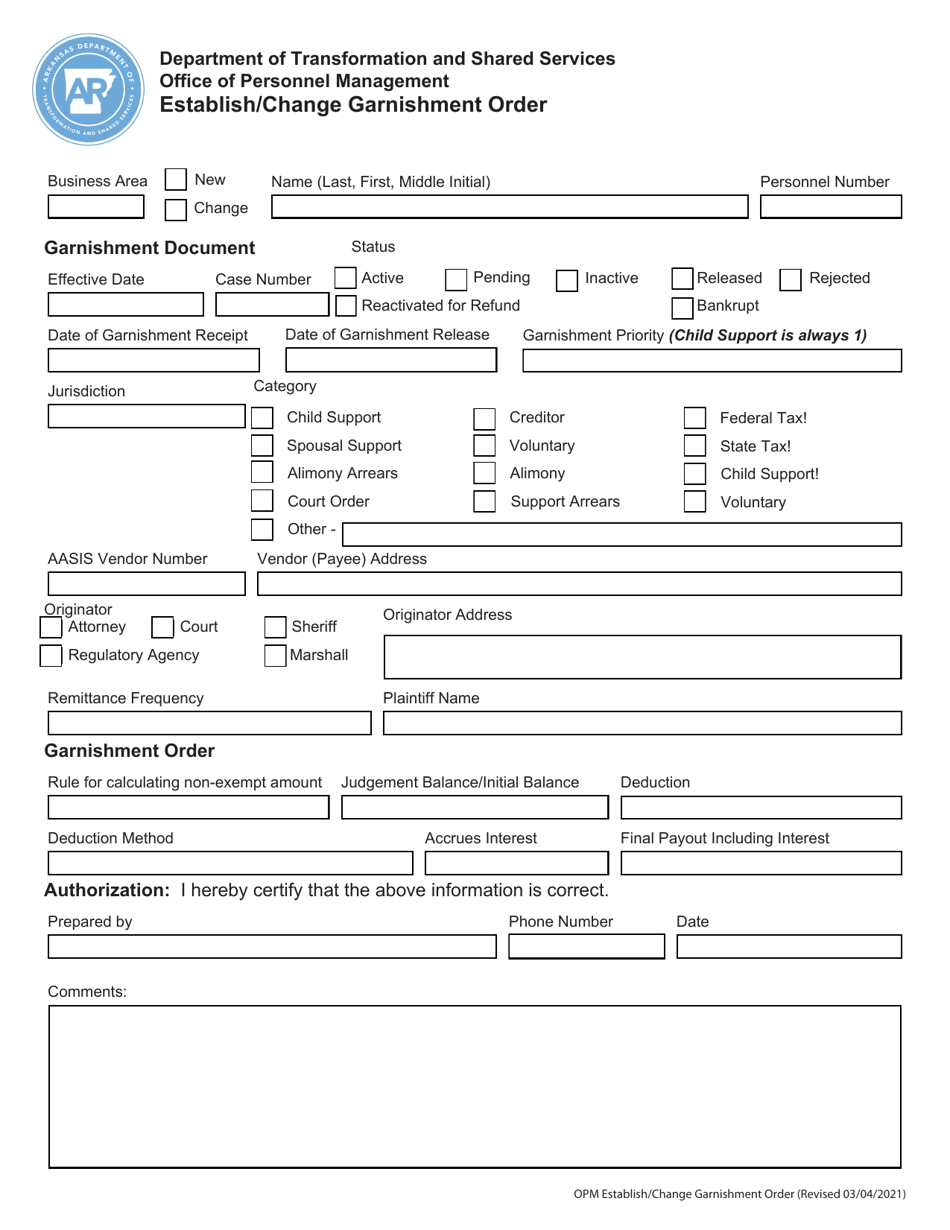

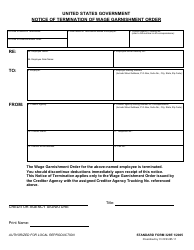

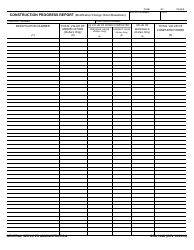

Establish / Change Garnishment Order - Arkansas

Establish/Change Garnishment Order is a legal document that was released by the Arkansas Department of Transformation and Shared Services - a government authority operating within Arkansas.

FAQ

Q: What is a garnishment order?

A: A garnishment order is a legal order that allows a creditor to collect money from a debtor's wages or bank account to satisfy a debt.

Q: How can I establish a garnishment order in Arkansas?

A: To establish a garnishment order in Arkansas, a creditor needs to file a lawsuit and obtain a judgment against the debtor. Once a judgment is obtained, the creditor can then request a garnishment order from the court.

Q: How can I change a garnishment order in Arkansas?

A: To change a garnishment order in Arkansas, you would need to file a motion with the court that issued the original order. The court will review the motion and make a decision on whether to modify the order or not.

Q: What are the limits on garnishment in Arkansas?

A: In Arkansas, the maximum amount that can be garnished from an individual's wages is 25% of their disposable earnings, or the amount by which their disposable earnings exceed 30 times the federal minimum wage, whichever is less.

Q: Can I stop a garnishment in Arkansas?

A: In Arkansas, it is possible to stop a garnishment by either paying off the debt in full or by successfully challenging the garnishment in court. It is advisable to seek legal advice to understand your options.

Q: What happens if my employer doesn't comply with a garnishment order in Arkansas?

A: If your employer fails to comply with a garnishment order in Arkansas, they may be held liable for the amount of the debt plus any associated costs or penalties. You may need to pursue legal action against your employer to enforce the order.

Q: What types of income can be garnished in Arkansas?

A: In Arkansas, various types of income can be subject to garnishment, including wages, salaries, commissions, bonuses, pension payments, and certain government benefits. However, certain types of income, such as Social Security benefits, are protected from garnishment.

Form Details:

- Released on March 4, 2021;

- The latest edition currently provided by the Arkansas Department of Transformation and Shared Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Transformation and Shared Services.