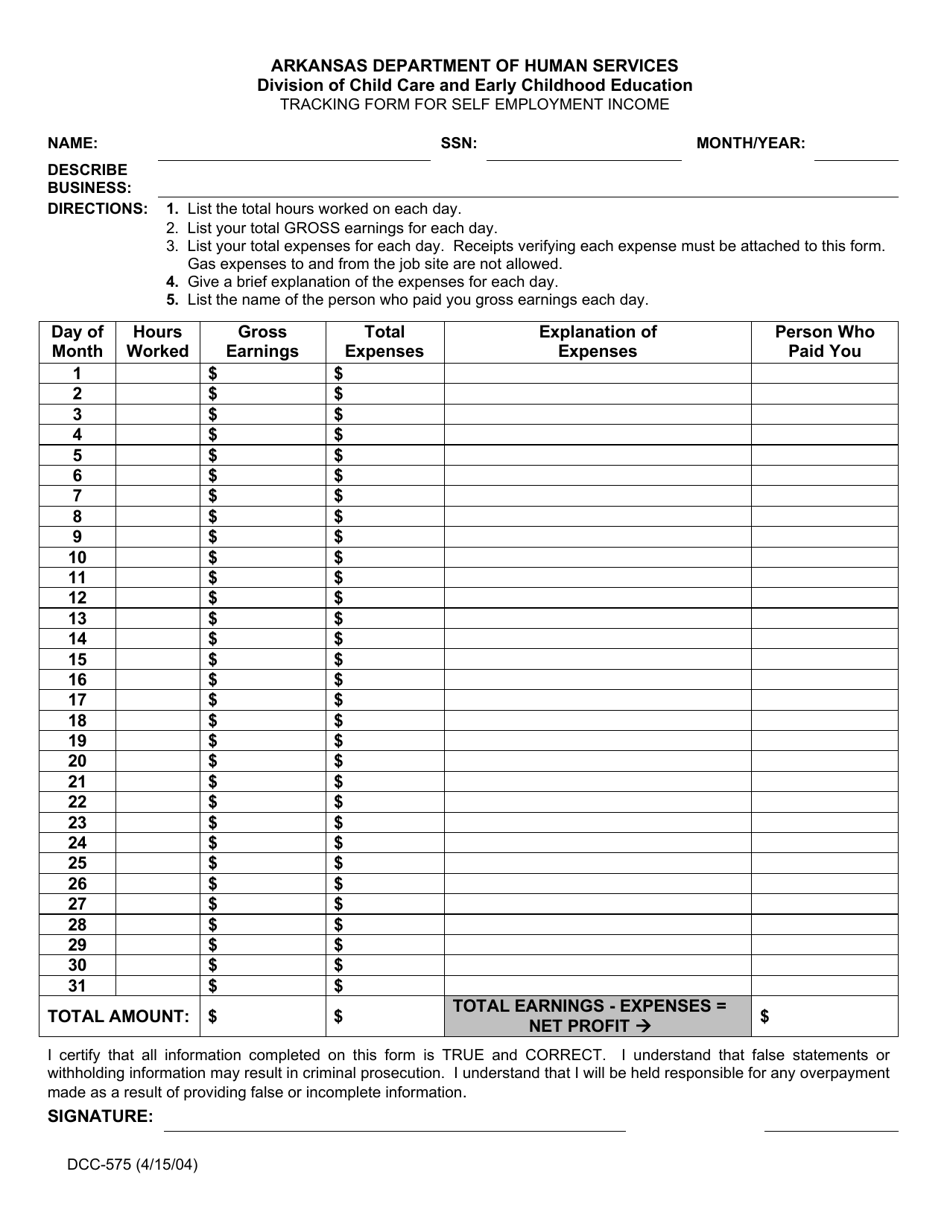

Form DCC-575 Tracking Form for Self Employment Income - Arkansas

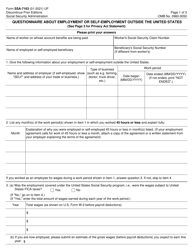

What Is Form DCC-575?

This is a legal form that was released by the Arkansas Department of Human Services - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DCC-575?

A: Form DCC-575 is the Tracking Form for Self Employment Income in Arkansas.

Q: Who needs to use Form DCC-575?

A: Individuals who are self-employed in Arkansas need to use Form DCC-575 to track their self-employment income.

Q: What is the purpose of Form DCC-575?

A: The purpose of Form DCC-575 is to help individuals track their self-employment income for tax purposes in Arkansas.

Q: What information is required on Form DCC-575?

A: Form DCC-575 requires information on self-employment income, including the amount earned and the dates when the income was received.

Q: When is Form DCC-575 due?

A: Form DCC-575 is due by the deadline for filing your annual tax return in Arkansas.

Q: Are there any penalties for not filing Form DCC-575?

A: Failure to file Form DCC-575 or providing false information can result in penalties and interest on any unpaid taxes.

Q: Is Form DCC-575 only for residents of Arkansas?

A: Yes, Form DCC-575 is specifically for individuals who are self-employed in Arkansas.

Q: Do I need to include additional documentation with Form DCC-575?

A: No, Form DCC-575 does not require any additional documentation to be submitted.

Form Details:

- Released on April 15, 2004;

- The latest edition provided by the Arkansas Department of Human Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DCC-575 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Human Services.