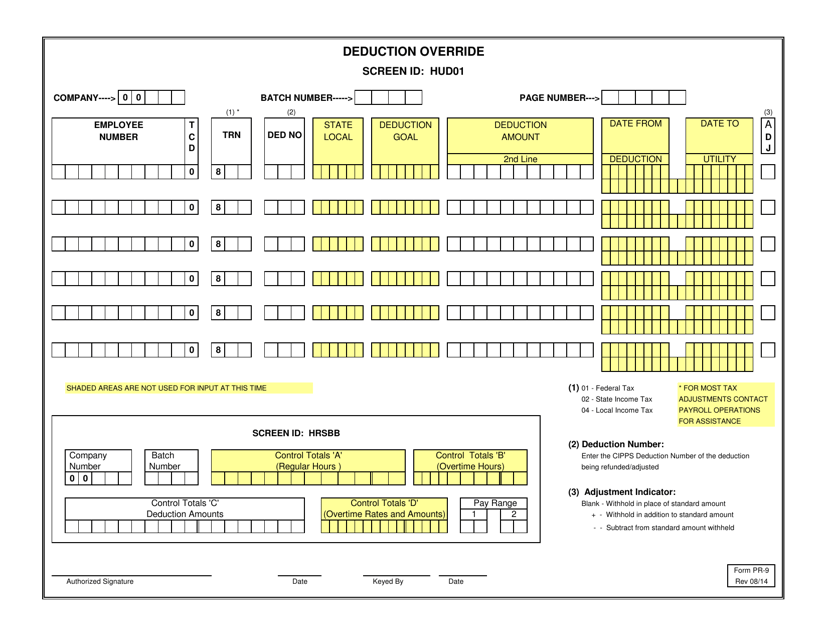

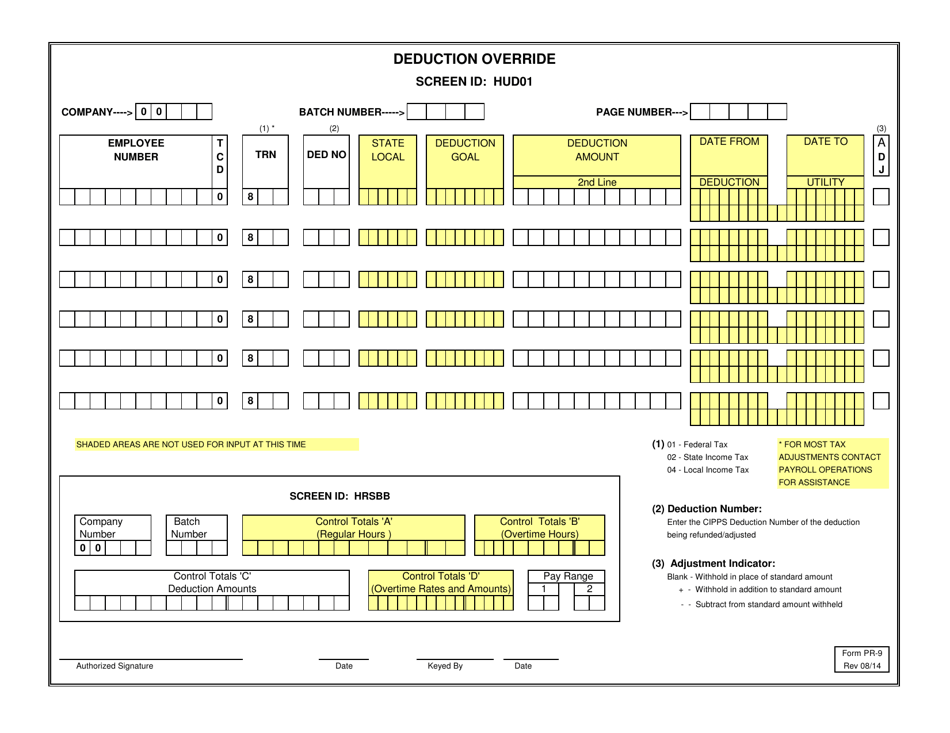

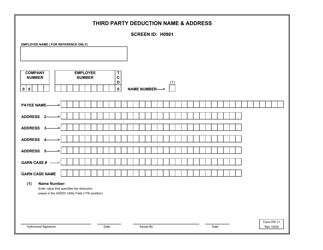

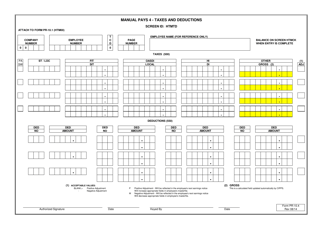

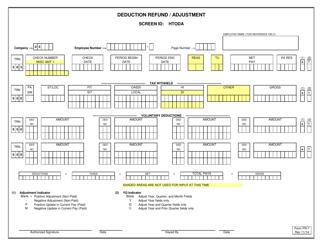

Form PR-9 Deduction Override - Virginia

What Is Form PR-9?

This is a legal form that was released by the Virginia Department of Accounts - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PR-9 Deduction Override?

A: PR-9 Deduction Override is a form used in the state of Virginia to correct or override tax deductions that were previously reported.

Q: When is the PR-9 Deduction Override form required?

A: The PR-9 Deduction Override form is required when you need to make changes to tax deductions that were previously reported on your tax return.

Q: How do I fill out the PR-9 Deduction Override form?

A: To fill out the PR-9 Deduction Override form, you will need to provide your personal information, such as your name and Social Security number, as well as details about the deductions you want to override.

Q: Is there a deadline to submit the PR-9 Deduction Override form?

A: The deadline to submit the PR-9 Deduction Override form is the same as the deadline for filing your tax return, which is typically April 15th.

Q: Do I need to include any supporting documents with the PR-9 Deduction Override form?

A: It is recommended to include supporting documents, such as receipts or proof of the correct deductions, with the PR-9 Deduction Override form.

Q: What happens after I submit the PR-9 Deduction Override form?

A: After you submit the PR-9 Deduction Override form, the Virginia Department of Taxation will review your request and make any necessary adjustments to your tax return.

Q: Can I make changes to my PR-9 Deduction Override form after submitting it?

A: No, you cannot make changes to your PR-9 Deduction Override form after submitting it. Make sure to review your form carefully before submitting it.

Q: What should I do if I made a mistake on my PR-9 Deduction Override form?

A: If you made a mistake on your PR-9 Deduction Override form, you should contact the Virginia Department of Taxation as soon as possible to request a correction.

Form Details:

- Released on August 1, 2014;

- The latest edition provided by the Virginia Department of Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-9 by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.