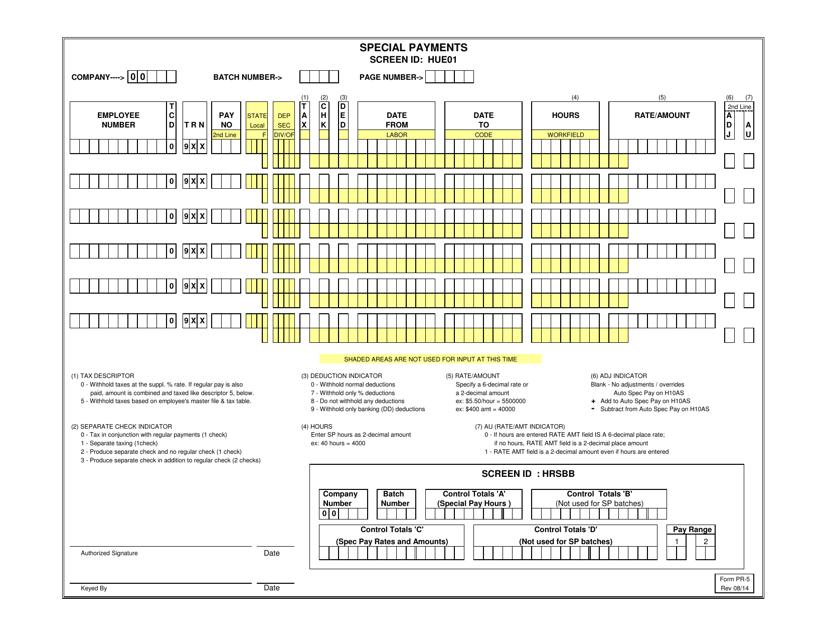

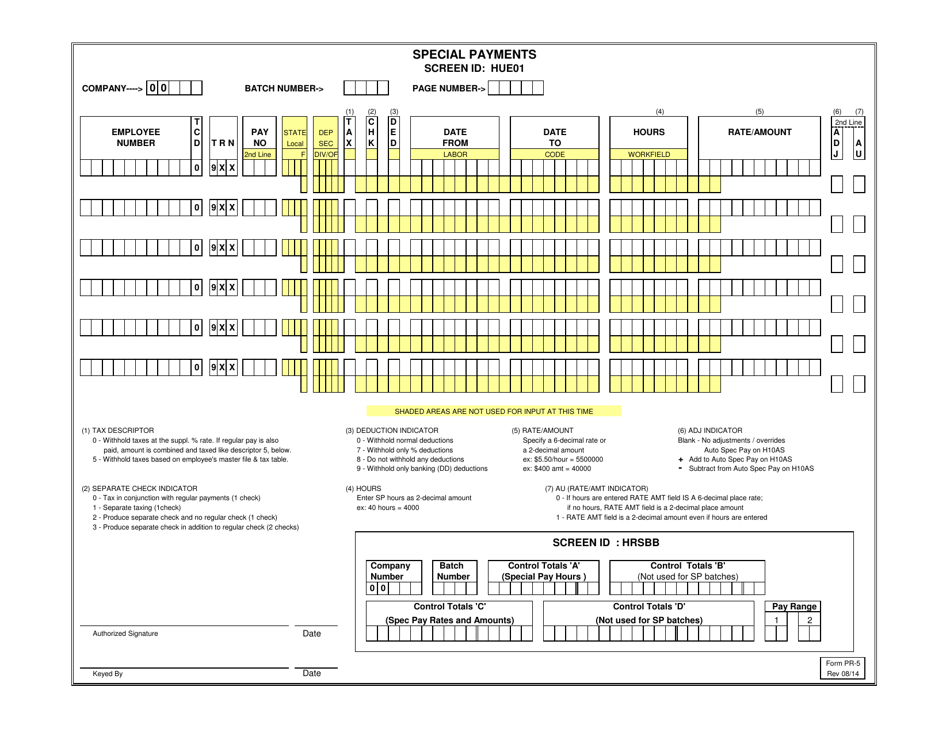

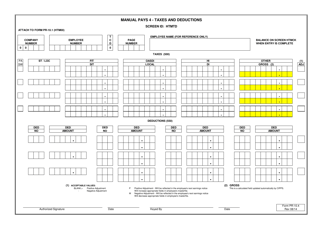

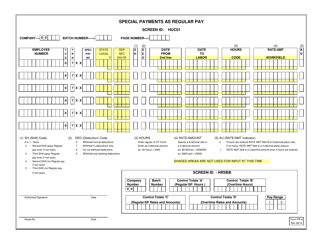

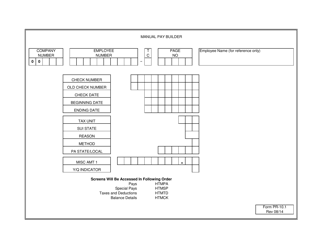

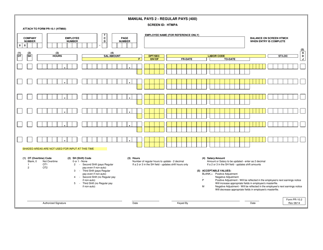

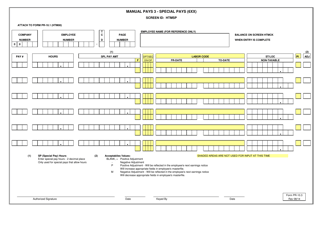

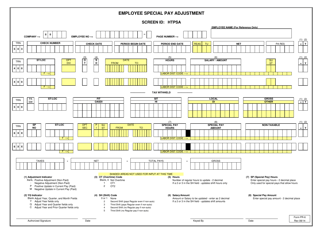

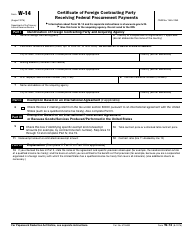

Form PR-5 Special Payments - Virginia

What Is Form PR-5?

This is a legal form that was released by the Virginia Department of Accounts - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form PR-5?

A: Form PR-5 is a form used in Virginia to report special payments.

Q: What are special payments?

A: Special payments are non-employee compensation, such as payments to independent contractors.

Q: Who needs to file form PR-5?

A: Any person or business that made special payments in Virginia needs to file form PR-5.

Q: When is form PR-5 due?

A: Form PR-5 is due on or before January 31st of the following year.

Q: Is there a penalty for late filing?

A: Yes, there is a penalty for late filing of form PR-5.

Form Details:

- Released on August 1, 2014;

- The latest edition provided by the Virginia Department of Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-5 by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.