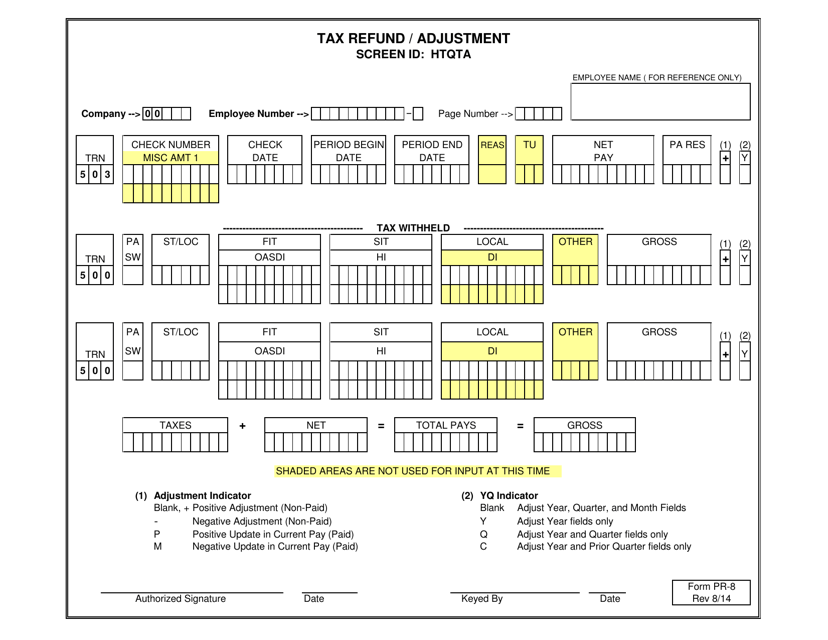

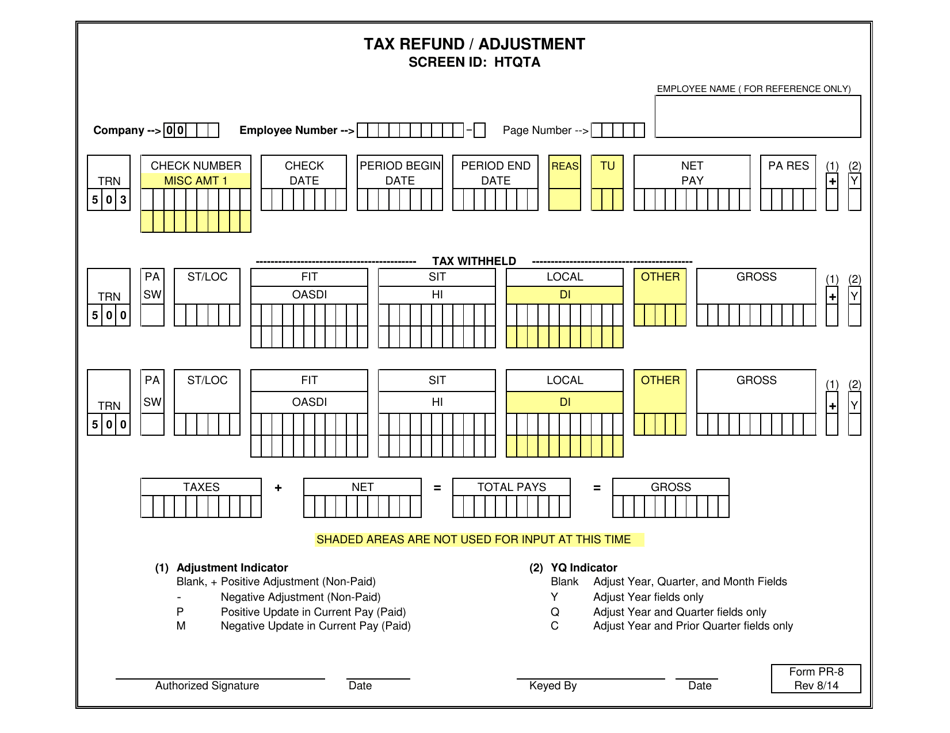

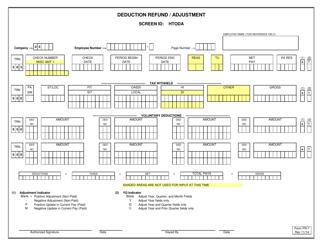

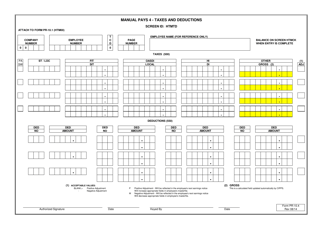

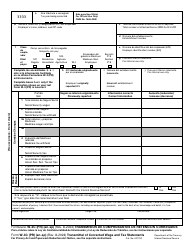

Form PR-8 Tax Refund / Adjustment - Virginia

What Is Form PR-8?

This is a legal form that was released by the Virginia Department of Accounts - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

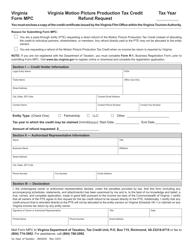

Q: What is Form PR-8?

A: Form PR-8 is a tax form used for requesting a refund or adjustment in Virginia.

Q: What is the purpose of Form PR-8?

A: The purpose of Form PR-8 is to request a refund or adjustment of taxes paid in Virginia.

Q: Who can use Form PR-8?

A: Any individual or business that has paid excess taxes in Virginia can use Form PR-8 to request a refund or adjustment.

Q: How do I fill out Form PR-8?

A: You will need to provide your personal or business information, details of the excess taxes paid, and reasons for the refund or adjustment request.

Q: Is there a deadline for submitting Form PR-8?

A: Yes, the deadline for submitting Form PR-8 is generally within three years from the original due date of the tax return.

Q: How long does it take to process Form PR-8?

A: The processing time for Form PR-8 can vary, but it typically takes several weeks to months to receive a response from the Virginia Department of Taxation.

Q: What should I do if my Form PR-8 is denied?

A: If your Form PR-8 is denied, you may have the option to appeal the decision or seek further assistance from the Virginia Department of Taxation.

Q: Can I submit Form PR-8 electronically?

A: No, Form PR-8 must be submitted by mail and cannot be filed electronically.

Form Details:

- Released on August 1, 2014;

- The latest edition provided by the Virginia Department of Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-8 by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.