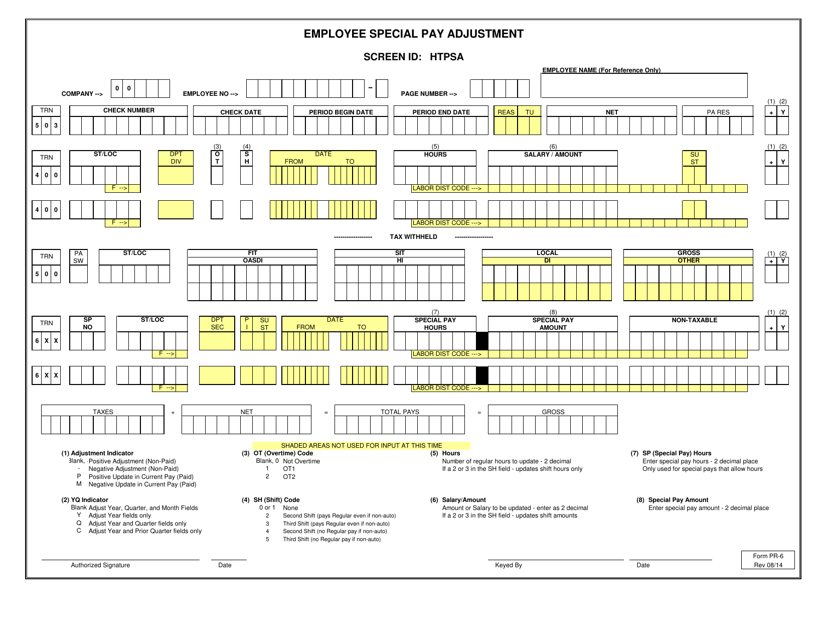

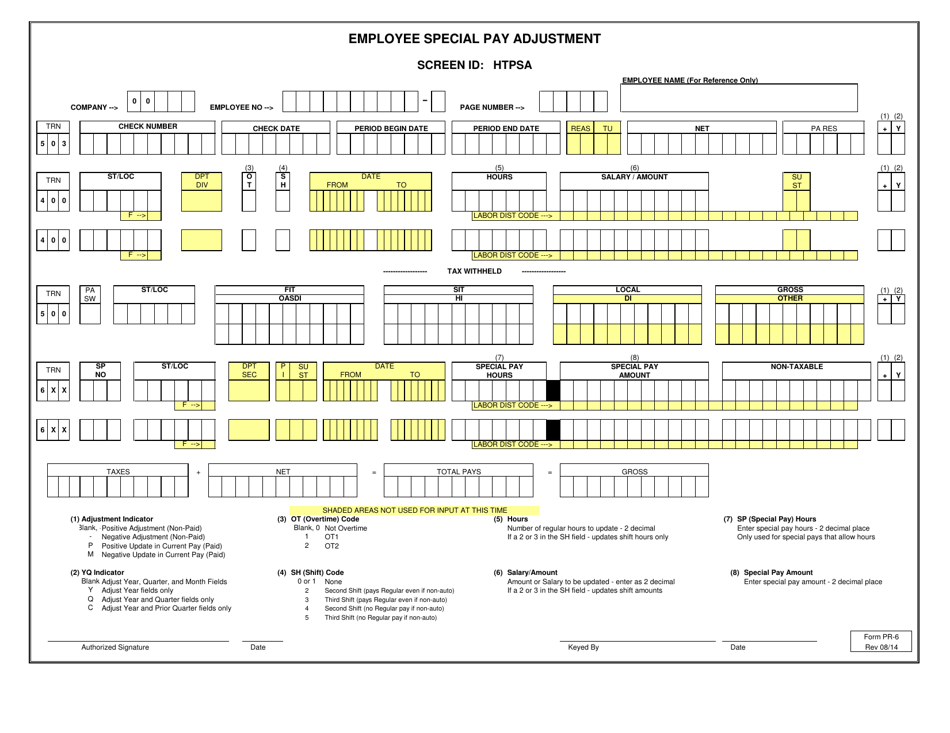

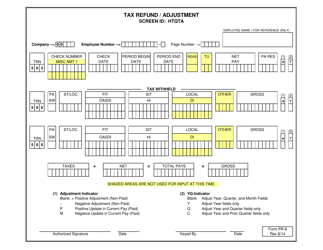

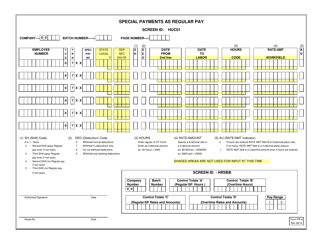

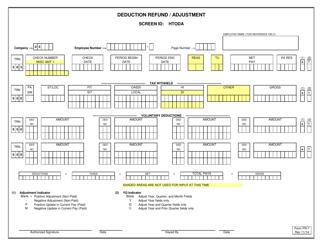

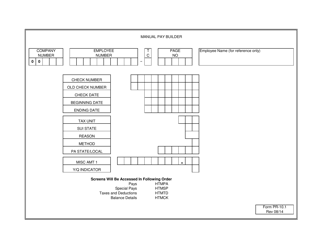

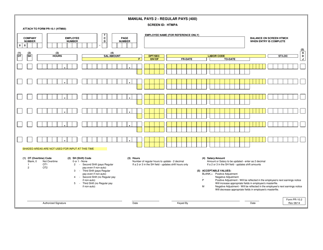

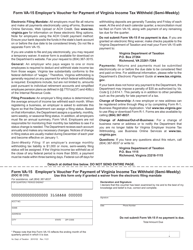

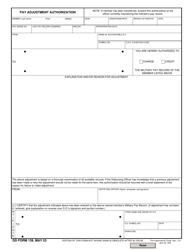

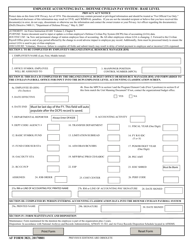

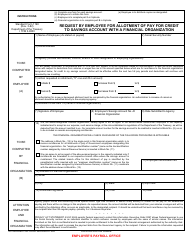

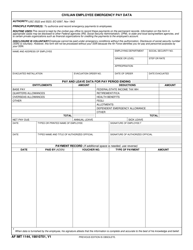

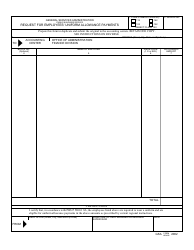

Form PR-6 Htpsa - Employee Special Pay Adjustment - Virginia

What Is Form PR-6?

This is a legal form that was released by the Virginia Department of Accounts - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PR-6 Htpsa?

A: Form PR-6 Htpsa is the Employee Special Pay Adjustment form for the state of Virginia.

Q: What is the purpose of Form PR-6 Htpsa?

A: The purpose of Form PR-6 Htpsa is to report information about special pay adjustments for employees in Virginia.

Q: Who needs to fill out Form PR-6 Htpsa?

A: Employers in Virginia need to fill out and submit Form PR-6 Htpsa.

Q: When is Form PR-6 Htpsa due?

A: Form PR-6 Htpsa is due by the last day of February following the end of the calendar year in which the special pay adjustments were made.

Q: What information is required on Form PR-6 Htpsa?

A: Form PR-6 Htpsa requires information about the employer, employee, special pay adjustments, and total Virginia taxable income.

Q: Are special pay adjustments taxable?

A: Yes, special pay adjustments are generally taxable and should be reported on Form PR-6 Htpsa.

Q: What should I do if I have questions about Form PR-6 Htpsa?

A: If you have questions about Form PR-6 Htpsa, you can contact the Virginia Department of Taxation or consult with a tax professional.

Form Details:

- Released on August 1, 2014;

- The latest edition provided by the Virginia Department of Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PR-6 by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.