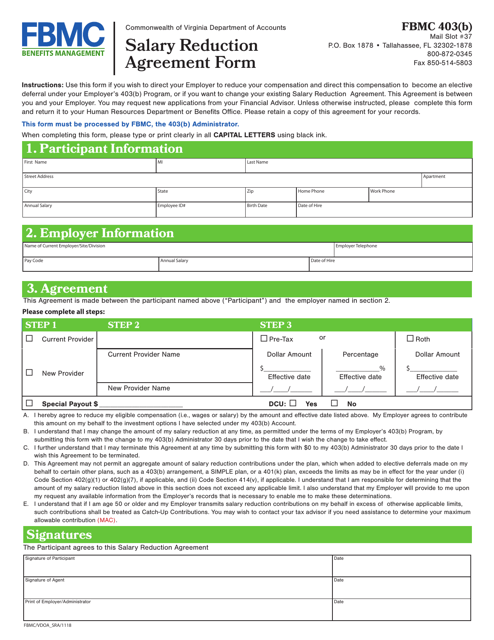

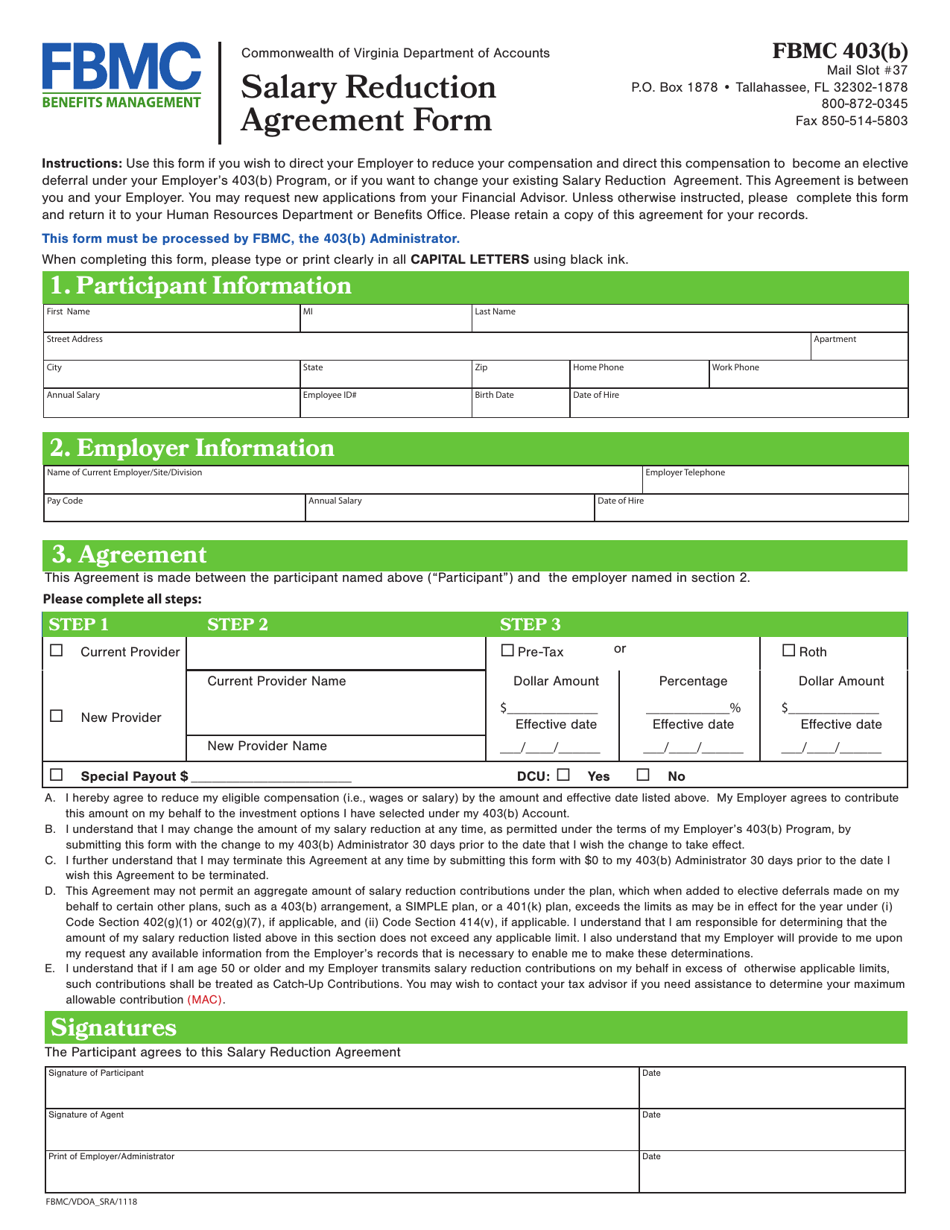

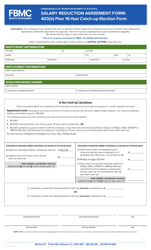

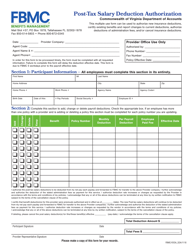

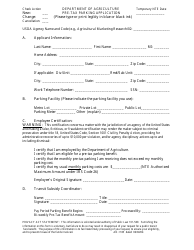

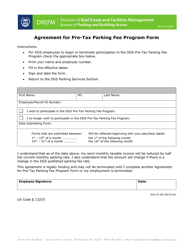

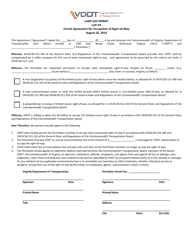

Pre-tax Salary Reduction Agreement Form - Virginia

Pre-tax Salary Reduction Agreement Form is a legal document that was released by the Virginia Department of Accounts - a government authority operating within Virginia.

FAQ

Q: What is a pre-tax salary reduction agreement?

A: A pre-tax salary reduction agreement is an agreement between an employee and their employer to reduce the employee's salary before taxes are deducted.

Q: Why would someone want to enter into a pre-tax salary reduction agreement?

A: Entering into a pre-tax salary reduction agreement can lower an employee's taxable income, potentially reducing their overall tax liability.

Q: Is a pre-tax salary reduction agreement available to all employees?

A: Generally, pre-tax salary reduction agreements are available to employees who are eligible to participate in their employer's retirement plans or other qualified benefit programs.

Q: Can a pre-tax salary reduction agreement be changed or canceled?

A: Yes, a pre-tax salary reduction agreement can usually be changed or canceled within the limits set by the employer's plan.

Q: Do pre-tax salary reduction contributions count towards Social Security and Medicare taxes?

A: No, pre-tax salary reduction contributions are not subject to Social Security and Medicare taxes.

Q: What are the potential benefits of a pre-tax salary reduction agreement?

A: Some potential benefits of a pre-tax salary reduction agreement include lower taxable income, reduced tax liability, and increased retirement savings.

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the Virginia Department of Accounts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.