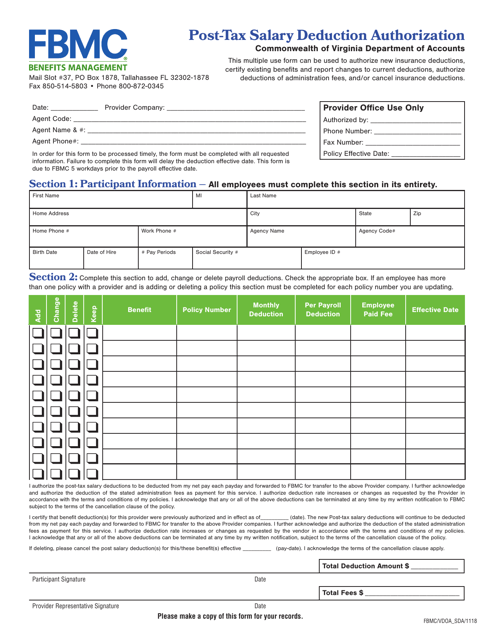

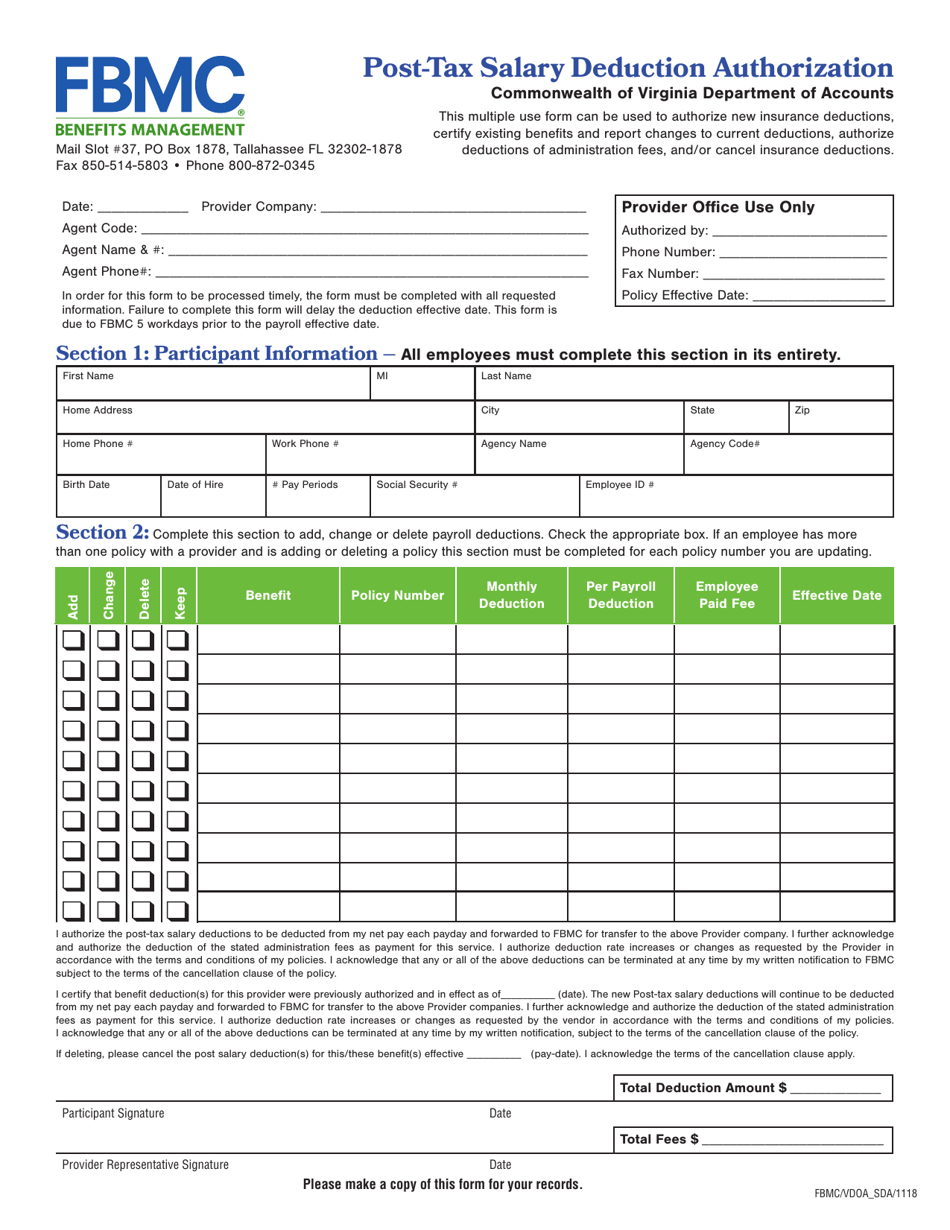

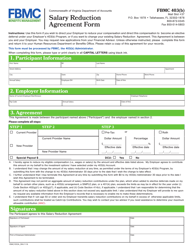

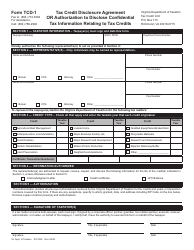

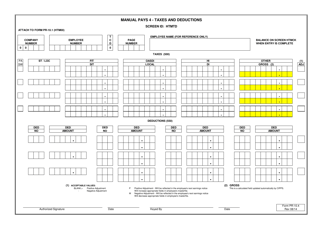

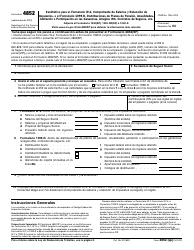

Post-tax Salary Deduction Authorization - Virginia

Post-tax Salary Deduction Authorization is a legal document that was released by the Virginia Department of Accounts - a government authority operating within Virginia.

FAQ

Q: What is a post-tax salary deduction authorization?

A: A post-tax salary deduction authorization is a document that allows an employer to deduct certain expenses or contributions from an employee's salary after taxes have been paid.

Q: What is the purpose of a post-tax salary deduction authorization?

A: The purpose of a post-tax salary deduction authorization is to facilitate the deduction of specific expenses or contributions from an employee's salary in a way that complies with legal and tax regulations.

Q: Who uses a post-tax salary deduction authorization in Virginia?

A: Employers in Virginia may use a post-tax salary deduction authorization to deduct expenses or contributions from their employees' salaries.

Q: What kind of expenses can be deducted through post-tax salary deduction authorization?

A: Expenses such as health insurance premiums, retirement contributions, and charitable donations can be deducted through a post-tax salary deduction authorization.

Q: Is a post-tax salary deduction authorization mandatory in Virginia?

A: No, a post-tax salary deduction authorization is not mandatory in Virginia. It is an optional agreement between an employer and an employee.

Q: Can an employee refuse to sign a post-tax salary deduction authorization?

A: Yes, an employee has the right to refuse to sign a post-tax salary deduction authorization. It is an agreement that both parties must voluntarily consent to.

Q: What should an employee consider before signing a post-tax salary deduction authorization?

A: Before signing a post-tax salary deduction authorization, an employee should carefully review the terms and conditions, understand the deductions being made, and assess their financial impact.

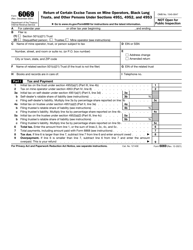

Form Details:

- Released on November 1, 2018;

- The latest edition currently provided by the Virginia Department of Accounts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.