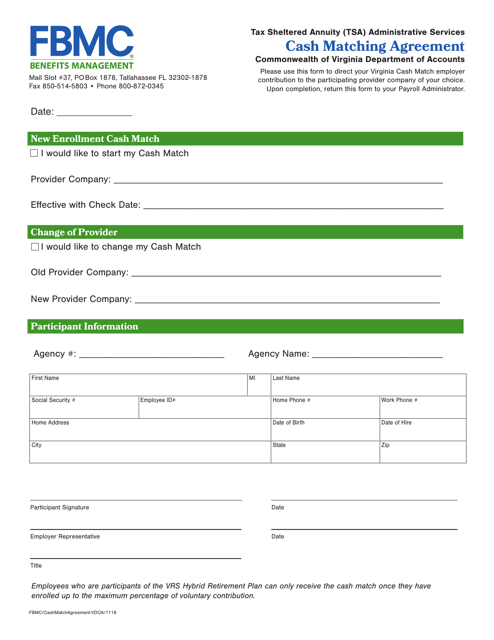

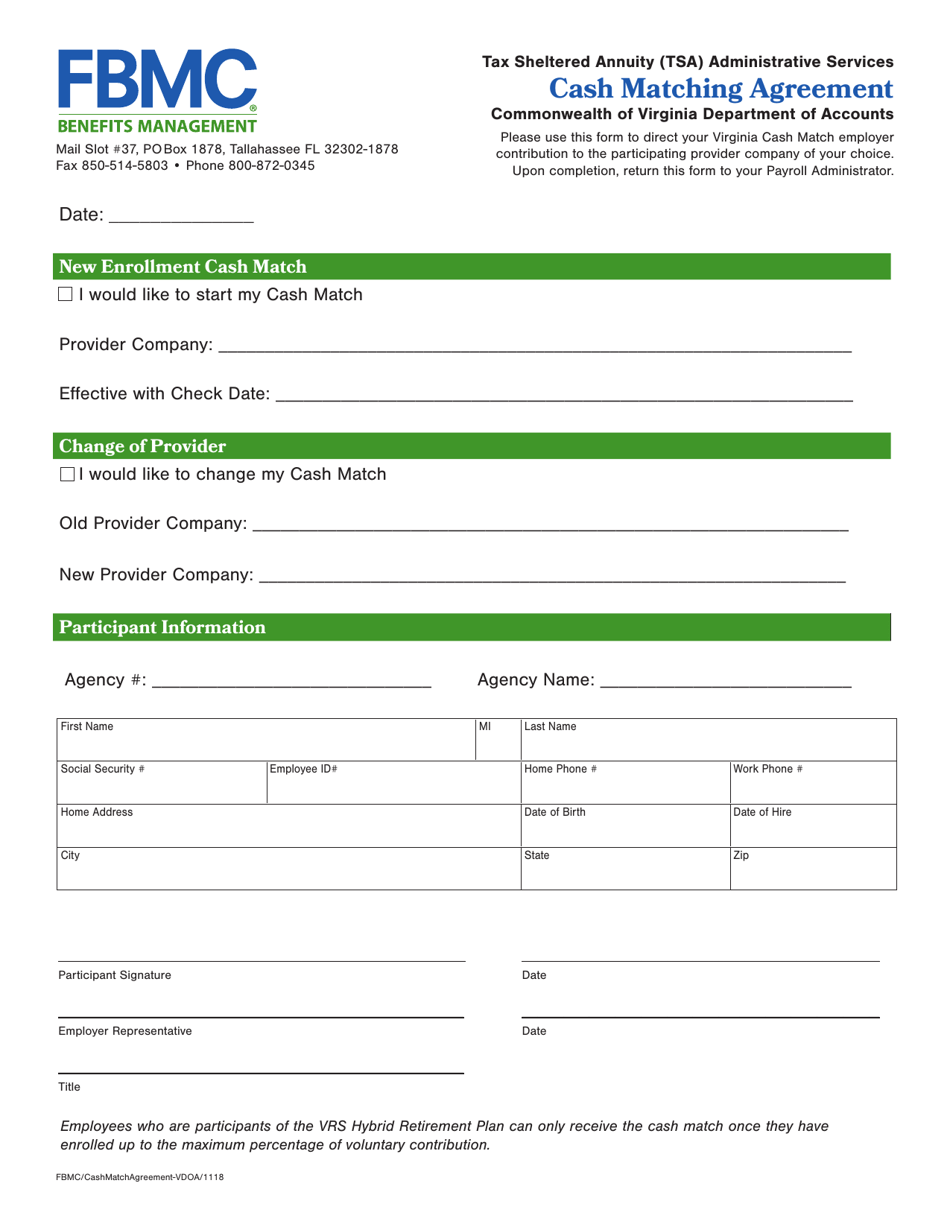

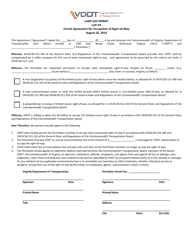

Cash Matching Agreement - Virginia

Cash Matching Agreement is a legal document that was released by the Virginia Department of Accounts - a government authority operating within Virginia.

FAQ

Q: What is a cash matching agreement?

A: A cash matching agreement is a contract between a company and a financial institution that ensures the company has sufficient funds to meet its financial obligations.

Q: Why would a company enter into a cash matching agreement?

A: A company may enter into a cash matching agreement to manage their cash flow and ensure they have the necessary funds available when needed.

Q: How does a cash matching agreement work?

A: In a cash matching agreement, the company deposits funds with the financial institution, which then invests those funds to generate returns. The returns are used to cover the company's cash needs as specified in the agreement.

Q: Is a cash matching agreement legally binding?

A: Yes, a cash matching agreement is a legally binding contract between the company and the financial institution.

Q: Are there any risks associated with cash matching agreements?

A: There are risks involved, such as the potential for the financial institution to not generate enough returns to cover the company's cash needs. It's important for companies to carefully assess the terms and conditions of the agreement and the financial institution's track record before entering into such an agreement.

Form Details:

- Released on November 1, 2018;

- The latest edition currently provided by the Virginia Department of Accounts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.