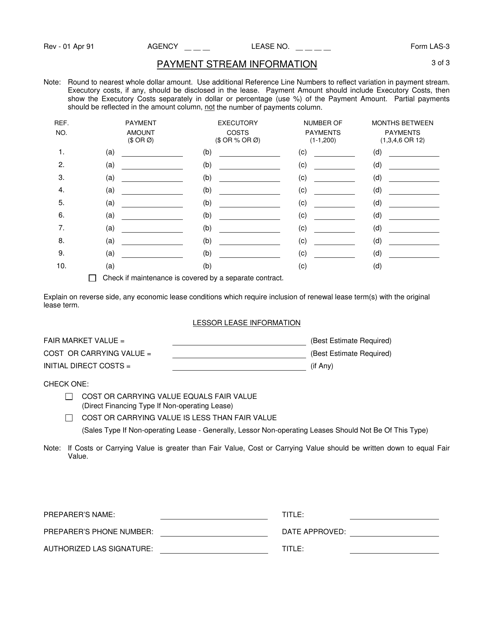

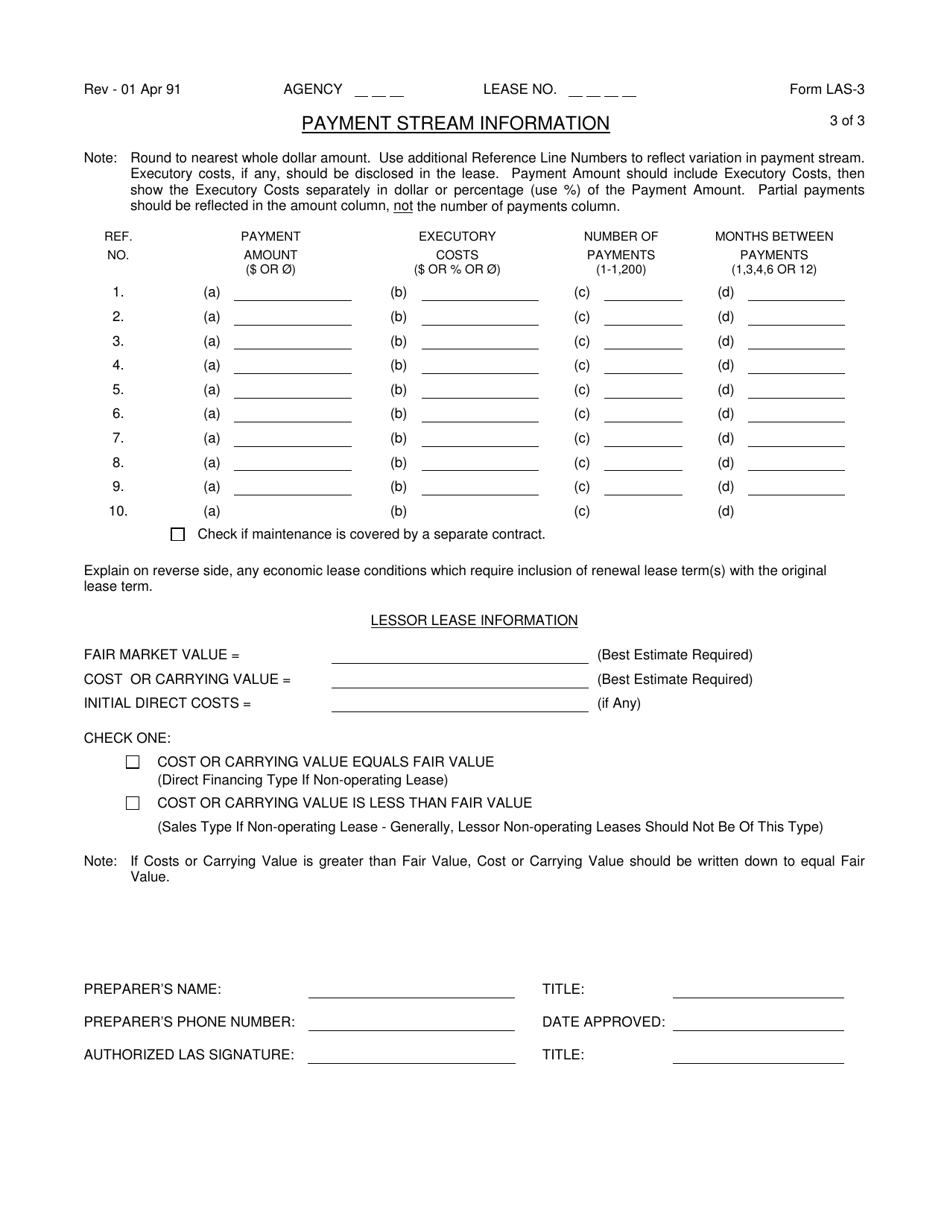

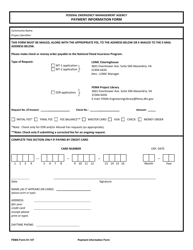

Form LAS-3 Payment Stream Information - Virginia

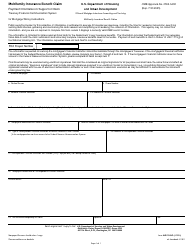

What Is Form LAS-3?

This is a legal form that was released by the Virginia Department of Accounts - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

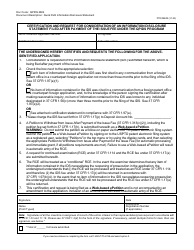

Q: What is Form LAS-3?

A: Form LAS-3 is a document used to report payment stream information in Virginia.

Q: Who needs to file Form LAS-3?

A: Anyone who is making payment streams in Virginia needs to file Form LAS-3.

Q: What is considered a payment stream?

A: A payment stream refers to any periodic payments made by one party to another, such as annuities or structured settlements.

Q: When is Form LAS-3 due?

A: Form LAS-3 is due by January 31st of each year.

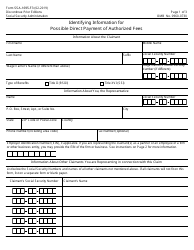

Q: What information do I need to provide on Form LAS-3?

A: You will need to provide details about the payment stream, including the recipient's name, contact information, and the total amount of payments made.

Q: Are there any penalties for not filing Form LAS-3?

A: Yes, there are penalties for failing to file or filing late, so it is important to submit the form on time.

Q: Is Form LAS-3 required for all payment streams?

A: No, Form LAS-3 is only required for payment streams made in Virginia.

Form Details:

- Released on April 1, 1991;

- The latest edition provided by the Virginia Department of Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LAS-3 by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.