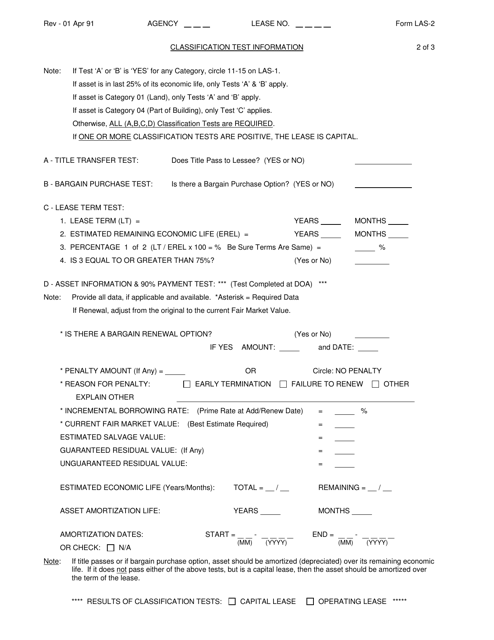

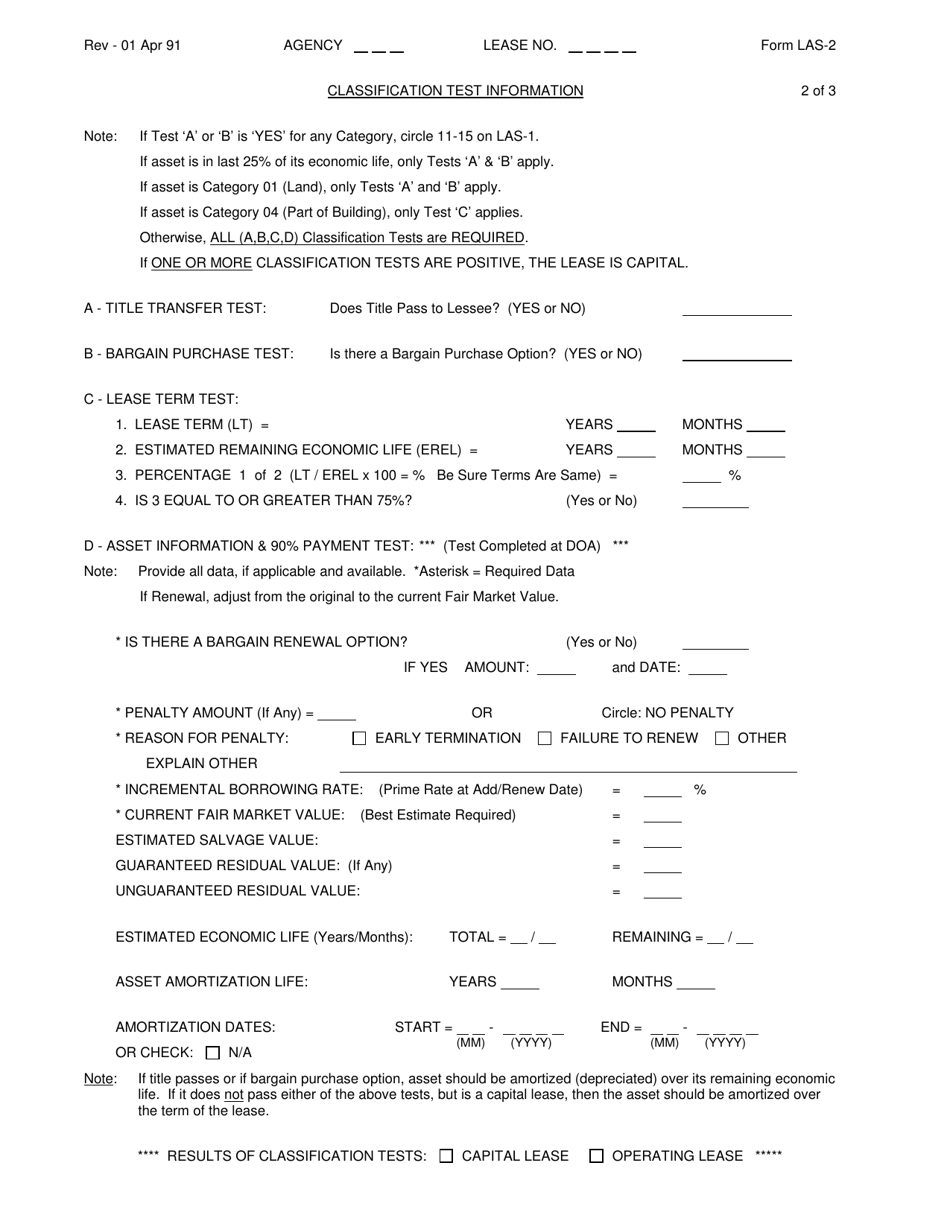

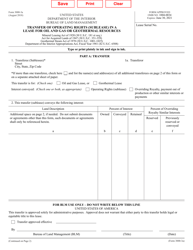

Form LAS-2 Lease Classification Test Information - Virginia

What Is Form LAS-2?

This is a legal form that was released by the Virginia Department of Accounts - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the LAS-2 Lease Classification Test?

A: The LAS-2 Lease Classification Test is a classification system used to determine whether a lease should be classified as a capital lease or an operating lease.

Q: What is the purpose of the LAS-2 Lease Classification Test?

A: The purpose of the LAS-2 Lease Classification Test is to determine the appropriate accounting treatment for a lease.

Q: Who uses the LAS-2 Lease Classification Test?

A: The LAS-2 Lease Classification Test is used by companies and organizations that need to classify their lease agreements for financial reporting purposes.

Q: What factors are considered in the LAS-2 Lease Classification Test?

A: The LAS-2 Lease Classification Test considers factors such as the lease term, the present value of lease payments, and the nature of the leased asset.

Q: How is a lease classified as a capital lease?

A: A lease is classified as a capital lease if it meets certain criteria, such as having a lease term of at least 75% of the asset's useful life or if the present value of lease payments exceeds 90% of the fair value of the asset.

Q: How is a lease classified as an operating lease?

A: A lease is classified as an operating lease if it does not meet the criteria for a capital lease.

Q: What are the accounting implications of a capital lease?

A: A capital lease is recorded as both an asset and a liability on the lessee's balance sheet, and the lessee recognizes depreciation expense and interest expense.

Q: What are the accounting implications of an operating lease?

A: An operating lease is not recorded as an asset or a liability on the lessee's balance sheet, and the lessee recognizes lease expense on a straight-line basis over the lease term.

Q: What are the disclosure requirements for leases?

A: Companies are required to disclose certain information about their leases in the footnotes to their financial statements, including the total future minimum lease payments and the future minimum sublease payments.

Q: Are there any exceptions or exemptions to the LAS-2 Lease Classification Test?

A: Yes, there are certain exceptions and exemptions to the LAS-2 Lease Classification Test, such as leases of land and certain short-term leases.

Form Details:

- Released on April 1, 1991;

- The latest edition provided by the Virginia Department of Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form LAS-2 by clicking the link below or browse more documents and templates provided by the Virginia Department of Accounts.