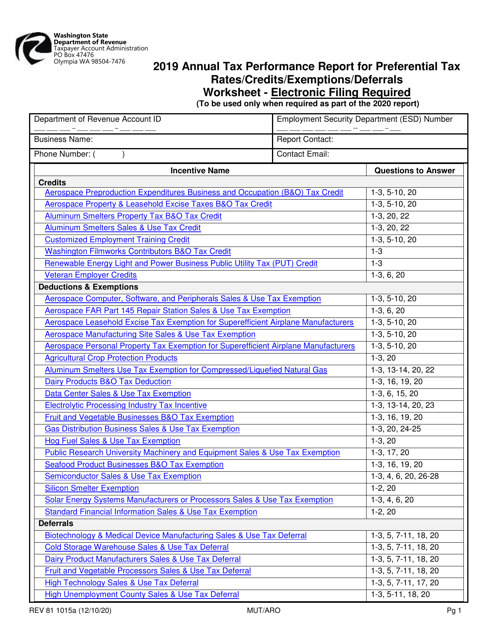

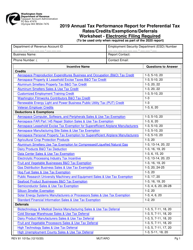

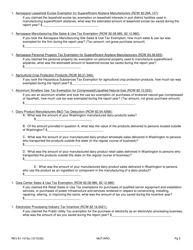

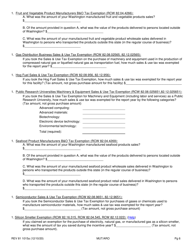

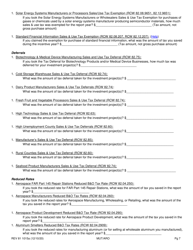

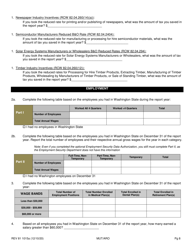

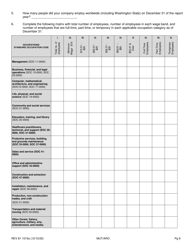

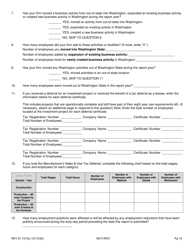

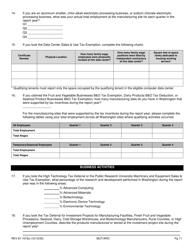

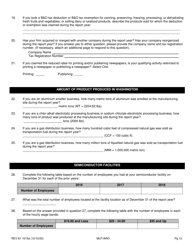

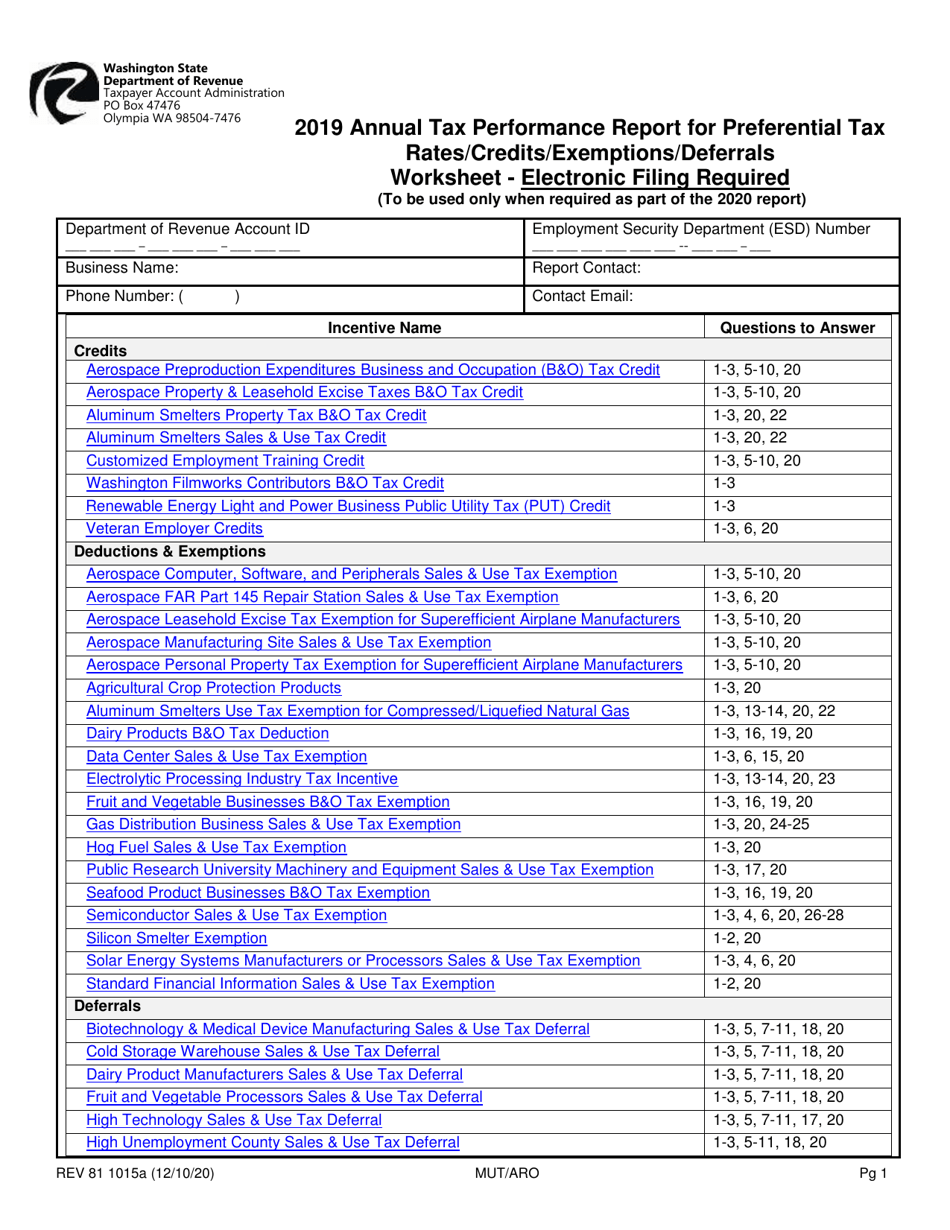

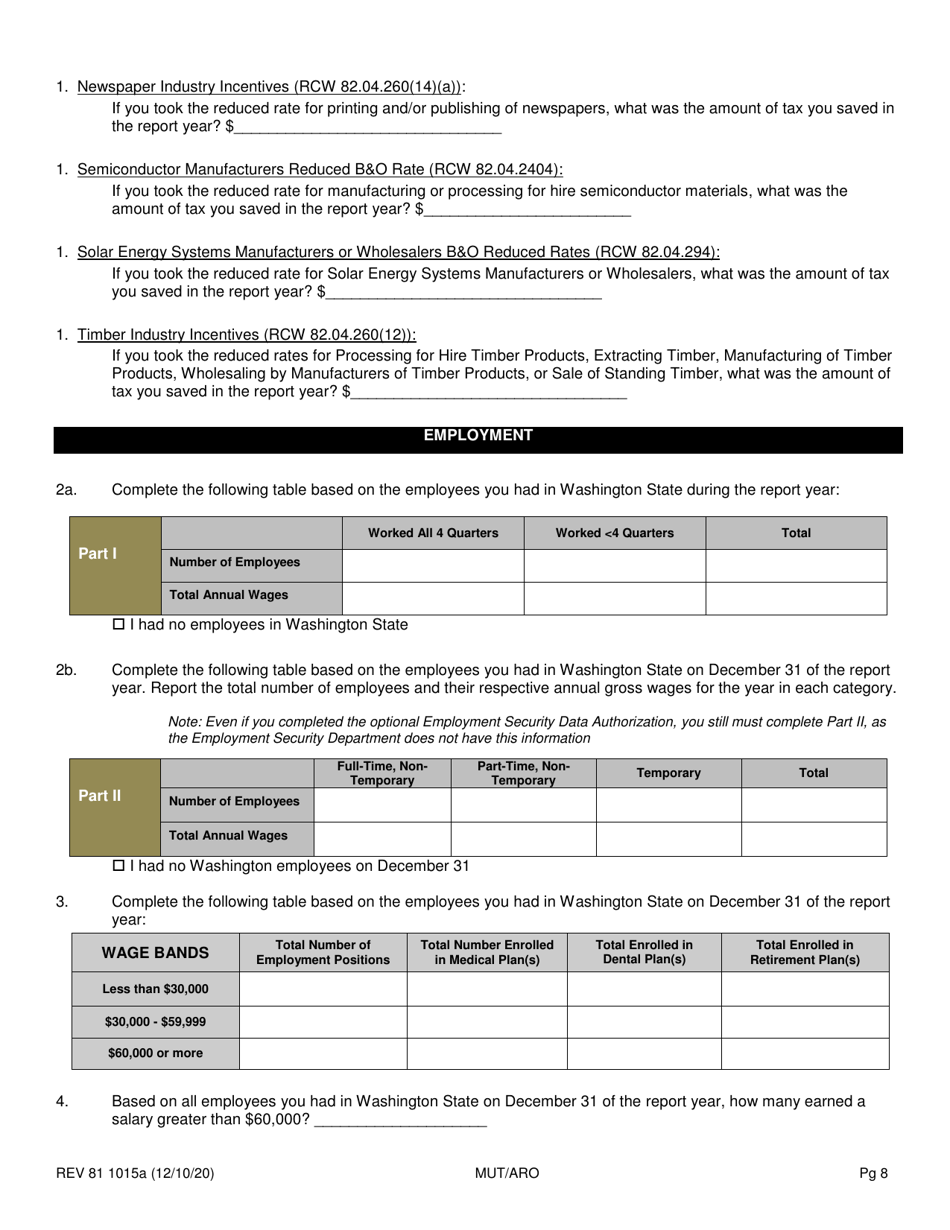

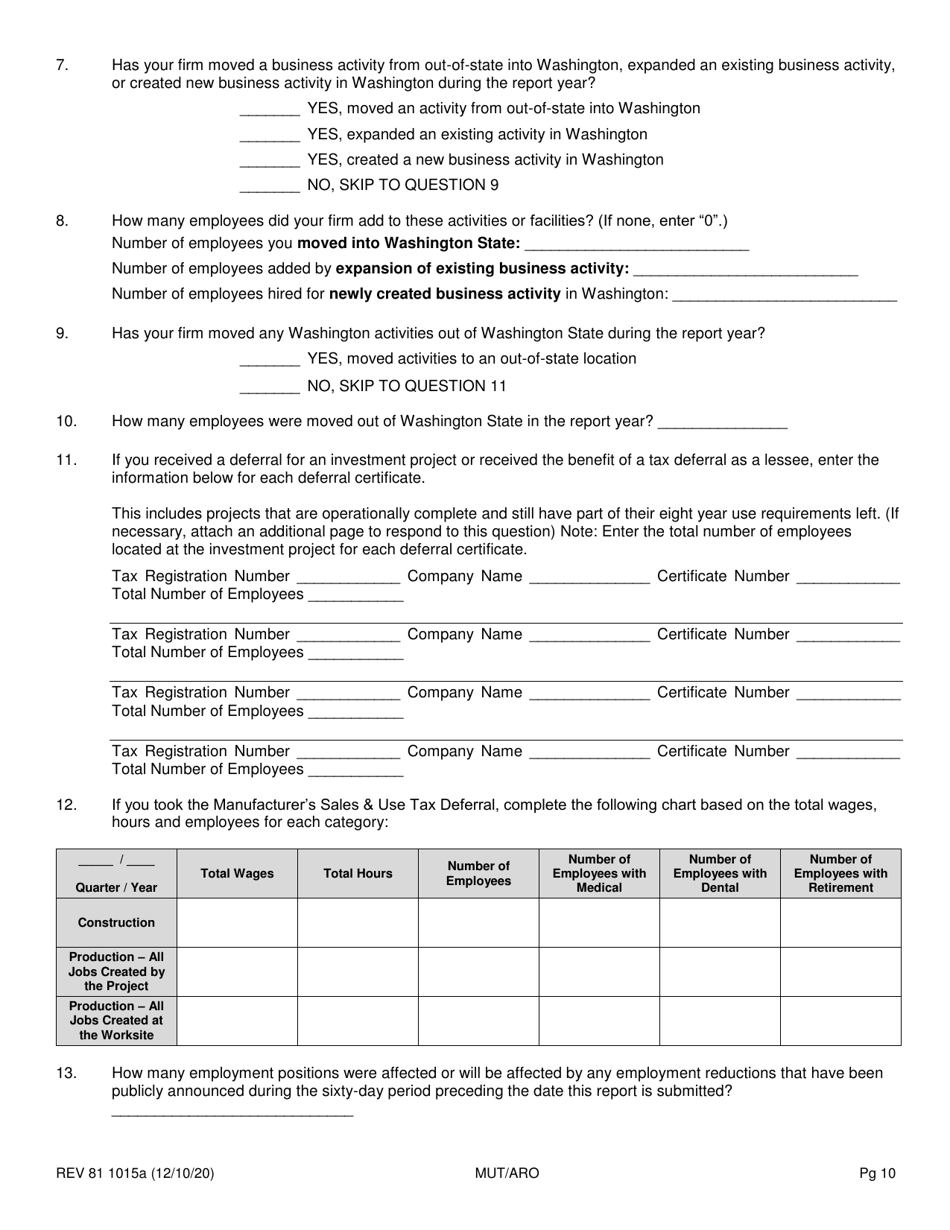

Form REV81 1015A Annual Tax Performance Report for Preferential Tax Rates / Credits / Exemptions / Deferrals Worksheet - Washington

What Is Form REV81 1015A?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV81 1015A?

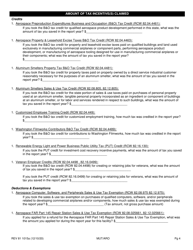

A: Form REV81 1015A is the Annual Tax Performance Report for Preferential Tax Rates/Credits/Exemptions/Deferrals Worksheet in Washington.

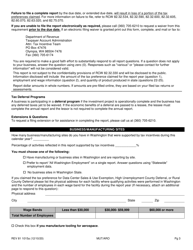

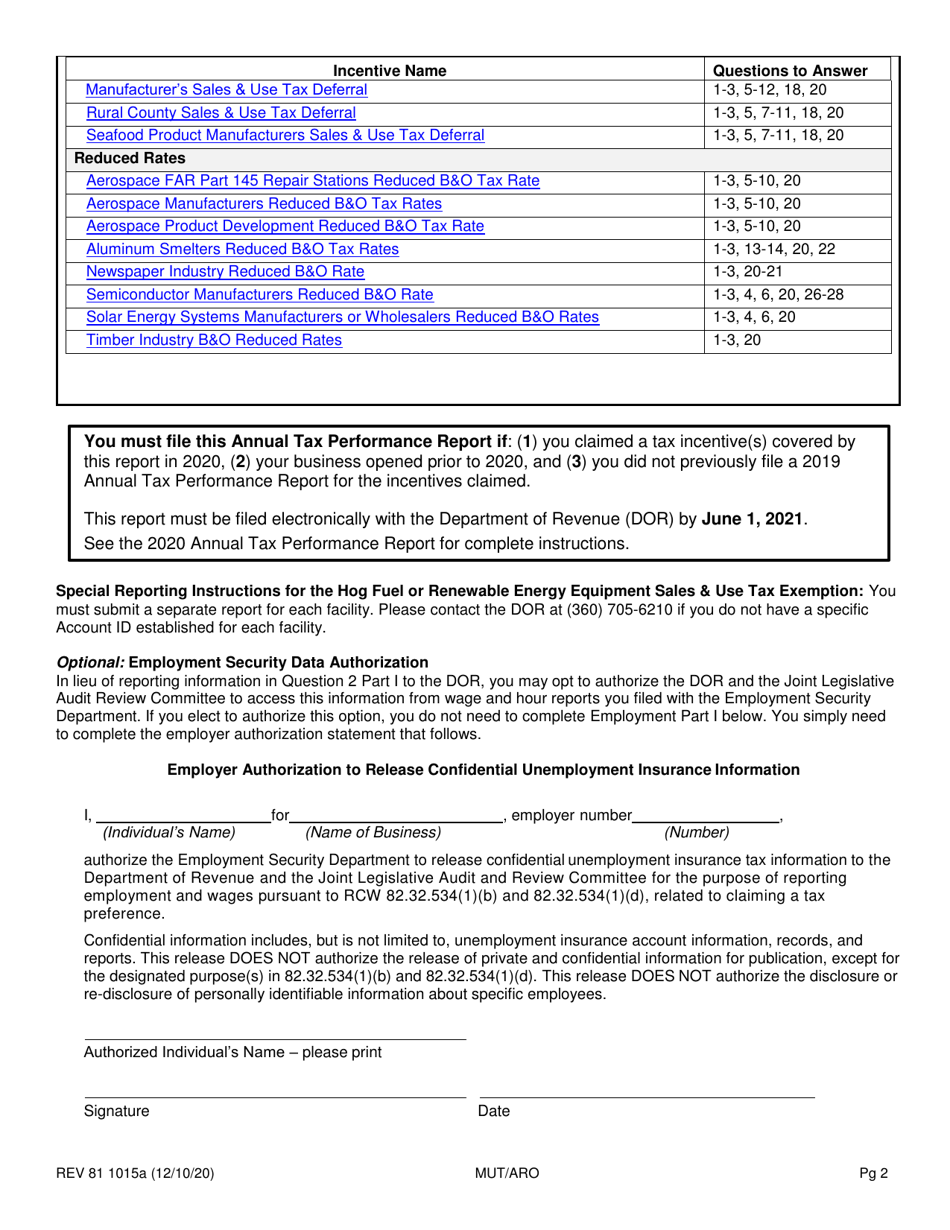

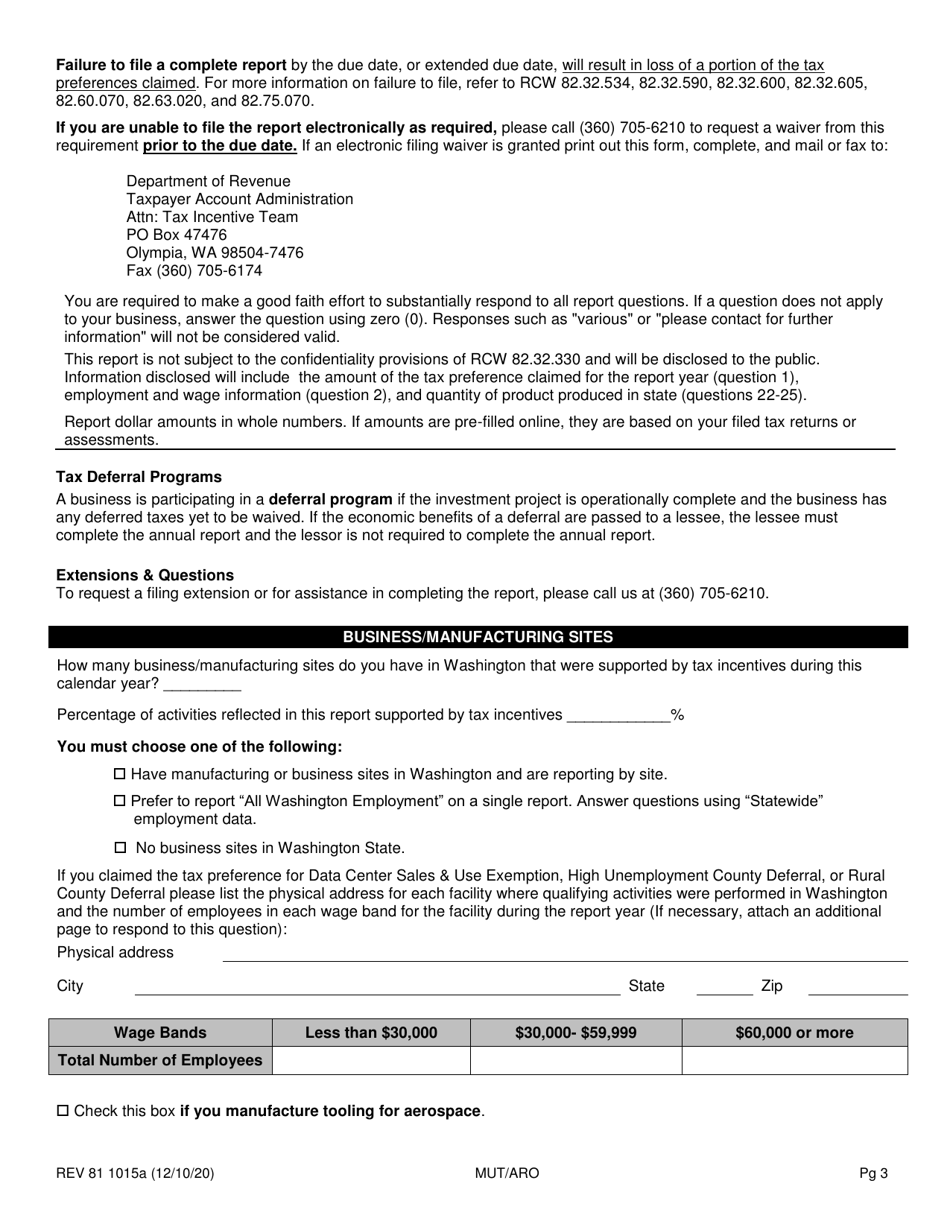

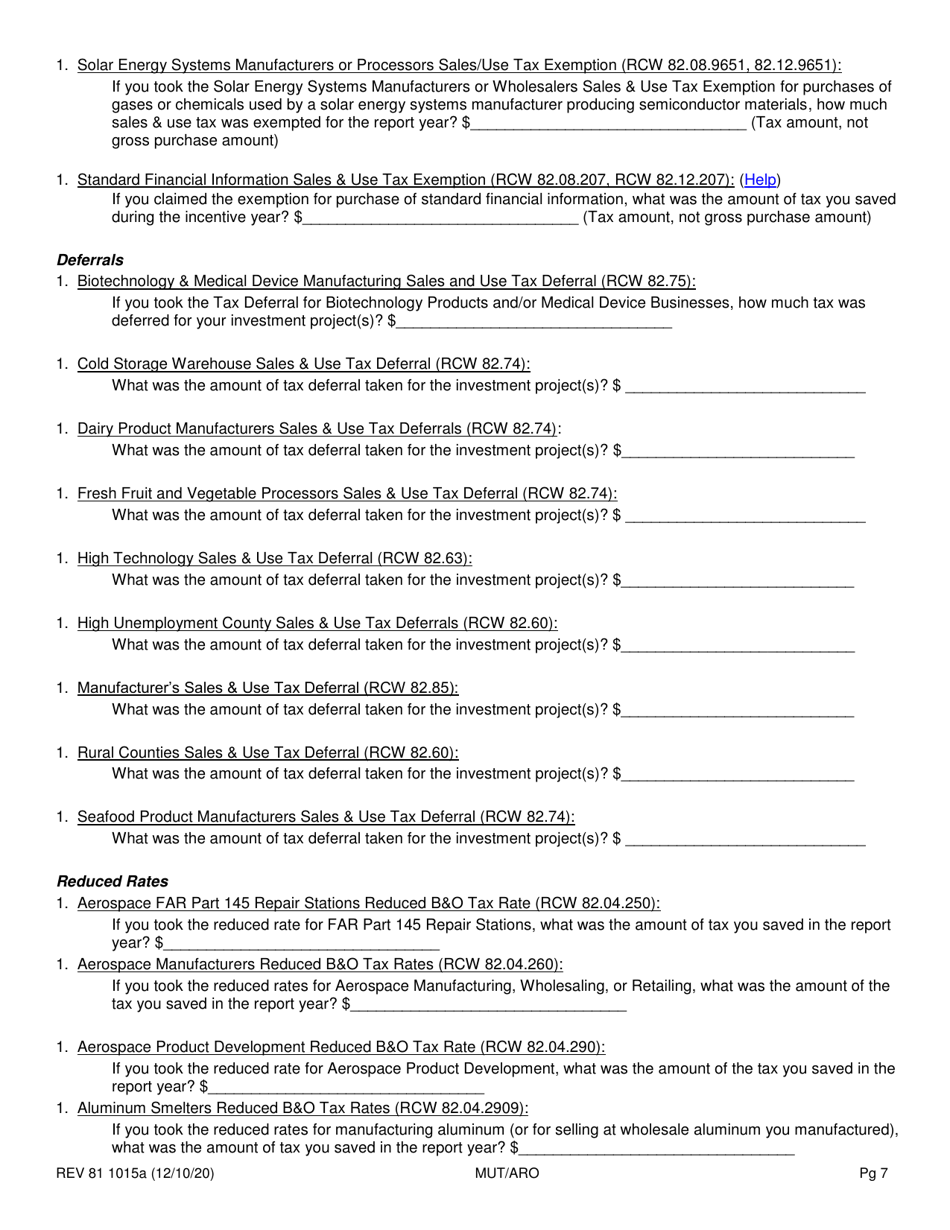

Q: What is the purpose of Form REV81 1015A?

A: The purpose of Form REV81 1015A is to report information related to preferential tax rates, credits, exemptions, and deferrals in Washington.

Q: Who needs to file Form REV81 1015A?

A: Individuals or businesses that have received preferential tax rates, credits, exemptions, or deferrals in Washington need to file Form REV81 1015A.

Q: When is Form REV81 1015A due?

A: The due date for Form REV81 1015A is typically determined by the Department of Revenue in Washington and may vary from year to year.

Form Details:

- Released on December 10, 2020;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV81 1015A by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.