This version of the form is not currently in use and is provided for reference only. Download this version of

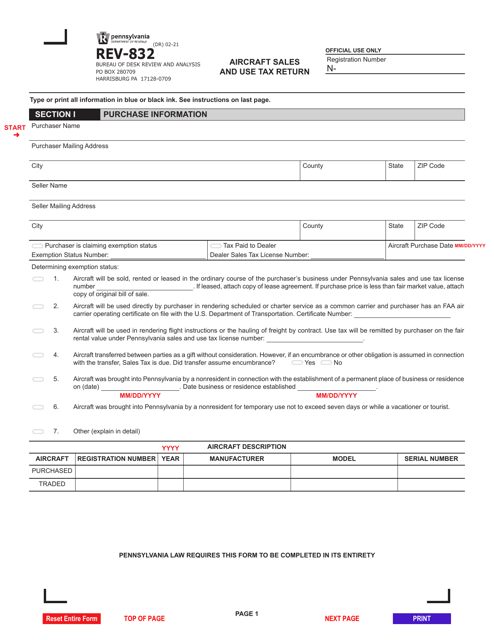

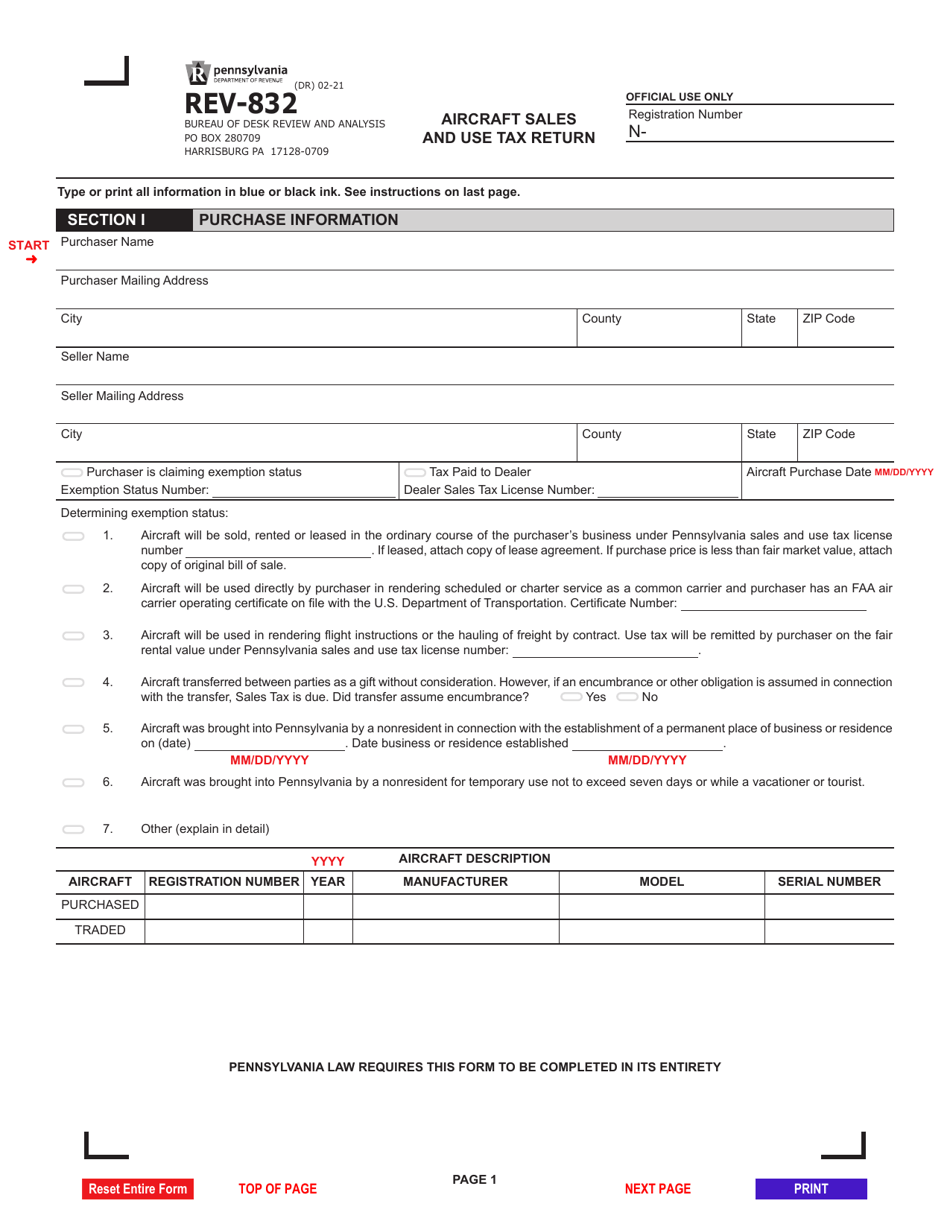

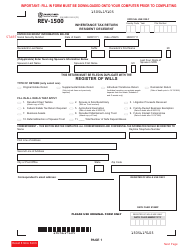

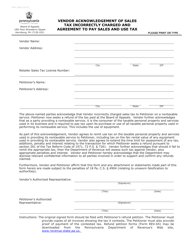

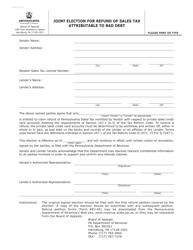

Form REV-832

for the current year.

Form REV-832 Aircraft Sales and Use Tax Return - Pennsylvania

What Is Form REV-832?

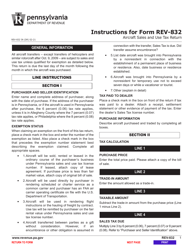

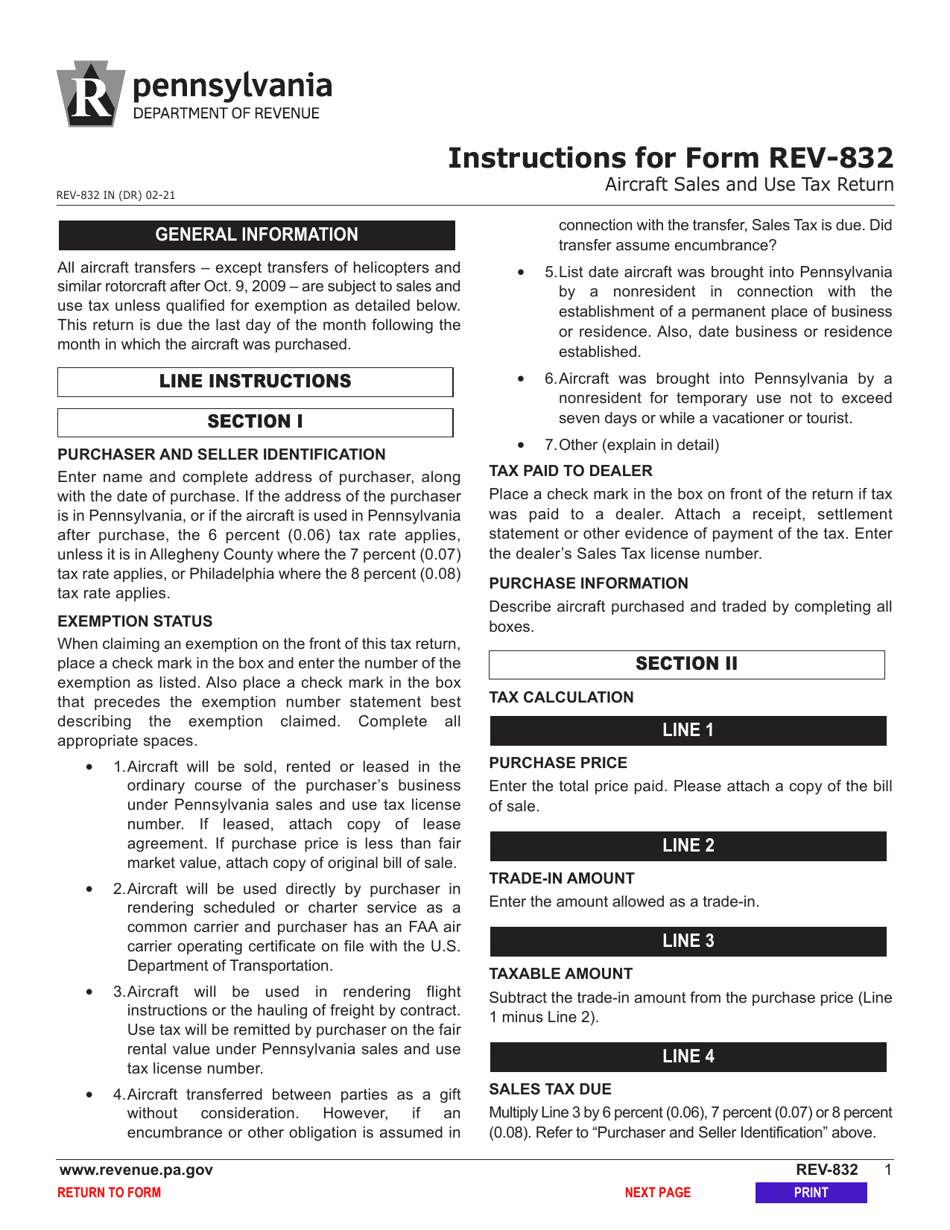

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV-832?

A: Form REV-832 is the Aircraft Sales and Use Tax Return used in Pennsylvania.

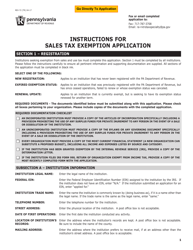

Q: Who needs to file form REV-832?

A: Anyone who purchases or sells an aircraft in Pennsylvania needs to file form REV-832.

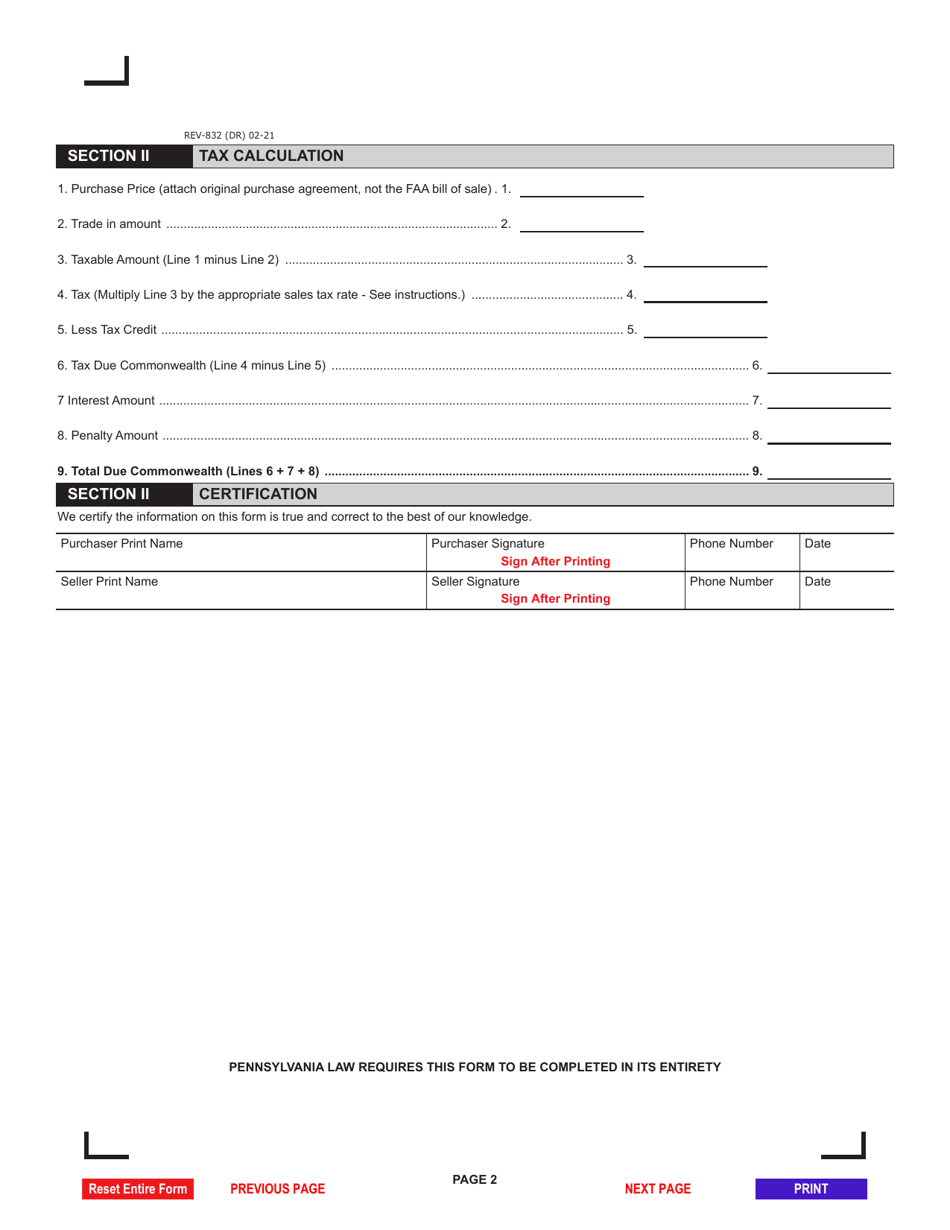

Q: What is the purpose of form REV-832?

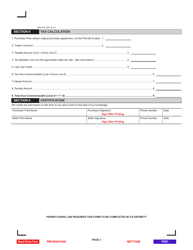

A: Form REV-832 is used to report and pay the sales and use tax on the purchase or sale of an aircraft.

Q: Do I need to include any supporting documents with form REV-832?

A: Yes, you will need to include copies of invoices or other documentation related to the purchase or sale of the aircraft.

Q: When is form REV-832 due?

A: Form REV-832 is due within 30 days of the purchase or sale of the aircraft.

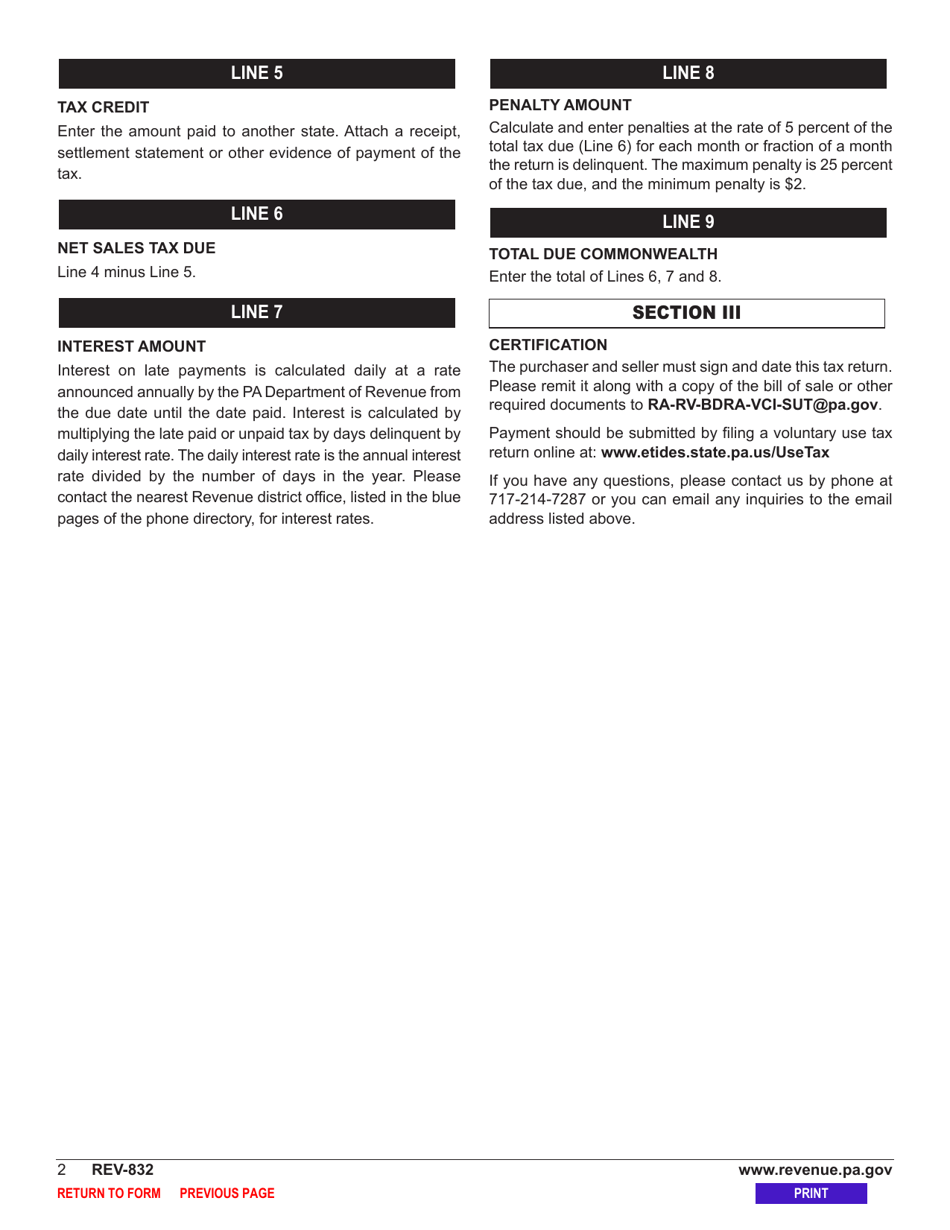

Q: Are there any penalties for late filing of form REV-832?

A: Yes, there may be penalties for late filing or underpayment of the sales and use tax.

Q: What should I do if I have questions about form REV-832?

A: If you have questions about form REV-832, you should contact the Pennsylvania Department of Revenue for assistance.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-832 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.