This version of the form is not currently in use and is provided for reference only. Download this version of

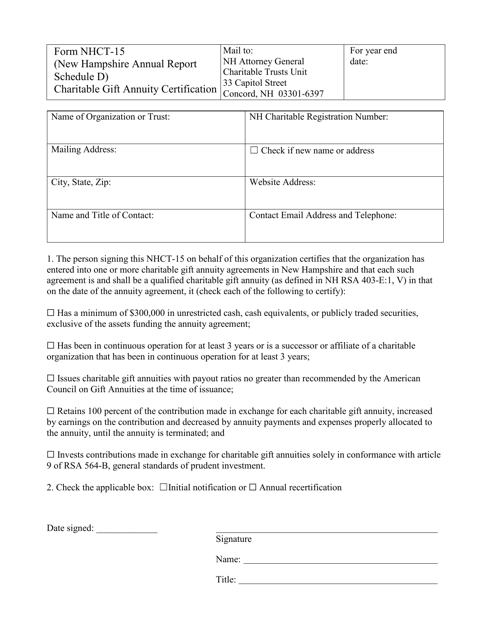

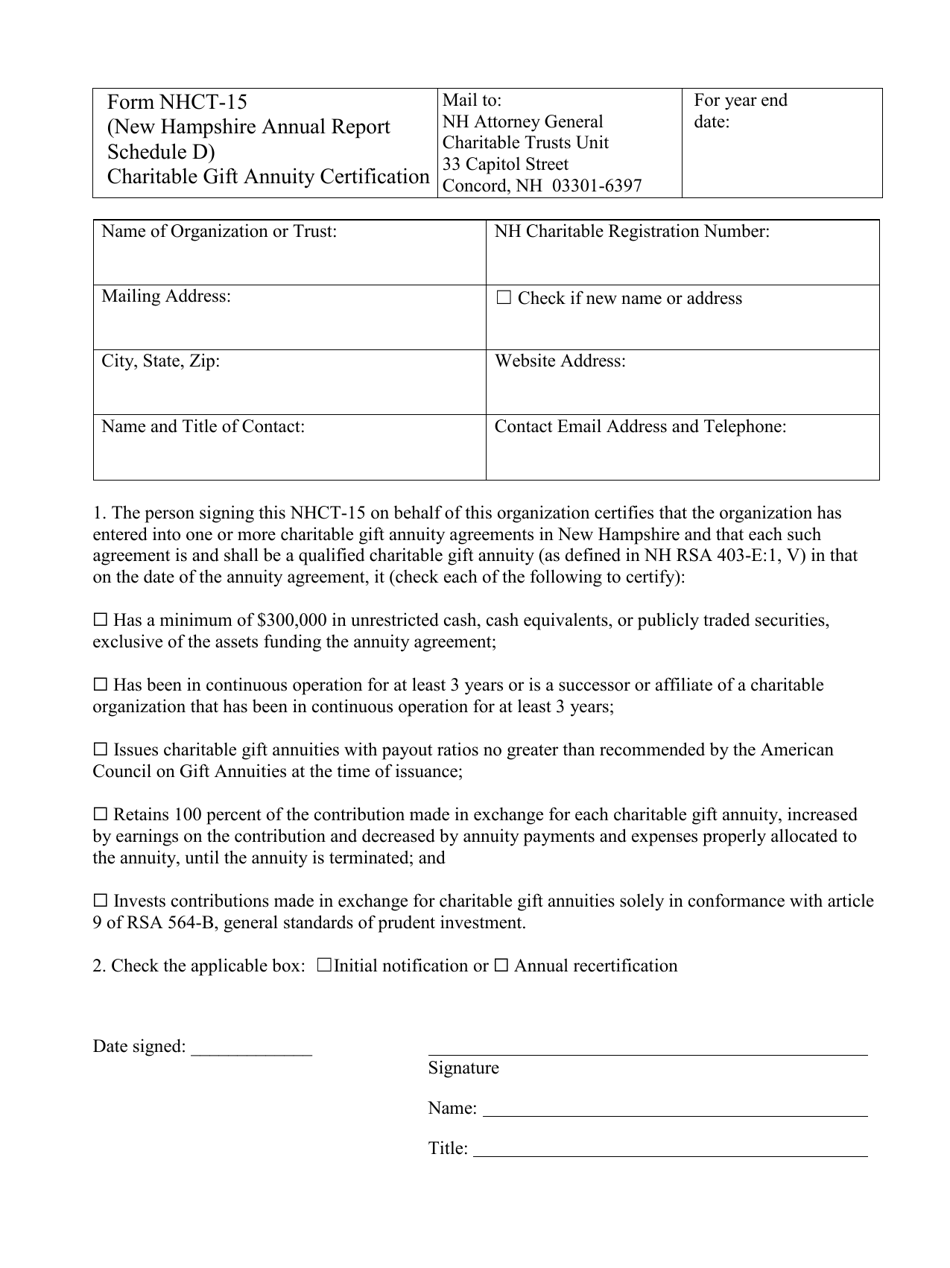

Form NHCT-15

for the current year.

Form NHCT-15 Charitable Gift Annuity Certification - New Hampshire

What Is Form NHCT-15?

This is a legal form that was released by the New Hampshire Department of Justice - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NHCT-15?

A: Form NHCT-15 is the Charitable Gift Annuity Certification specifically for residents of New Hampshire.

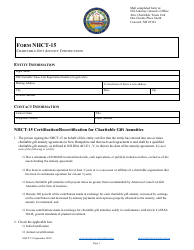

Q: What is a Charitable Gift Annuity?

A: A Charitable Gift Annuity is a contract between a donor and a charitable organization in which the donor transfers assets to the organization in exchange for regular fixed income payments for life.

Q: Who needs to complete Form NHCT-15?

A: Residents of New Hampshire who are establishing a Charitable Gift Annuity need to complete Form NHCT-15.

Q: What information is required on Form NHCT-15?

A: Form NHCT-15 requires information such as the donor's personal information, the charitable organization's information, and details about the charitable gift annuity.

Q: Do I need to file Form NHCT-15 with the IRS?

A: No, Form NHCT-15 is specific to New Hampshire and does not need to be filed with the IRS.

Form Details:

- The latest edition provided by the New Hampshire Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NHCT-15 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Justice.