This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3 PRP

for the current year.

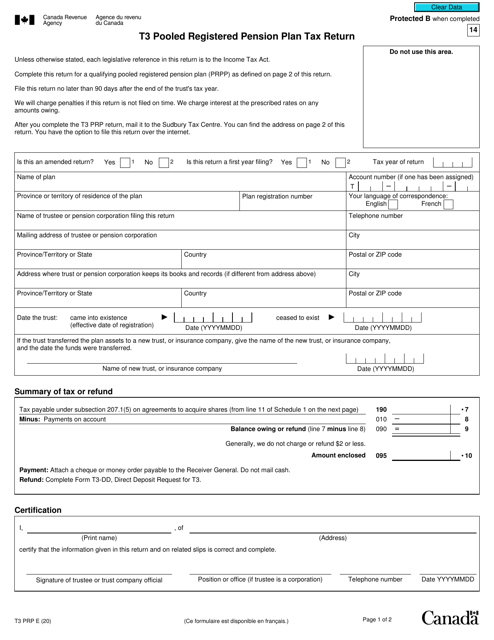

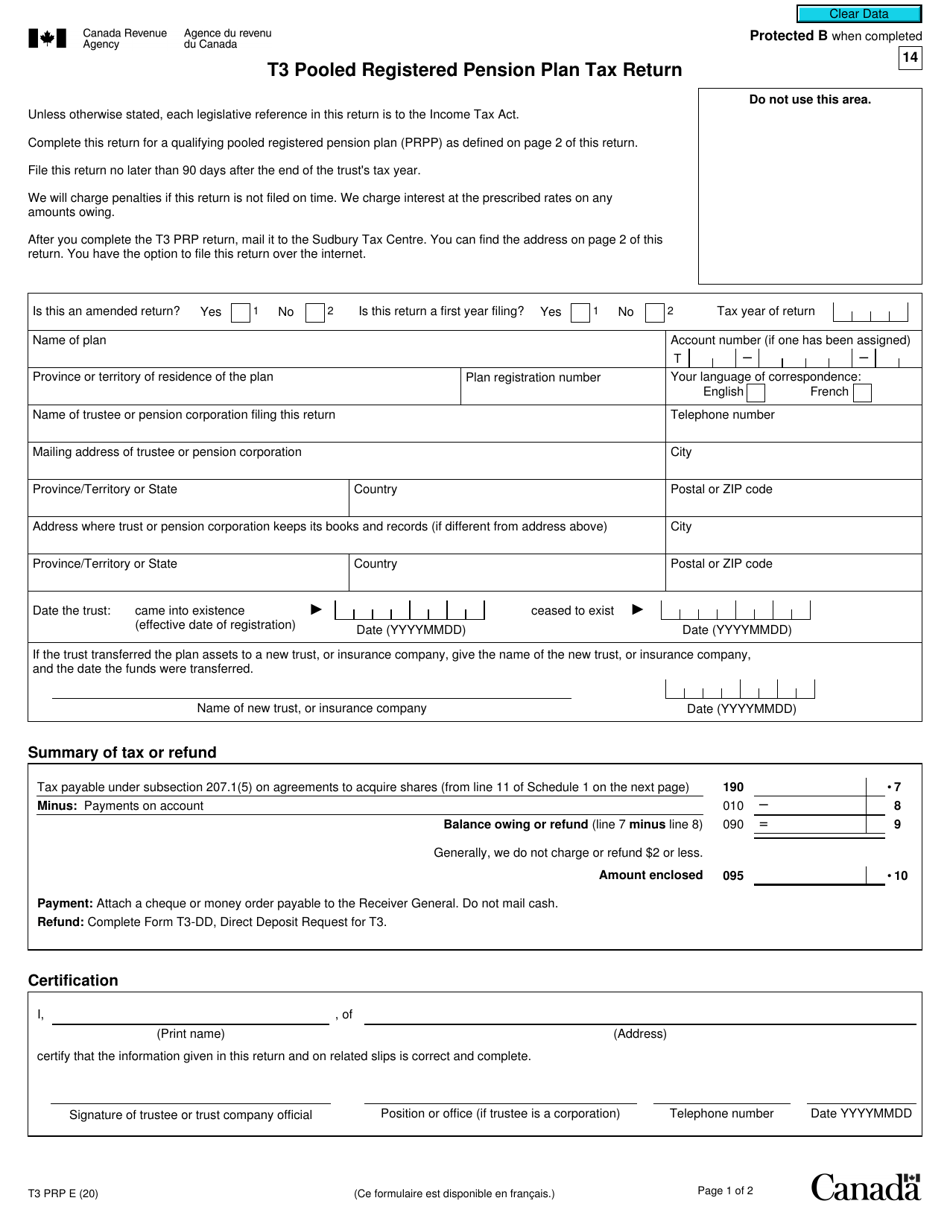

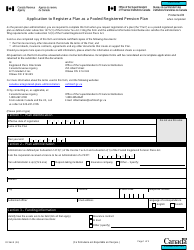

Form T3 PRP T3 Pooled Registered Pension Plan Tax Return - Canada

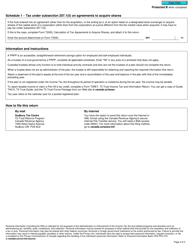

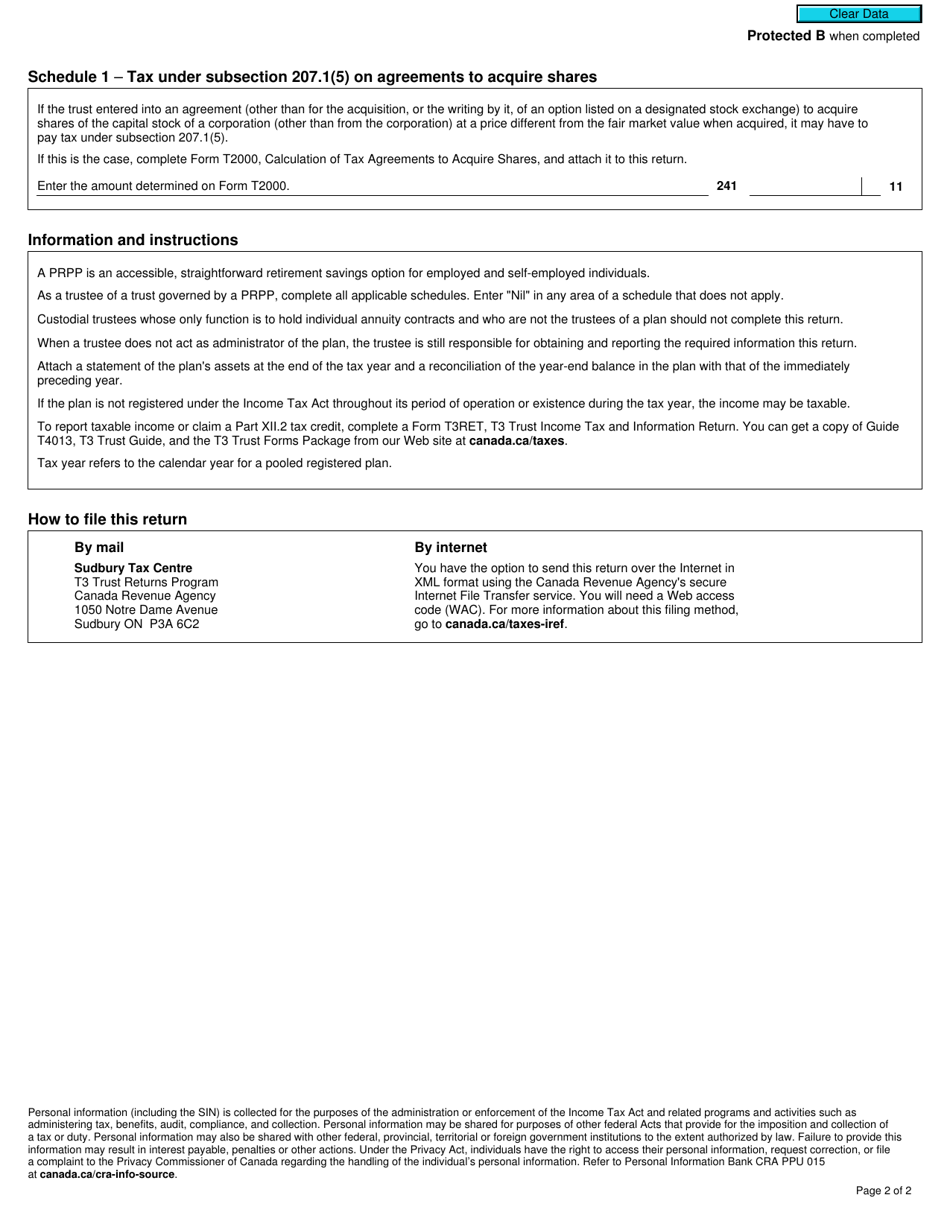

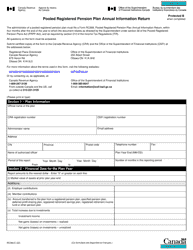

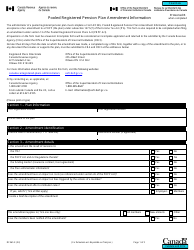

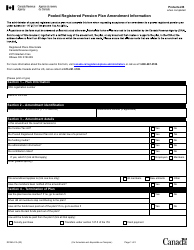

Form T3 PRP, also known as the T3 Pooled Registered Pension Plan (PRPP) Tax Return, is used in Canada for reporting income, deductions, and other tax-related information for PRPPs. It is specifically designed for individuals or entities who are responsible for administering the PRPP and need to report and pay taxes on behalf of the plan.

The trustee of the Pooled Registered Pension Plan (PRPP) is responsible for filing the Form T3 PRP tax return in Canada.

FAQ

Q: What is Form T3 PRP?

A: Form T3 PRP is a tax return form for Pooled Registered Pension Plans in Canada.

Q: What is a Pooled Registered Pension Plan (PRPP)?

A: A PRPP is a retirement savings option available to individuals and employees of small businesses in Canada.

Q: Who needs to file Form T3 PRP?

A: Individuals or businesses who operate a PRPP in Canada need to file Form T3 PRP.

Q: What information is required on Form T3 PRP?

A: Form T3 PRP requires information about the plan, contributions, investments, and beneficiaries.

Q: When is the deadline to file Form T3 PRP?

A: The deadline to file Form T3 PRP is 90 days after the end of the calendar year.

Q: Are there any penalties for late filing of Form T3 PRP?

A: Yes, there are penalties for late filing of Form T3 PRP. It is important to file the return on time to avoid penalties.

Q: Is Form T3 PRP applicable in the United States?

A: No, Form T3 PRP is specific to Canadian tax purposes and not applicable in the United States.