This version of the form is not currently in use and is provided for reference only. Download this version of

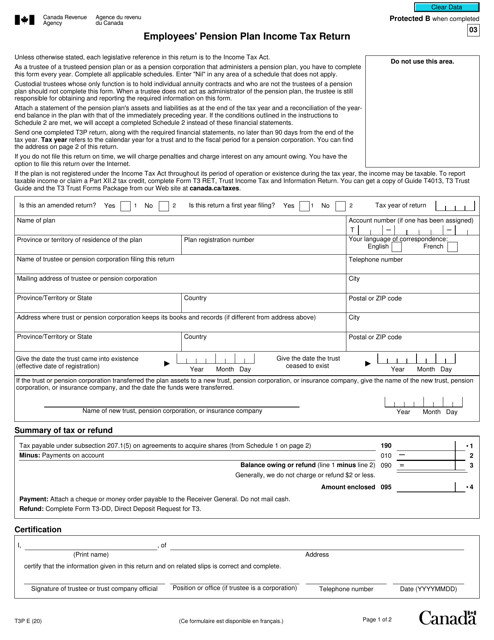

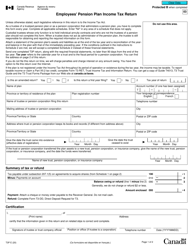

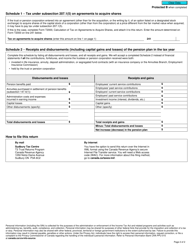

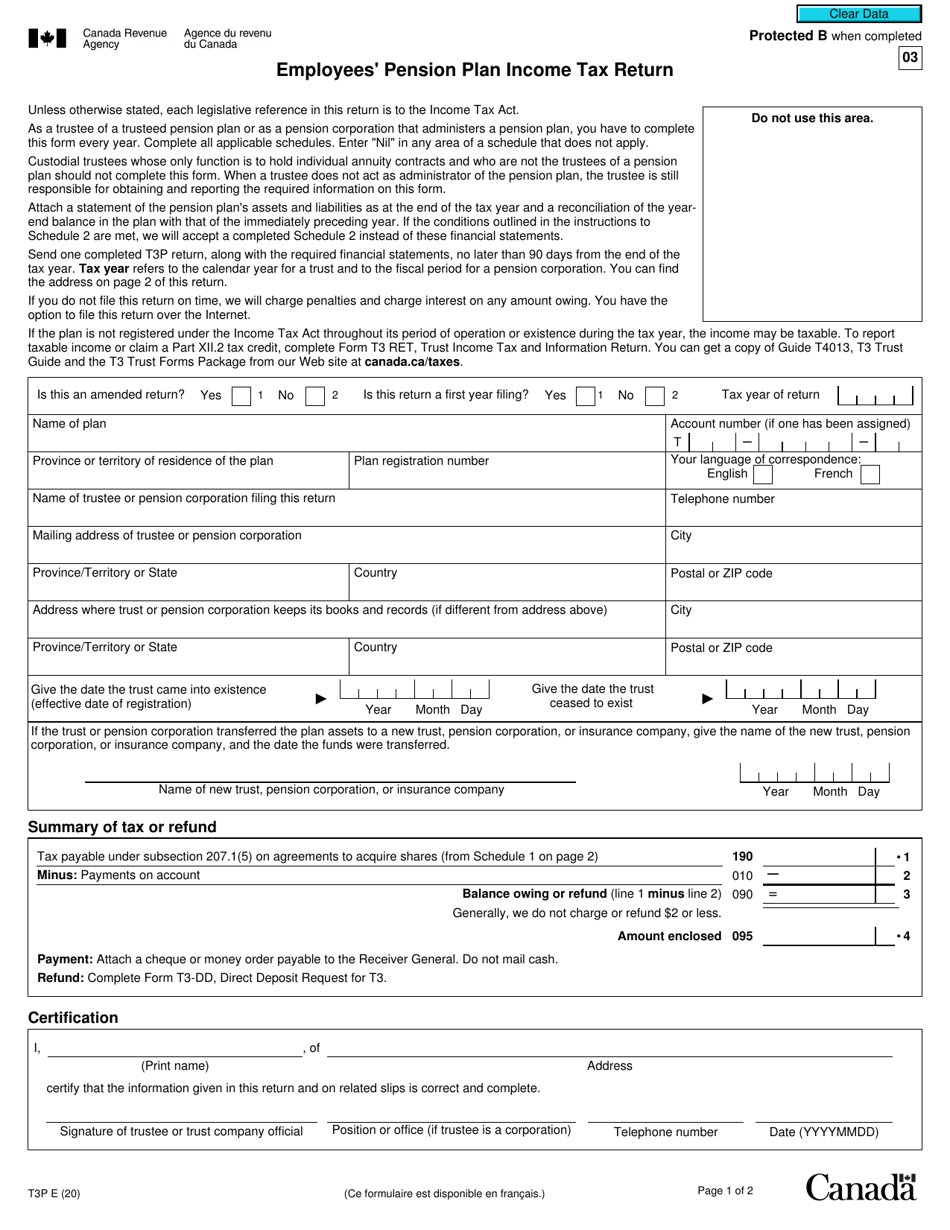

Form T3P

for the current year.

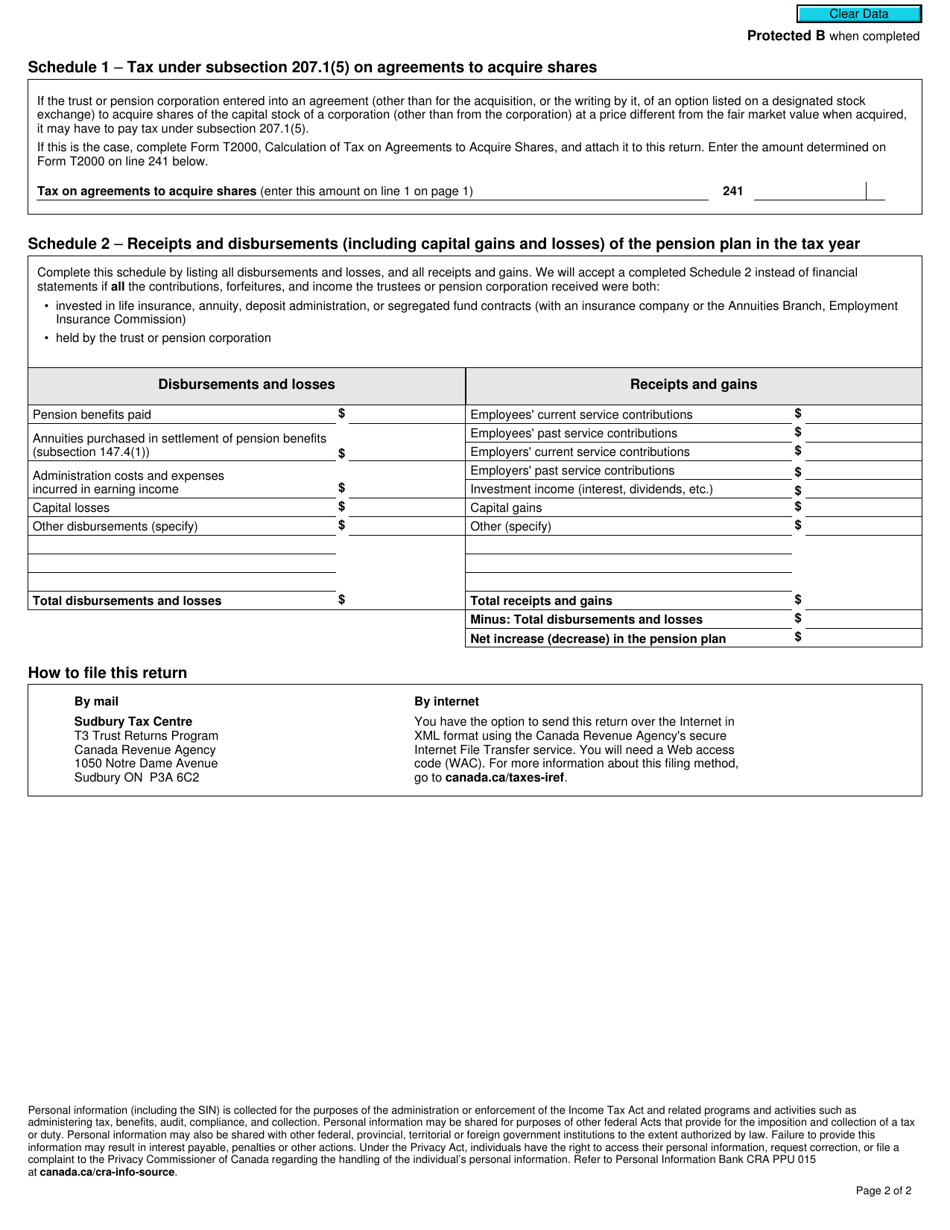

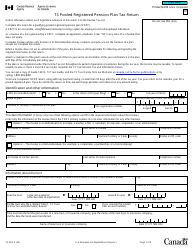

Form T3P Employees' Pension Plan Income Tax Return - Canada

Form T3P is used for reporting and filing income tax returns for registered pension plans in Canada, specifically for employees participating in those plans. It is used to report the income earned by the pension plan and calculate the taxes owed.

The employer files the Form T3P Employees' Pension Plan Income Tax Return in Canada.

FAQ

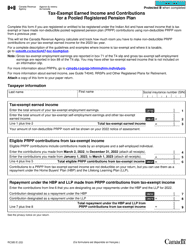

Q: What is Form T3P?

A: Form T3P is the Employees' Pension Plan Income Tax Return, used in Canada.

Q: Who needs to file Form T3P?

A: Form T3P needs to be filed by employers who have an employees' pension plan in Canada.

Q: What is the purpose of Form T3P?

A: The purpose of Form T3P is to report income and calculate taxes owed for the employees' pension plan.

Q: When is the deadline to file Form T3P?

A: The deadline to file Form T3P is within 90 days after the end of the pension plan year.

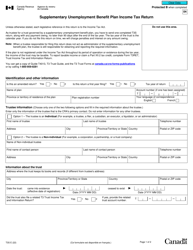

Q: Are there any penalties for late filing of Form T3P?

A: Yes, there may be penalties for late filing of Form T3P, including interest charges on any taxes owed.

Q: Are there any exceptions to filing Form T3P?

A: There may be exceptions to filing Form T3P, depending on the specific circumstances. It is best to consult with the CRA or a tax professional for guidance.