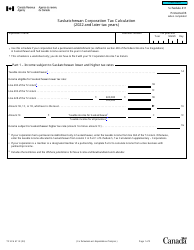

This version of the form is not currently in use and is provided for reference only. Download this version of

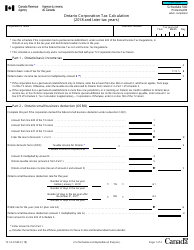

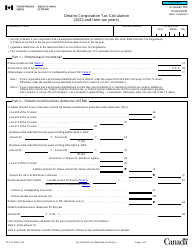

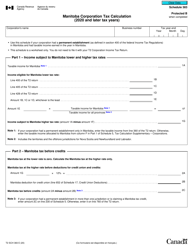

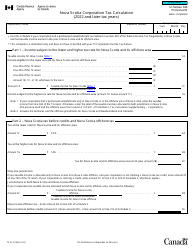

Form T2 Schedule 5

for the current year.

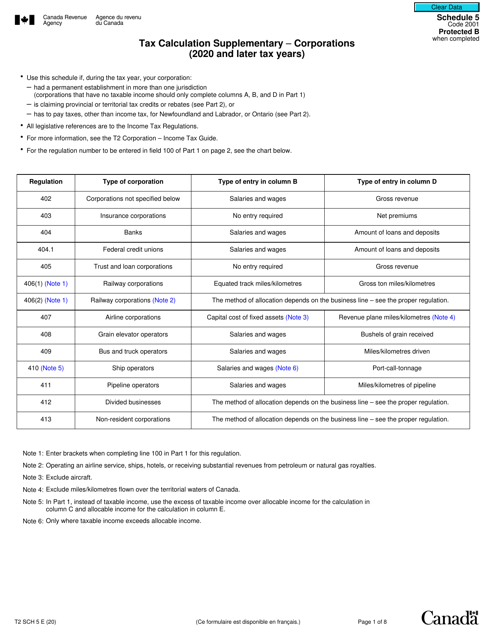

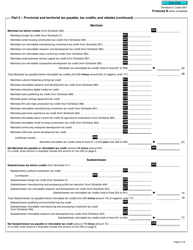

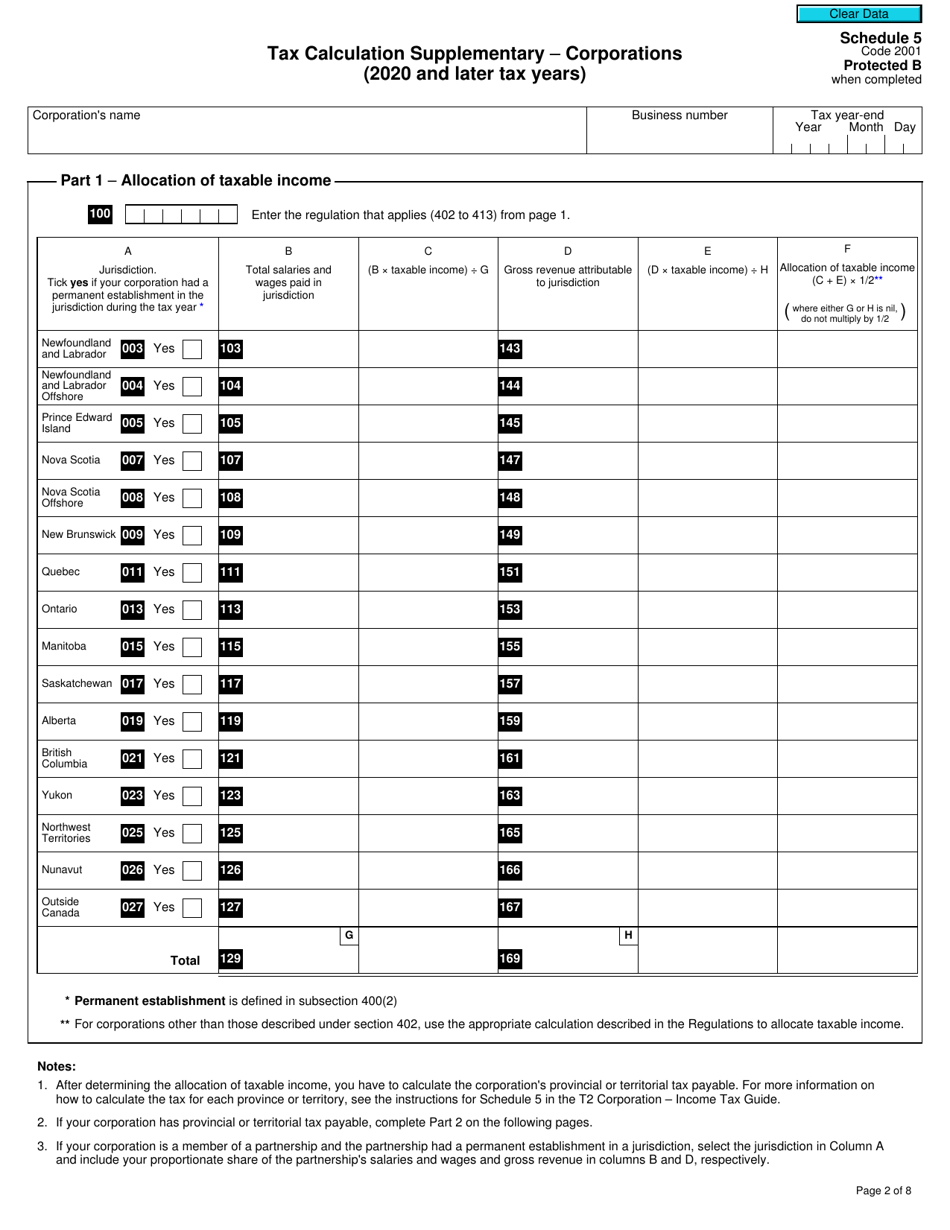

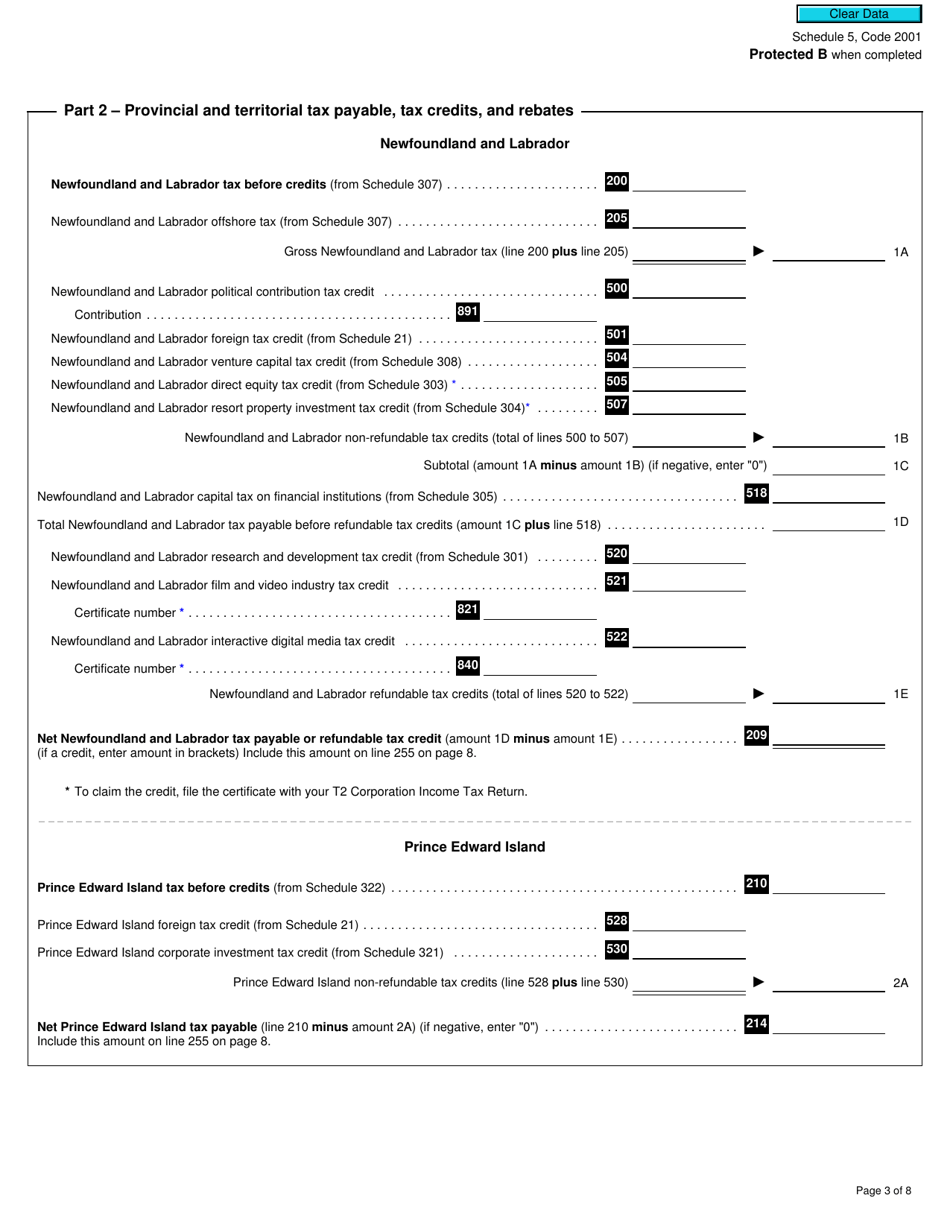

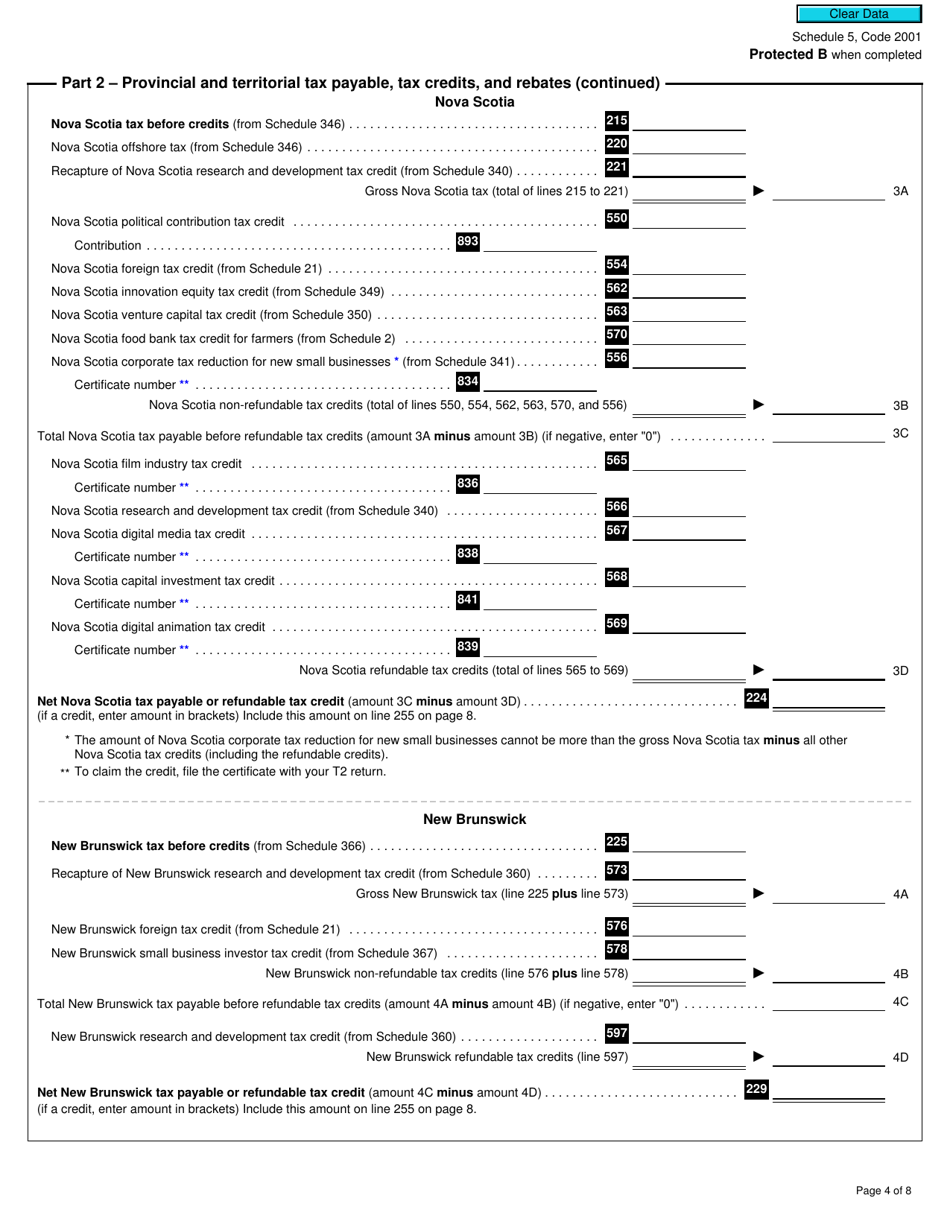

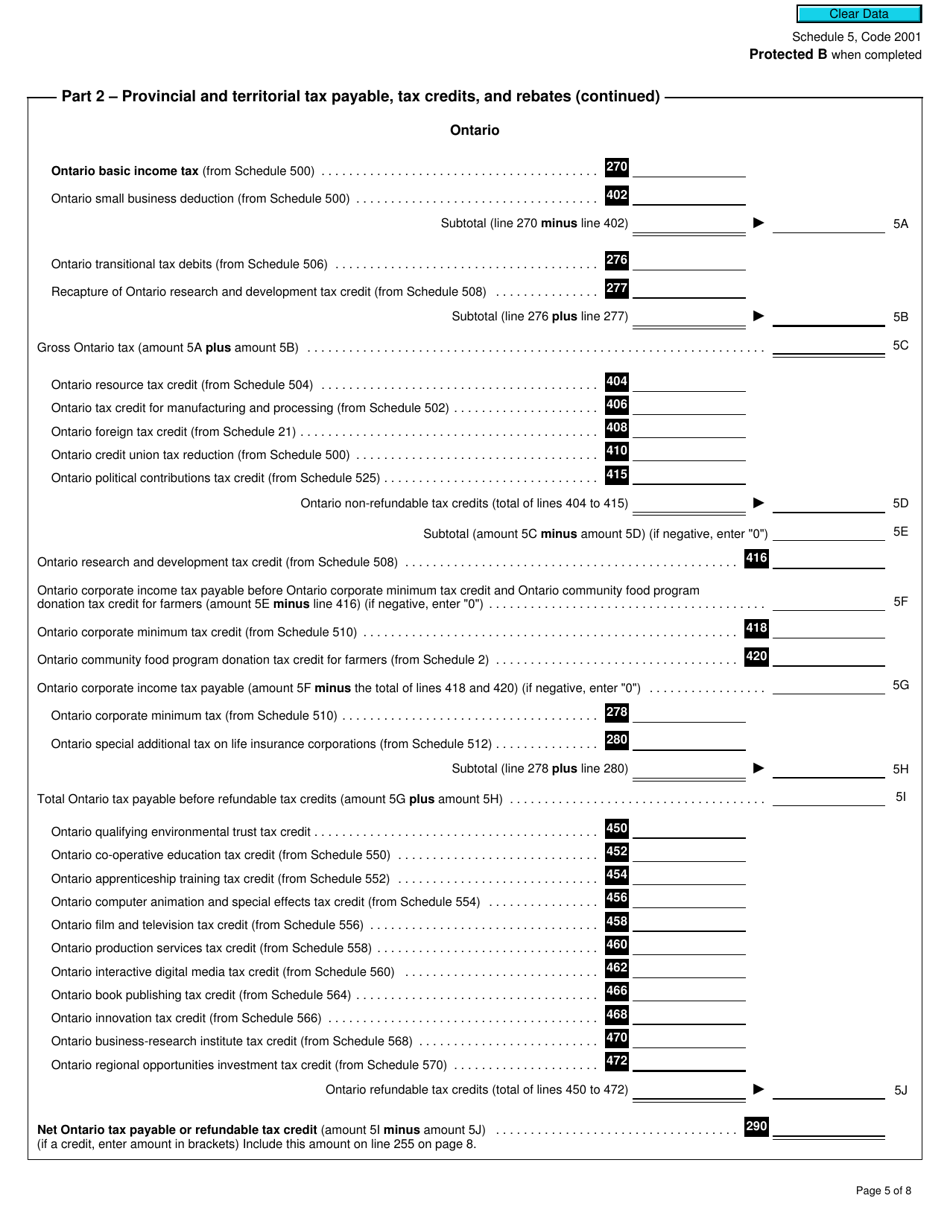

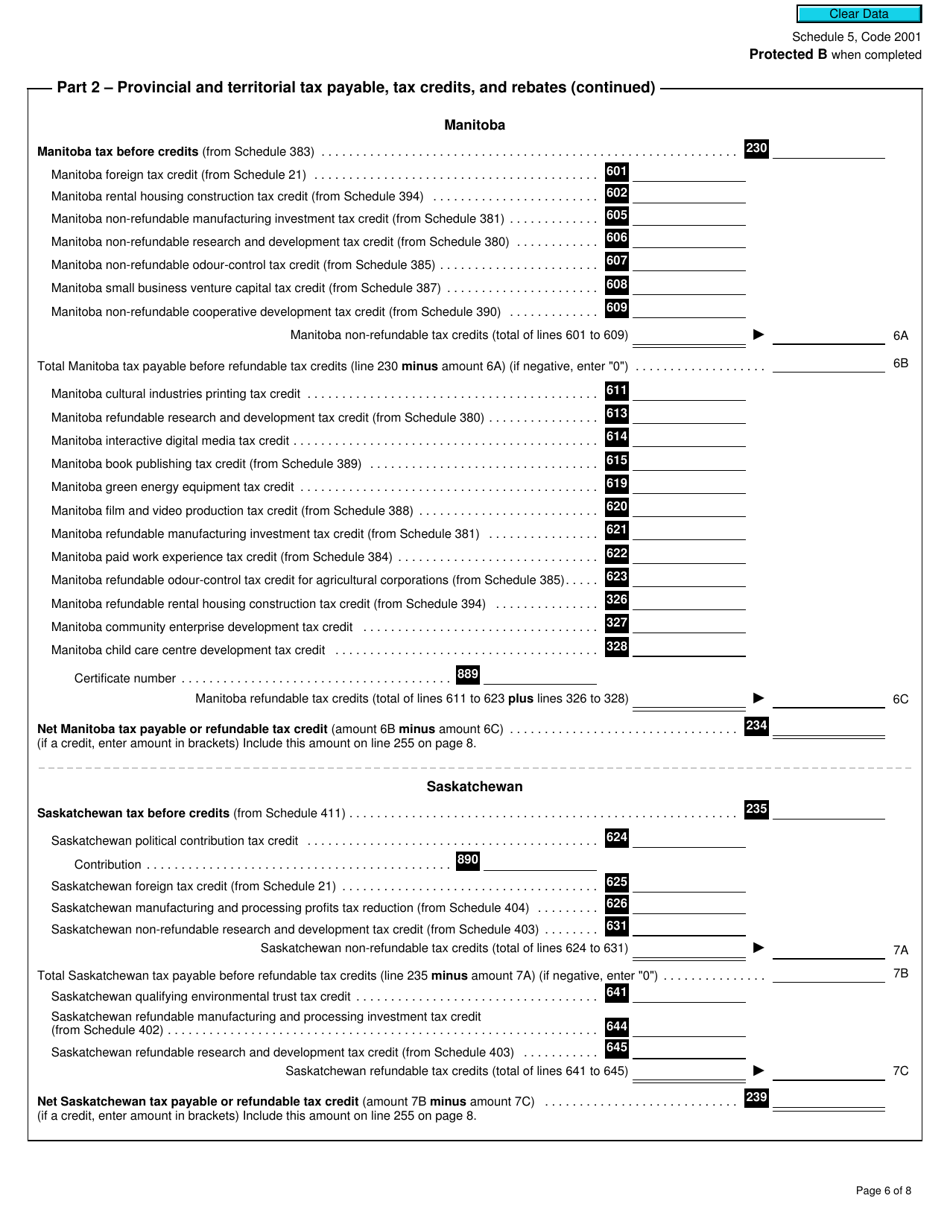

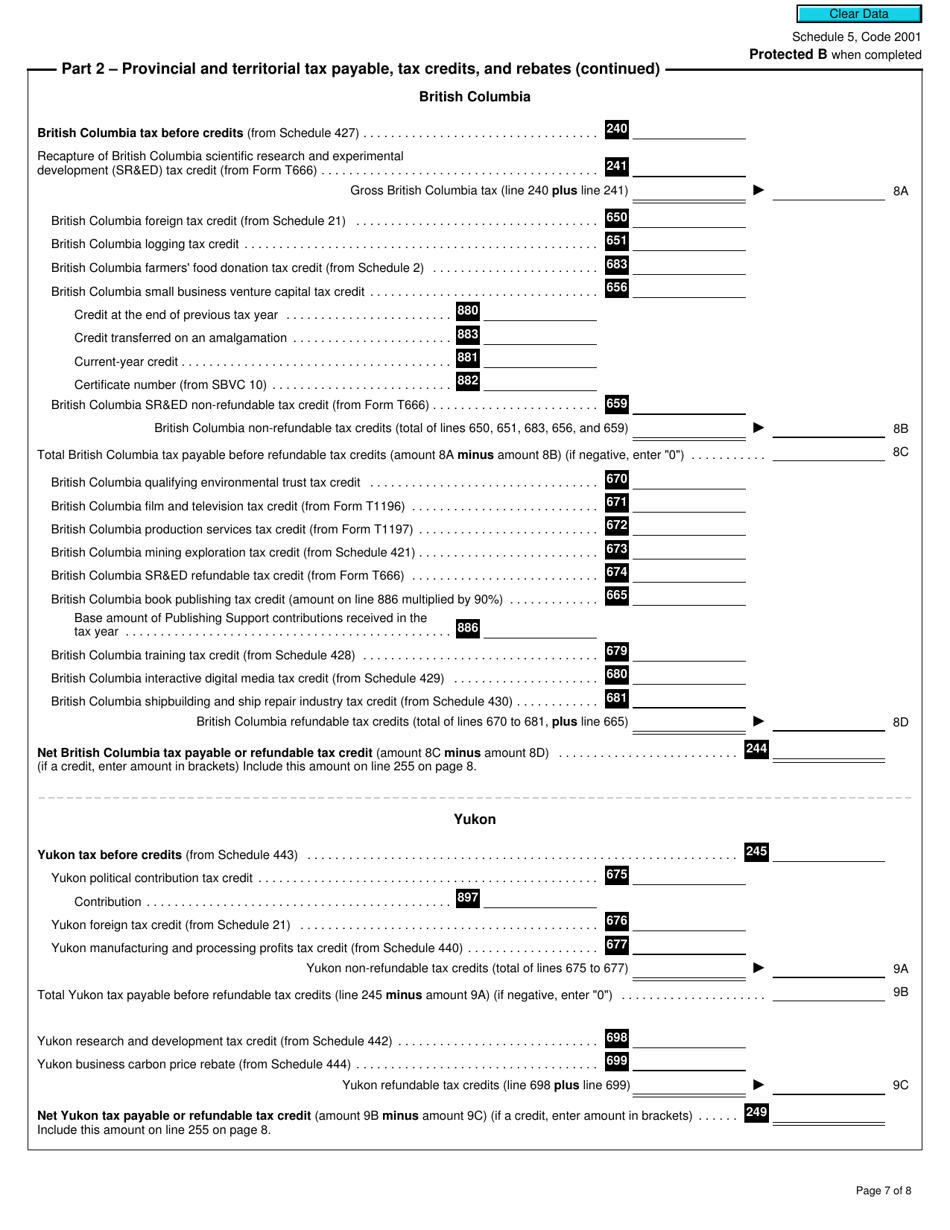

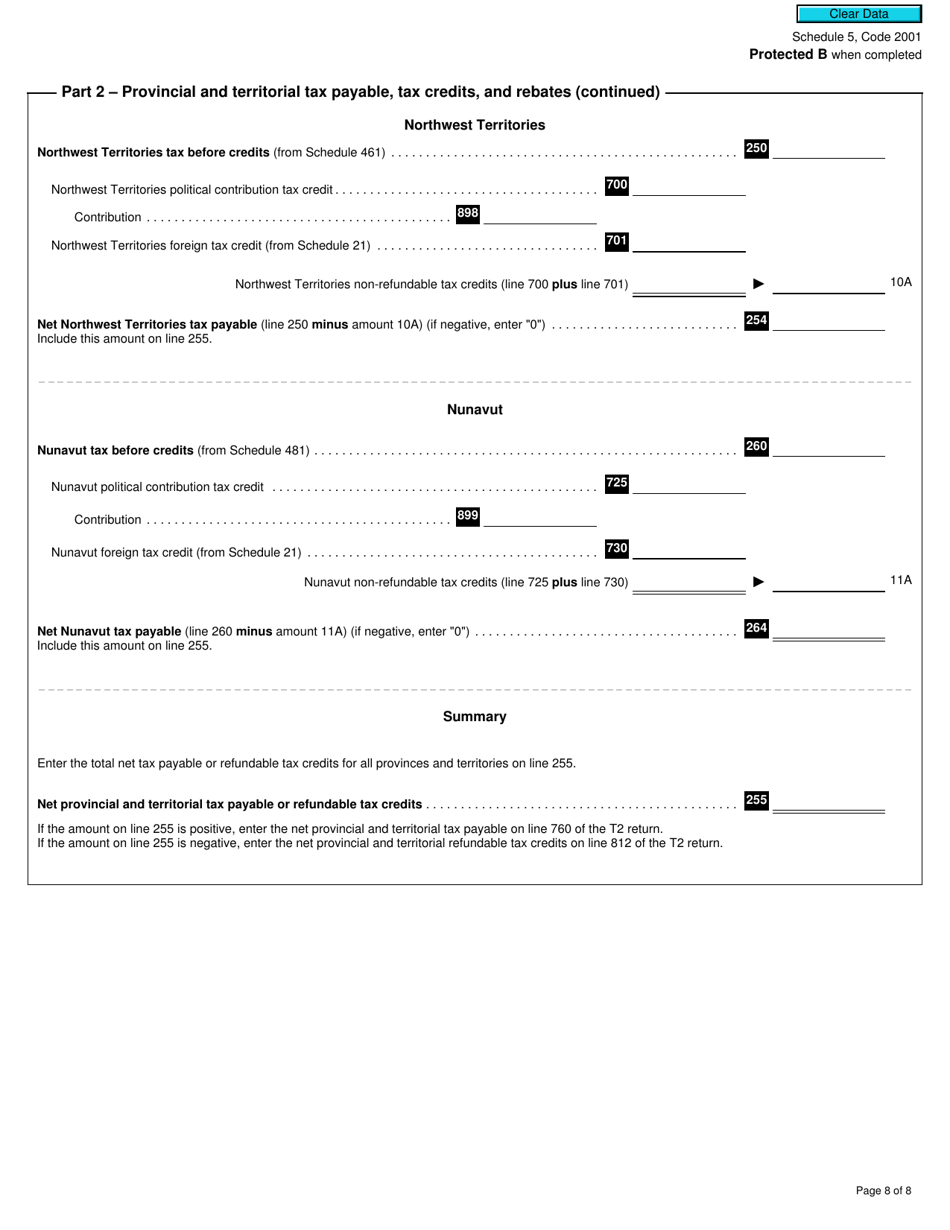

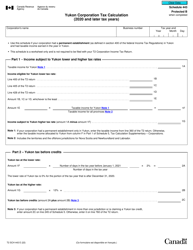

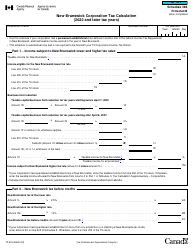

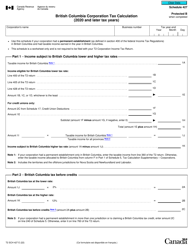

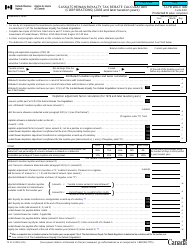

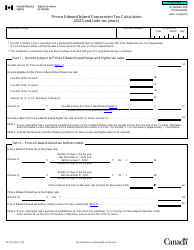

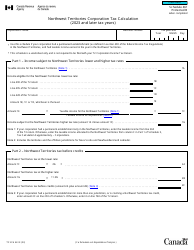

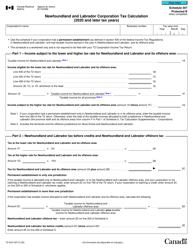

Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2020 and Later Tax Years) - Canada

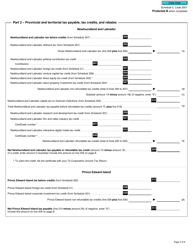

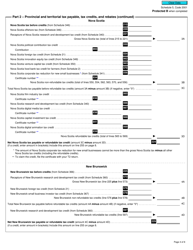

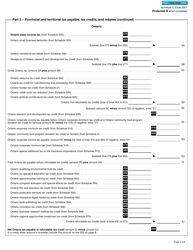

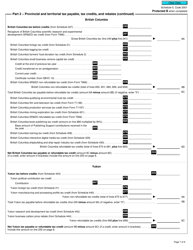

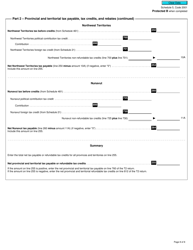

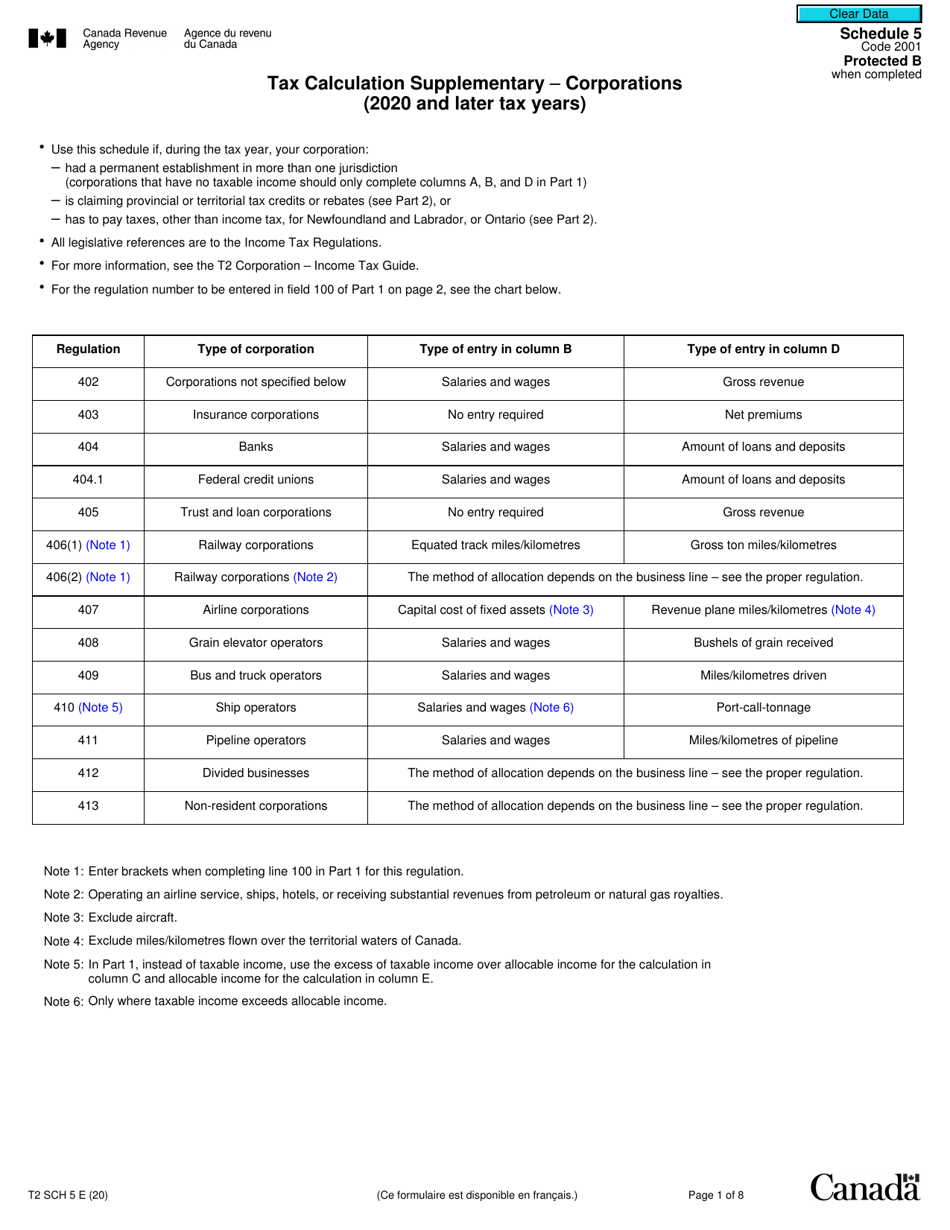

Form T2 Schedule 5 is used by corporations in Canada to calculate their taxes for the year 2020 and onwards. It provides a detailed breakdown of various calculations and adjustments that need to be made in order to determine the final tax liability of the corporation.

The Form T2 Schedule 5 Tax Calculation Supplementary - Corporations (2020 and Later Tax Years) in Canada is filed by corporations when preparing their tax returns.

FAQ

Q: What is Form T2 Schedule 5?

A: Form T2 Schedule 5 is a tax form used by corporations in Canada to calculate their income tax liability.

Q: What is the purpose of Form T2 Schedule 5?

A: The purpose of Form T2 Schedule 5 is to provide a detailed calculation of a corporation's income tax liability.

Q: Who is required to file Form T2 Schedule 5?

A: Corporations in Canada are required to file Form T2 Schedule 5 if they need to calculate their income tax liability.

Q: What tax years does Form T2 Schedule 5 apply to?

A: Form T2 Schedule 5 applies to tax years starting in 2020 and later.

Q: Are there any other supplementary forms required with Form T2 Schedule 5?

A: Yes, corporations may need to file other supplementary forms depending on their specific tax situation.

Q: When is the deadline to file Form T2 Schedule 5?

A: The deadline to file Form T2 Schedule 5 is within six months after the end of the corporation's tax year.

Q: What happens if a corporation does not file Form T2 Schedule 5 on time?

A: If a corporation does not file Form T2 Schedule 5 on time, it may be subject to penalties and interest charges by the CRA.