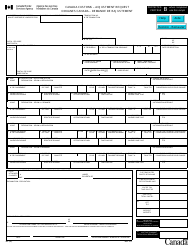

Form T1-ADJ T1 Adjustment Request - Large Print - Canada

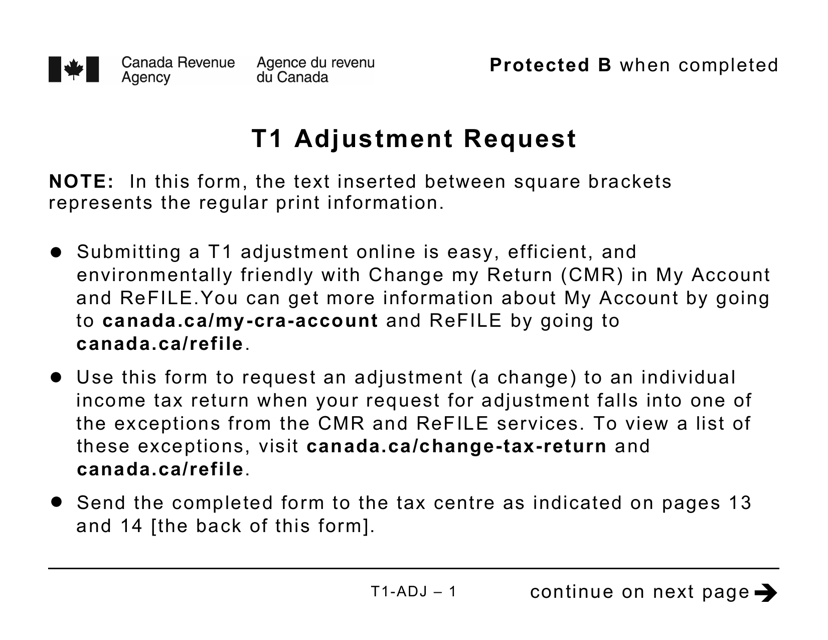

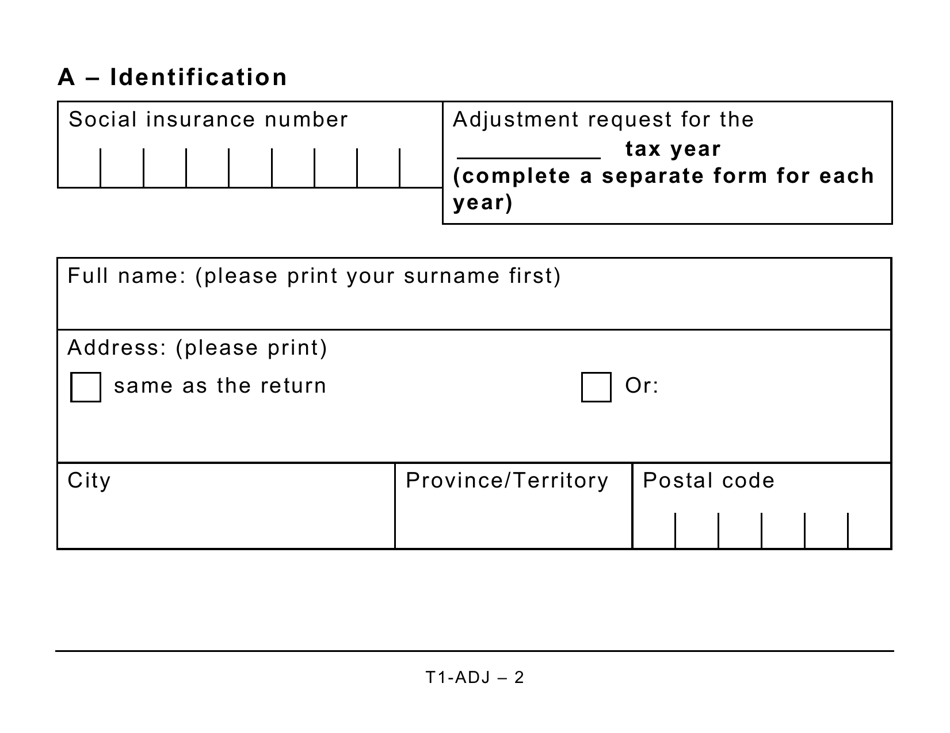

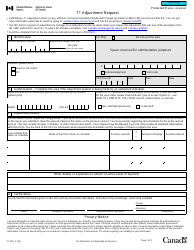

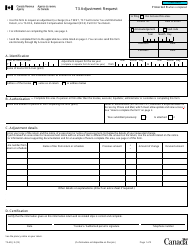

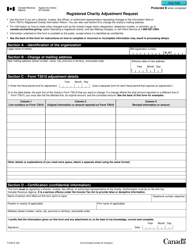

Form T1-ADJ is used in Canada to request adjustments to your personal income tax return. It is specifically designed as a large print version for individuals with visual impairments.

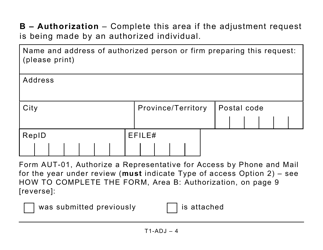

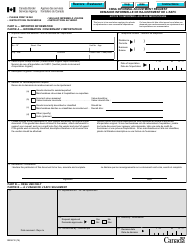

The Form T1-ADJ T1 Adjustment Request in Canada is filed by individual taxpayers who need to make changes or corrections to their previously filed income tax return.

FAQ

Q: What is a T1-ADJ?

A: T1-ADJ is a T1 Adjustment Request form in Canada.

Q: What is the purpose of the T1-ADJ form?

A: The T1-ADJ form is used to request changes or adjustments to a previously filed personal income tax return.

Q: What is the difference between the regular T1-ADJ and the Large Print version?

A: The Large Print version of the T1-ADJ form is designed for individuals who have vision impairments and need a larger font size to read the form.

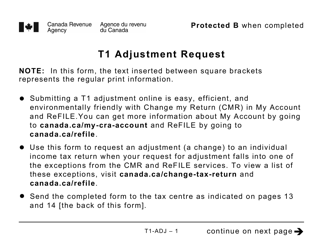

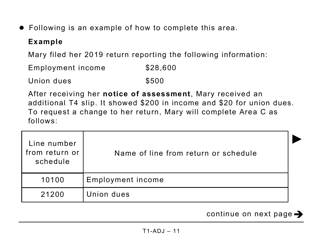

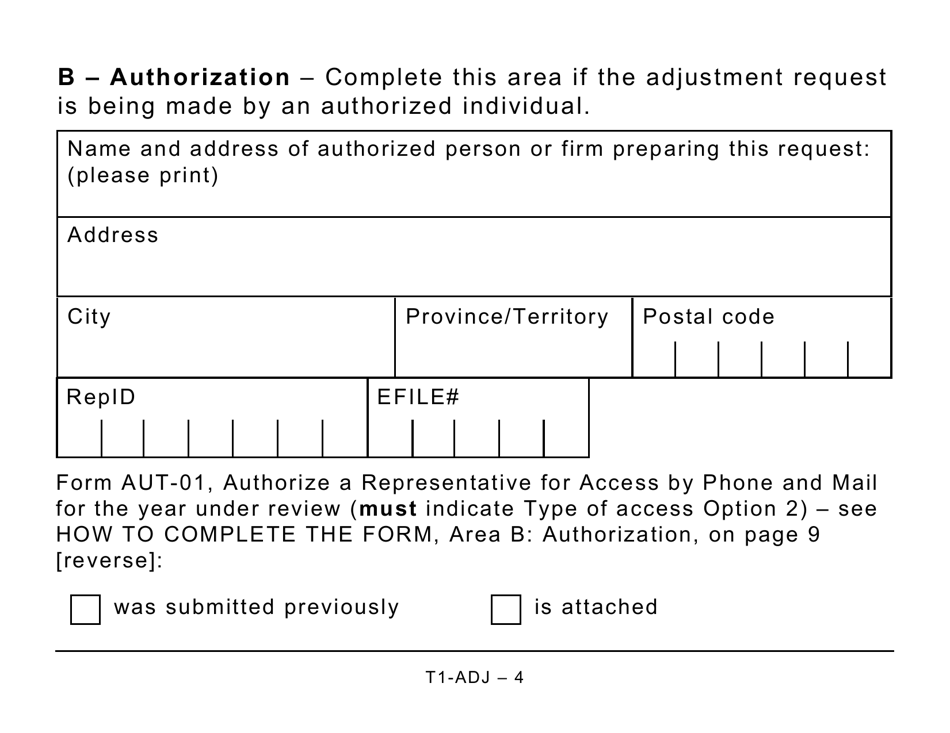

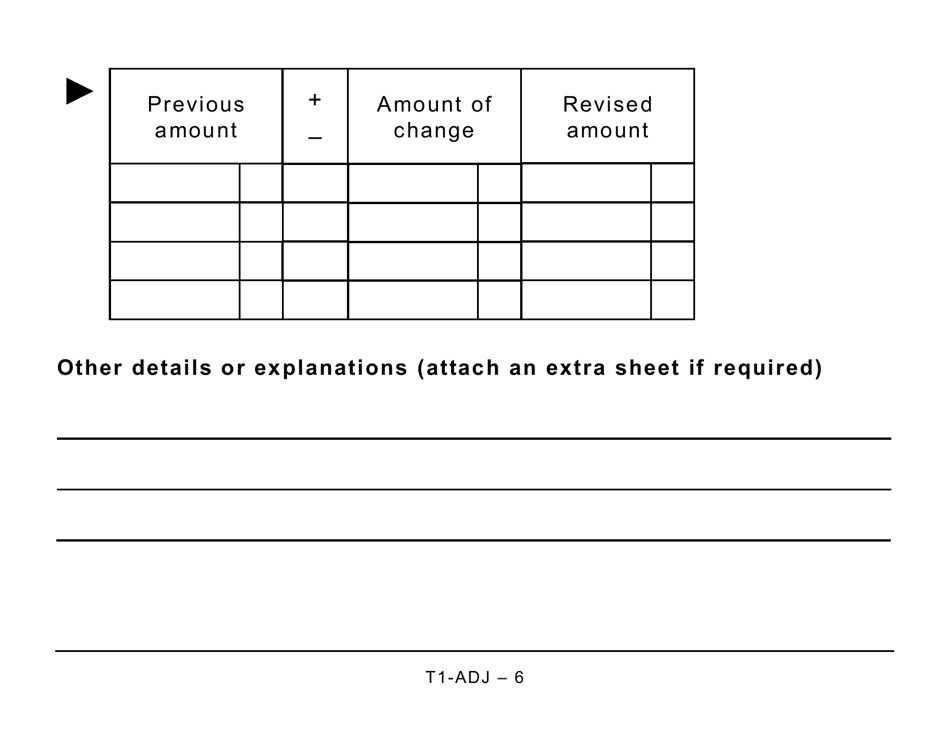

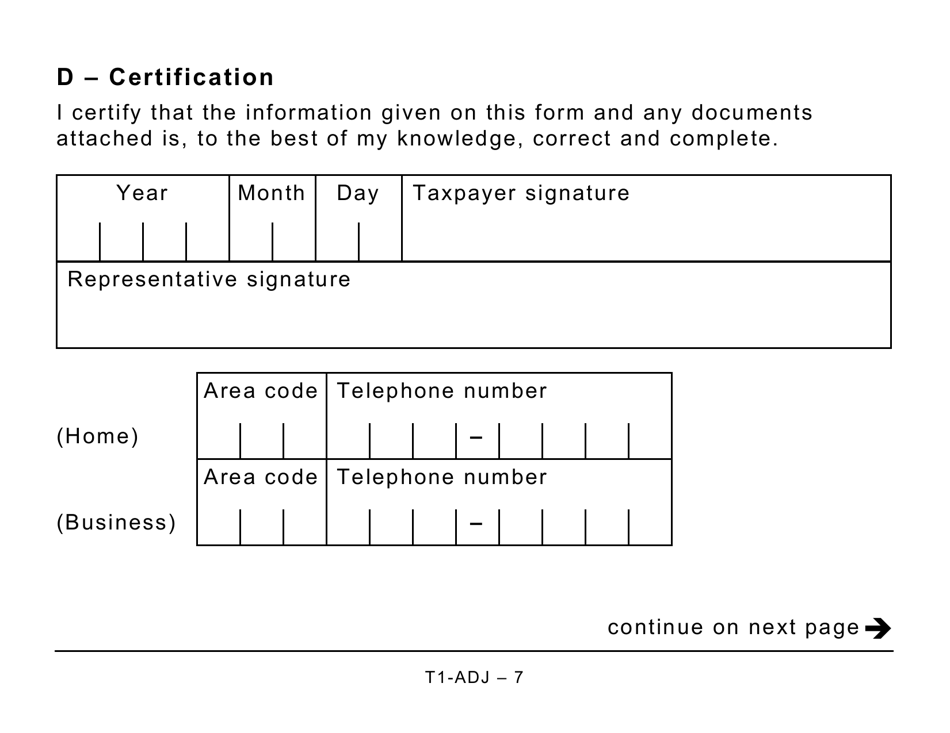

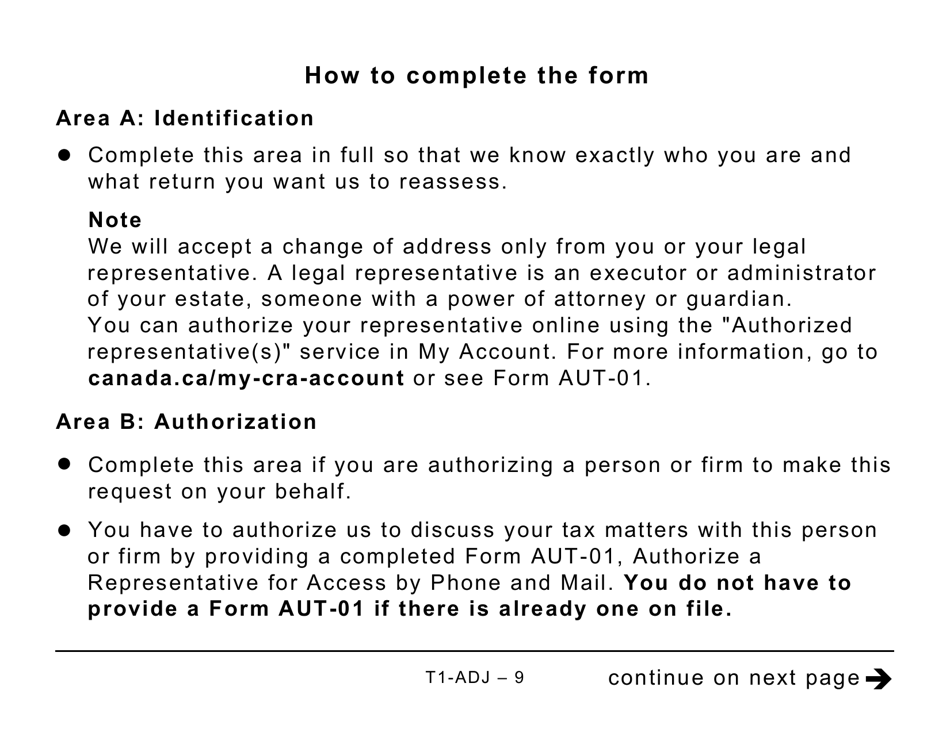

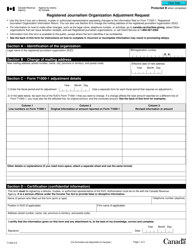

Q: How do I fill out the T1-ADJ form?

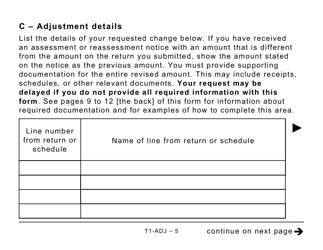

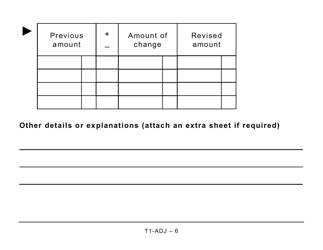

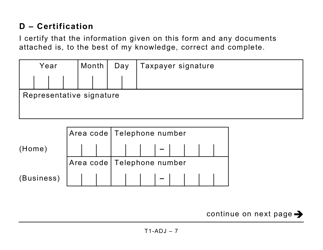

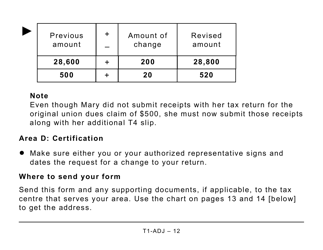

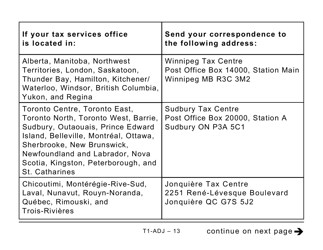

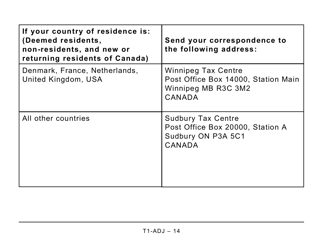

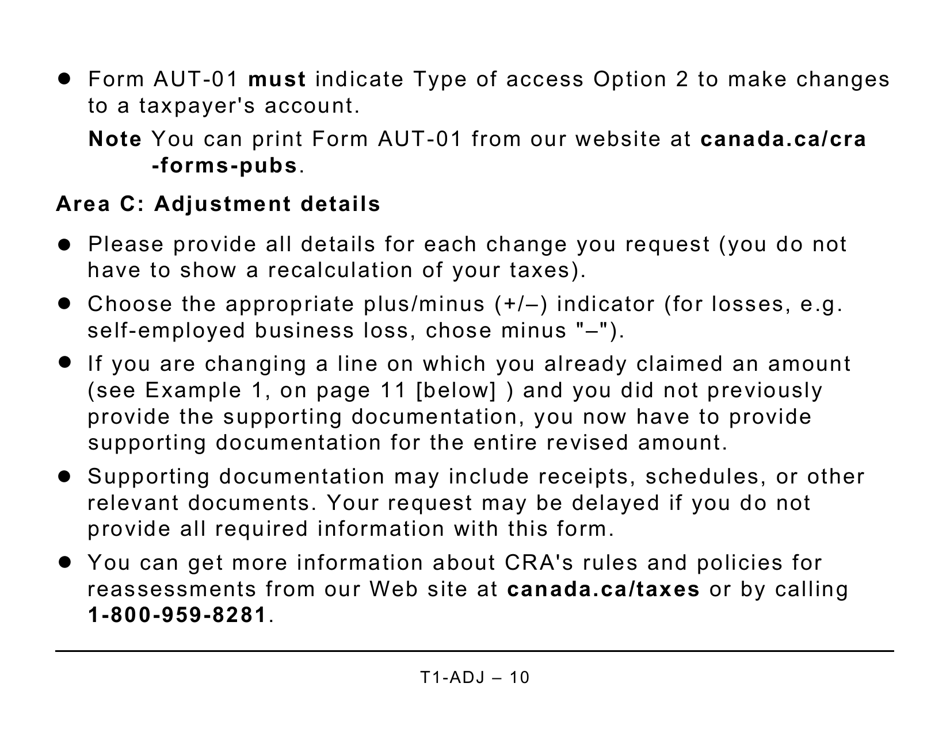

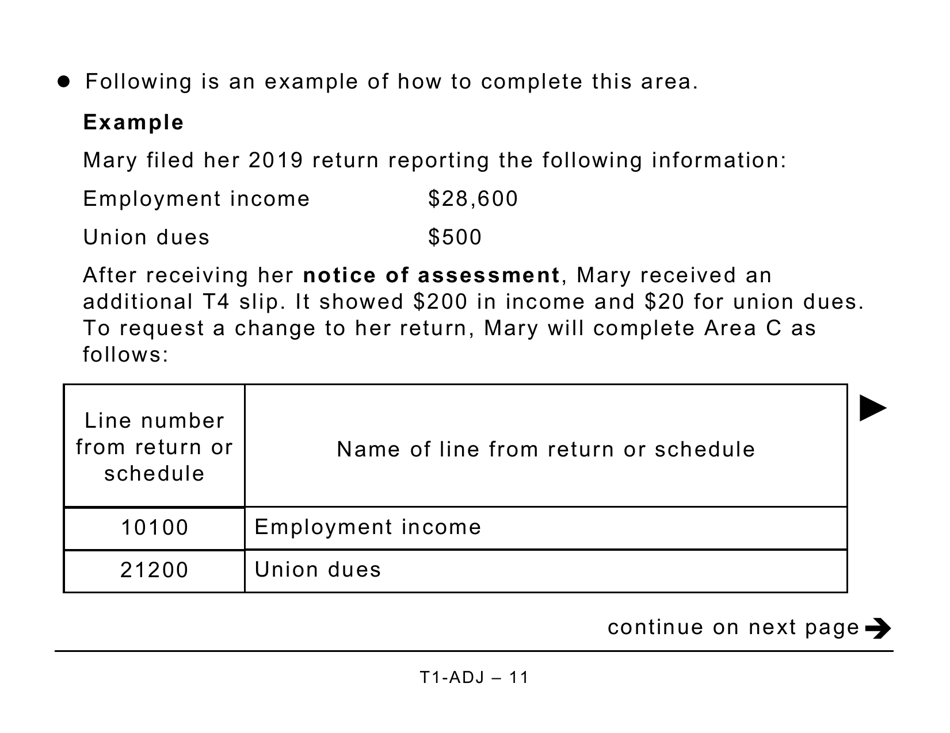

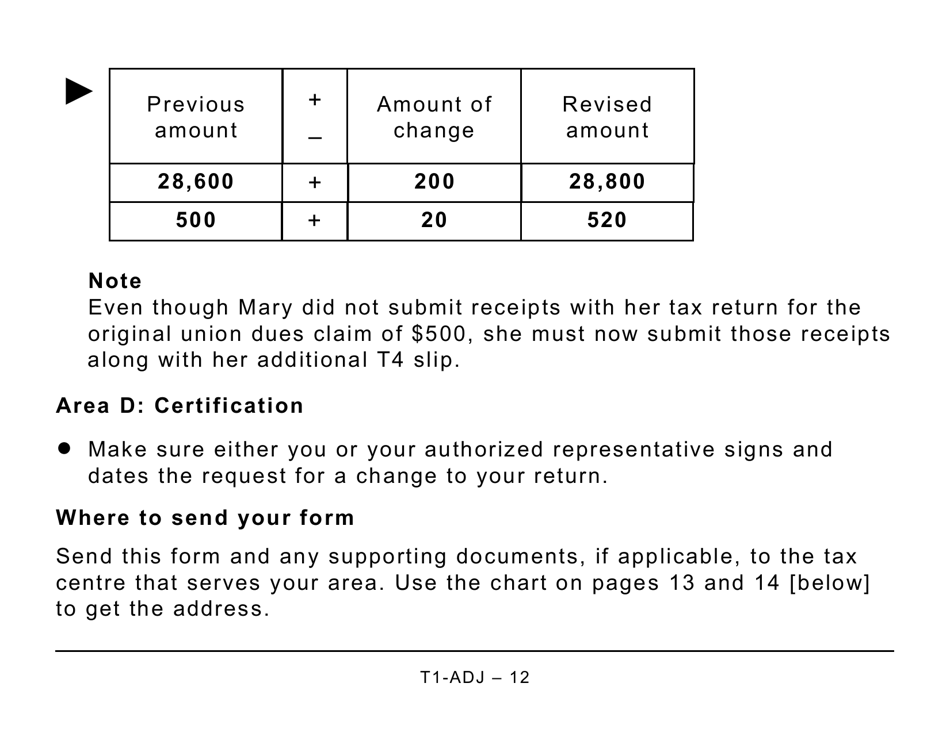

A: Follow the instructions provided on the form and provide accurate information about the changes or adjustments you are requesting.

Q: Can I file the T1-ADJ form electronically?

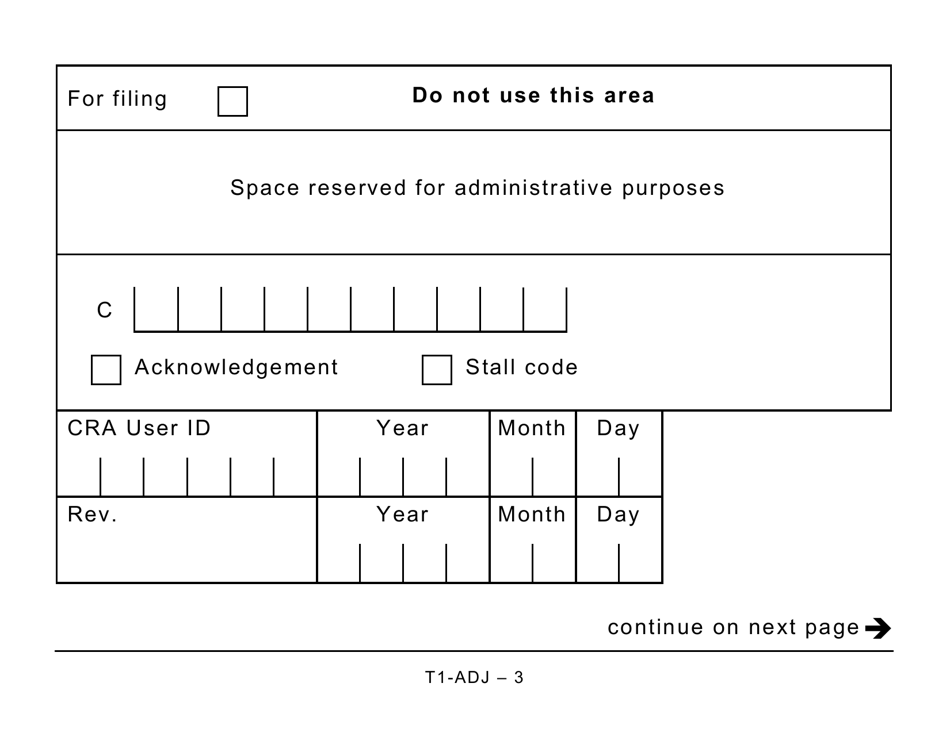

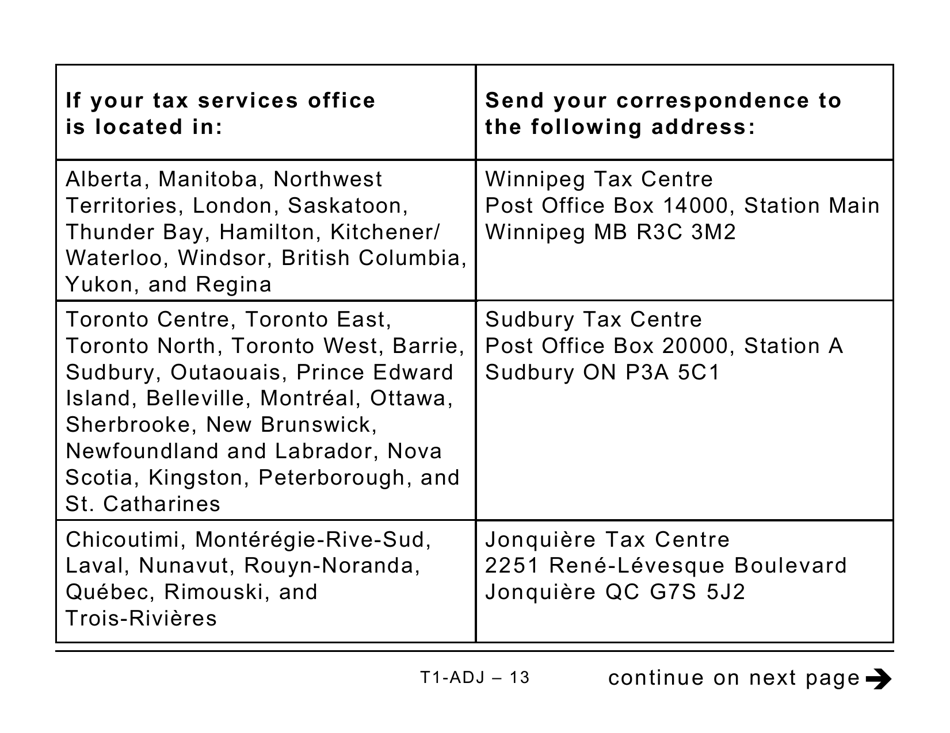

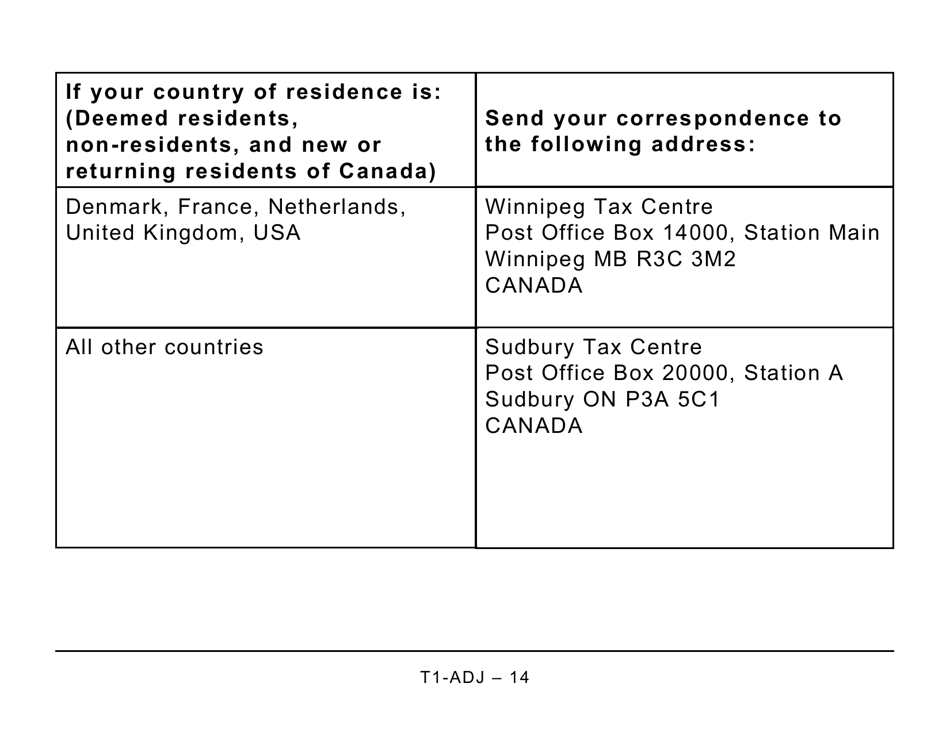

A: No, the T1-ADJ form cannot be filed electronically. You must mail the completed form to the CRA.

Q: Is there a deadline for submitting the T1-ADJ form?

A: The deadline for submitting the T1-ADJ form is generally within 10 years from the original notice of assessment.

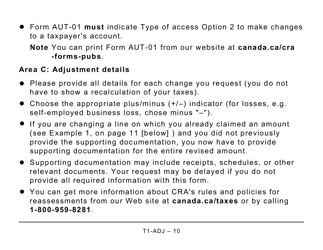

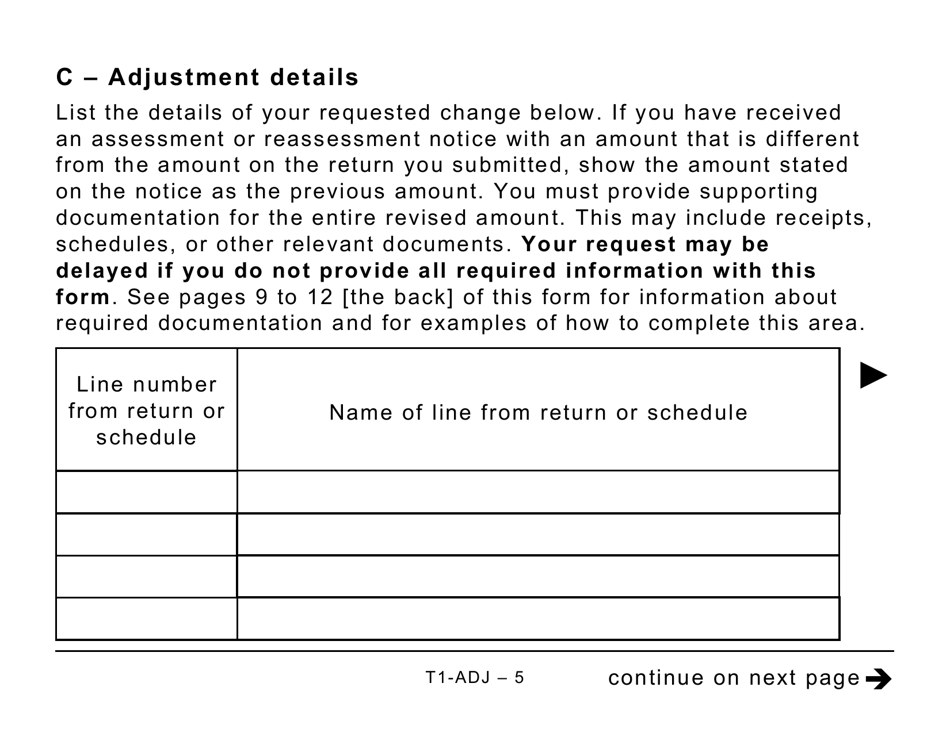

Q: What supporting documents do I need to include with the T1-ADJ form?

A: Include any relevant documents such as T-slips, receipts, or other supporting documents that validate the changes or adjustments you are requesting.

Q: How long does it take for the CRA to process a T1-ADJ request?

A: Processing times can vary, but the CRA aims to process T1-ADJ requests within 8 weeks of receiving them.

Q: What should I do if I disagree with the CRA's decision on my T1-ADJ request?

A: You can contact the CRA and provide additional documentation or appeal the decision through the formal dispute resolution process if you disagree with the CRA's decision on your T1-ADJ request.