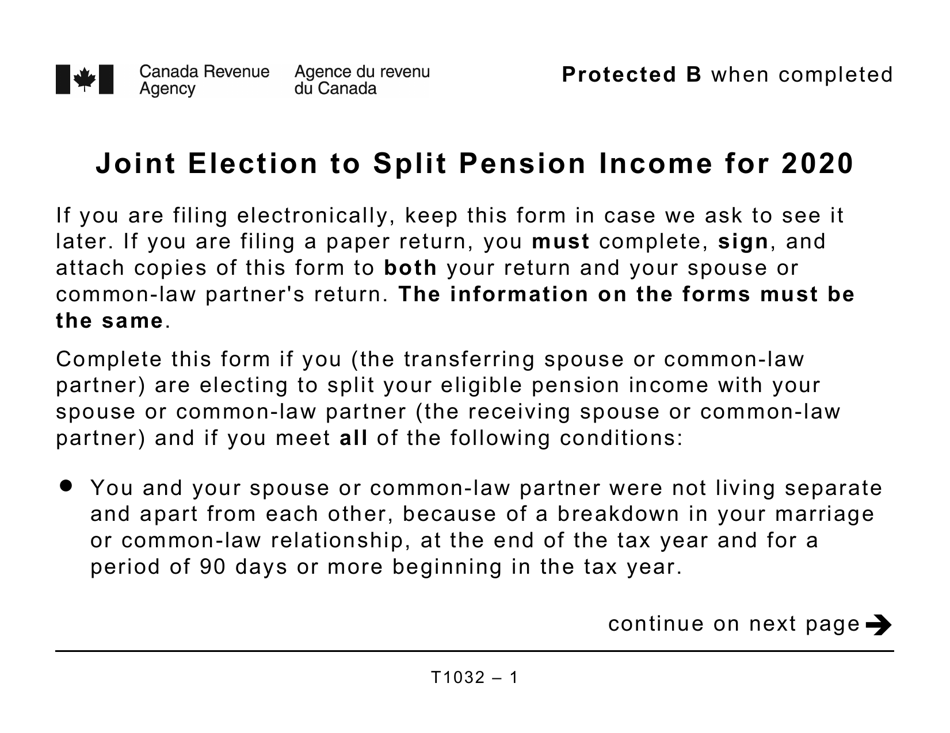

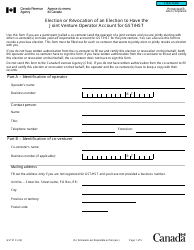

Form T1032 Joint Election to Split Pension Income - Large Print - Canada

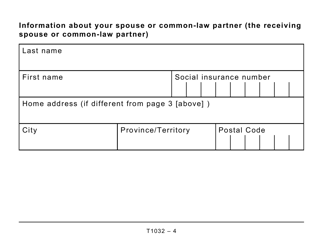

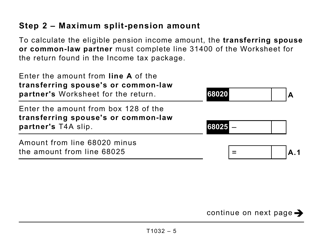

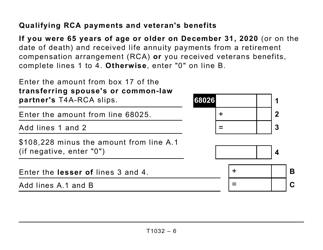

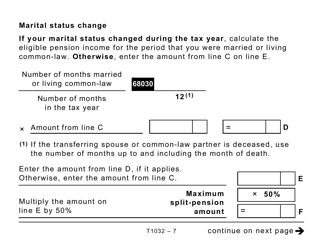

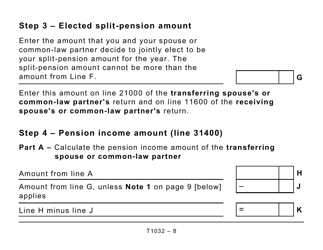

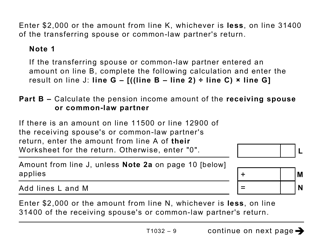

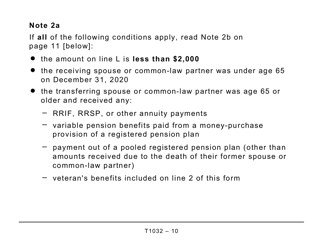

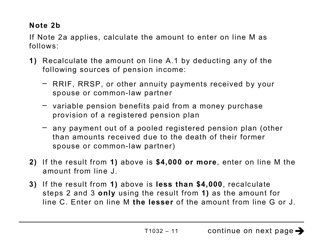

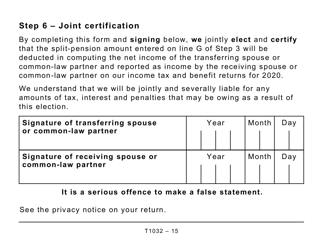

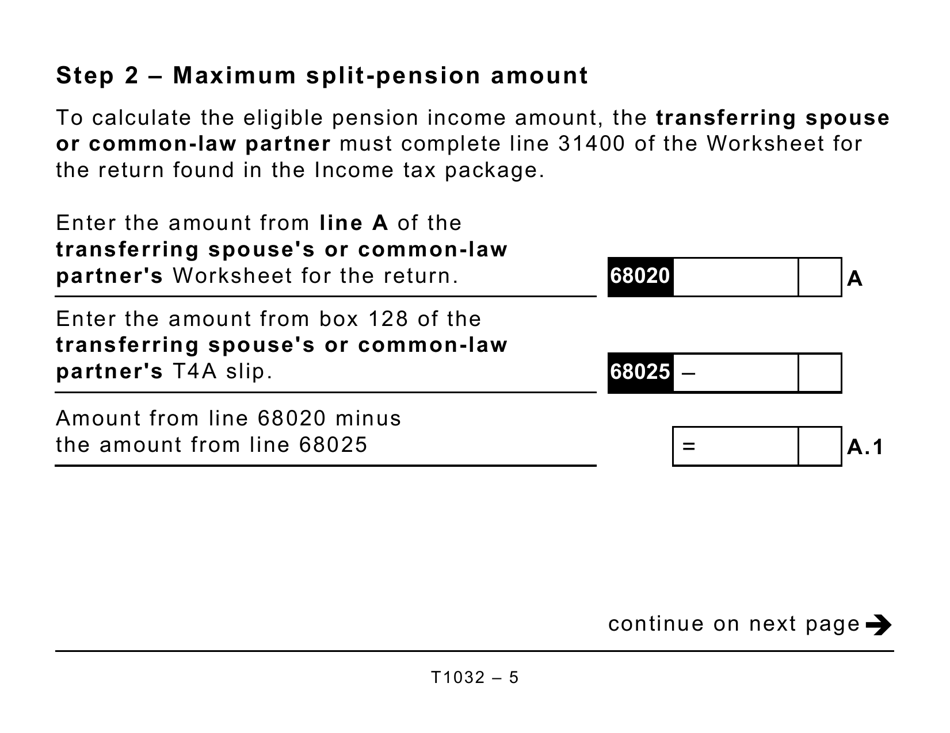

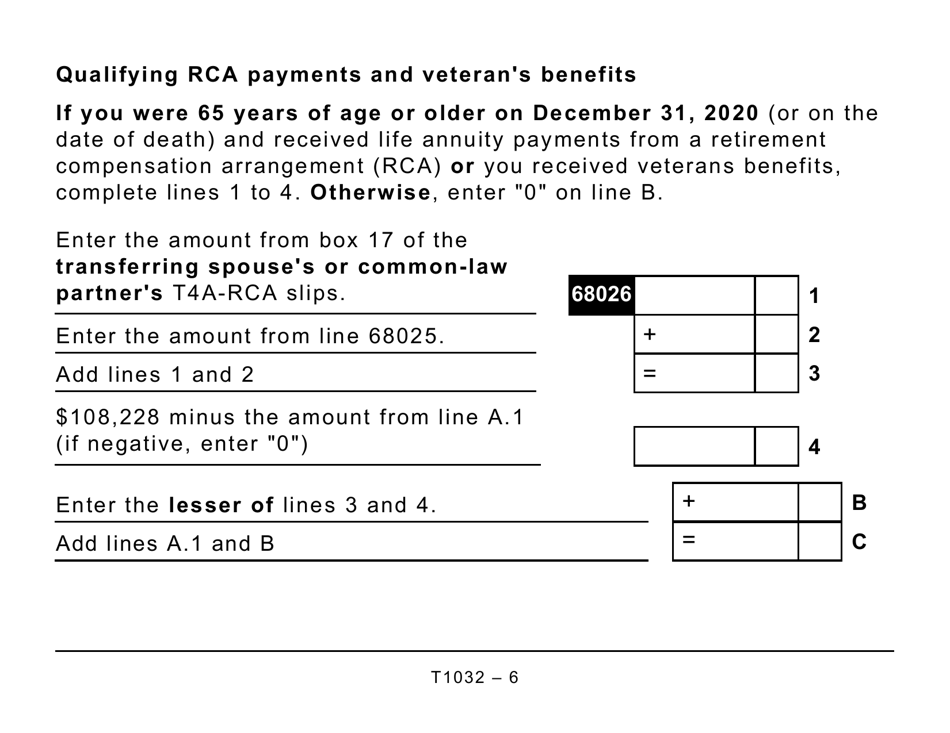

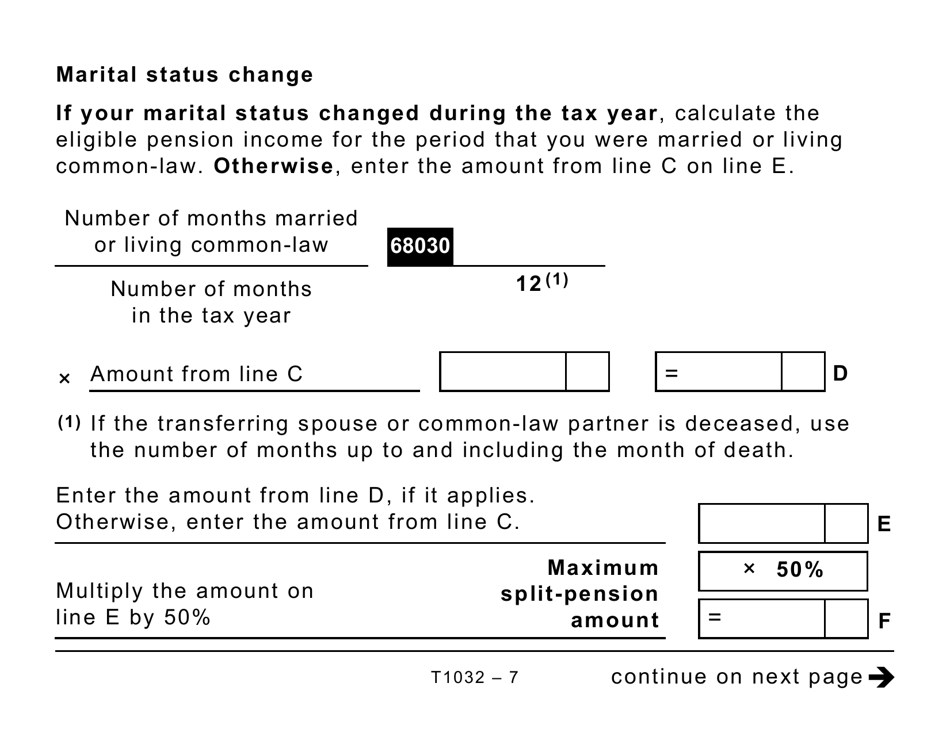

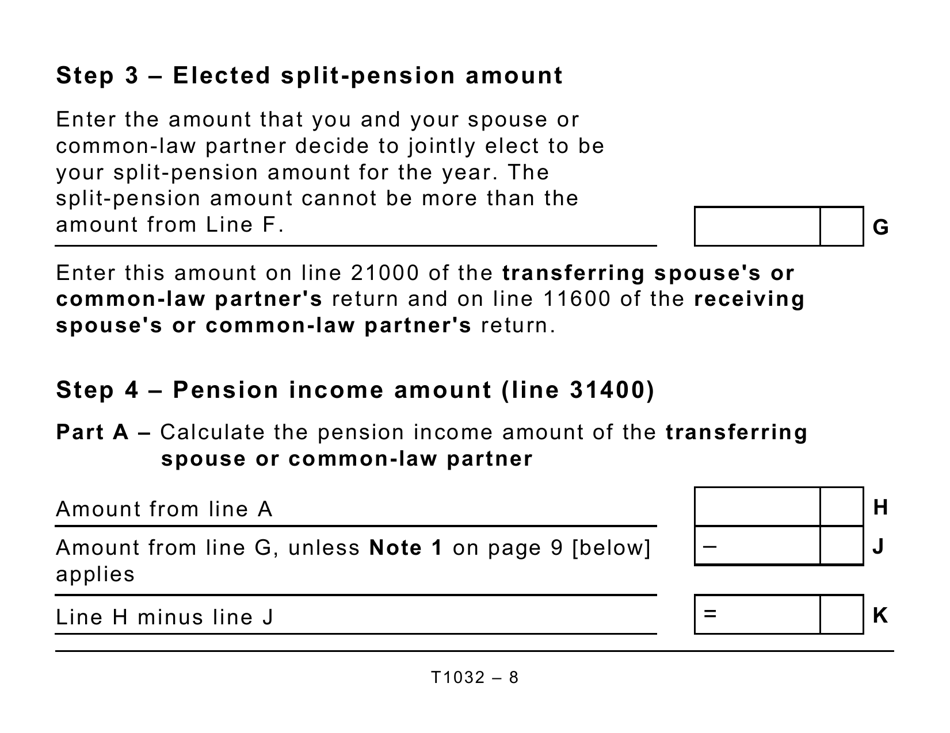

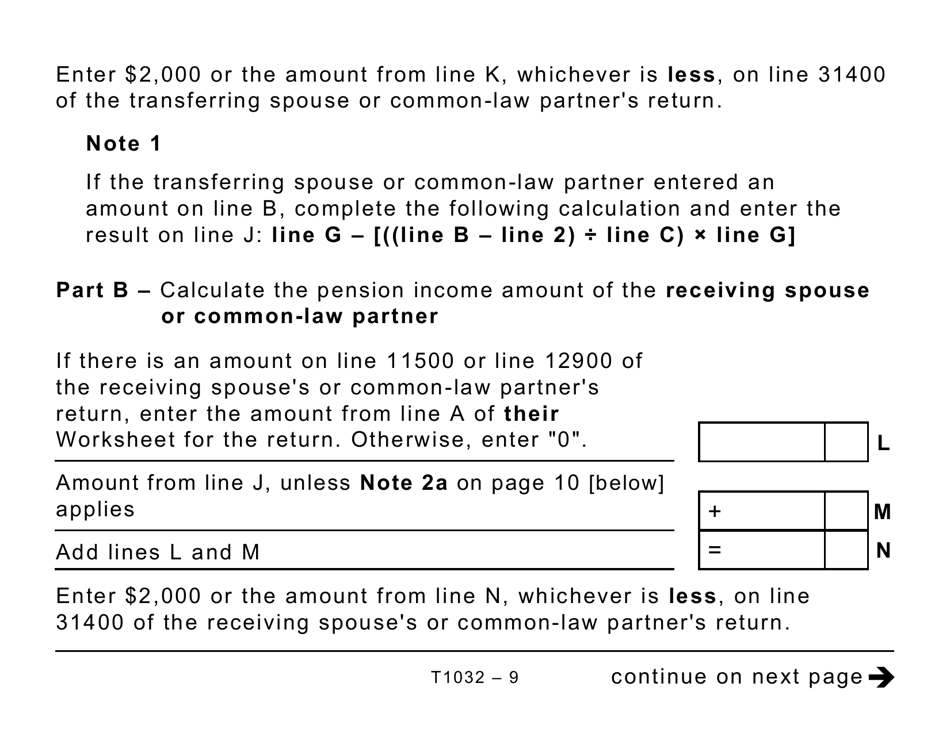

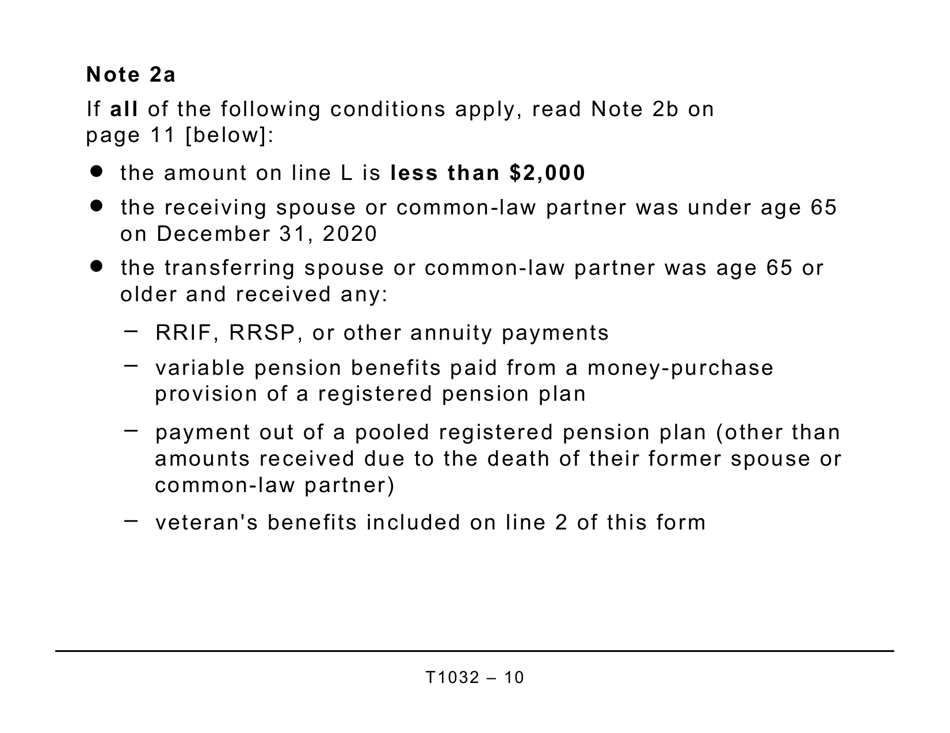

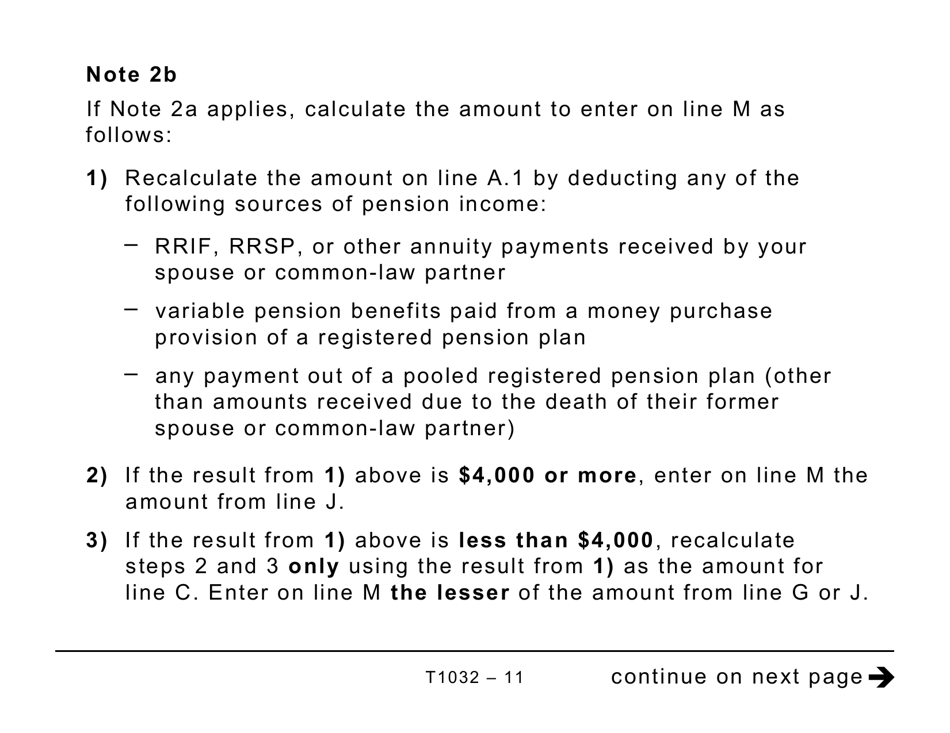

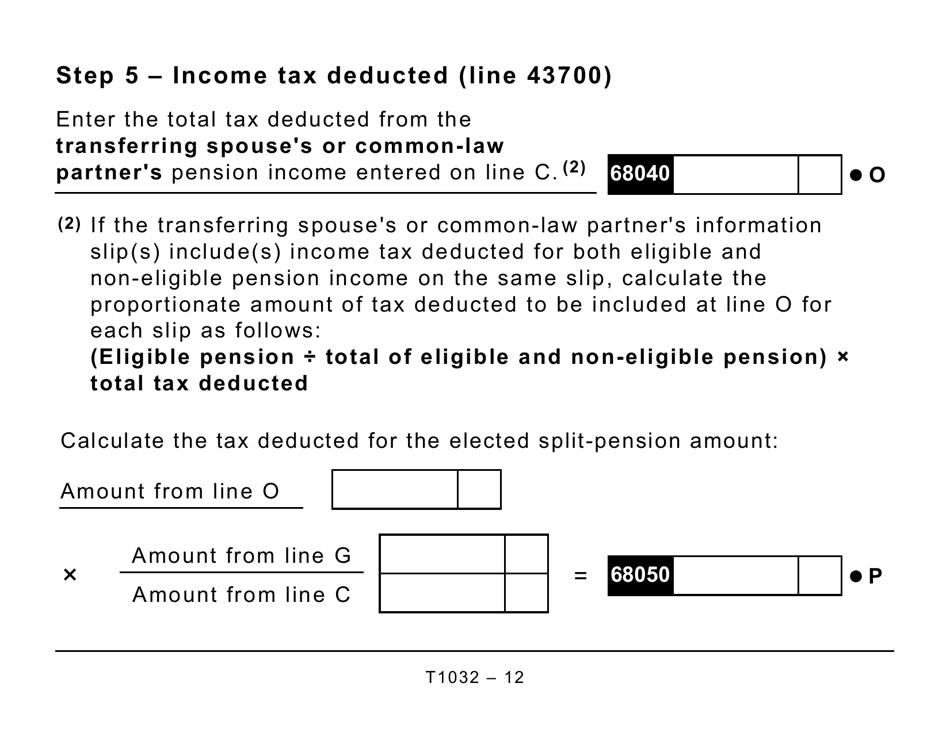

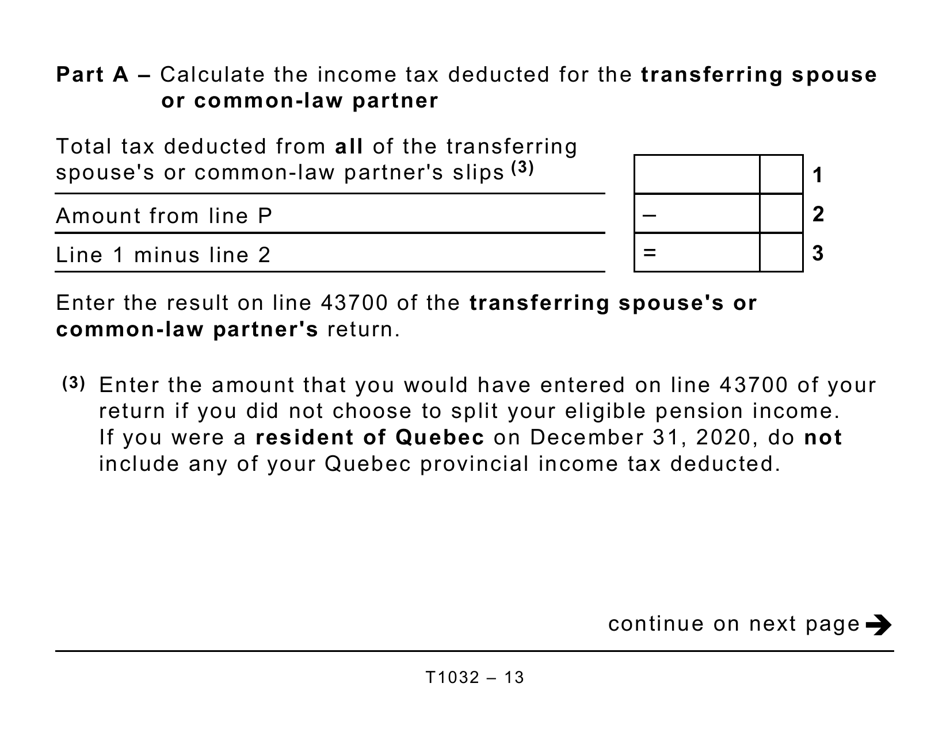

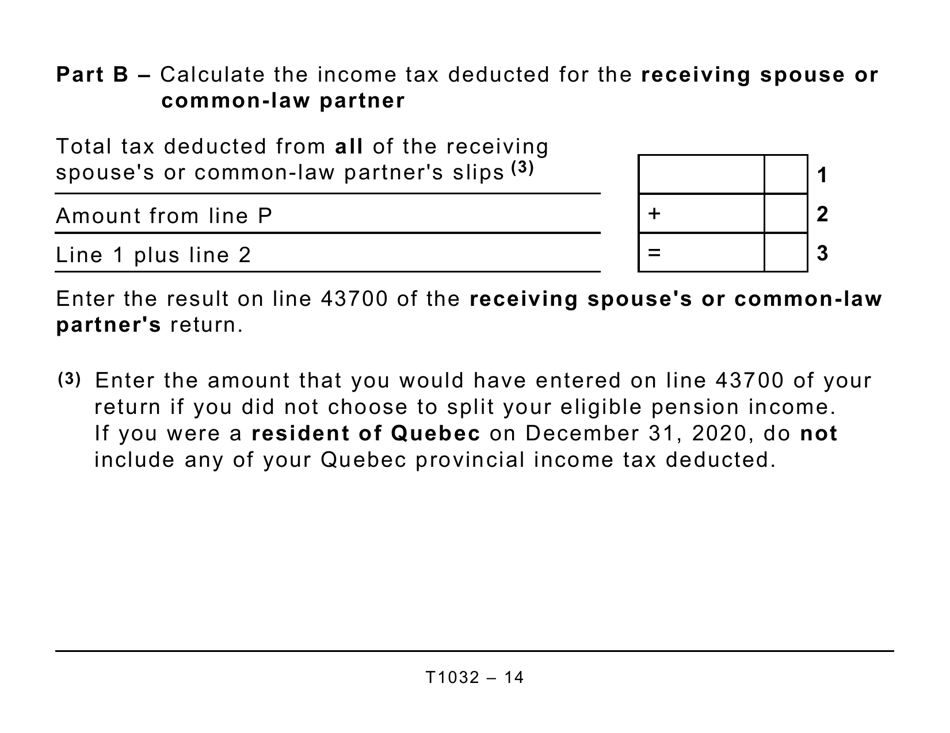

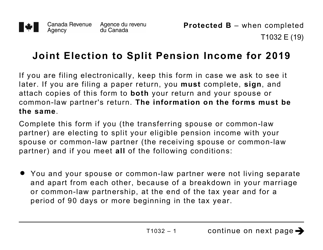

Form T1032 Joint Election to Split Pension Income - Large Print is used in Canada for electing to split pension income between the taxpayer and their spouse or common-law partner. By completing this form, individuals can allocate a portion of their eligible pension income to their spouse or common-law partner's income tax return, which may result in potential tax savings.

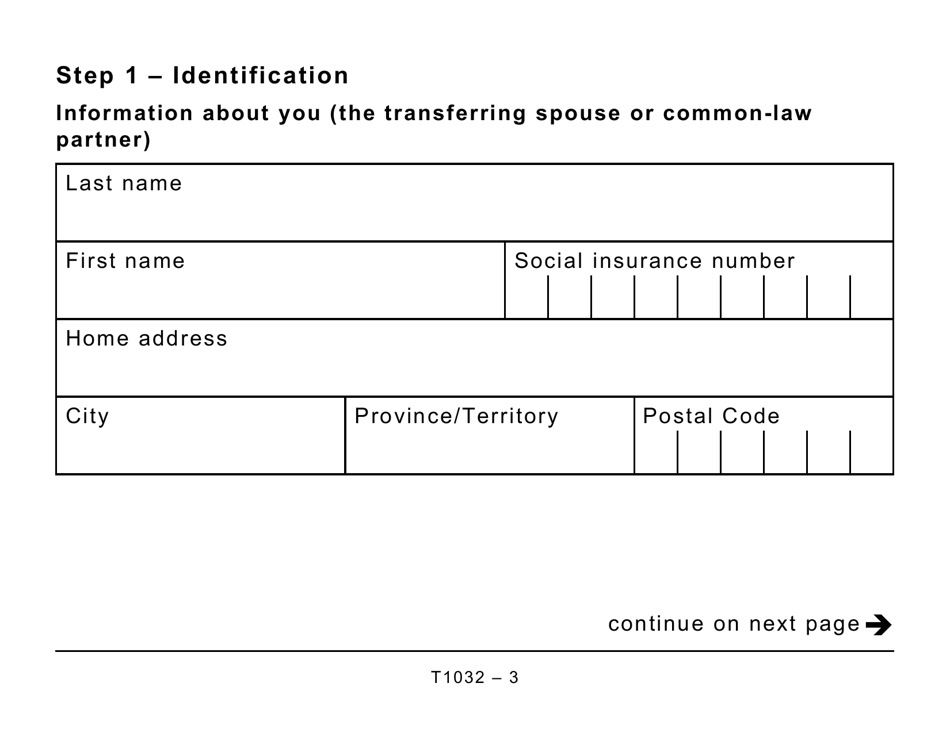

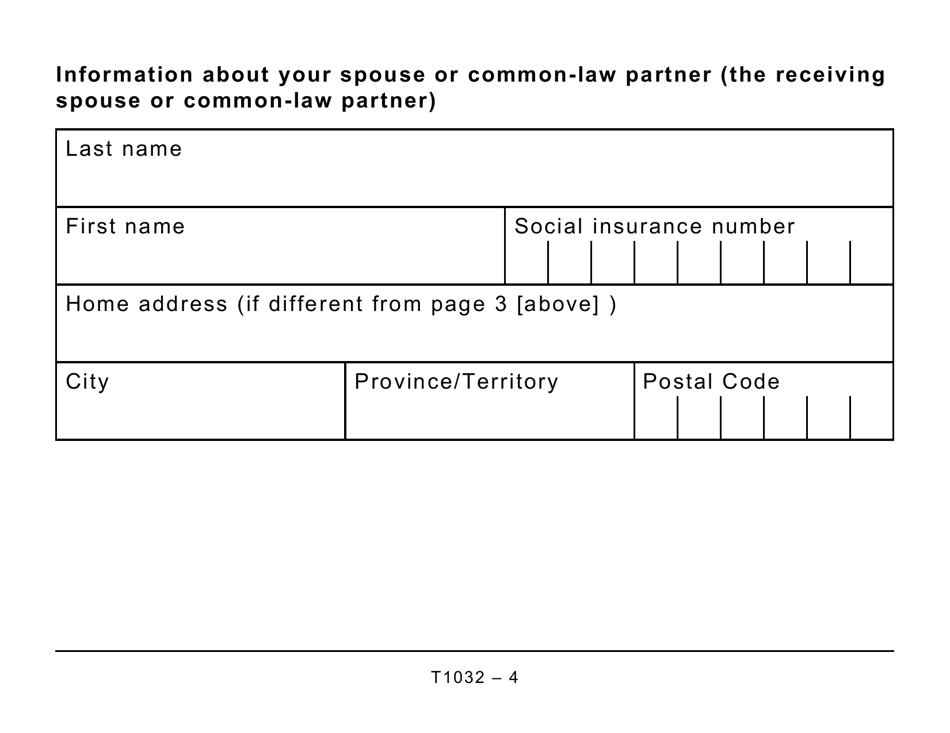

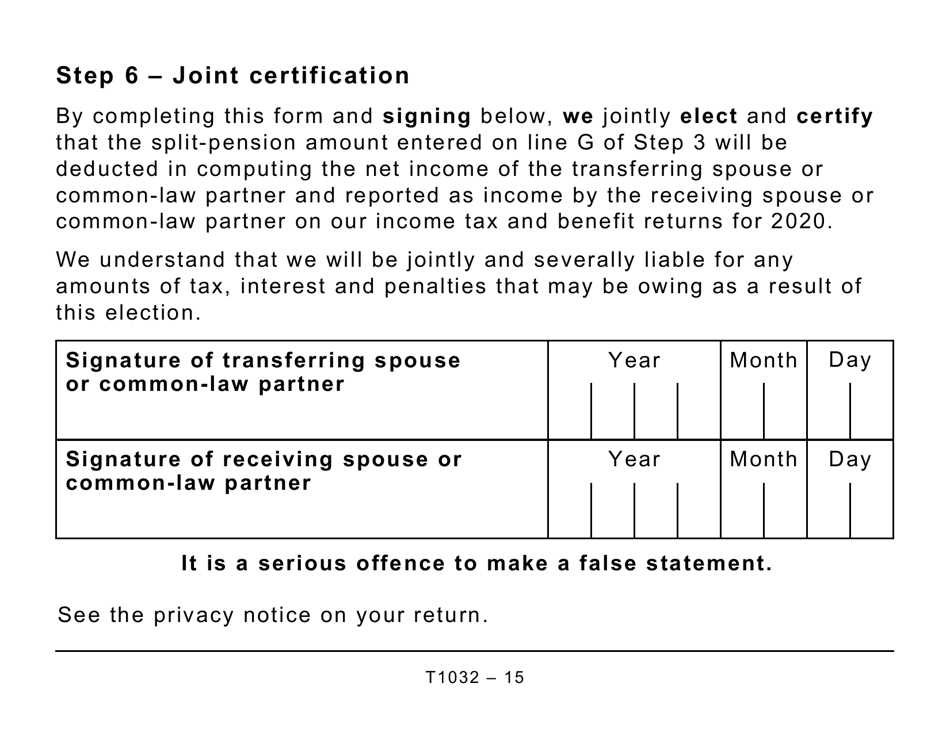

The Form T1032 Joint Election to Split Pension Income - Large Print in Canada is typically filed by both the individual receiving the pension income and their spouse or common-law partner.

FAQ

Q: What is Form T1032?

A: Form T1032 is a Joint Election to Split Pension Income form in Canada.

Q: What is the purpose of Form T1032?

A: The purpose of Form T1032 is to allow eligible individuals to split eligible pension income with their spouse or common-law partner.

Q: Who can complete Form T1032?

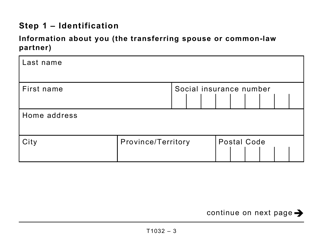

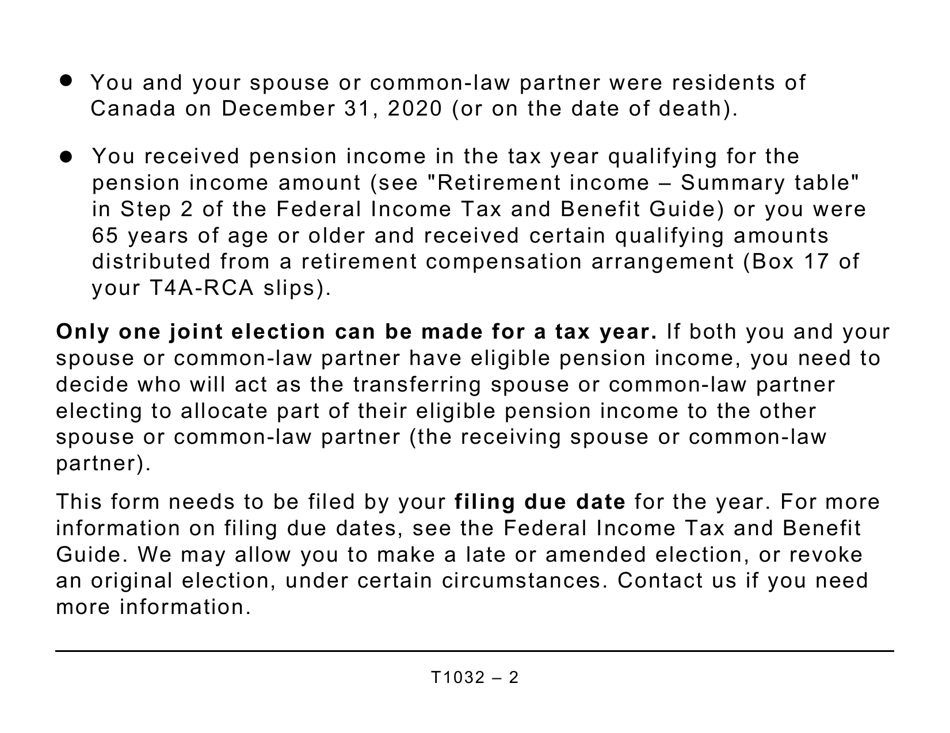

A: Both you and your spouse or common-law partner must complete and sign Form T1032.

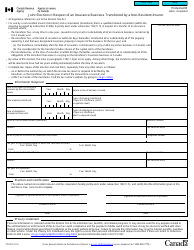

Q: What is considered eligible pension income?

A: Eligible pension income includes amounts received as a result of the breakdown of a registered retirement savings plan (RRSP), registered retirement income fund (RRIF), or deferred profit sharing plan (DPSP).

Q: Can all pension income be split using Form T1032?

A: No, only certain types of pension income are eligible for splitting using Form T1032.

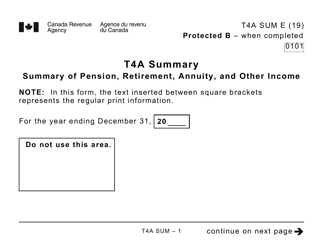

Q: Is Form T1032 available in large print?

A: Yes, there is a version of Form T1032 available in large print.

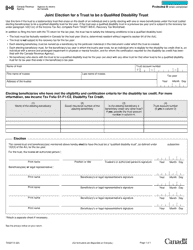

Q: Are there any deadlines for submitting Form T1032?

A: Yes, you must submit Form T1032 by the due date of your income tax return for the year in which you want to split the pension income.

Q: Can I split my pension income with someone other than my spouse or common-law partner?

A: No, Form T1032 is specifically for splitting eligible pension income with your spouse or common-law partner.