This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

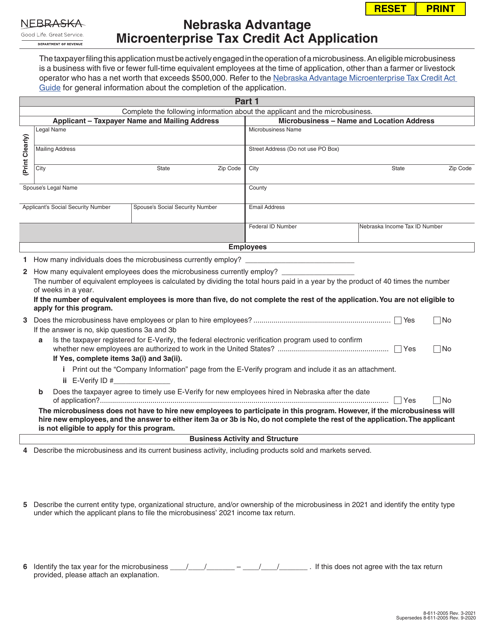

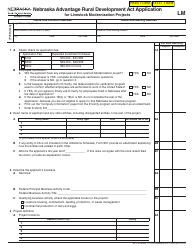

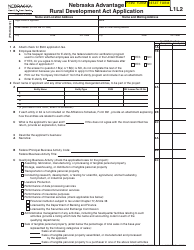

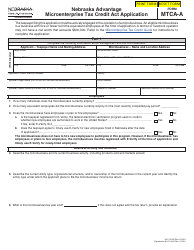

Nebraska Advantage Microenterprise Tax Credit Act Application - Nebraska

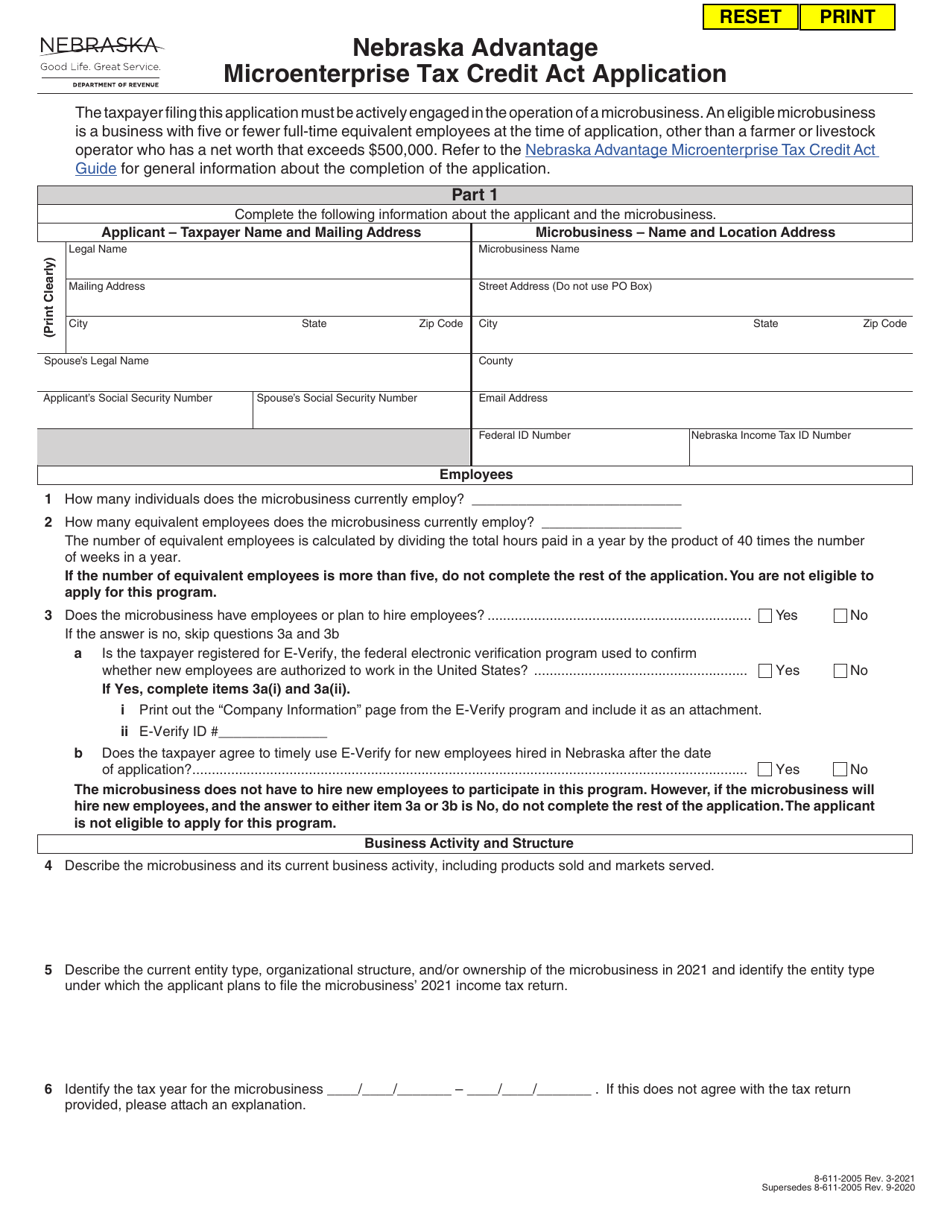

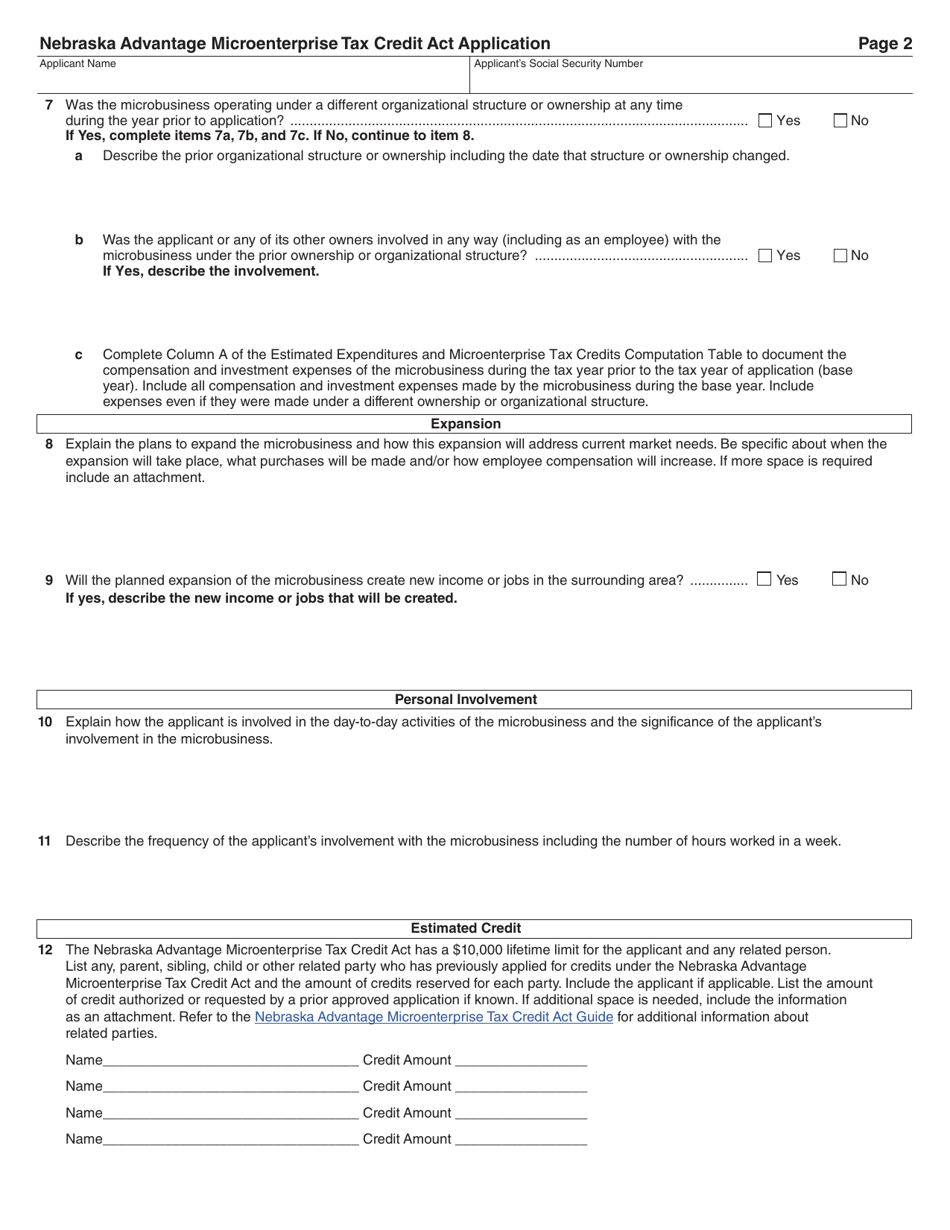

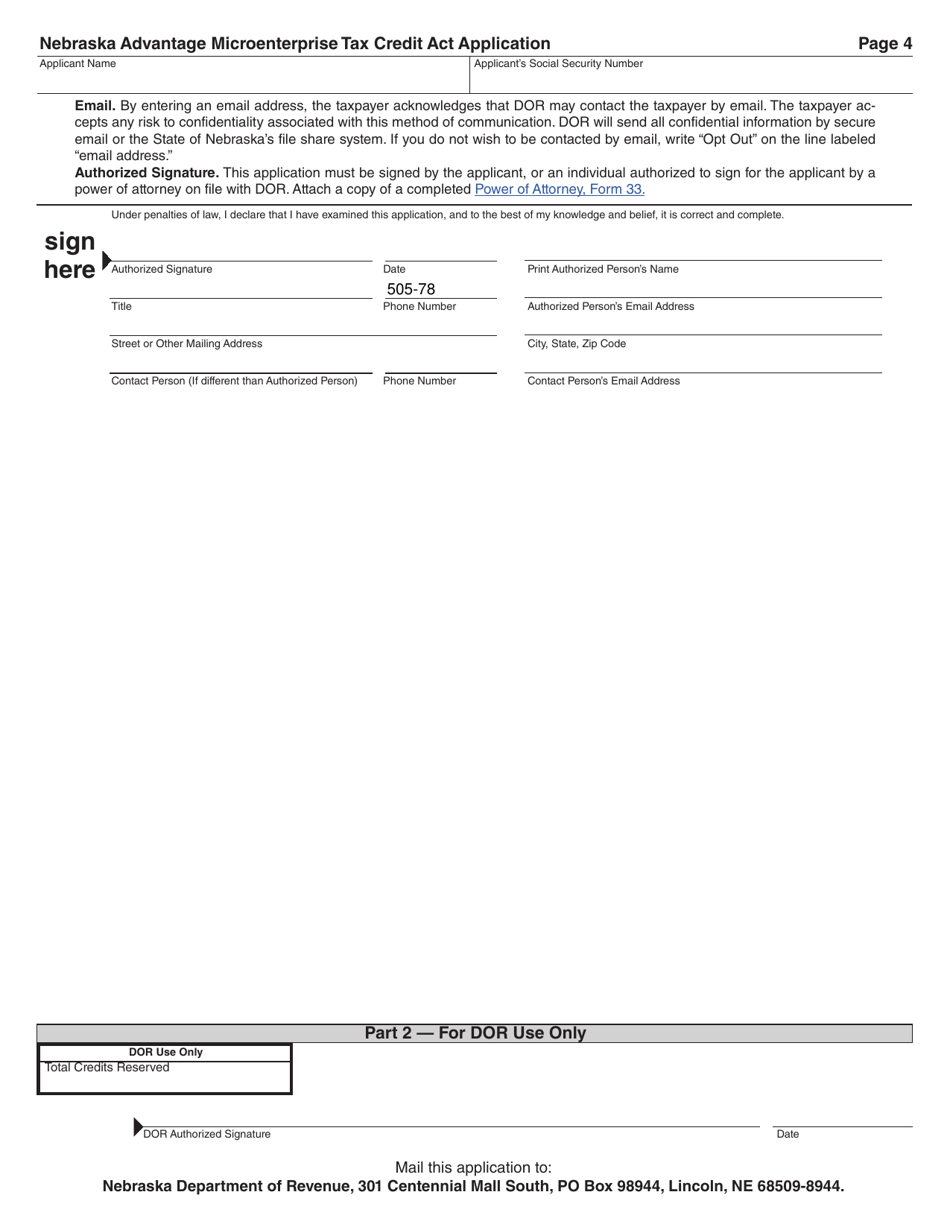

Nebraska Advantage Microenterprise Tax Credit Act Application is a legal document that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska.

FAQ

Q: What is the Nebraska Advantage Microenterprise Tax Credit Act?

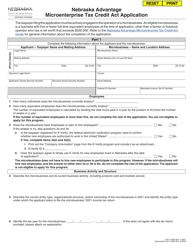

A: The Nebraska Advantage Microenterprise Tax Credit Act is a program that provides tax incentives to microenterprises in Nebraska.

Q: What is a microenterprise?

A: A microenterprise is a small business with five or fewer employees.

Q: Who is eligible to apply for the Nebraska Advantage Microenterprise Tax Credit?

A: Microenterprises that meet certain criteria, such as being located in Nebraska and having a certain level of annual sales or gross receipts, may be eligible to apply.

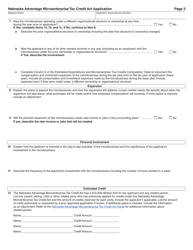

Q: What are the tax incentives provided by the program?

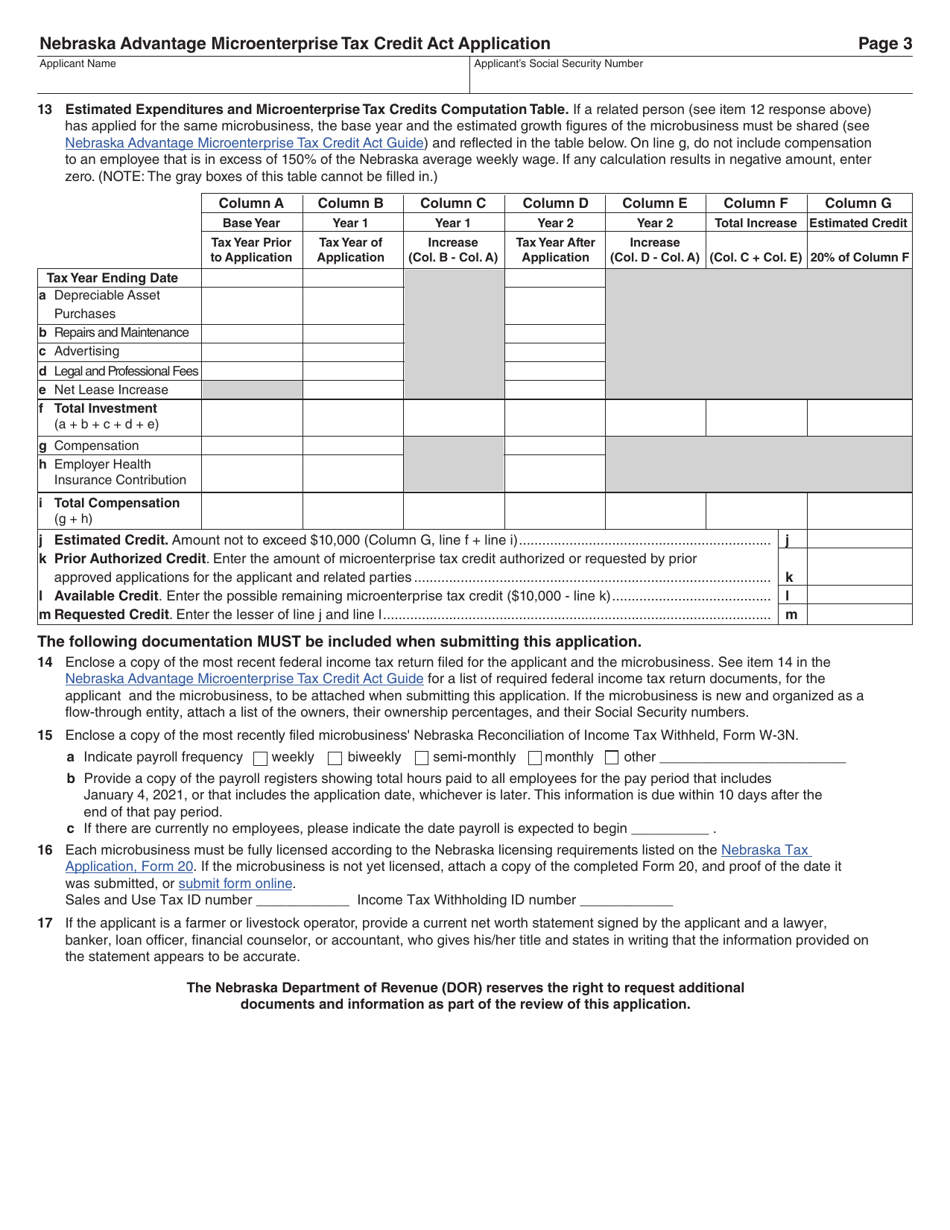

A: The program offers a tax credit equal to 20% of the investment made by an eligible microenterprise, up to a maximum of $10,000 per year for up to five years.

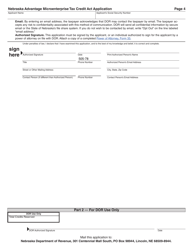

Q: How can I apply for the Nebraska Advantage Microenterprise Tax Credit?

A: You can apply by submitting an application to the Nebraska Department of Revenue. The application must include information about your microenterprise and its activities.

Q: Are there any deadlines for applying?

A: Yes, applications must be submitted by the last day of the calendar year following the calendar year in which the investment was made.

Q: Can I apply for the tax credit if I have already received other tax incentives?

A: Yes, you may still be eligible for the microenterprise tax credit even if you have received other tax incentives.

Q: Are there any restrictions on how the tax credit can be used?

A: Yes, the tax credit can only be used to offset state income tax liability.

Form Details:

- Released on March 1, 2021;

- The latest edition currently provided by the Nebraska Department of Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.