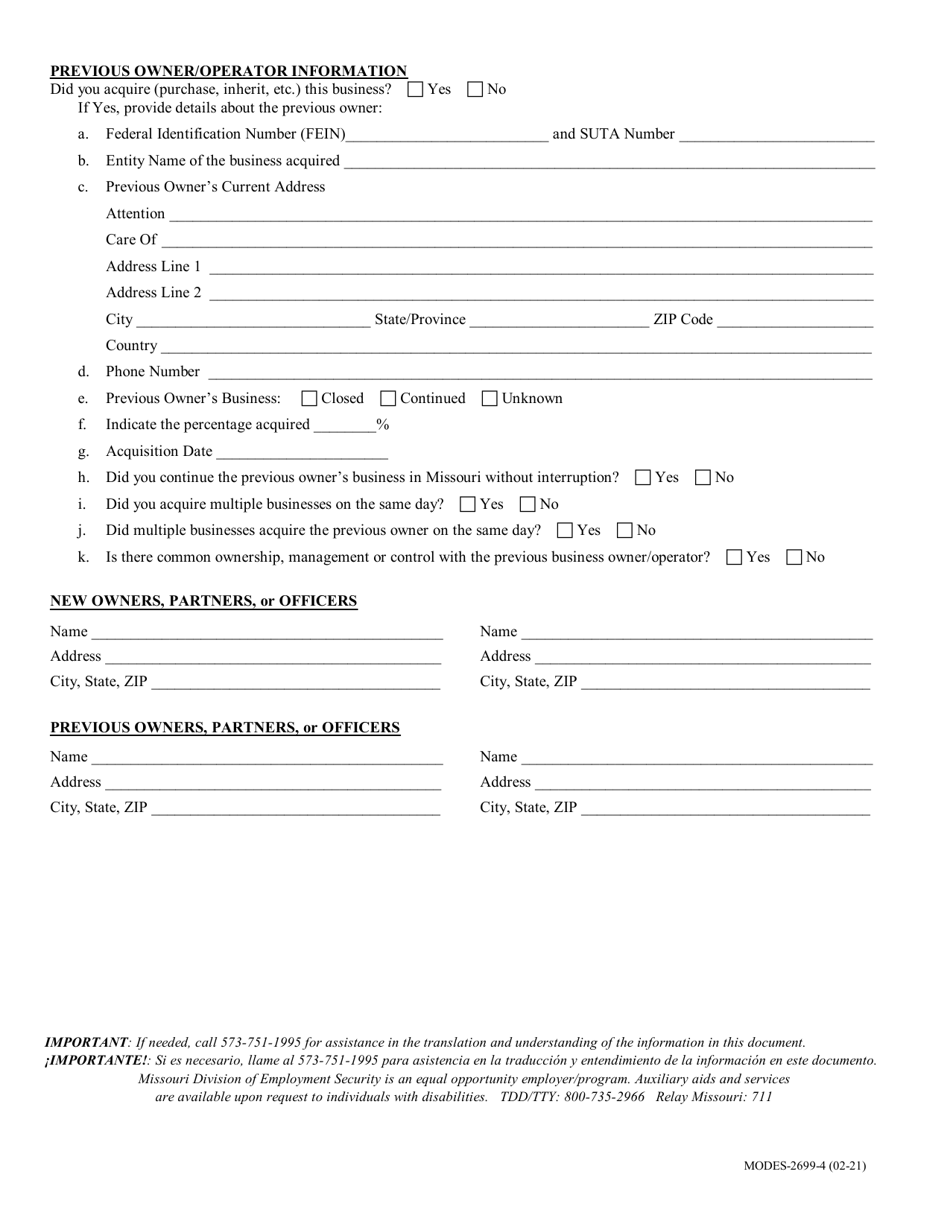

This version of the form is not currently in use and is provided for reference only. Download this version of

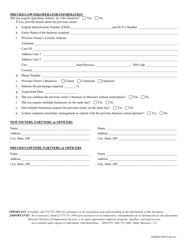

Form MODES-2699

for the current year.

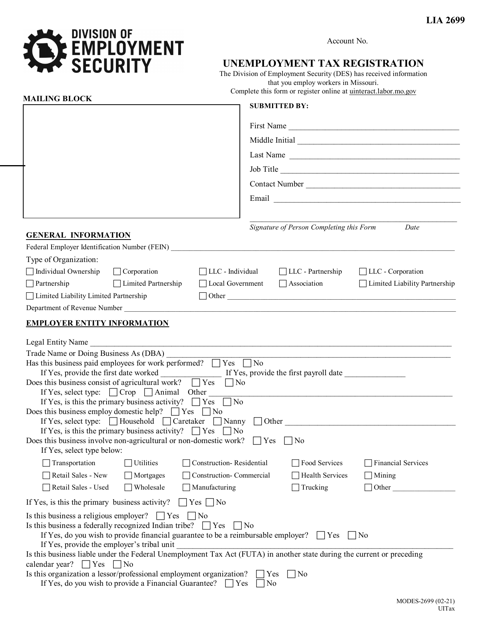

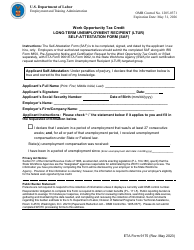

Form MODES-2699 Unemployment Tax Registration - Missouri

What Is Form MODES-2699?

This is a legal form that was released by the Missouri Department of Labor and Industrial Relations - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MODES-2699?

A: MODES-2699 is the unemployment tax registration form for the state of Missouri.

Q: Who needs to complete MODES-2699?

A: Employers in Missouri who are required to pay unemployment taxes need to complete MODES-2699.

Q: What is the purpose of MODES-2699?

A: The purpose of MODES-2699 is to register employers for unemployment tax purposes in Missouri.

Q: Are there any fees associated with completing MODES-2699?

A: No, there are no fees associated with completing MODES-2699. It is a registration form.

Q: Are all employers in Missouri required to complete MODES-2699?

A: No, only employers who are liable for paying unemployment taxes in Missouri need to complete MODES-2699.

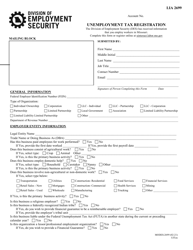

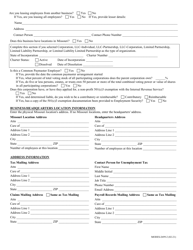

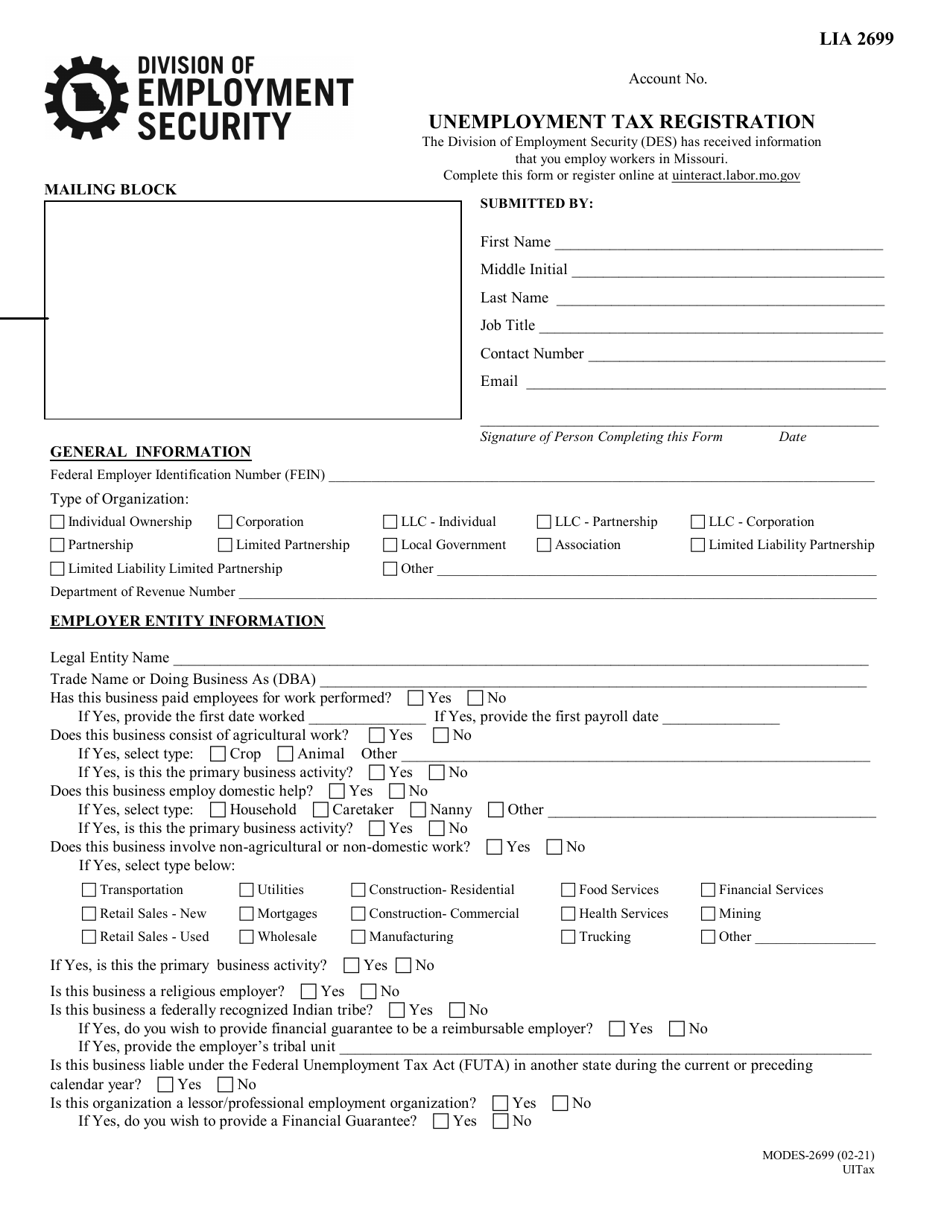

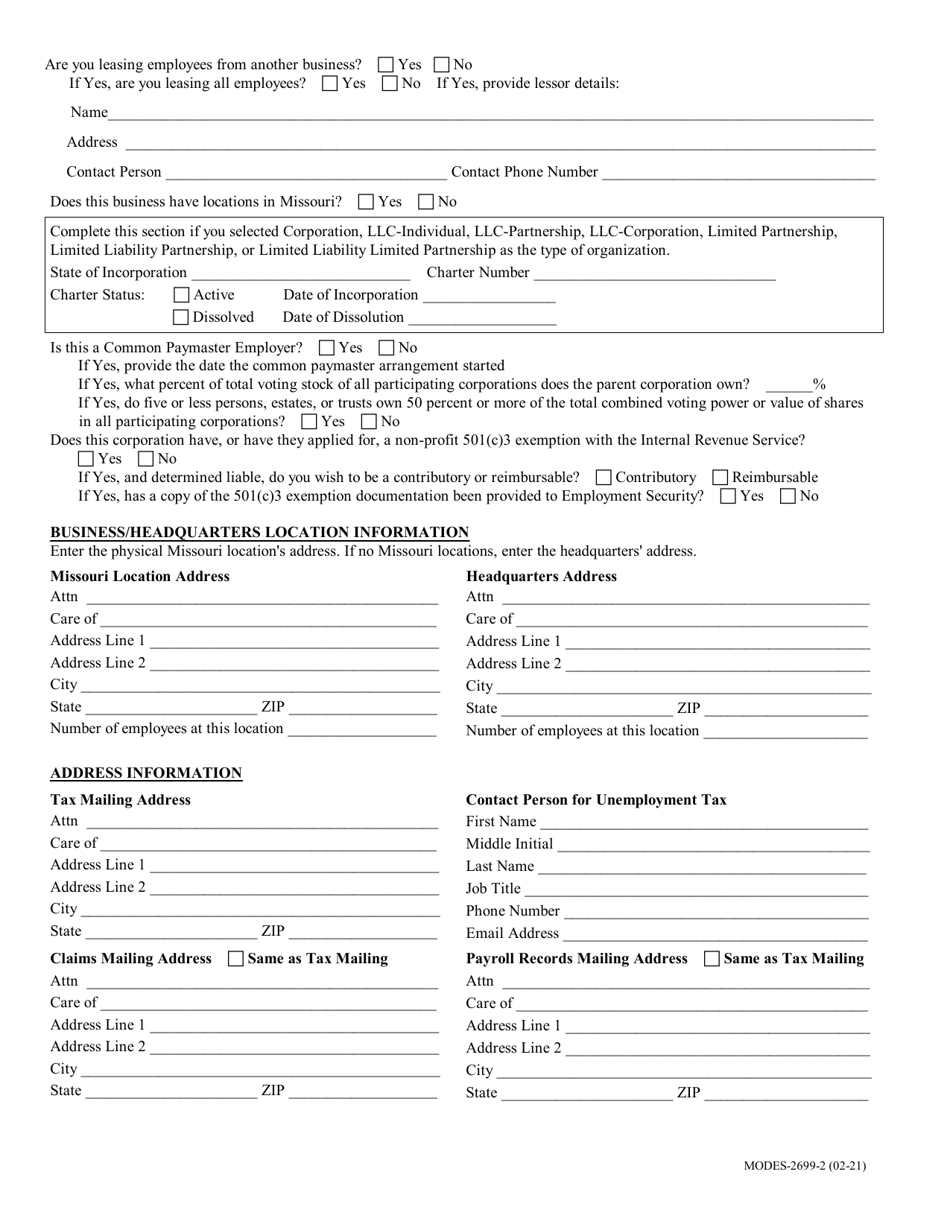

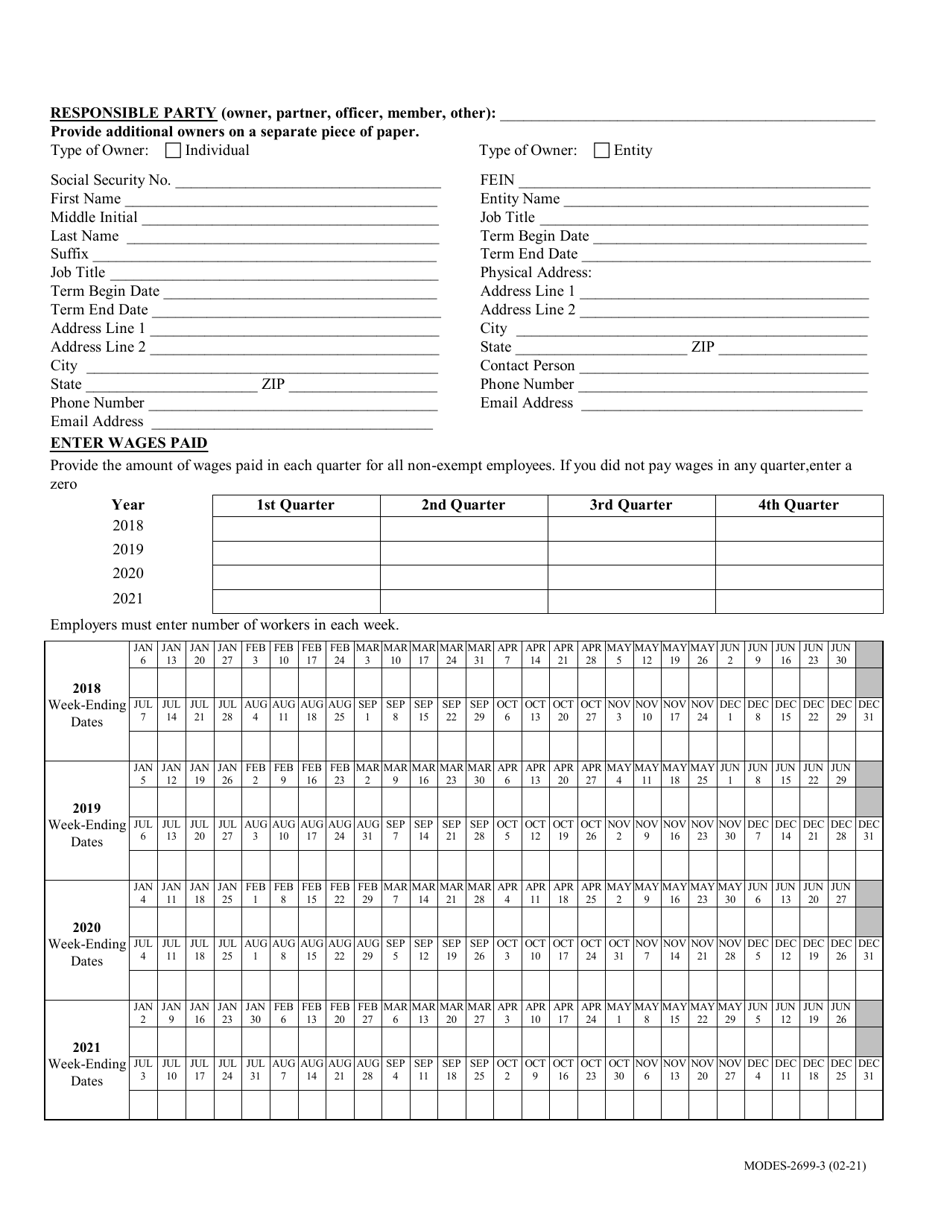

Q: What information is required on MODES-2699?

A: MODES-2699 requires information such as the employer's name, address, federal employer identification number (FEIN), and business type.

Q: When should MODES-2699 be completed?

A: MODES-2699 should be completed before the employer begins paying wages to employees in Missouri.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Missouri Department of Labor and Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MODES-2699 by clicking the link below or browse more documents and templates provided by the Missouri Department of Labor and Industrial Relations.