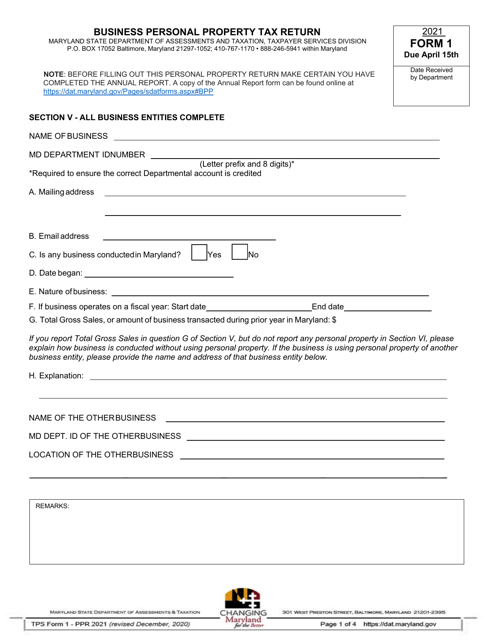

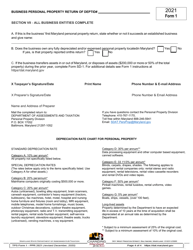

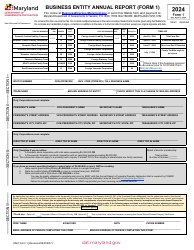

Form 1 Business Personal Property Tax Return - Maryland

What Is Form 1?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 1 Business Personal Property Tax Return?

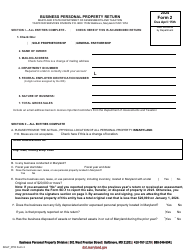

A: Form 1 is a tax return used in Maryland for reporting business personal property.

Q: Who needs to file Form 1?

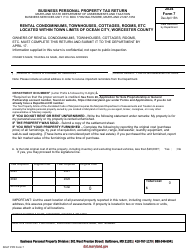

A: Any business or individual owning tangible personal property used in a business or rental activity in Maryland must file Form 1.

Q: When is the deadline to file Form 1?

A: The deadline to file Form 1 in Maryland is April 15th each year.

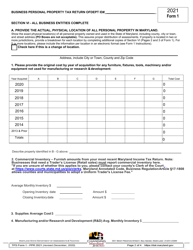

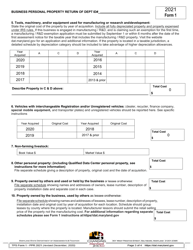

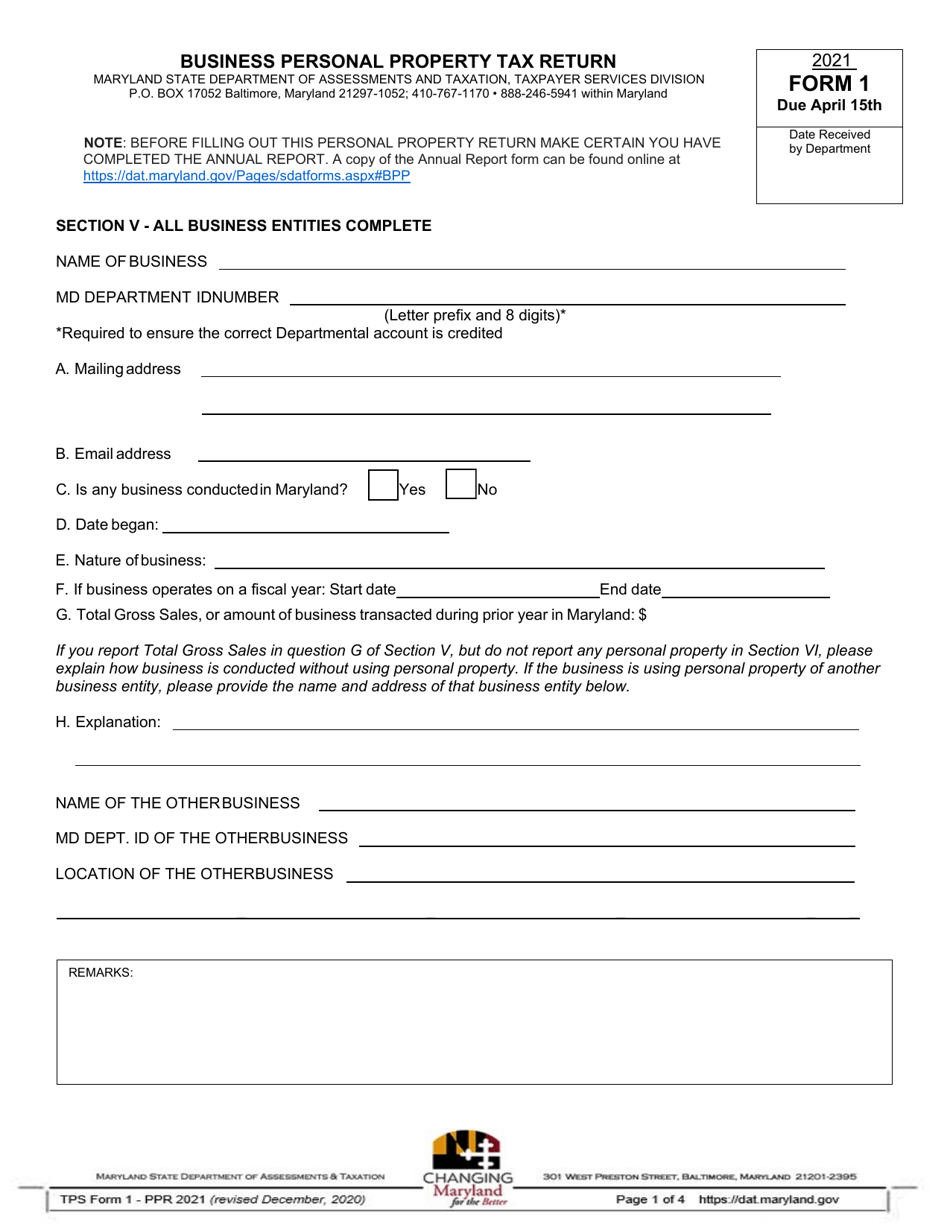

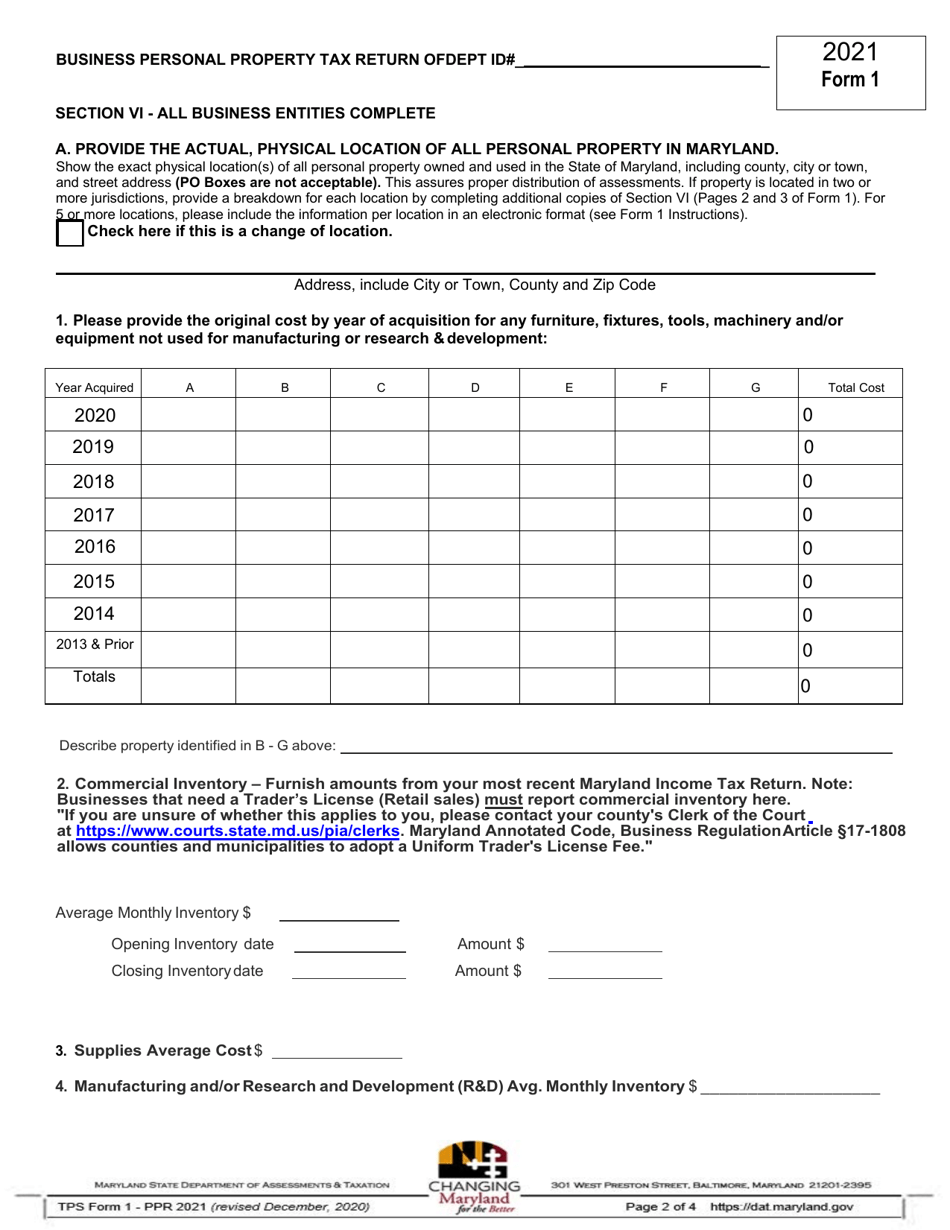

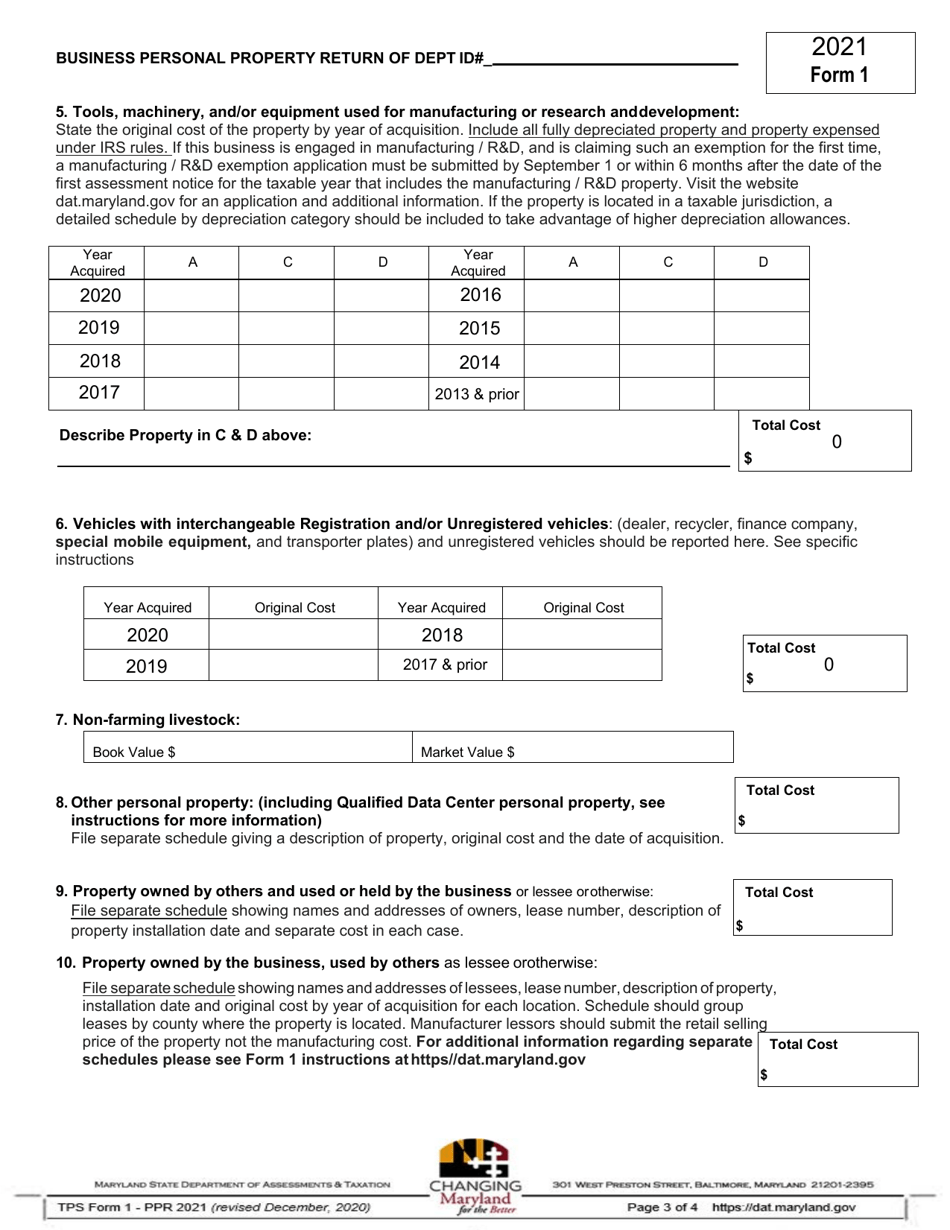

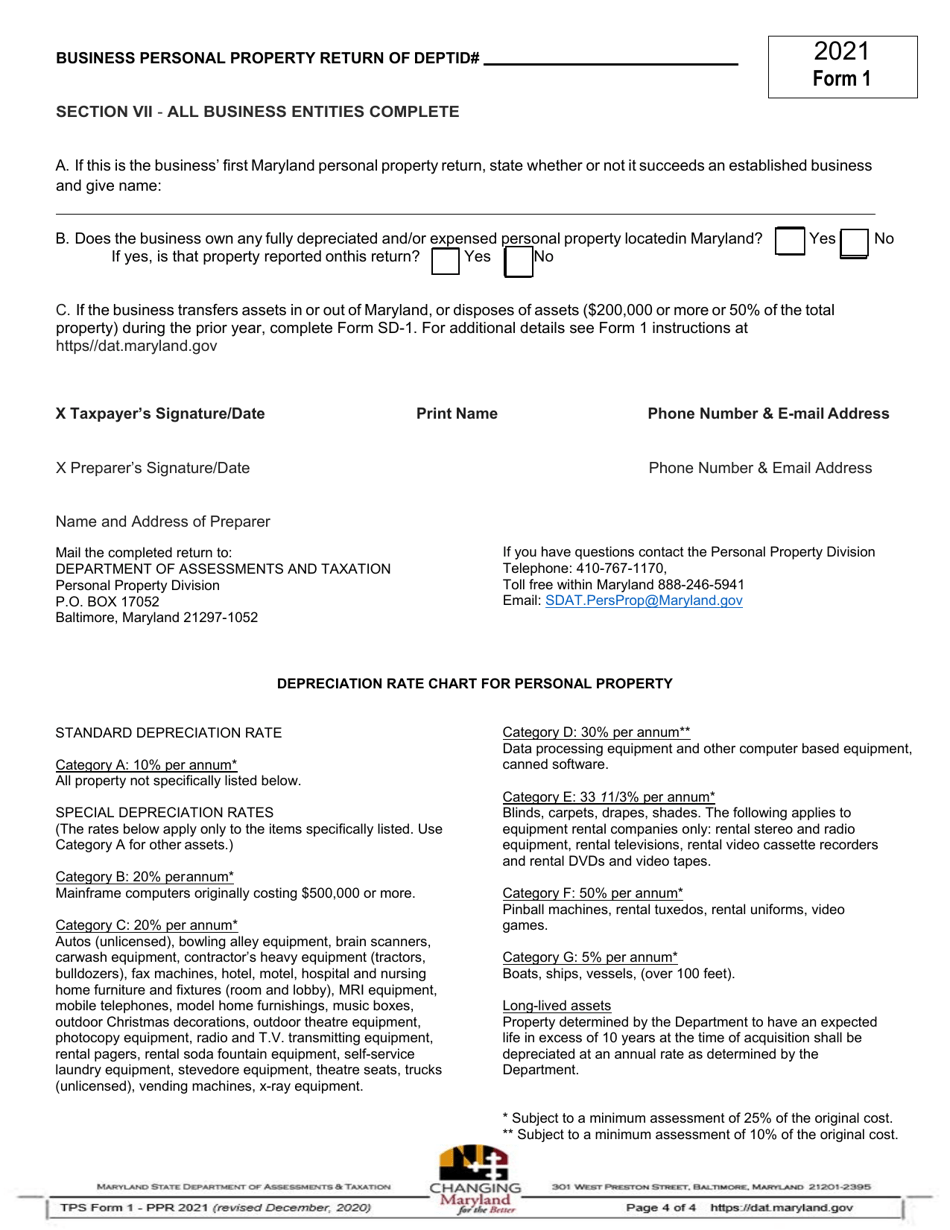

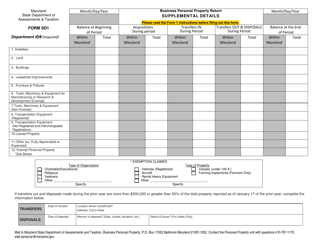

Q: What information is required on Form 1?

A: Form 1 requires detailed information about the business or individual, as well as a listing of all tangible personal property subject to taxation.

Q: How is the personal property tax calculated?

A: The personal property tax is calculated based on the assessed value of the tangible personal property owned by the business or individual.

Q: Are there any exemptions for personal property tax in Maryland?

A: Yes, certain types of personal property, such as inventory, are exempt from taxation in Maryland.

Q: What happens if I don't file Form 1?

A: Failure to file Form 1 may result in penalties and interest charges, and could lead to enforcement actions by the state.

Q: Can I request an extension to file Form 1?

A: Yes, you can request an extension for filing Form 1 in Maryland. The extension must be requested before the original due date.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.