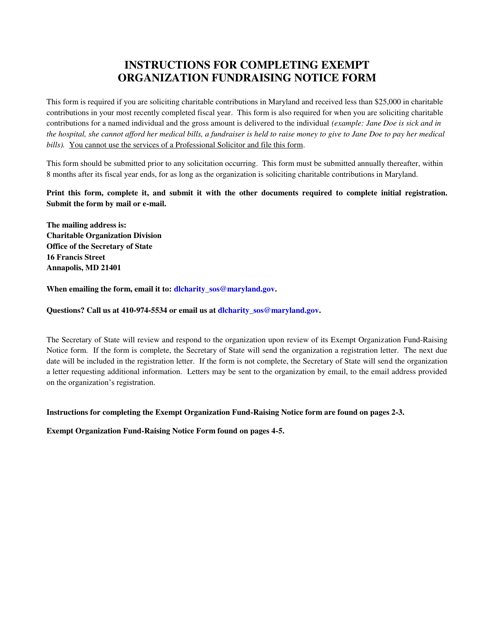

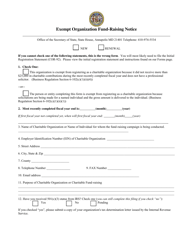

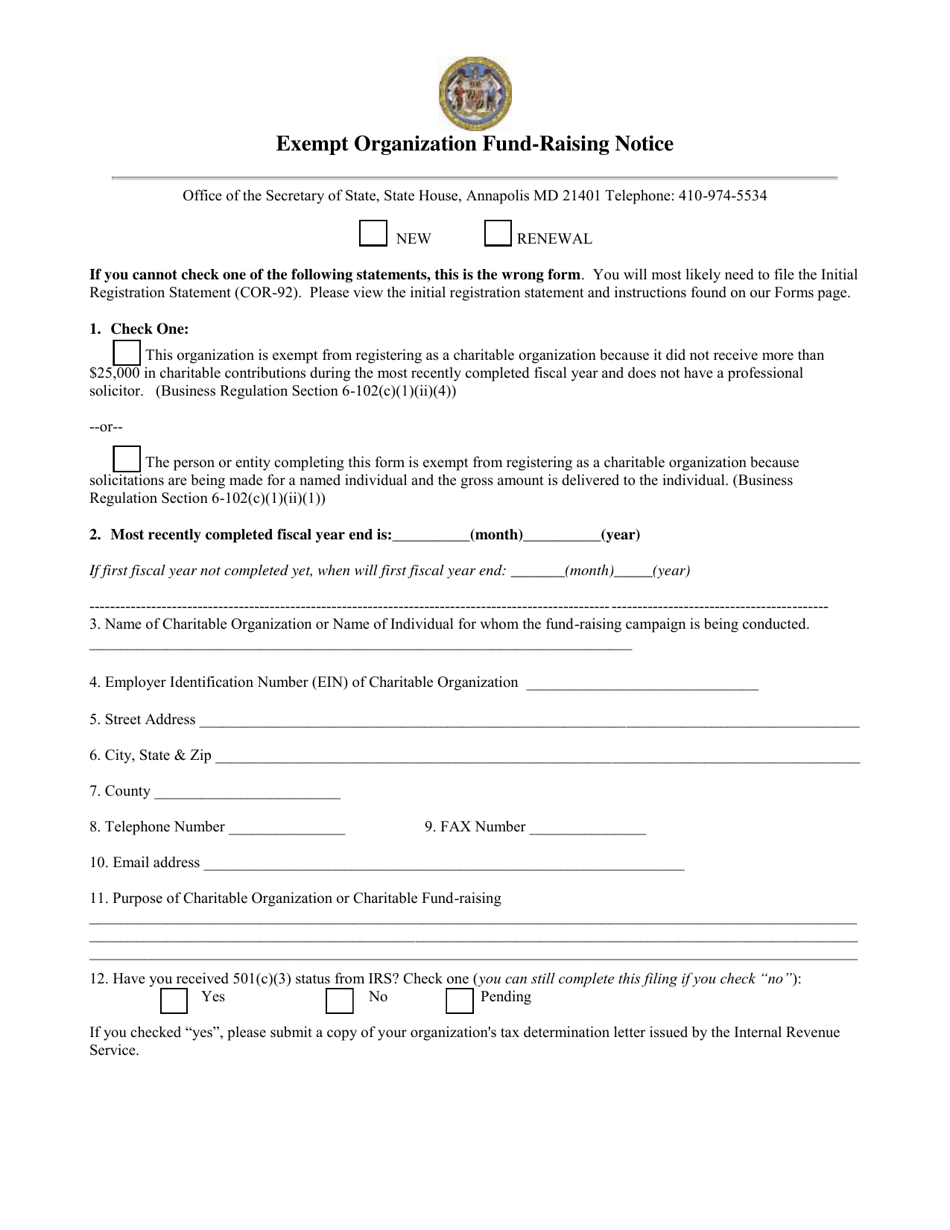

Exempt Organization Fund-Raising Notice - Maryland

Exempt Organization Fund-Raising Notice is a legal document that was released by the Maryland Secretary of State - a government authority operating within Maryland.

FAQ

Q: What is the Exempt Organization Fund-Raising Notice?

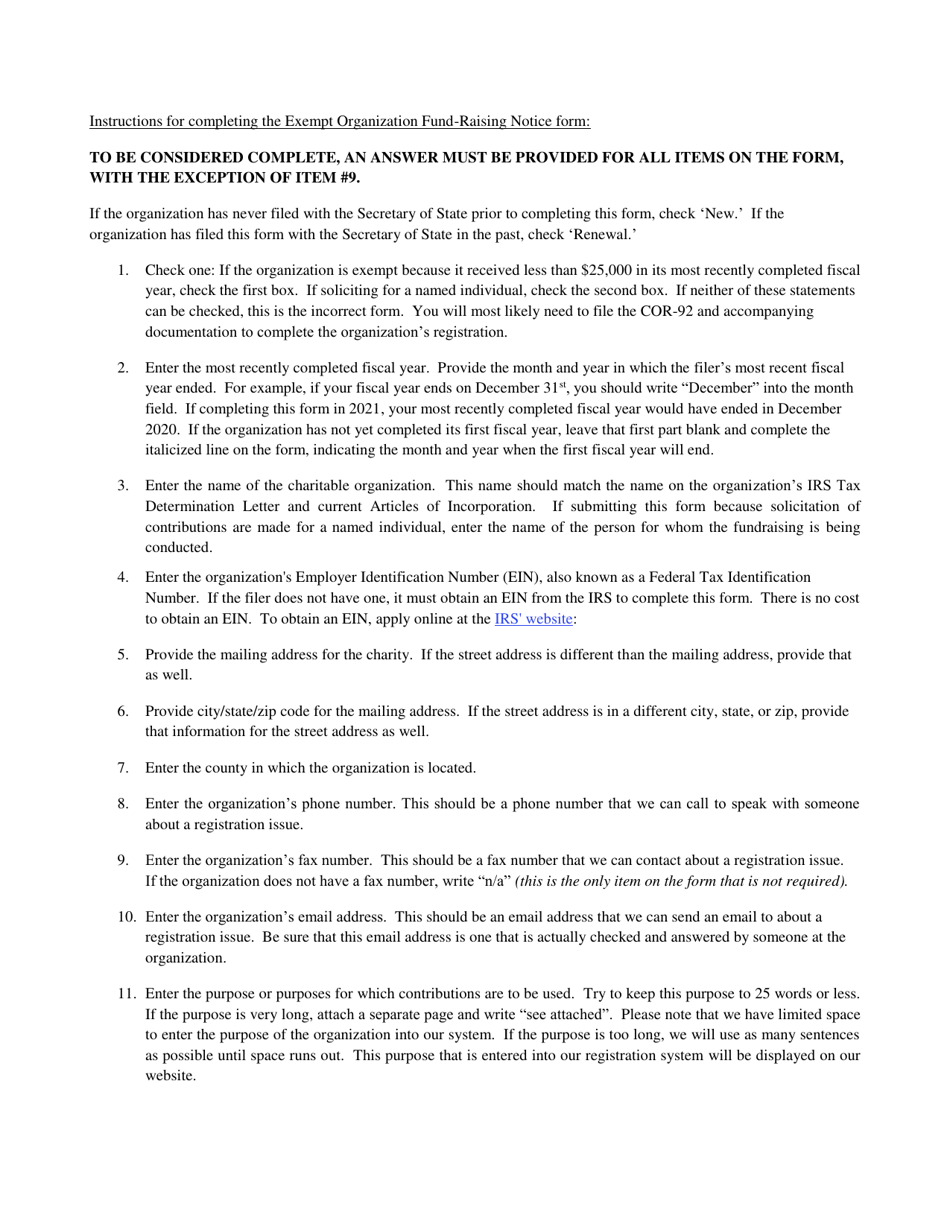

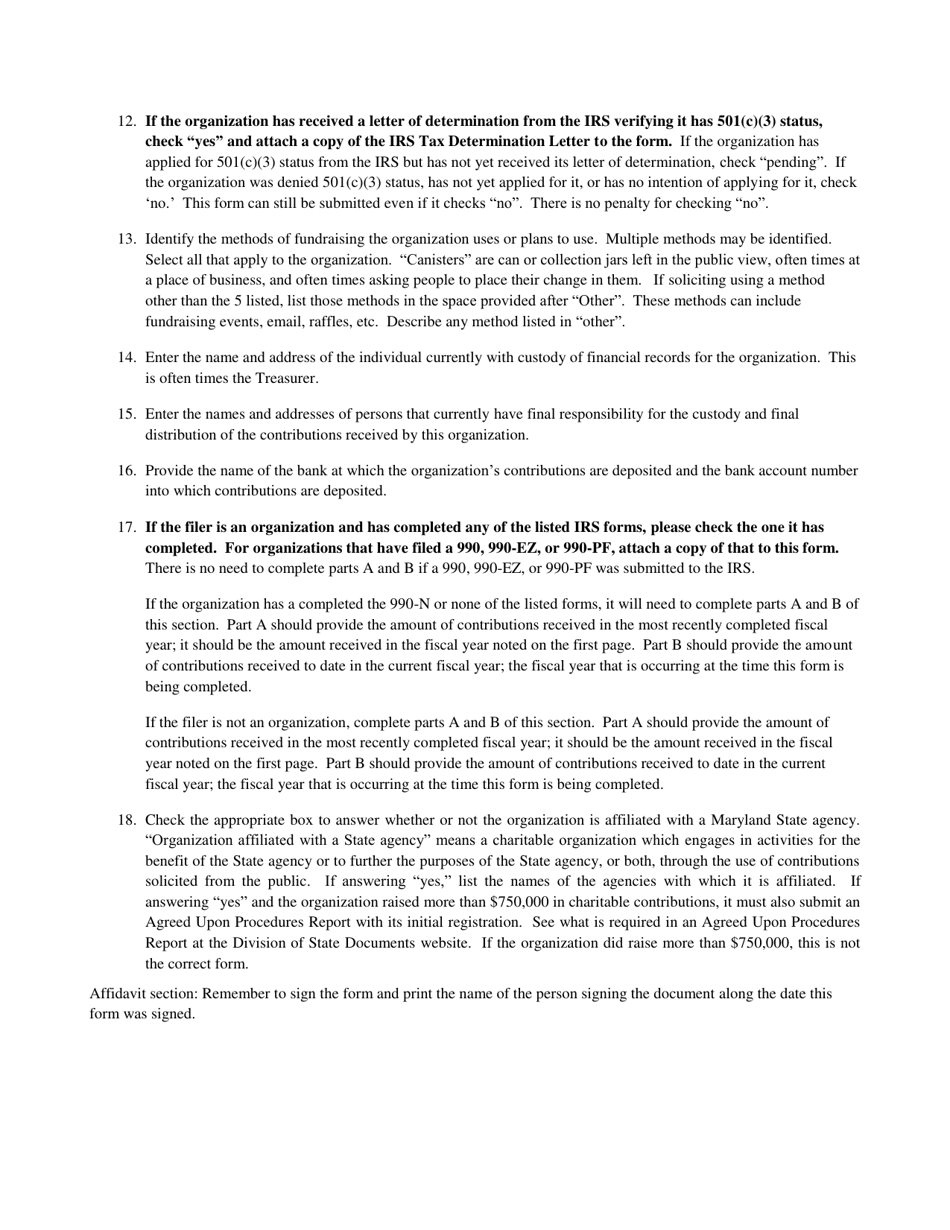

A: The Exempt Organization Fund-Raising Notice is a requirement for charitable organizations in Maryland to provide information about their fundraising activities.

Q: Which organizations are required to submit the Exempt Organization Fund-Raising Notice?

A: Charitable organizations that are exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code and are soliciting donations in Maryland are required to submit the notice.

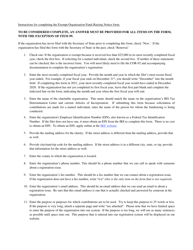

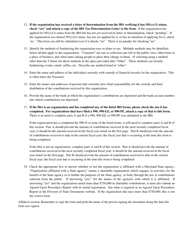

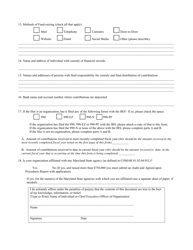

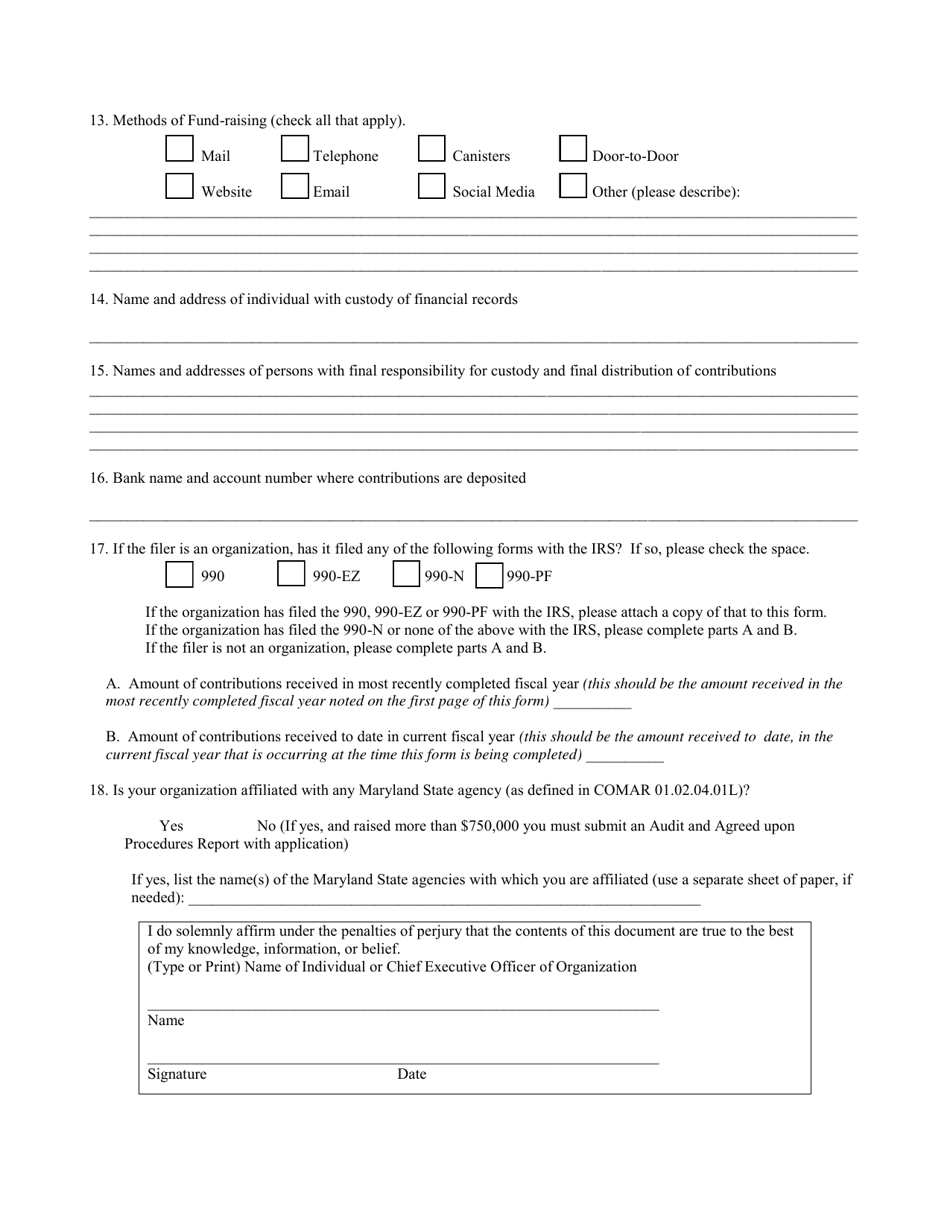

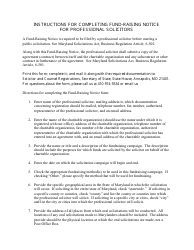

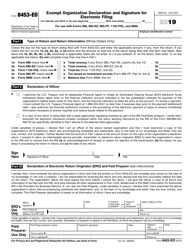

Q: What information is included in the Exempt Organization Fund-Raising Notice?

A: The notice includes information about the organization's purpose, programs, and finances, as well as details about its fundraising activities.

Q: When is the deadline to submit the Exempt Organization Fund-Raising Notice?

A: The notice must be submitted at least 10 days before solicitation begins in Maryland.

Q: What happens if a charitable organization fails to submit the Exempt Organization Fund-Raising Notice?

A: Failure to submit the notice may result in penalties, including fines and revocation of charitable status in Maryland.

Form Details:

- The latest edition currently provided by the Maryland Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Secretary of State.