This version of the form is not currently in use and is provided for reference only. Download this version of

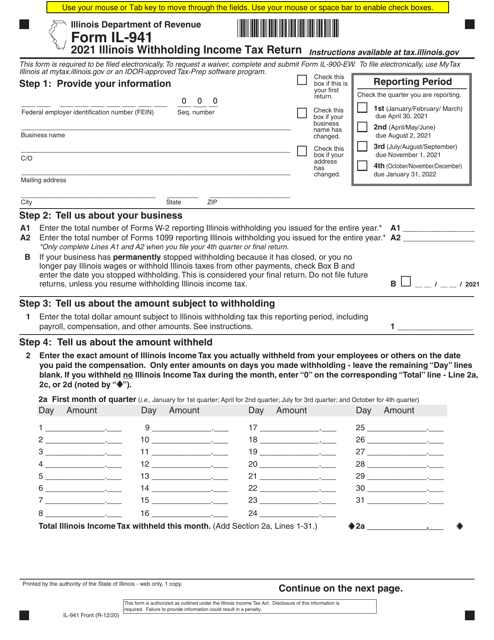

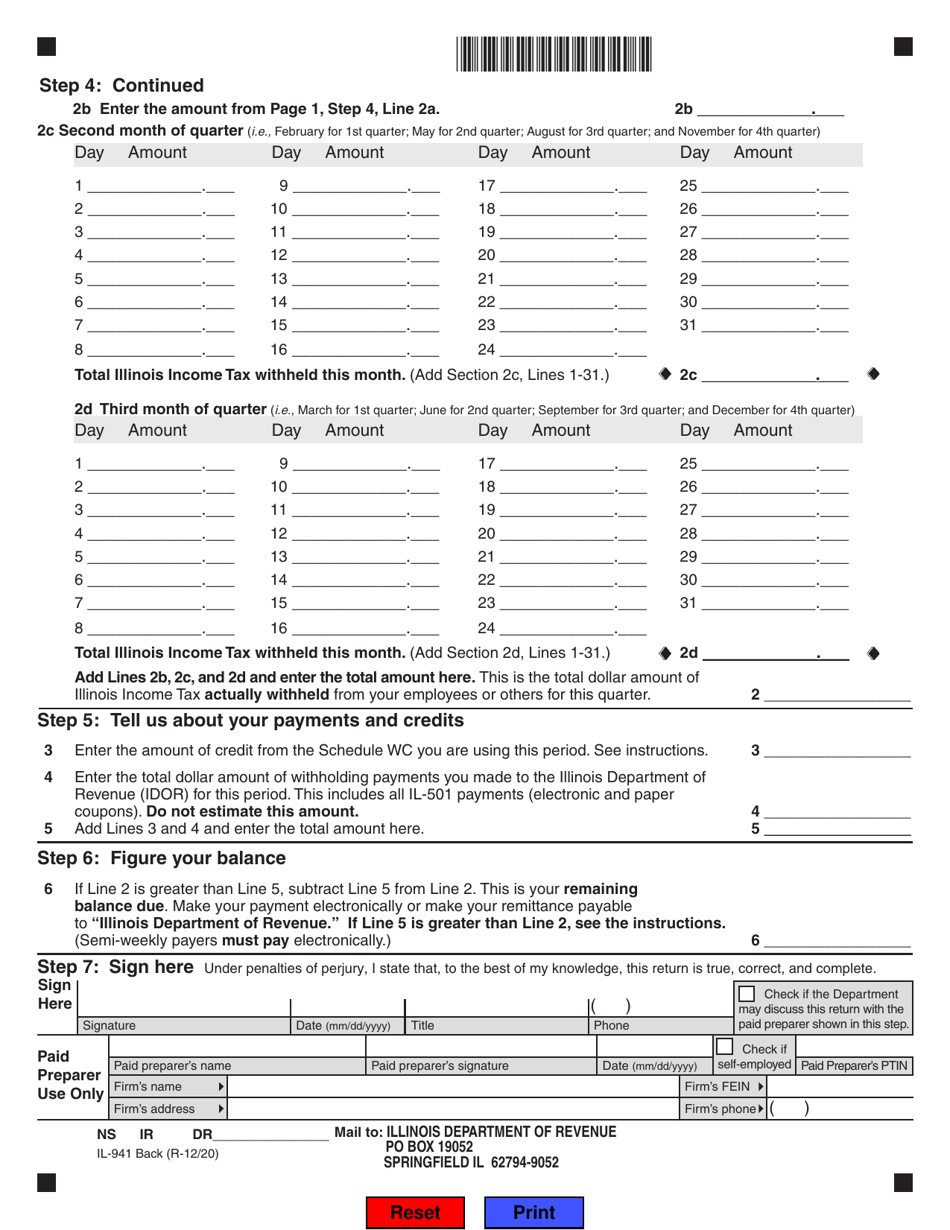

Form IL-941

for the current year.

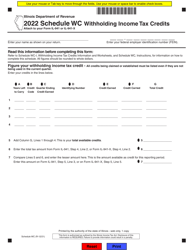

Form IL-941 Illinois Withholding Income Tax Return - Illinois

What Is Form IL-941?

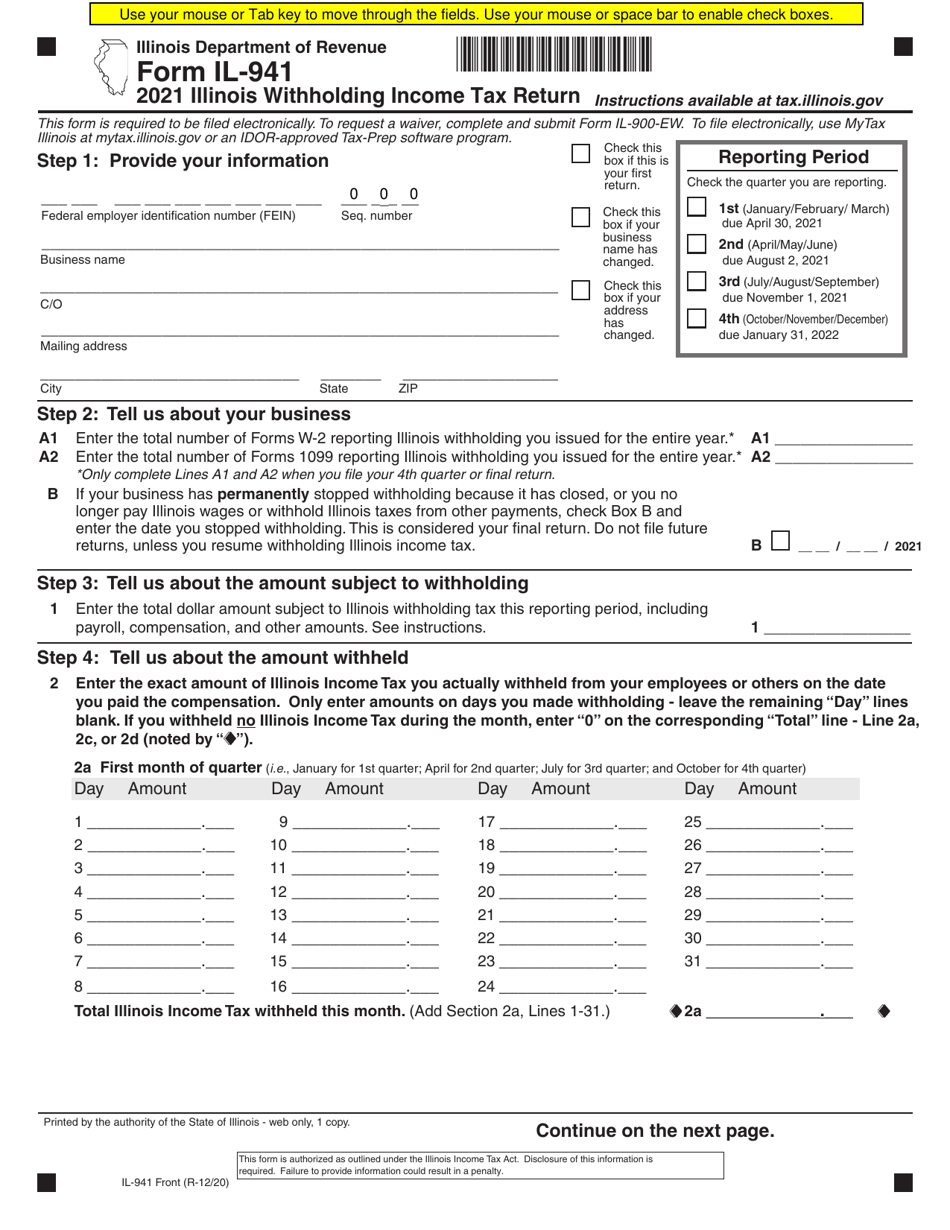

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-941?

A: Form IL-941 is the Illinois Withholding Income Tax Return.

Q: Who is required to file Form IL-941?

A: Employers who withhold Illinois income tax from employees' wages are required to file Form IL-941.

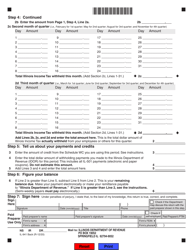

Q: What information is needed to complete Form IL-941?

A: Employers will need to provide information about their business, employees' wages and withholding, and any adjustments or credits.

Q: When is Form IL-941 due?

A: Form IL-941 is due on a quarterly basis. The due dates are typically the last day of the month following the end of the quarter. For example, the first quarter return is due by April 30th.

Q: Are there any penalties for late or incorrect filing of Form IL-941?

A: Yes, there are penalties for late or incorrect filing of Form IL-941. It is important to file the return on time and ensure accuracy to avoid penalties.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-941 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.