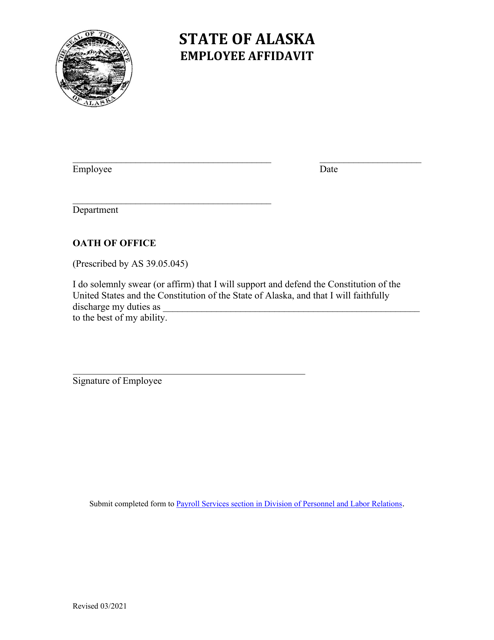

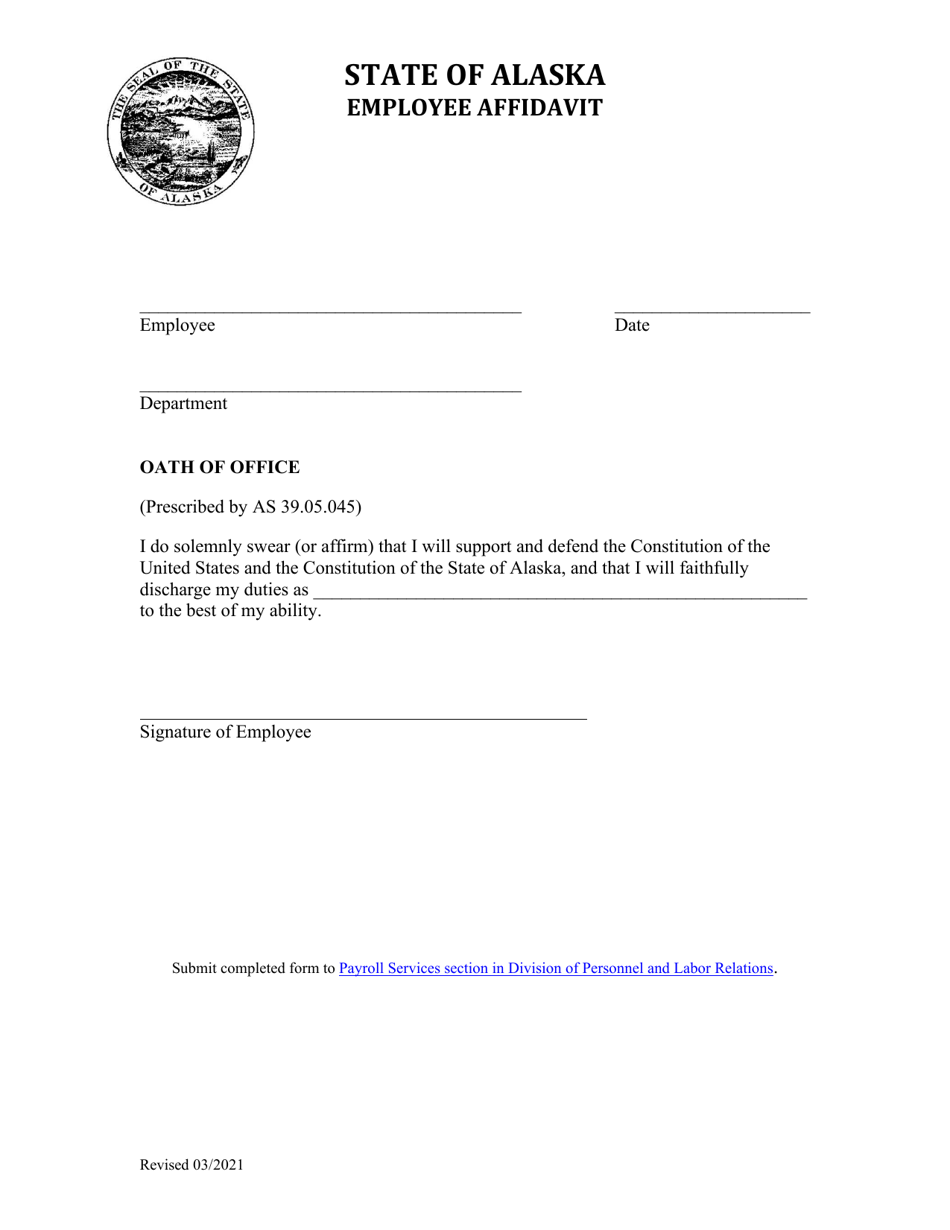

Employee Affidavit - Alaska

Employee Affidavit is a legal document that was released by the Alaska Department of Administration - a government authority operating within Alaska.

FAQ

Q: What is an employee affidavit in Alaska?

A: An employee affidavit in Alaska is a document signed by a worker confirming their employment with a specific employer.

Q: Why would someone need to complete an employee affidavit?

A: Someone may need to complete an employee affidavit to verify their employment for various purposes, such as obtaining a loan or demonstrating income for government assistance programs.

Q: How can I obtain an employee affidavit form in Alaska?

A: Employee affidavit forms can typically be obtained from the employer or human resources department of the company where you are employed.

Q: Are there any specific requirements or information that need to be included in an employee affidavit?

A: While requirements can vary, an employee affidavit generally includes information such as the employee's name, position, dates of employment, and the employer's contact information.

Q: Can an employee affidavit be notarized?

A: Yes, an employee affidavit can be notarized if required by the specific purpose it is being used for.

Q: Are there any fees associated with getting an employee affidavit in Alaska?

A: There are generally no fees associated with obtaining an employee affidavit in Alaska, but it is recommended to check with your employer or relevant authorities for any specific requirements or fees.

Q: How long does an employee affidavit remain valid?

A: The validity of an employee affidavit may vary depending on the purpose it is being used for. It is best to consult with the requesting entity or organization to determine the required validity period.

Q: Can an employee affidavit be used as proof of employment for immigration purposes?

A: An employee affidavit may be considered as supporting evidence of employment for immigration purposes, but it is advisable to consult with an immigration attorney or the relevant immigration authorities for specific guidance.

Q: What should I do if I suspect fraudulent use of an employee affidavit?

A: If you suspect fraudulent use of an employee affidavit, you should report it to the appropriate authorities, such as your employer, human resources department, or law enforcement agencies.

Q: Can an employee affidavit be used as proof of income for tax purposes?

A: An employee affidavit alone may not be sufficient as proof of income for tax purposes. It is generally recommended to provide official tax documents, such as W-2 forms or pay stubs, when filing taxes.

Form Details:

- Released on March 1, 2021;

- The latest edition currently provided by the Alaska Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Administration.