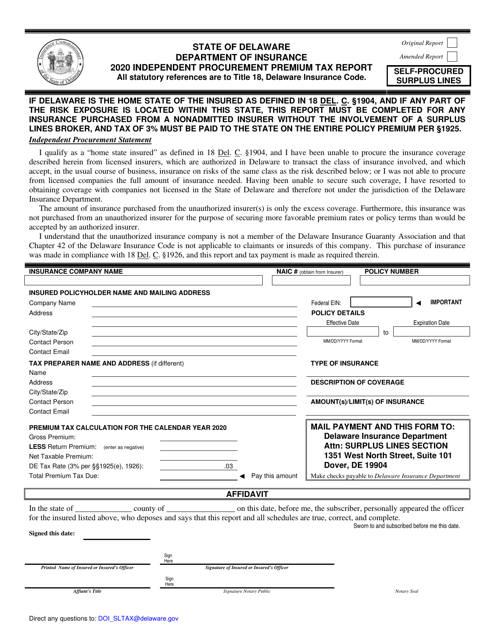

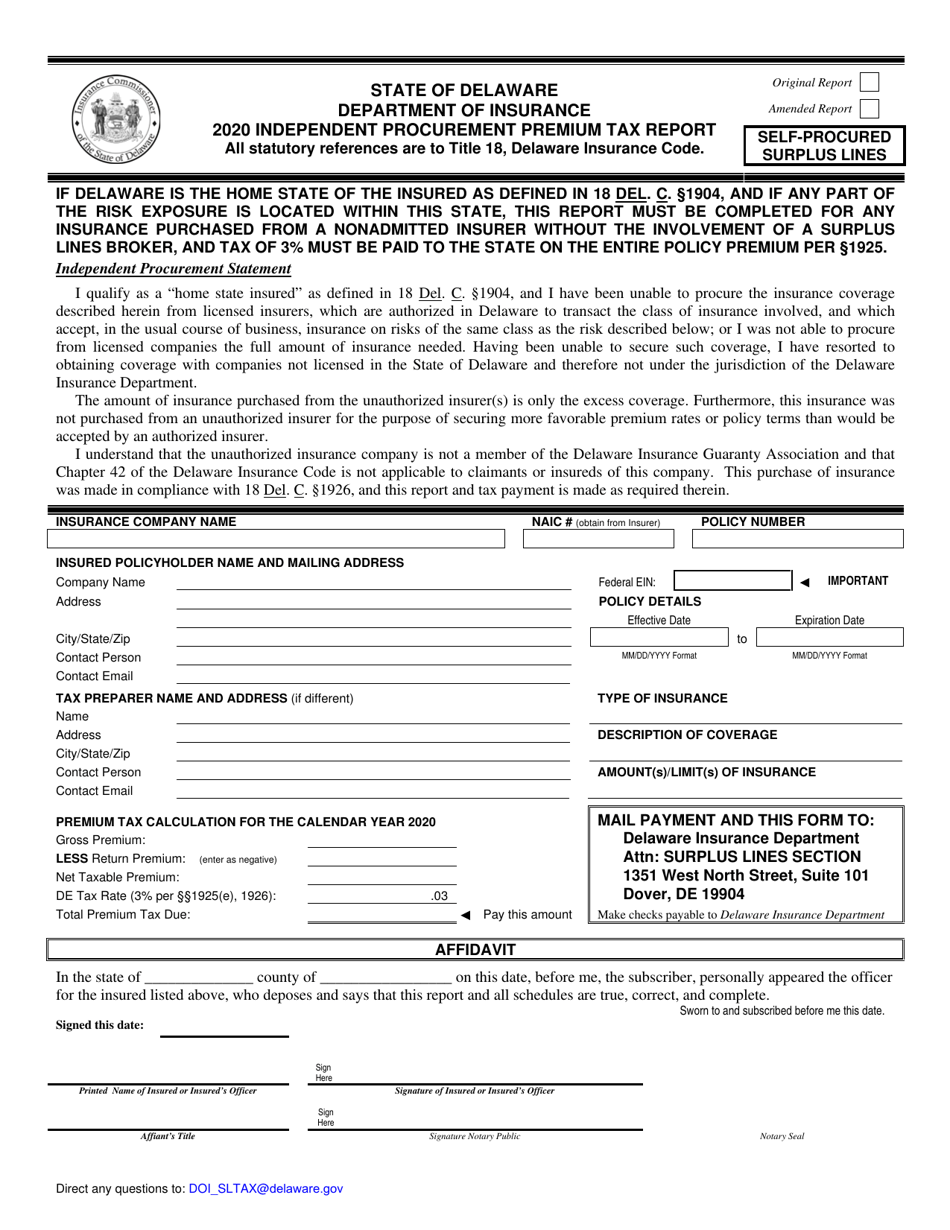

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

Independent Procurement Premium Tax Report - Delaware

Independent Procurement Premium Tax Report is a legal document that was released by the Delaware Department of Insurance - a government authority operating within Delaware.

FAQ

Q: What is the Independent Procurement Premium Tax Report in Delaware?

A: The Independent Procurement Premium Tax Report is a report filed by insurance companies in Delaware to report and pay premium taxes for policies procured independently.

Q: Who is required to file the Independent Procurement Premium Tax Report?

A: Insurance companies that have procured policies independently in Delaware are required to file the Independent Procurement Premium Tax Report.

Q: How often is the Independent Procurement Premium Tax Report filed?

A: The report is filed annually.

Q: When is the due date for filing the Independent Procurement Premium Tax Report?

A: The due date for filing the report is typically March 1st of each year.

Q: How is the tax calculated for the Independent Procurement Premium Tax Report?

A: The tax is calculated based on the premiums collected from independent procurement policies in Delaware.

Q: Are there any exemptions or deductions available for the Independent Procurement Premium Tax?

A: Specific exemptions or deductions may vary. It is advisable to consult with a tax professional or refer to the Delaware Department of Insurance for more information.

Form Details:

- The latest edition currently provided by the Delaware Department of Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Insurance.