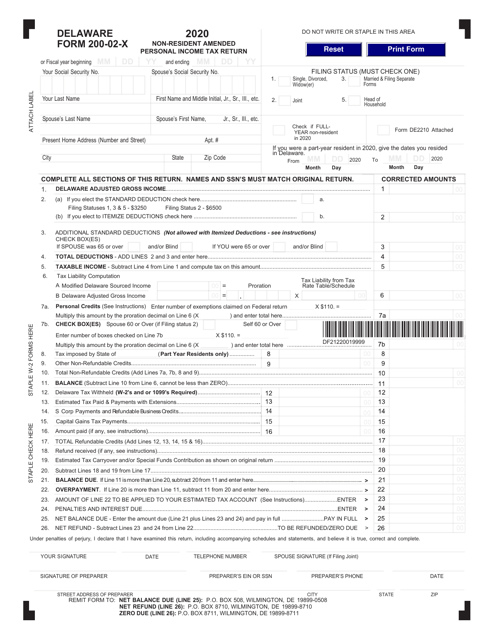

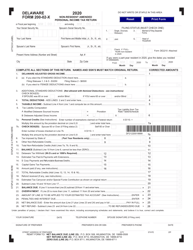

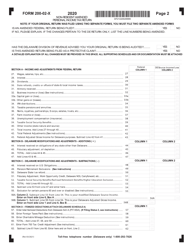

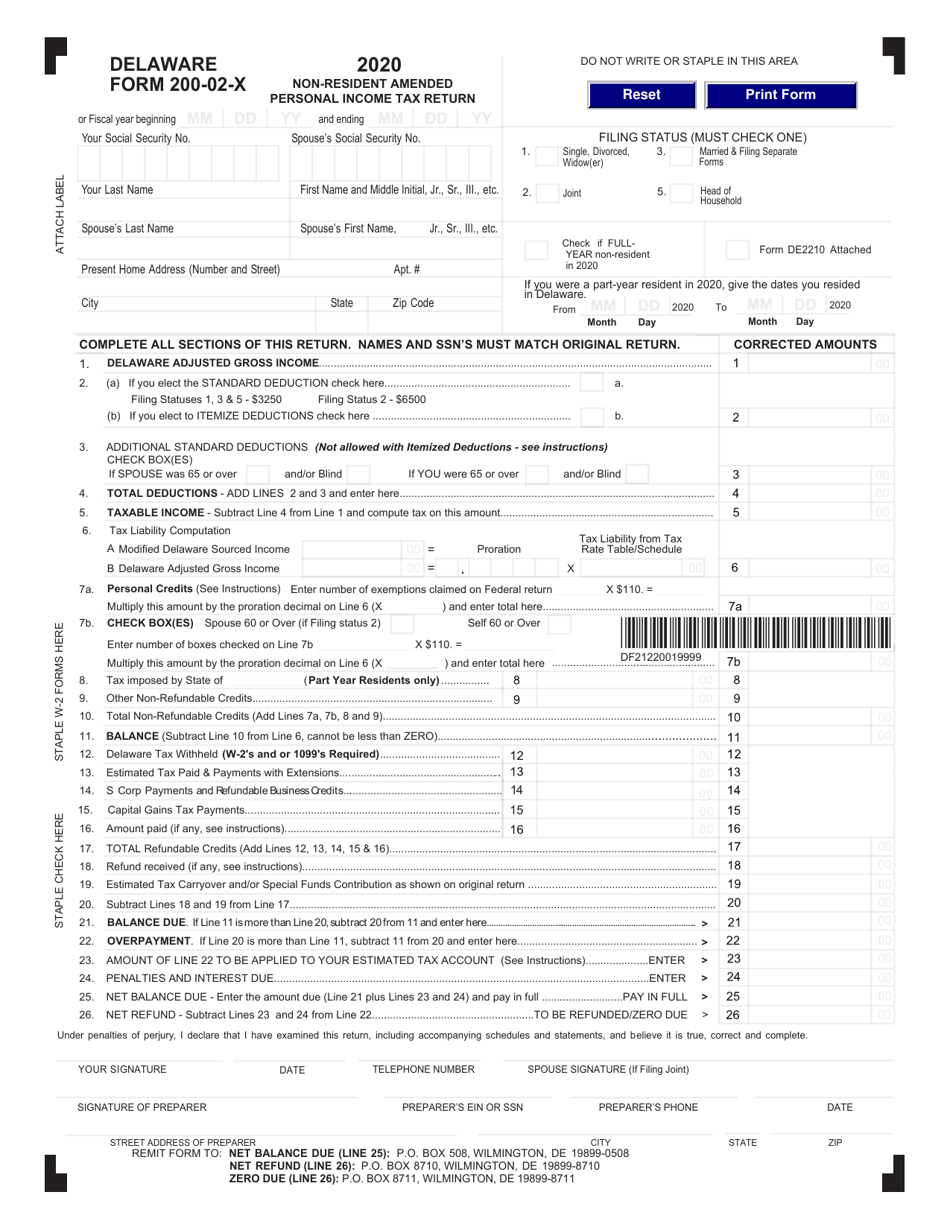

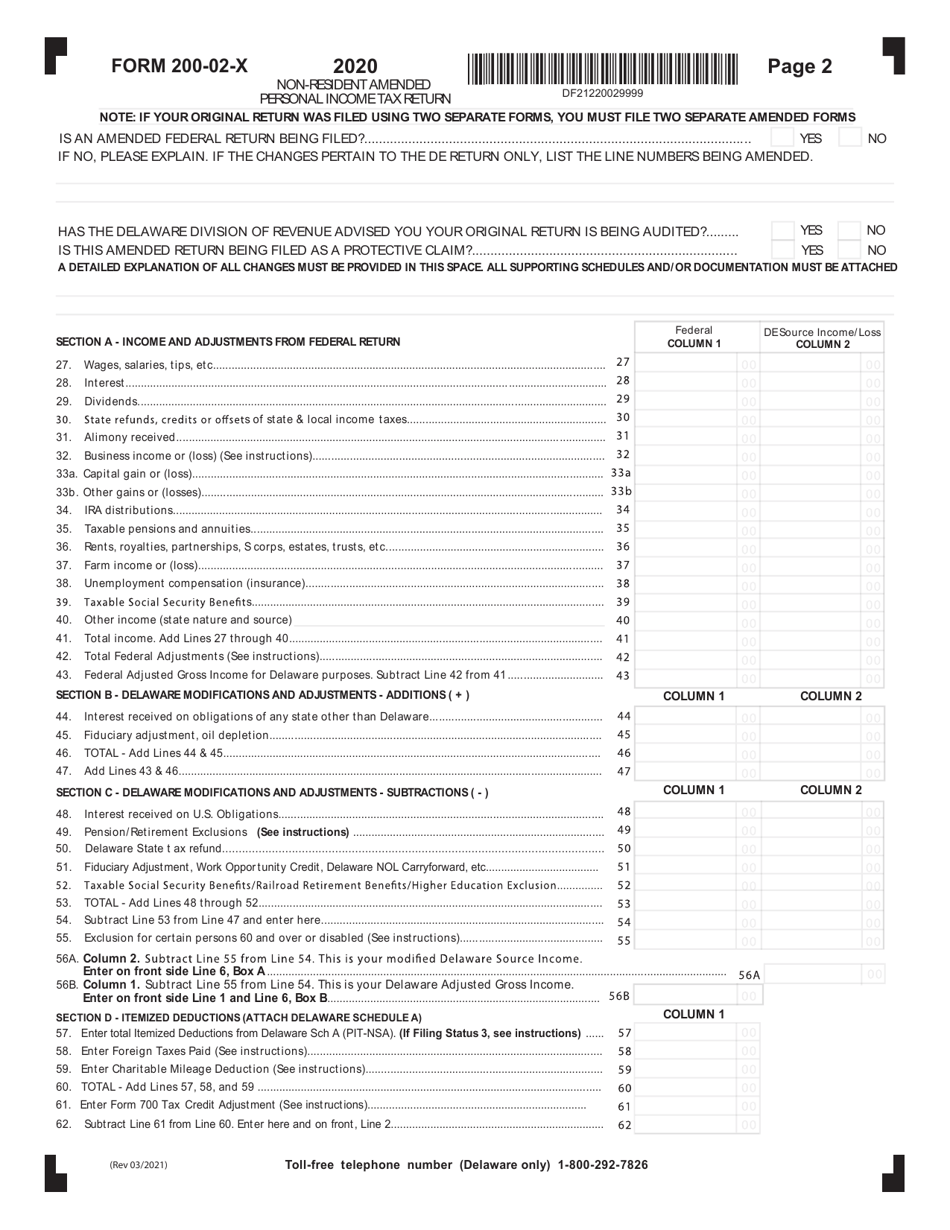

Form 200-02-X Non-resident Amended Personal Income Tax Return - Delaware

What Is Form 200-02-X?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form 200-02-X?

A: Form 200-02-X is the Non-resident Amended Personal Income Tax Return for Delaware.

Q: Who should use form 200-02-X?

A: Non-residents who need to amend their personal income tax return for Delaware should use form 200-02-X.

Q: What is the purpose of form 200-02-X?

A: The purpose of form 200-02-X is to allow non-residents to correct errors or make changes to their previously filed personal income tax return for Delaware.

Q: Are there any special requirements or instructions for completing form 200-02-X?

A: Yes, non-residents should carefully follow the instructions provided with form 200-02-X to ensure accurate and complete reporting of their amended personal income tax information for Delaware.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 200-02-X by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.