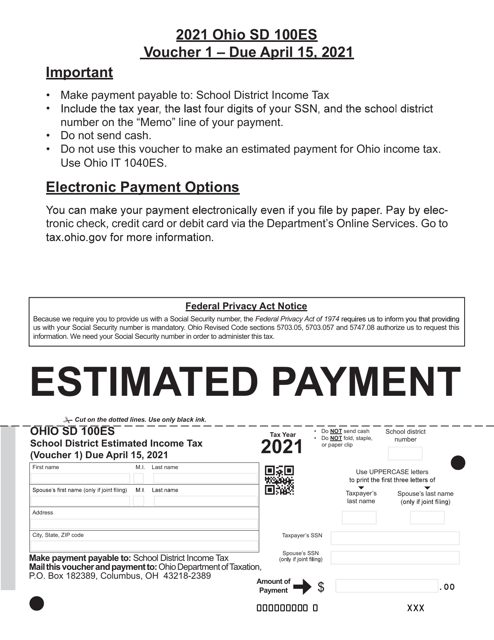

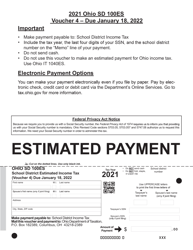

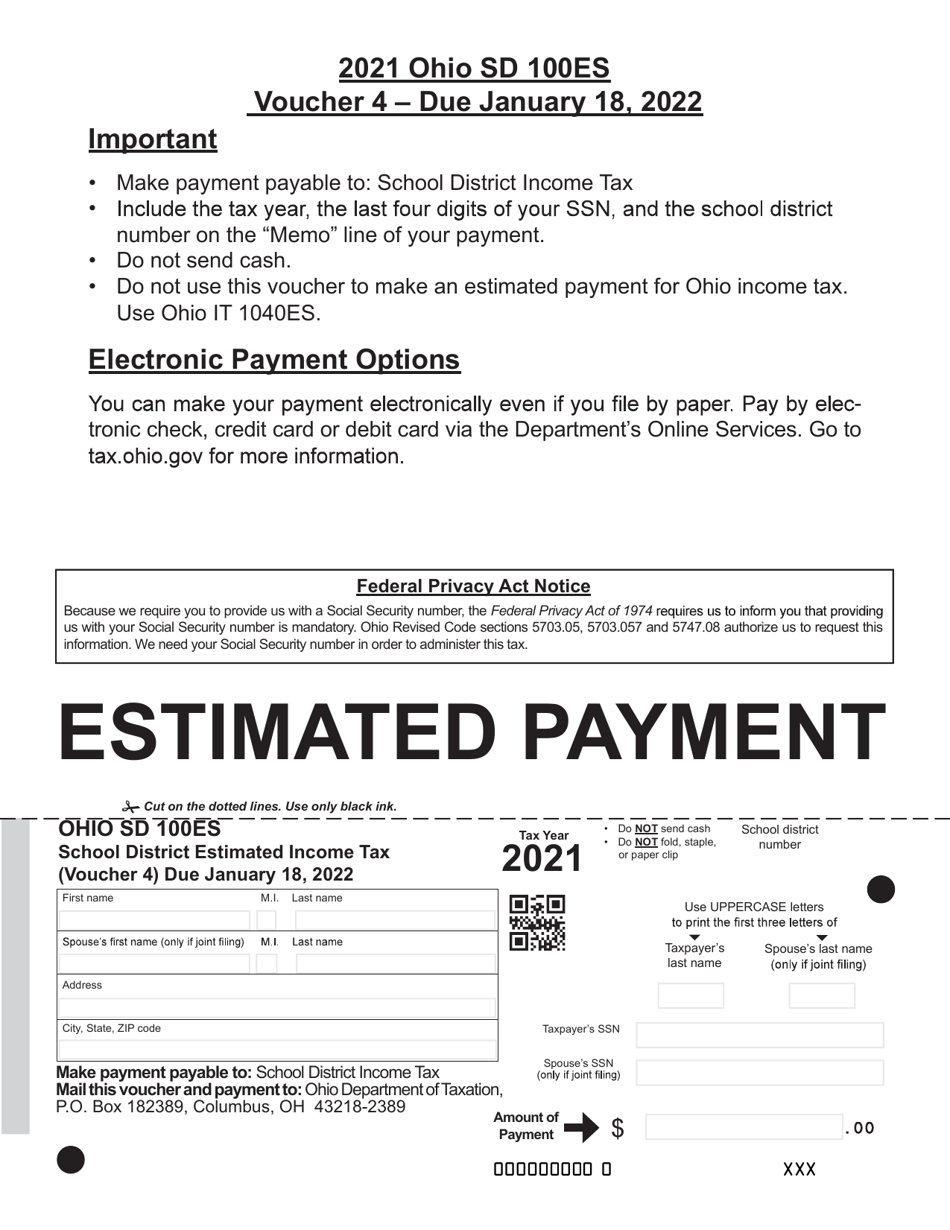

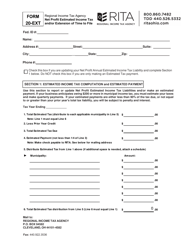

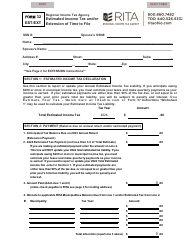

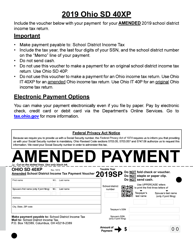

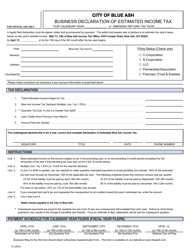

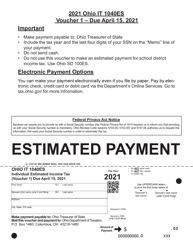

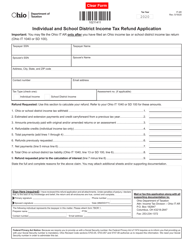

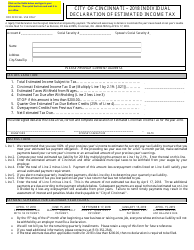

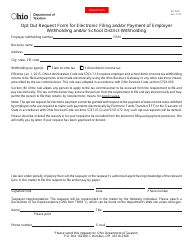

Form SD100ES School District Estimated Income Tax Voucher - Ohio

What Is Form SD100ES?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SD100ES?

A: Form SD100ES is the School District Estimated Income Tax Voucher for the state of Ohio.

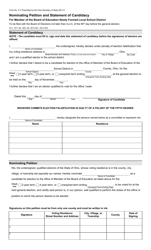

Q: What is the purpose of Form SD100ES?

A: Form SD100ES is used to make estimated income tax payments to your school district in Ohio.

Q: Who needs to file Form SD100ES?

A: If you are an Ohio resident and have taxable income, you may need to file Form SD100ES.

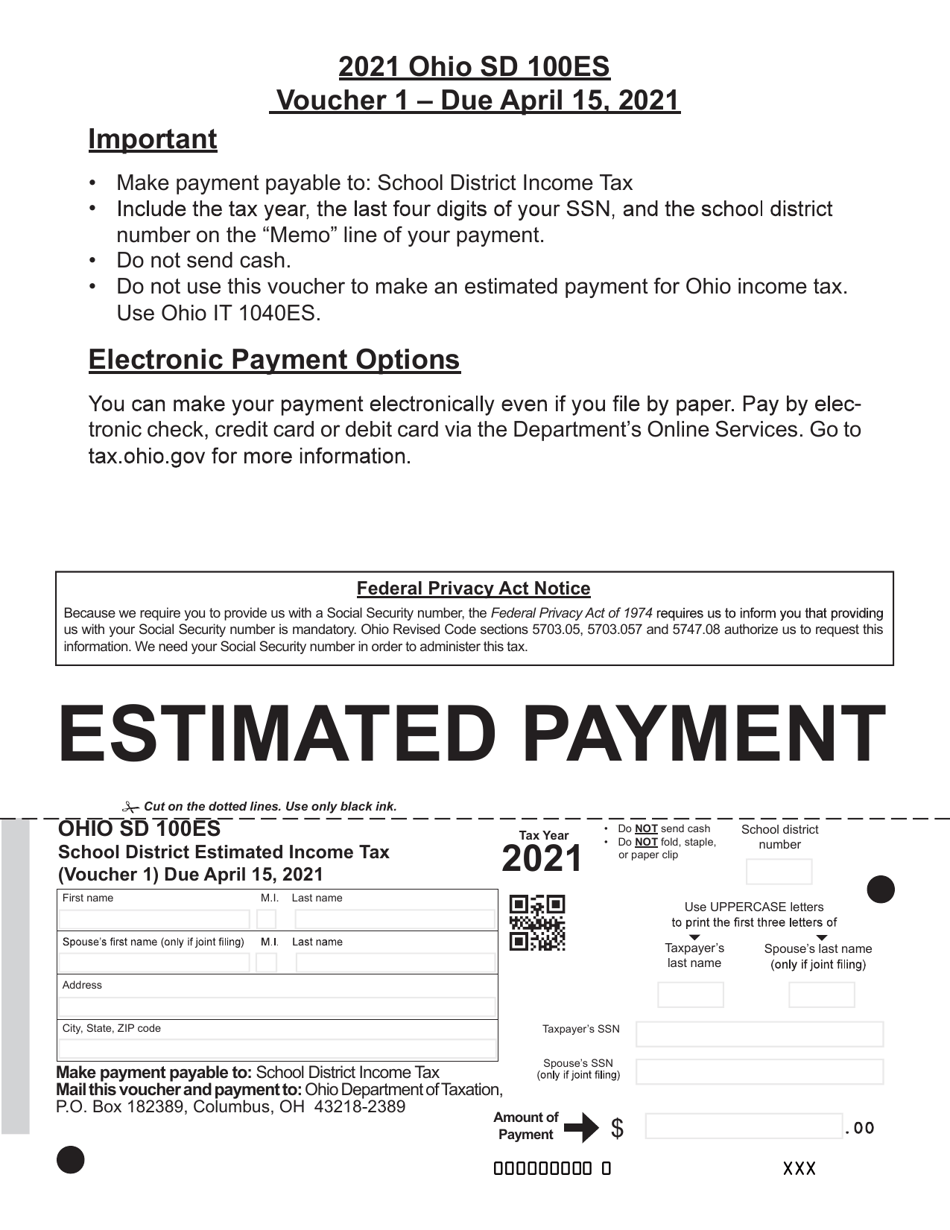

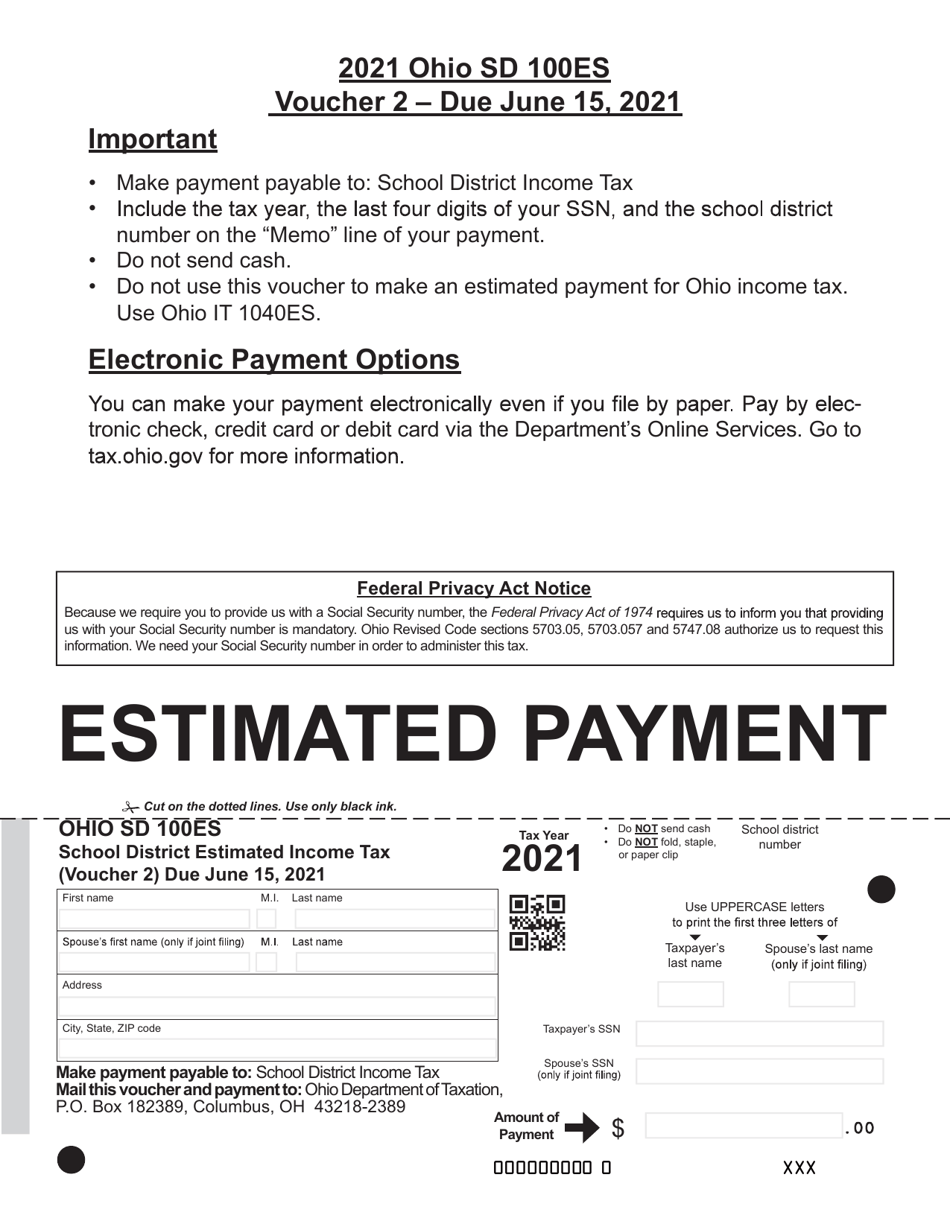

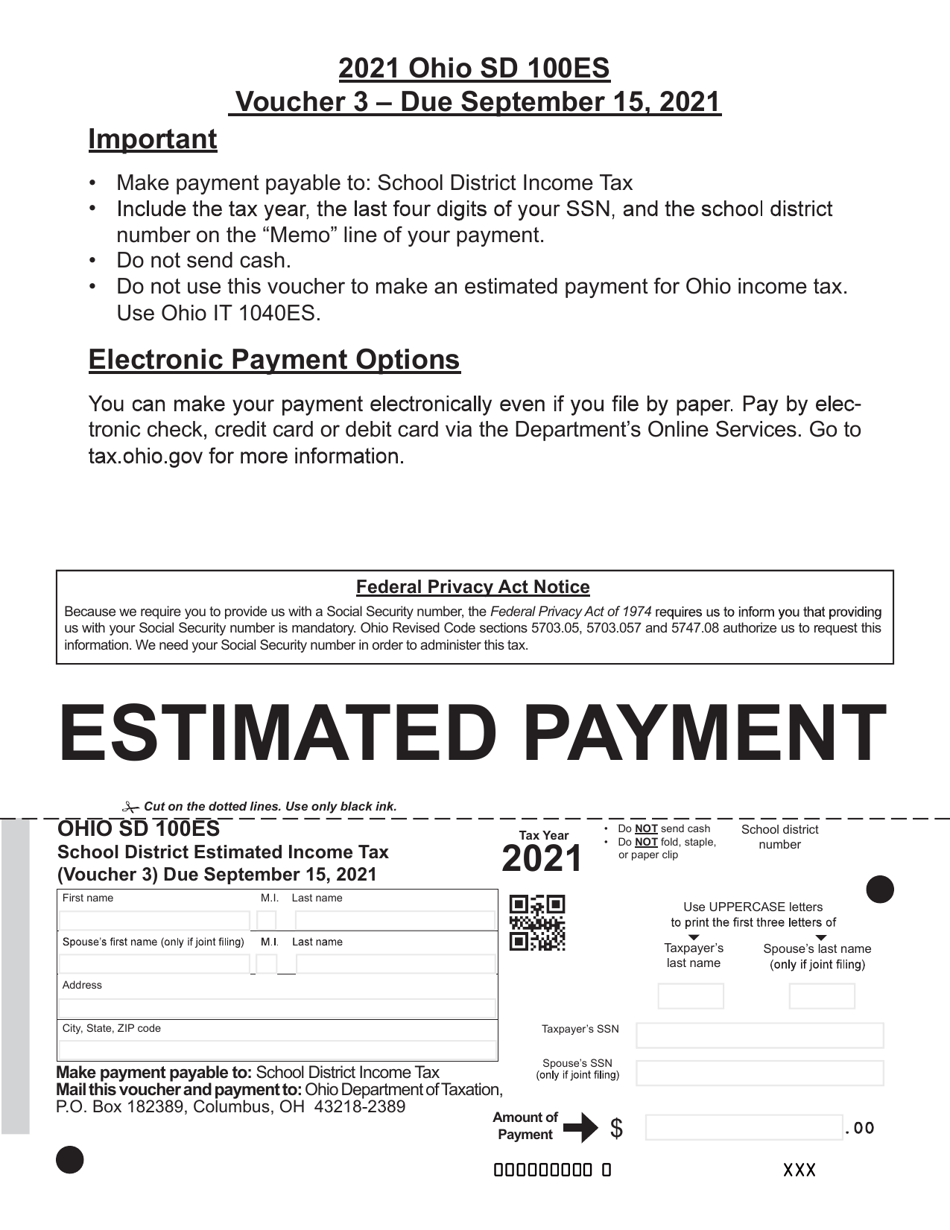

Q: When is Form SD100ES due?

A: Form SD100ES is due on or before the 15th day of the 4th, 6th, 9th, and 12th months of your taxable year.

Q: Are there any penalties for not filing Form SD100ES?

A: Yes, failure to timely file and pay the estimated tax may result in penalties and interest.

Q: Can I file Form SD100ES electronically?

A: No, Form SD100ES cannot be filed electronically and must be mailed to the appropriate address for your school district.

Q: What if I need to change or update my estimated tax payments?

A: If you need to change or update your estimated tax payments, you can submit a new Form SD100ES with the revised information.

Form Details:

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SD100ES by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.