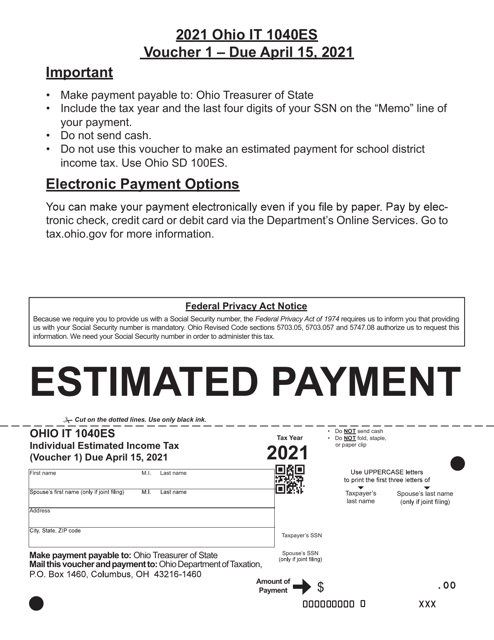

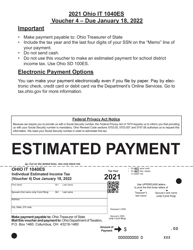

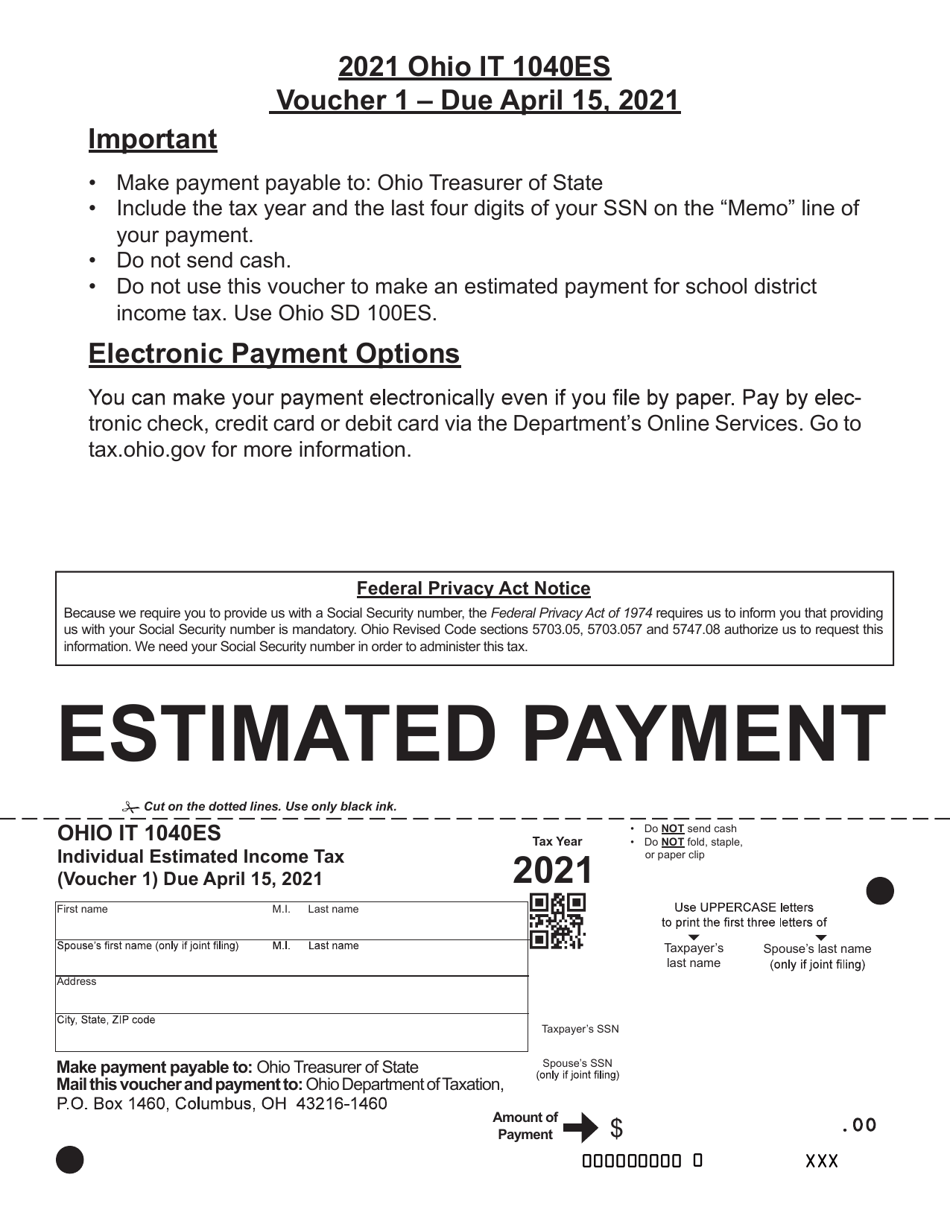

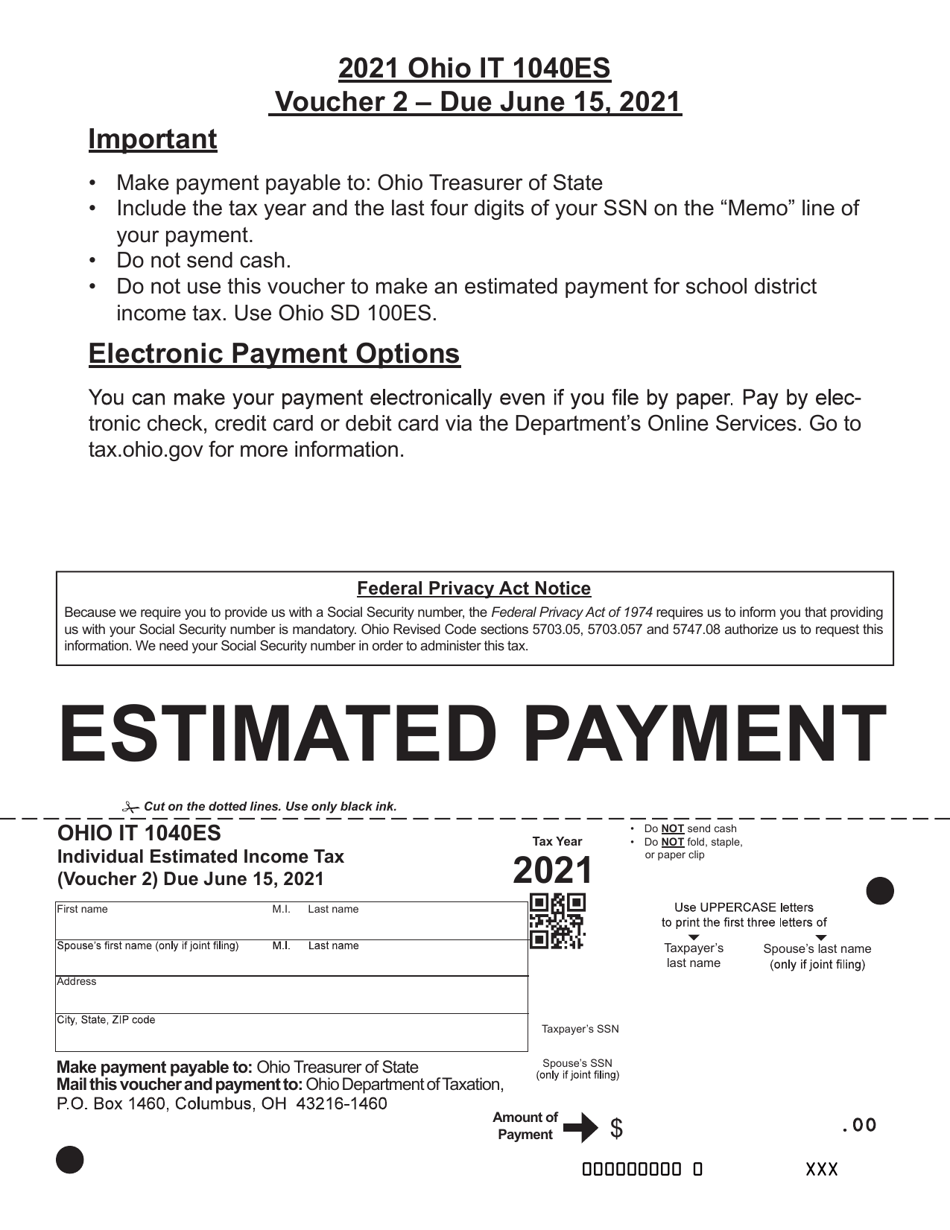

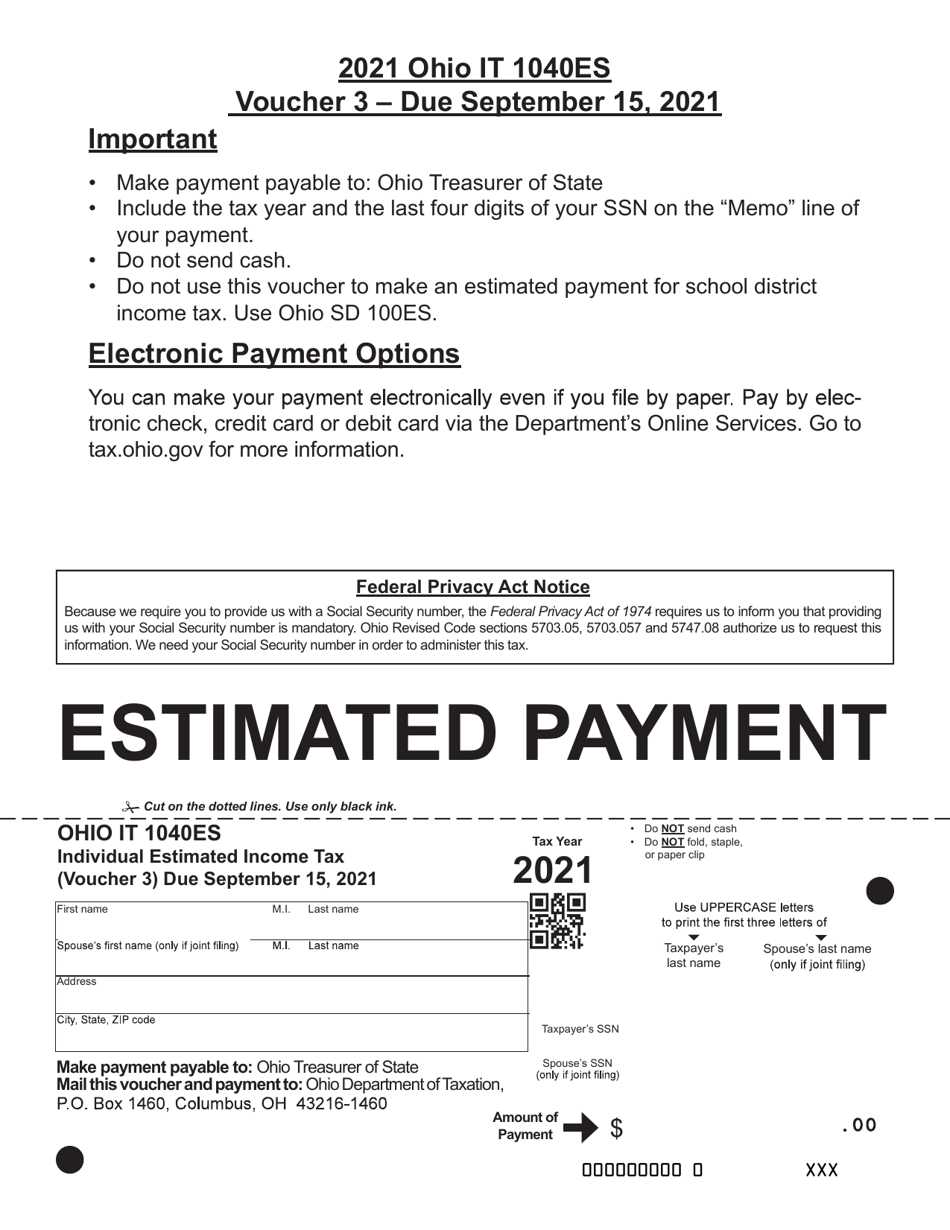

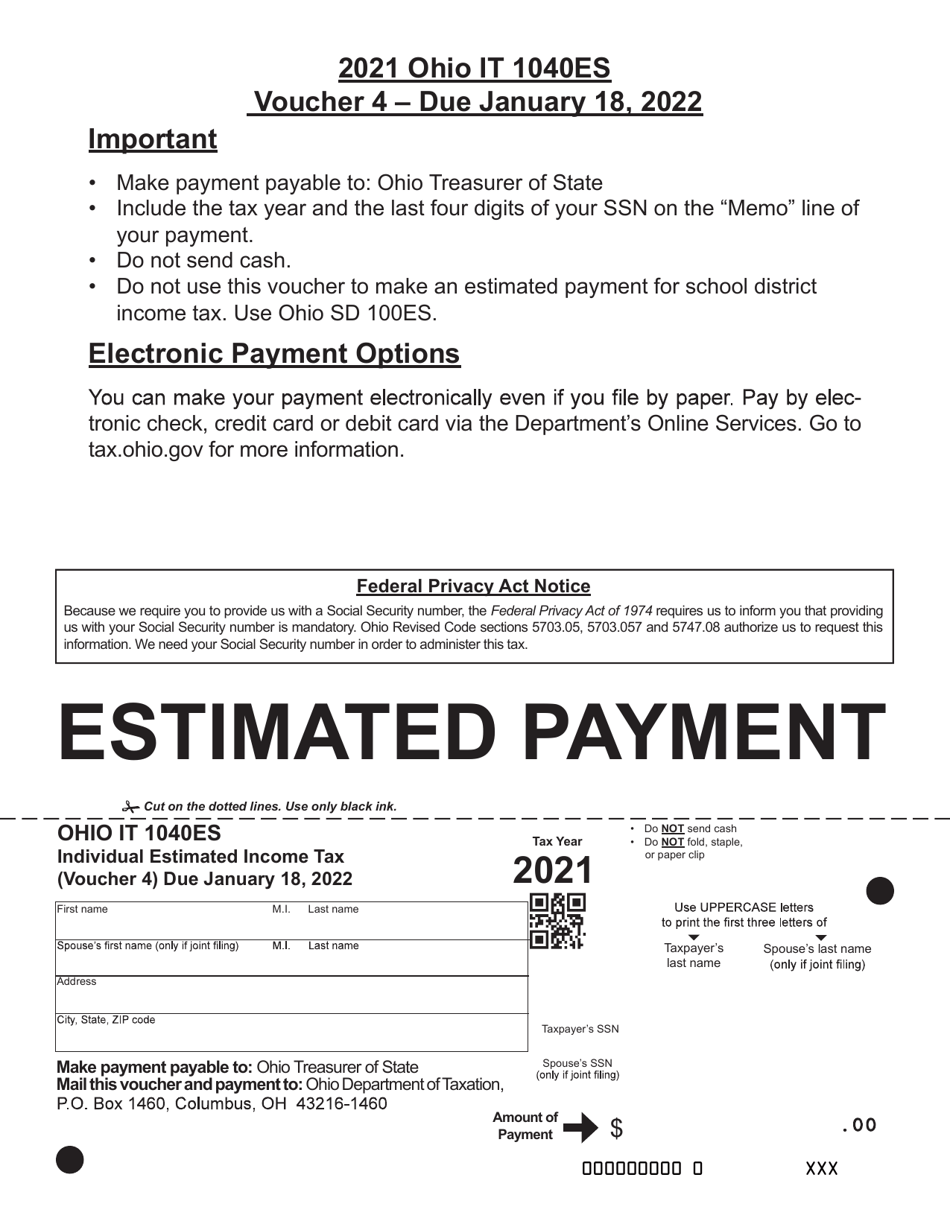

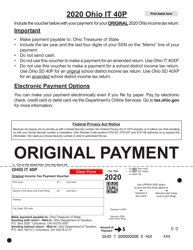

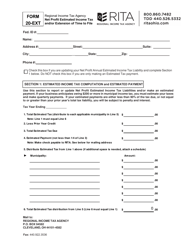

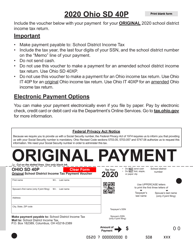

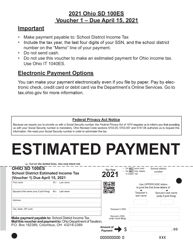

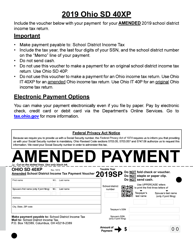

Form IT1040ES Individual Estimated Income Tax Voucher - Ohio

What Is Form IT1040ES?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT1040ES form?

A: The IT1040ES form is the Individual Estimated Income Tax Voucher for the state of Ohio.

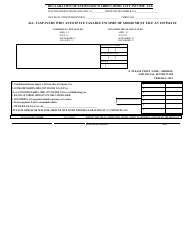

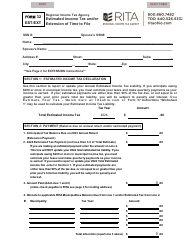

Q: Who needs to file the IT1040ES form?

A: Individuals who have income from sources that are not subject to withholding tax, such as self-employment income or rental income, may need to file the IT1040ES form.

Q: What is the purpose of the IT1040ES form?

A: The purpose of the IT1040ES form is to make estimated income tax payments to the state of Ohio throughout the year.

Q: When is the IT1040ES form due?

A: The due dates for the IT1040ES form are April 15th, June 15th, September 15th, and January 15th of the following year.

Q: What happens if I don't file the IT1040ES form?

A: If you are required to file the IT1040ES form and fail to do so, you may be subject to penalties and interest on the underpayment of estimated taxes.

Q: Can I make changes to the IT1040ES form after I've submitted it?

A: If you need to make changes to the IT1040ES form after you have submitted it, you will need to file an amended voucher using the IT1040ES-R form.

Q: Is the IT1040ES form the same as the federal estimated tax form?

A: No, the IT1040ES form is specific to the state of Ohio and is separate from the federal estimated tax form.

Form Details:

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT1040ES by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.